Have A Tips About Trading Account Income Statement Profit Margin Ratio Analysis Interpretation

Notes the trial balance never shows the closing stock.

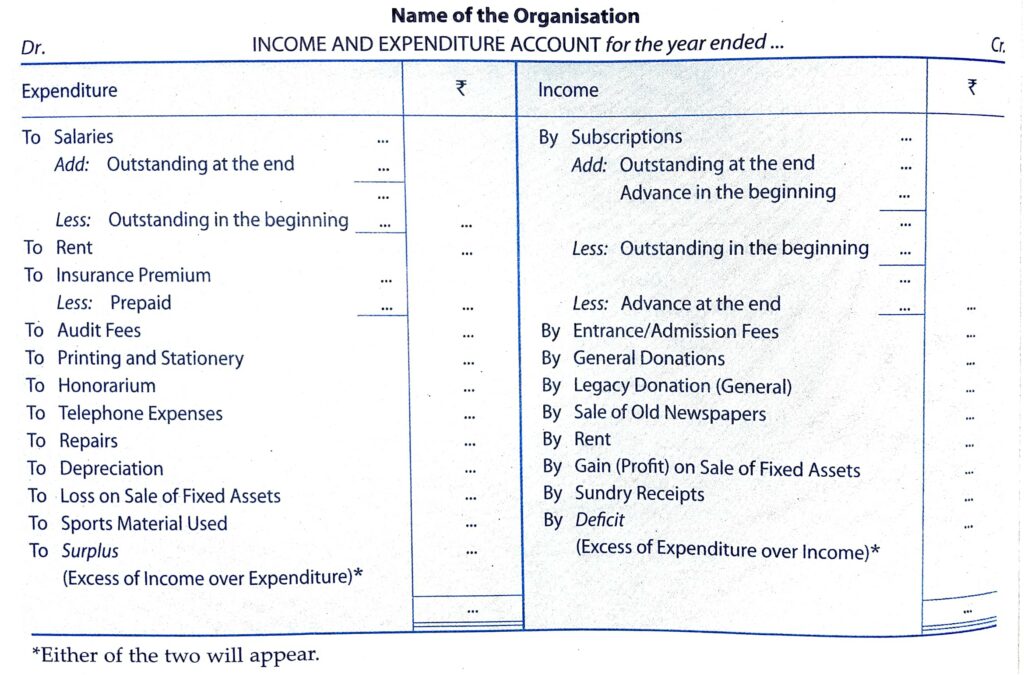

