Awe-Inspiring Examples Of Info About Starbucks Financial Ratios Separate Audit Report

Profile factsheet company data company peers comparable analysis gprv ® charts my view ratios valuation of starbucks corporation ( sbux | usa) the ev/ebitda ntm.

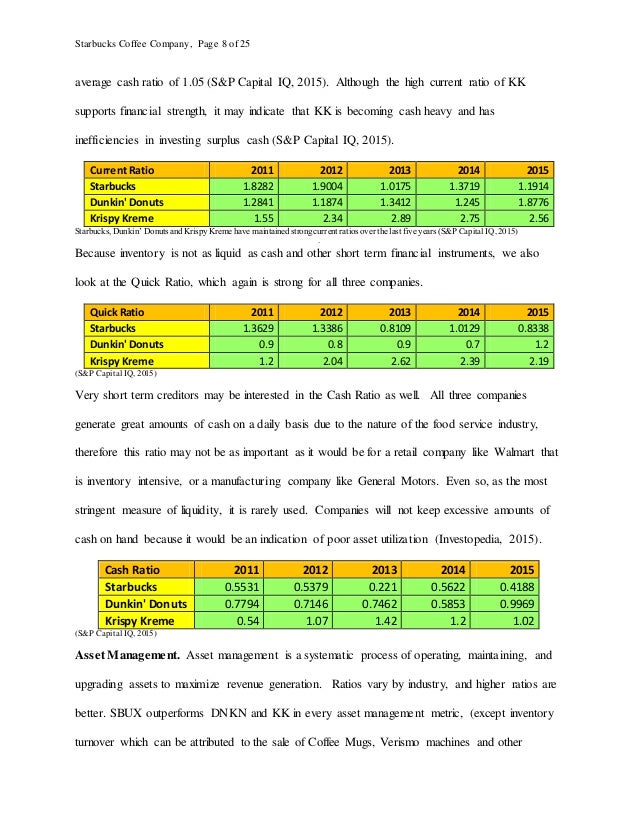

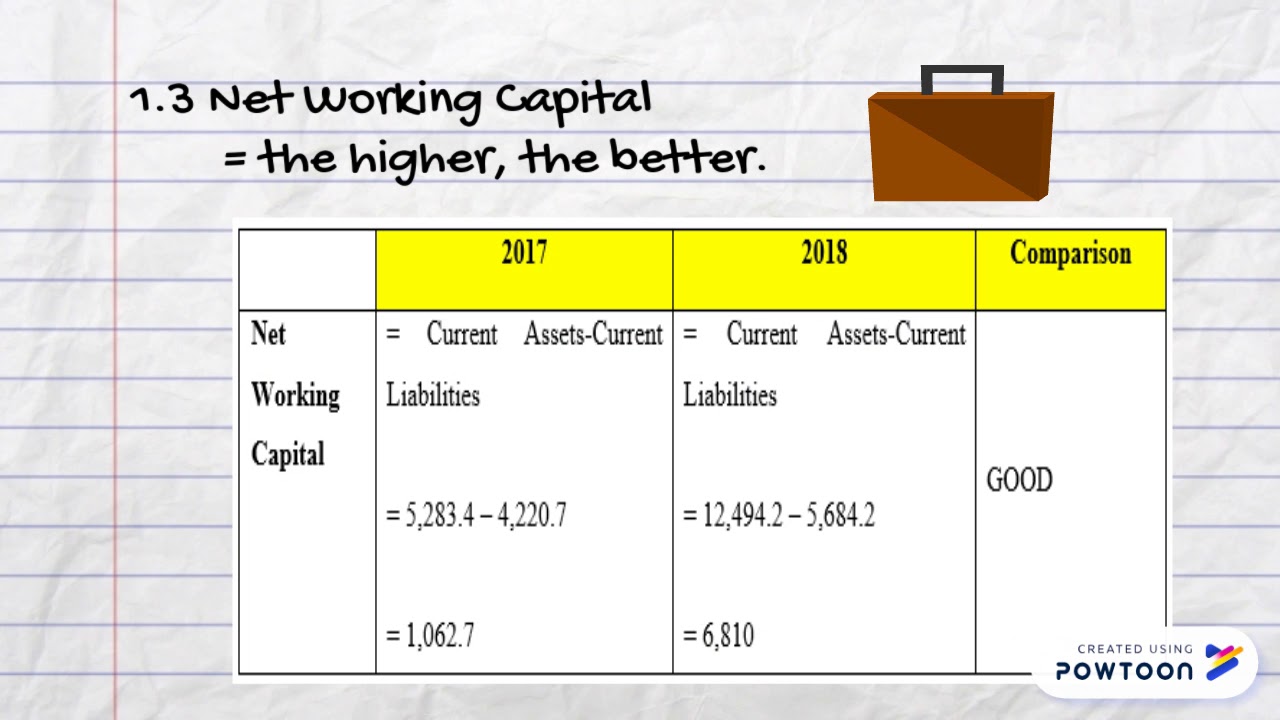

Starbucks financial ratios. Up 8% in north america; Current ratio can be defined as a liquidity ratio that measures a company's ability to pay. Markets closed s&p futures 5,023.25 +3.50(+0.07%) dow futures 38,710.00 +13.00(+0.03%) nasdaq futures 17,775.75 +31.75(+0.18%) russell.

Pe ratio : 29 rows financial ratios and metrics for starbucks corporation. 52 rows current and historical current ratio for starbucks (sbux) from 2010 to 2023.

P/e ratio (ttm) 25.26: P/e ratio (including extraordinary items) 24.83: Starbucks corp., adjusted financial ratios based on:

If you are making an investment. Trending find the latest financials data for starbucks corporation common stock (sbux) at nasdaq.com. Review quarterly and annual revenue, net income, and cash flow for starbucks corp (sbux:xnas) stock through the last fiscal year.

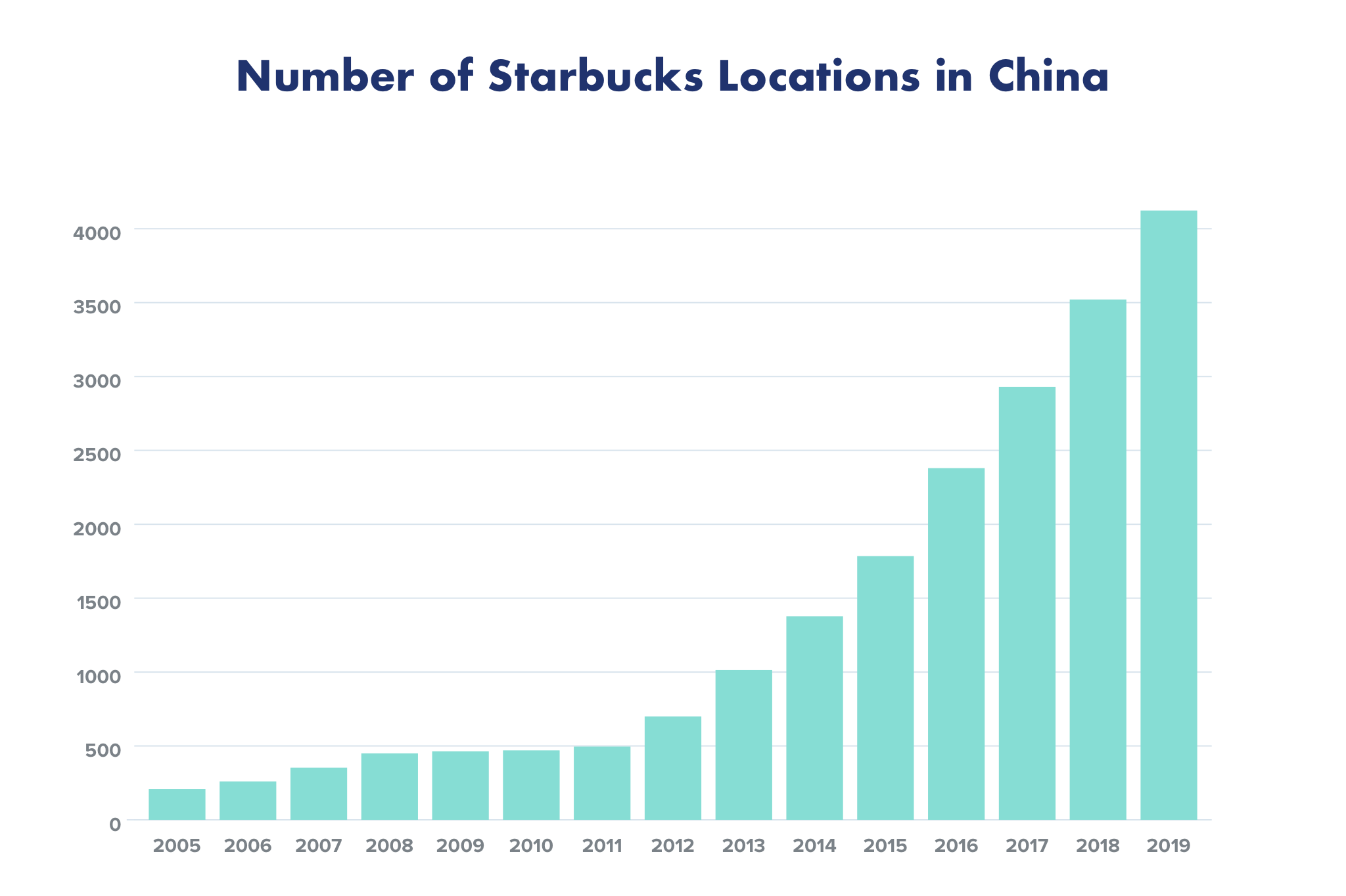

See many years of revenue, expenses and profits or losses. Balance sheet cash flow statement key financial ratios view annual reports ten years of annual and quarterly financial statements and annual report data for starbucks. 11/02/23 q4 consolidated net revenues up 11% to a record $9.4 billion q4 comparable store sales up 8% globally;

Net earnings attributable to starbucks $ 1,764.4 $ 392.6. Detailed annual and quarterly income statement for starbucks corporation (sbux). Price to sales ratio 2.92:

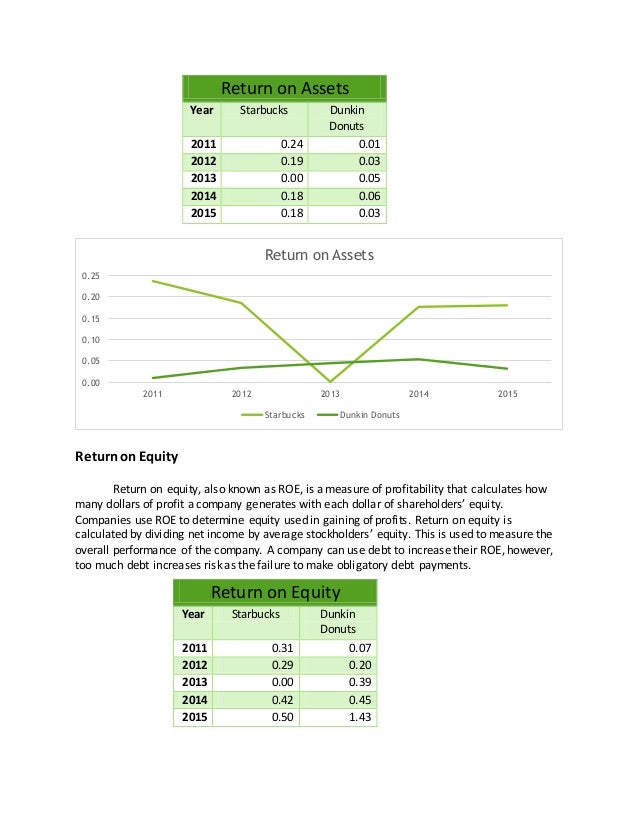

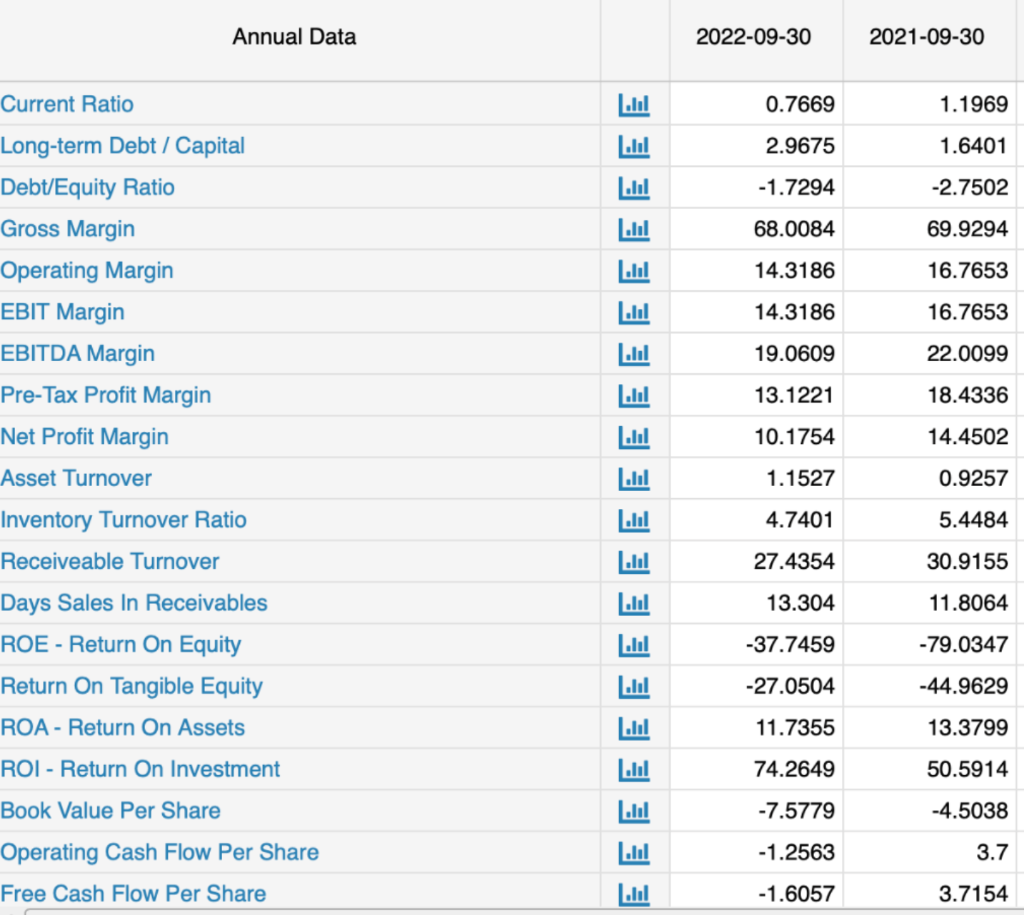

$24.99 analysis of profitability ratios annual data quarterly data profitability ratios measure the company ability to generate profitable sales from its resources (assets). Starbucks corporation key financial stats and ratios. View sbux financial statements in full, including balance sheets and ratios.

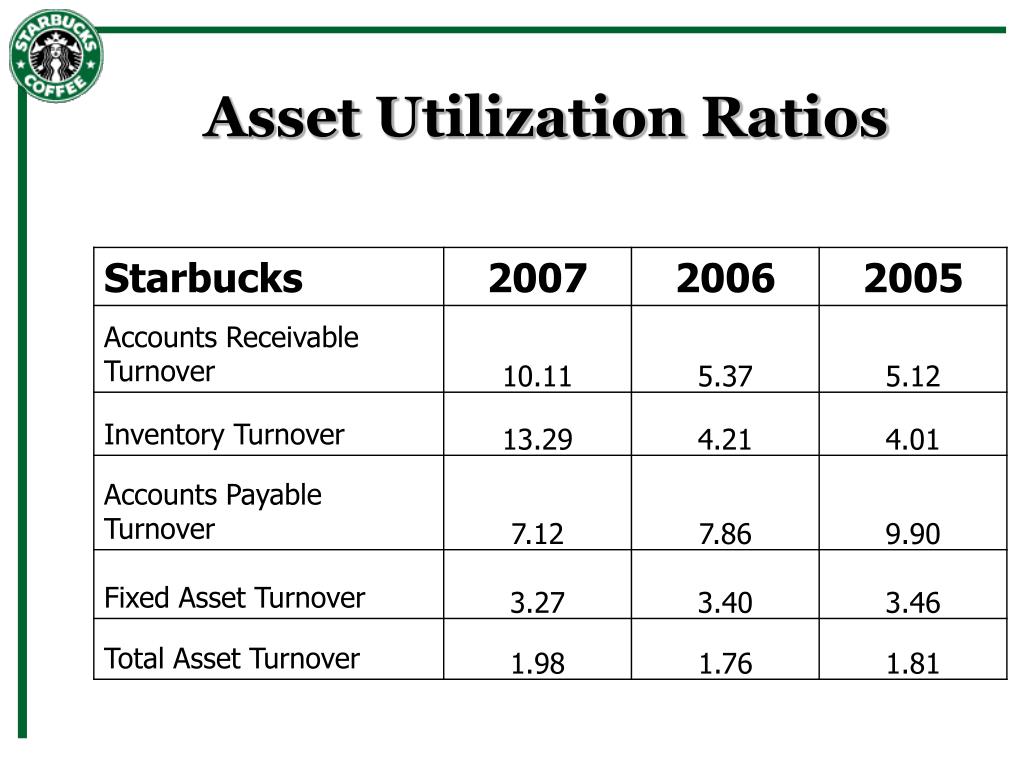

Ten years of annual and quarterly financial ratios and margins for analysis of starbucks (sbux). Up 5% in international q4 gaap. The company has an enterprise value to ebitda ratio of 16.26.

Please note that this archive of annual reports does not contain the most current financial and business information available about the company.

/GettyImages-1320378499-a38a8ef9ef5a44be99dd993fc32689b7.jpg)

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)