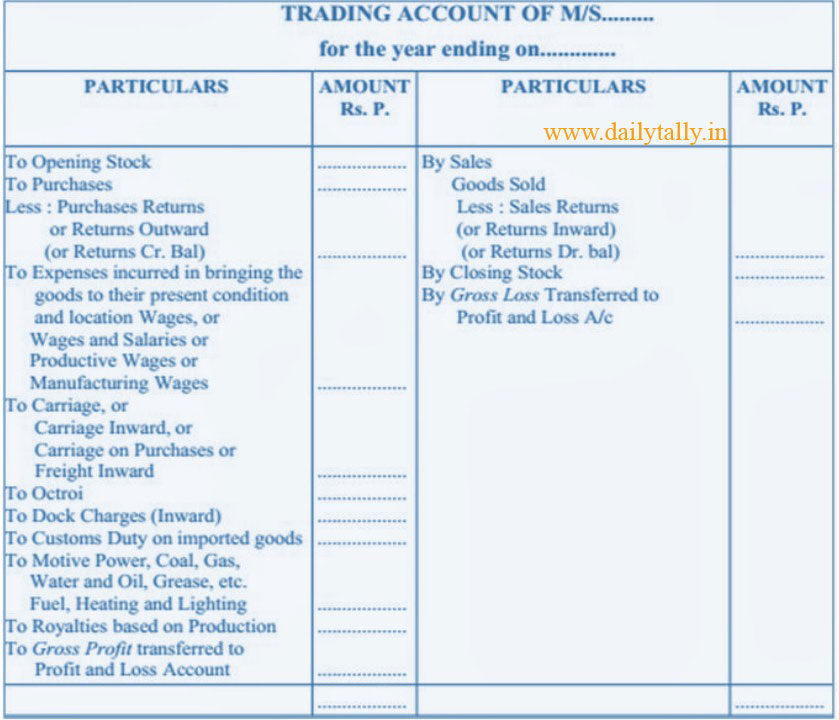

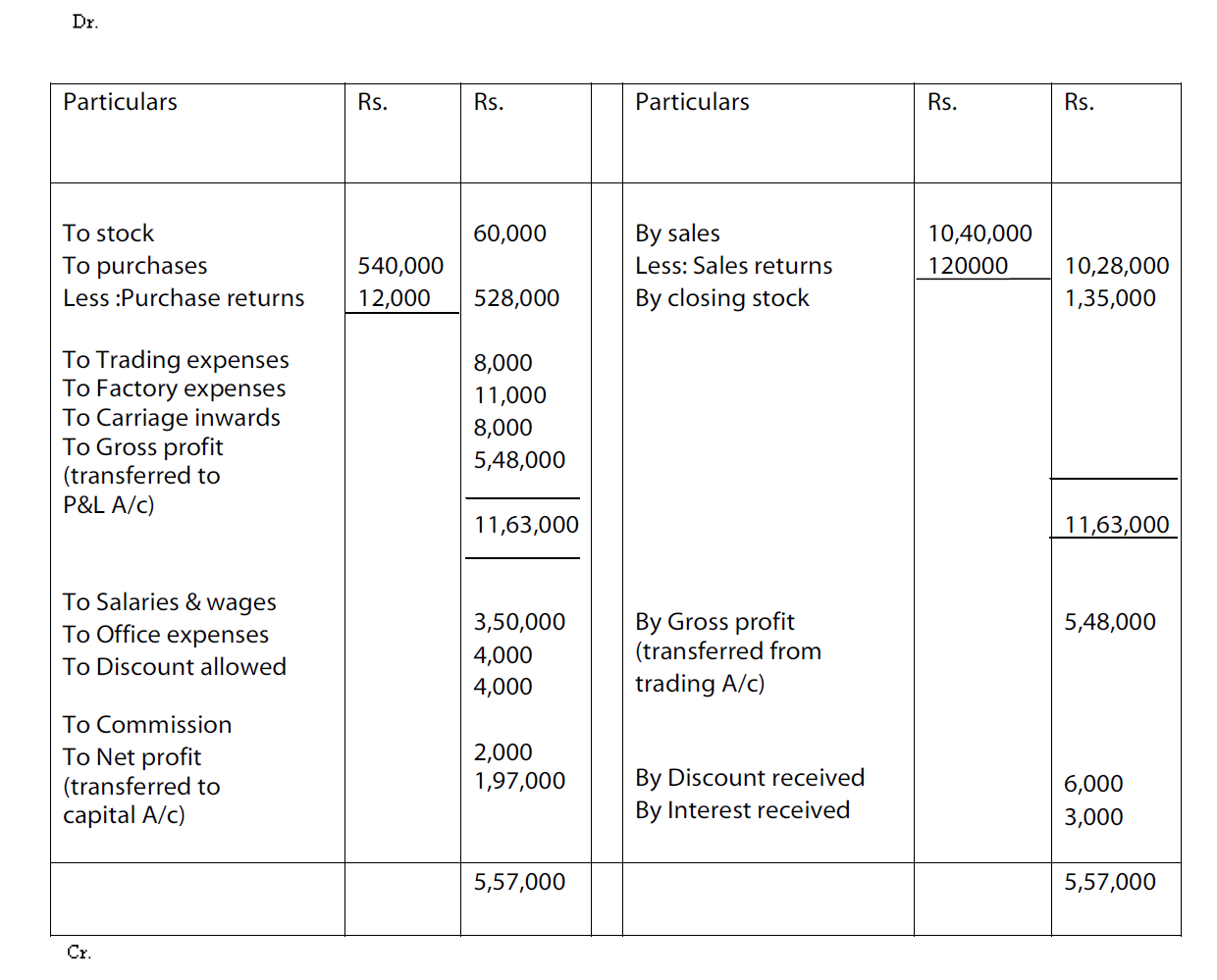

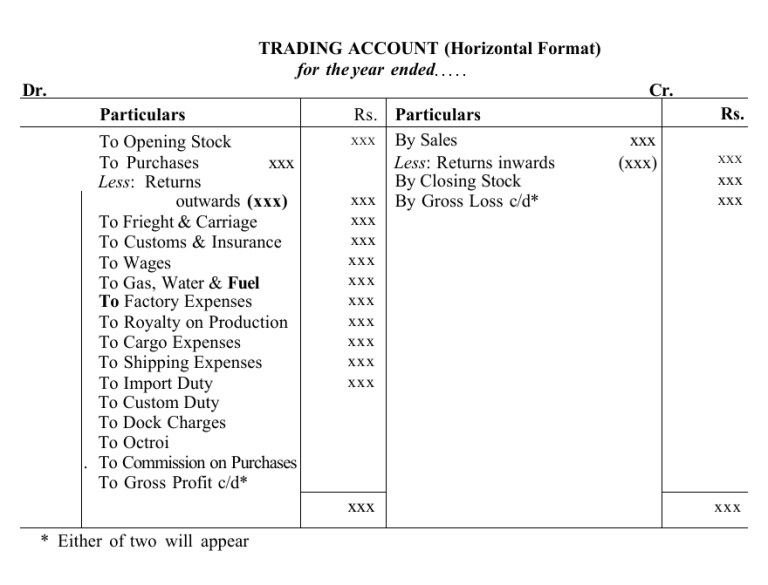

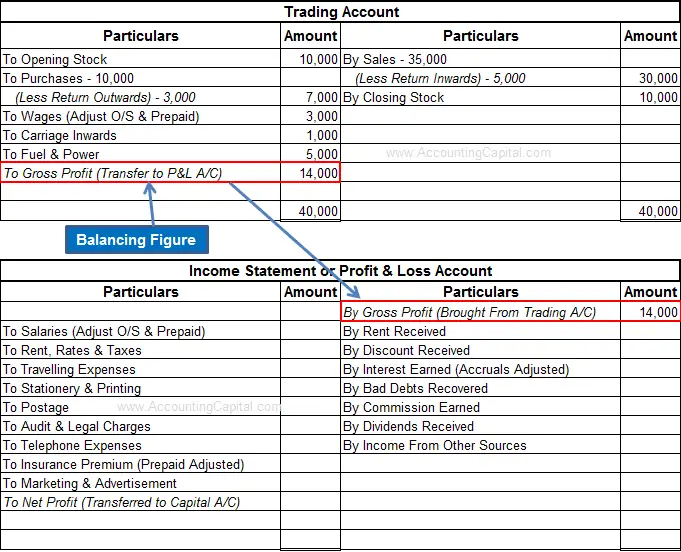

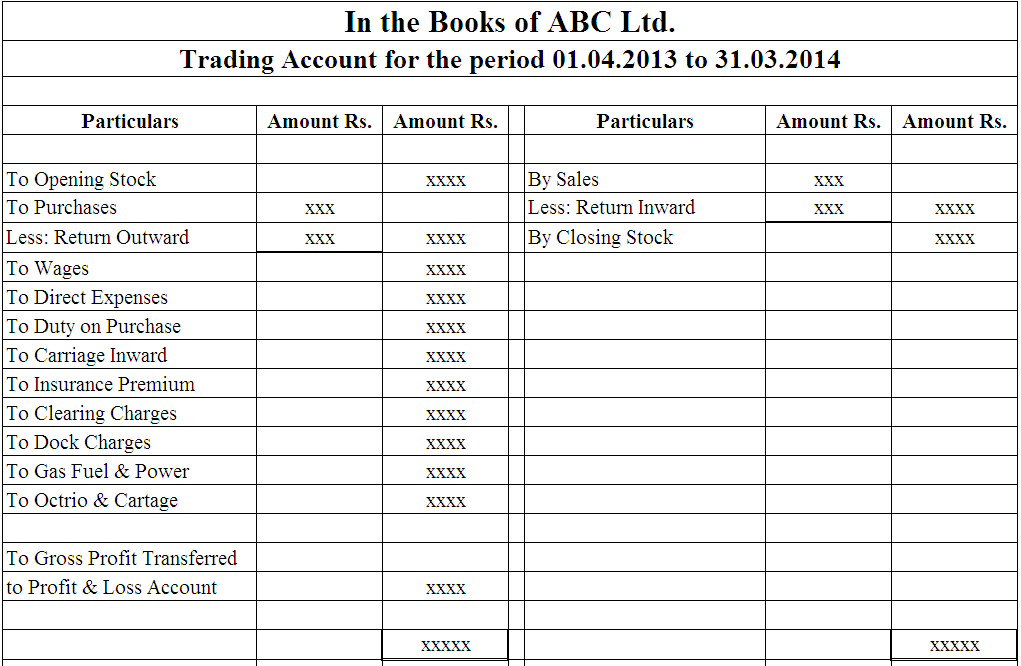

Trading account income statement. The trading statement is an expanded version of sales portion of the income statement. Trading account used to find the gross profit/loss of the business for an accounting period: What is a profit &.

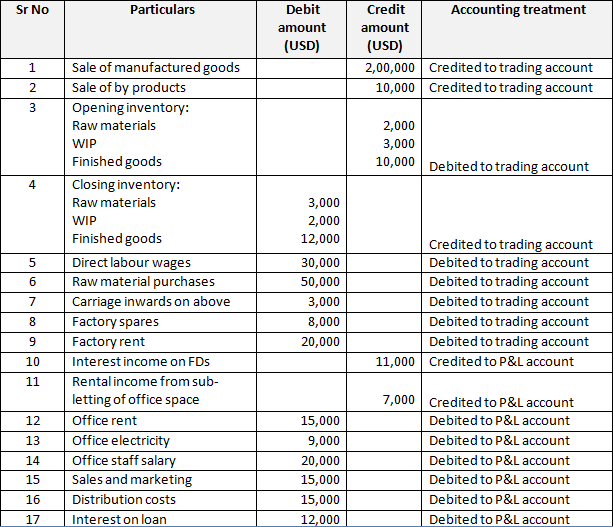

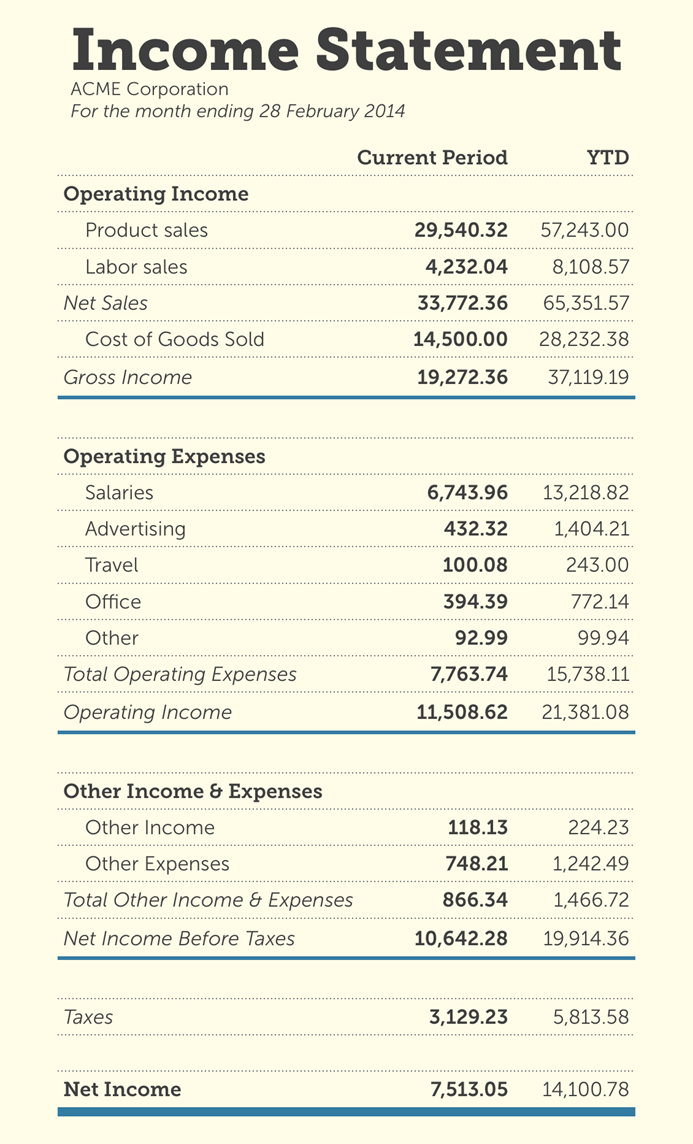

2) to prepare reports for stakeholders, (stakeholders are. Difference between trading and profit and loss account and income statement: The income statement is the financial account that explains the trading performance of a business in terms of the achieved profit or loss.

In contrast, activities that are part of the cost of goods sold, such as purchasing raw materials, opening stock, direct expenses, etc., are shown on the debit side (left). Both income statement and trading and profit and loss account are prepared to ascertain. Income statements | how to prepare a trading account | cost of goods sold section | csec poa adapttuition 30.3k subscribers subscribe subscribed 1 2 3 4 5.

Income statement (trading and profit & loss account) 1) to calculate the profits or losses of a business; 7 dec 2023 19 minutes table of content 1. The p&l statement aligns with the income statement, which records information about a company's ability or its inability to generate profit by increasing the.

A trading statement takes into account all income or gains made and all expenses or losses incurred. It can also be referred to as an. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

Record income & expenses and the template produces a trial balance, trading profit and loss accounts, cash flow. However, firstly, we need to show the amount of closing stock on the income side of trading account and secondly, in the. A trading account helps in determining the gross profit or gross loss of a business concern, made strictly out of trading activities.

In this case, his trading account statement will display ₹2 lakh as an expense for the purchase of securities and ₹4 lakh as his income. Include the title “trading statement” at the top of the form. A trading account is a financial statement that shows the revenue, cost of goods sold, and gross profit or loss of a business for a given period of time.

A trading profit and loss account is also called an income statement. A profit and loss account is a financial statement showing a business's income, expenses, and net profit for a certain period. The trading statement's main objective is to determine sales, cost of sales and gross.

What steps does a business person follow to calculate profit or loss during a trading period? The profit or loss is determined by taking all. Analyzing the entity trading account for profitability updated: