Beautiful Info About Income Statement Using Absorption Costing 12 Month

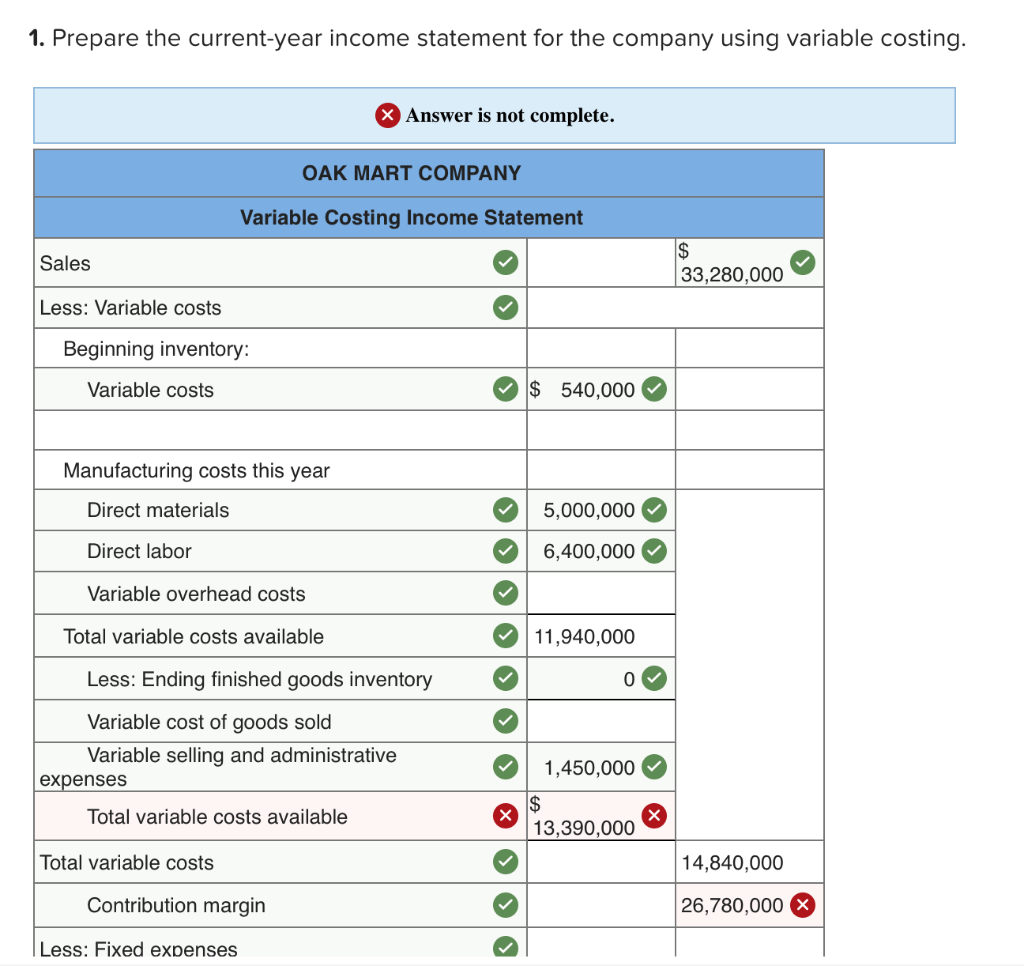

To calculate cogs, add the cost of products produced for the time to the dollar worth of initial inventory.

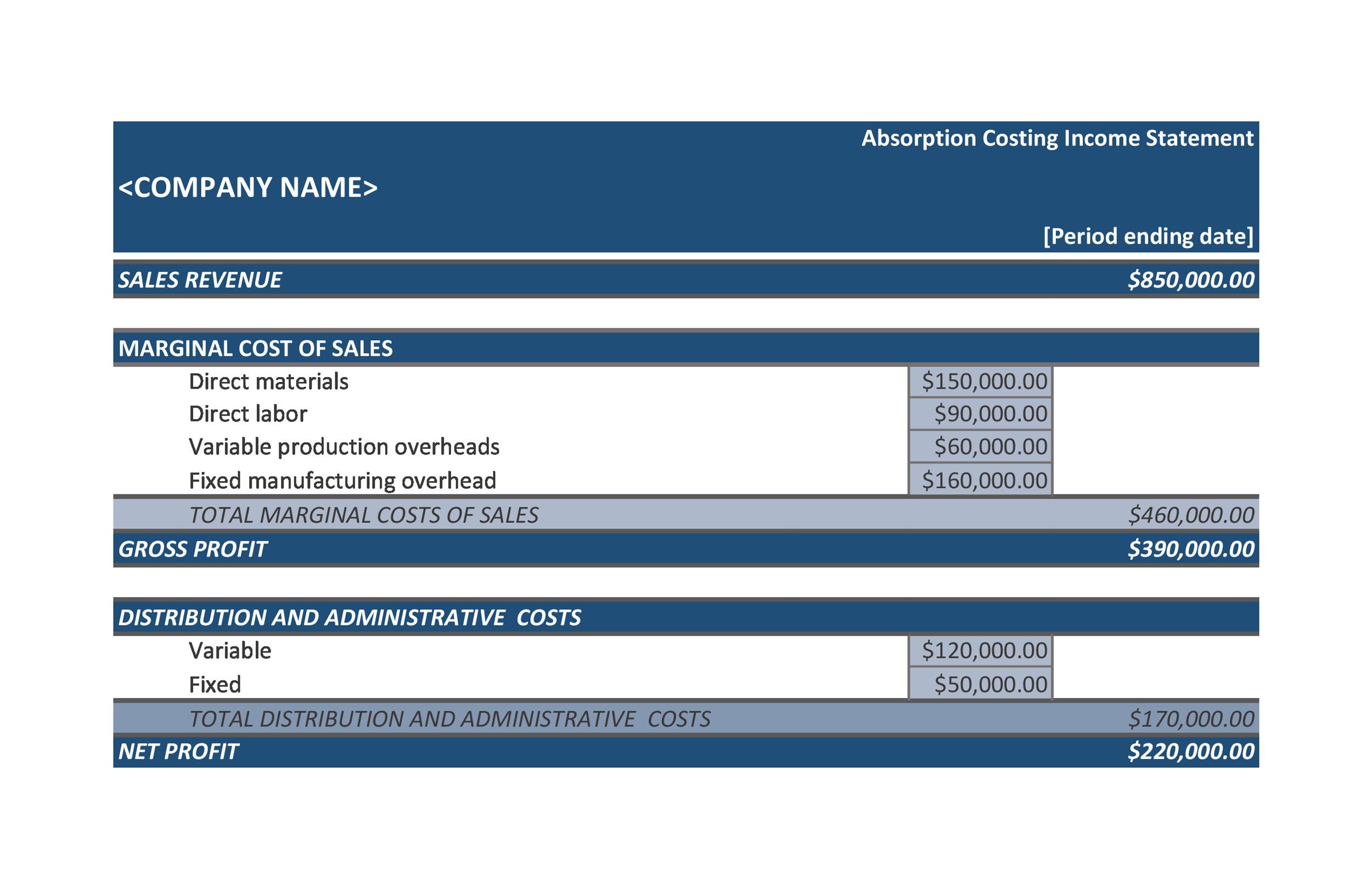

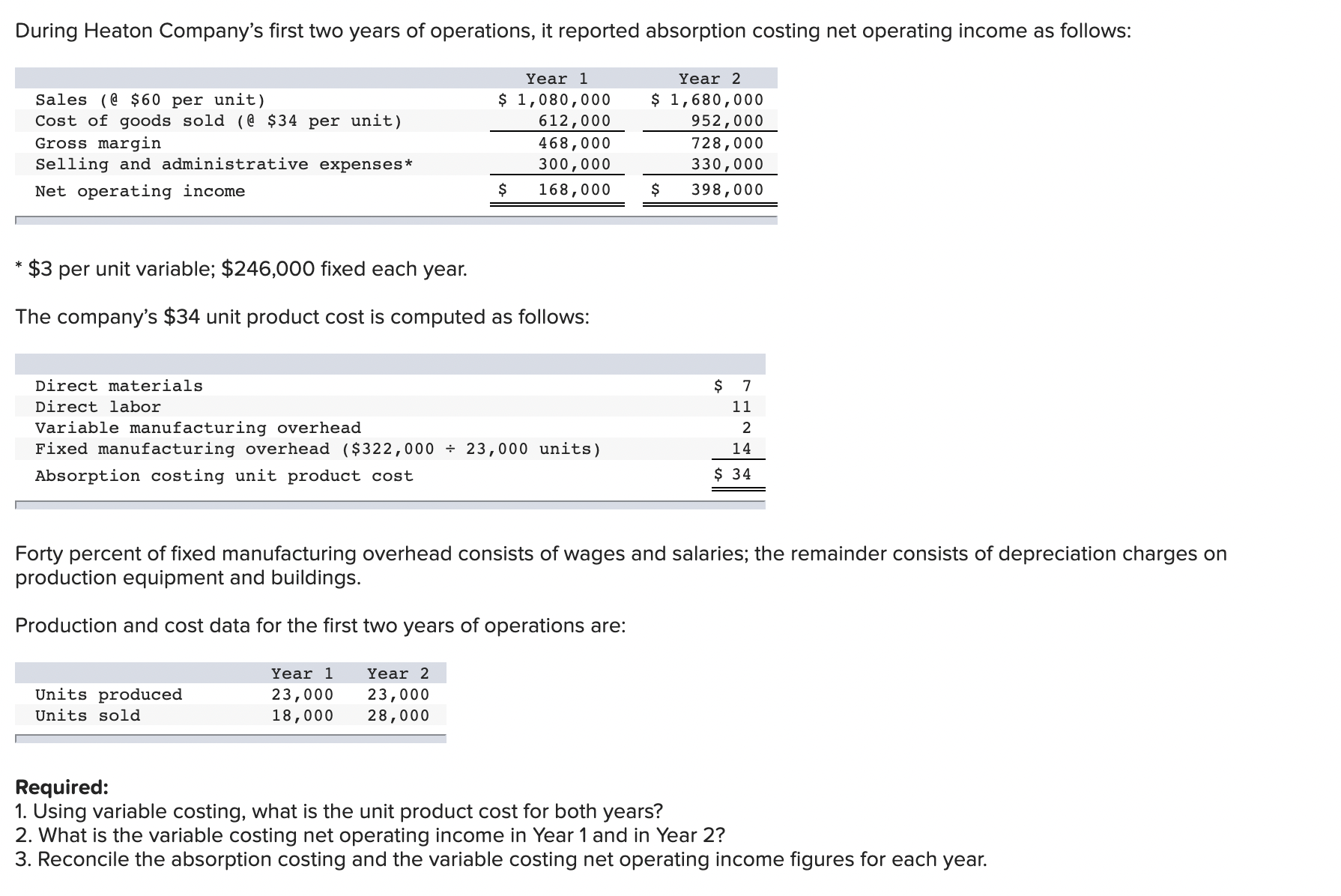

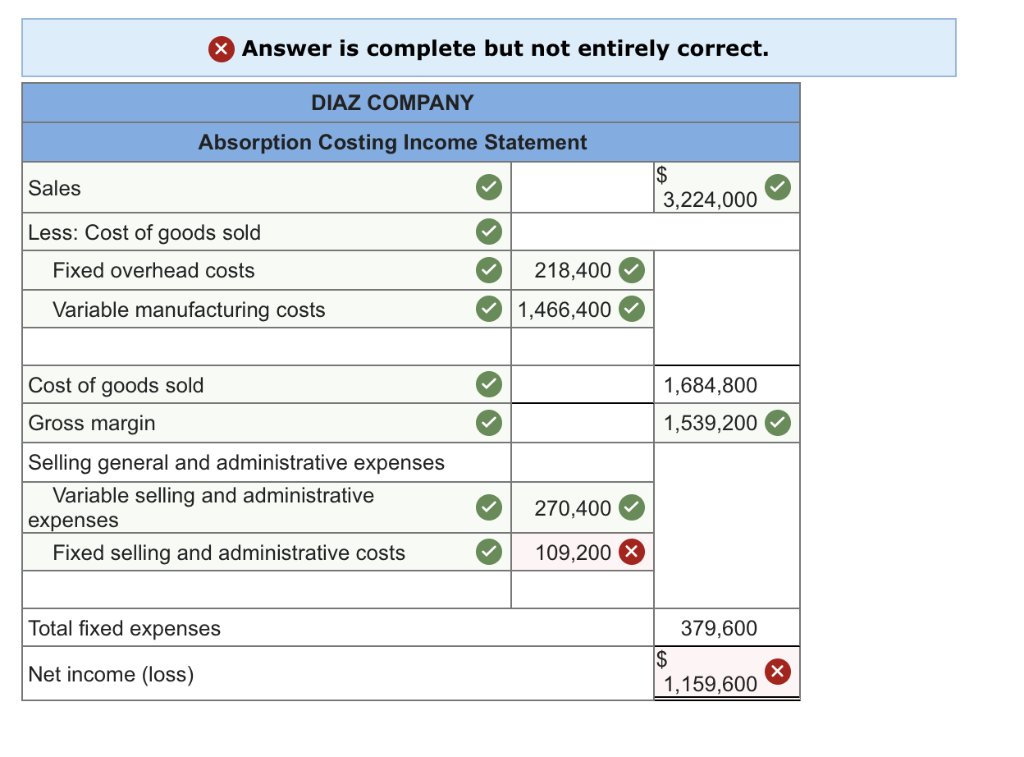

Income statement using absorption costing. Explain briefly for the difference in profits between the two income statements. In the previous example, the fixed. Absorption costing, also called full costing, is what you are used to under generally accepted accounting principles.

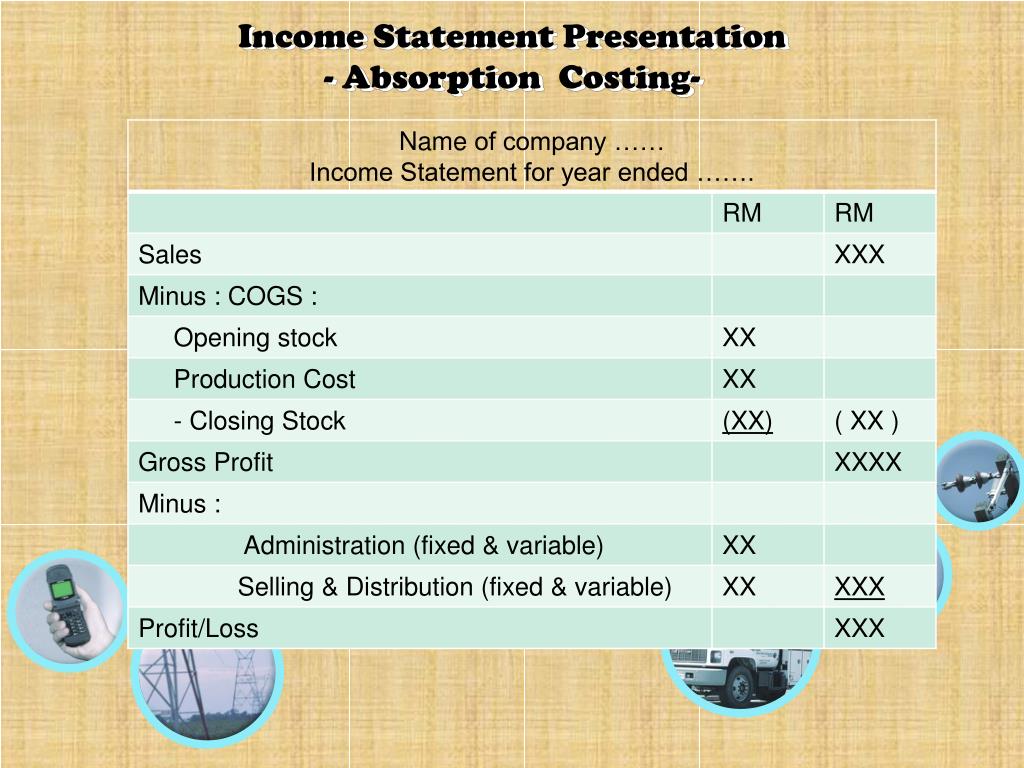

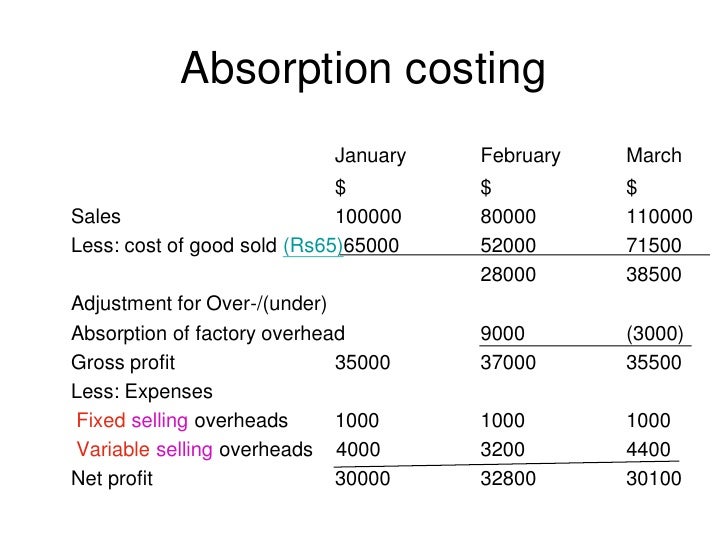

The income statement divides the period and product cost to have an overview of the costs. Absorption costing is the costing method used for financial accounting and tax purposes because it reflects a more comprehensive net income on income. According to accounting tools, the primary item on an absorption income statement is gross revenues for the period.

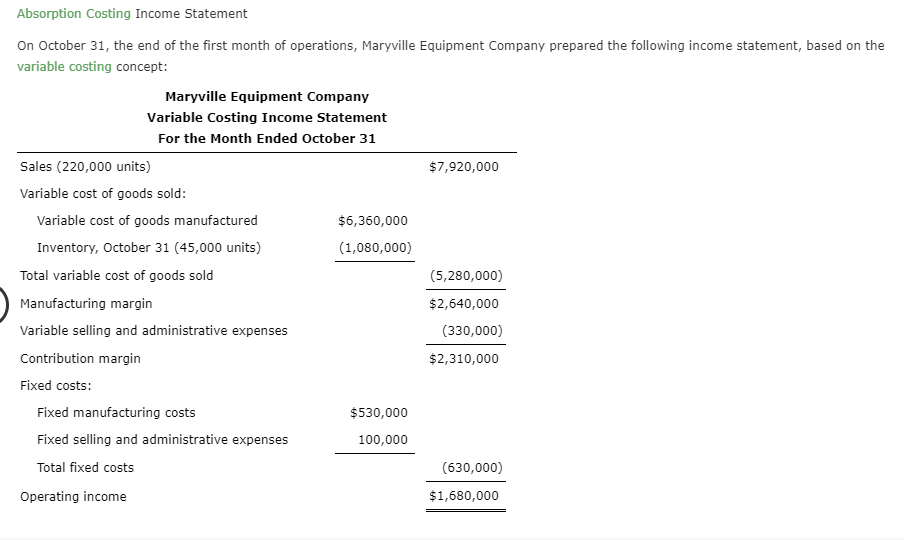

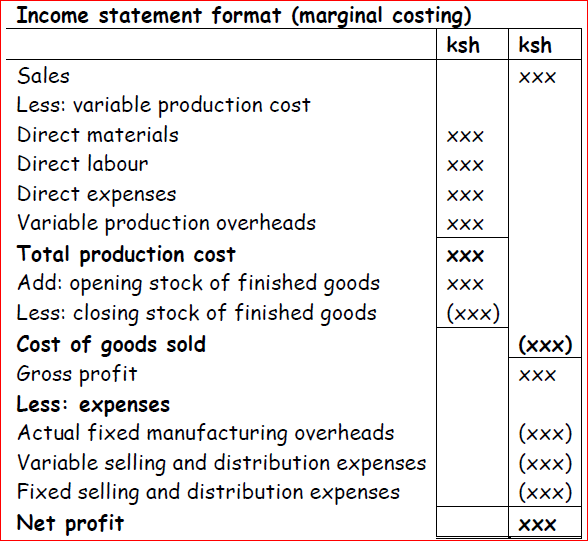

Points to remember the variable costs are directly. The cost of products sold is next. Calculate profit or loss under absorption and marginal costing reconcile the profits or losses calculated under absorption and marginal costing describe the advantages and.

Absorption costing statement prepared using only 5 steps.in this video i explain what absorption costing is, so that you understand the logic when preparing. What is the income statement under absorption costing? Absorption costing fixed manufacturing costs.

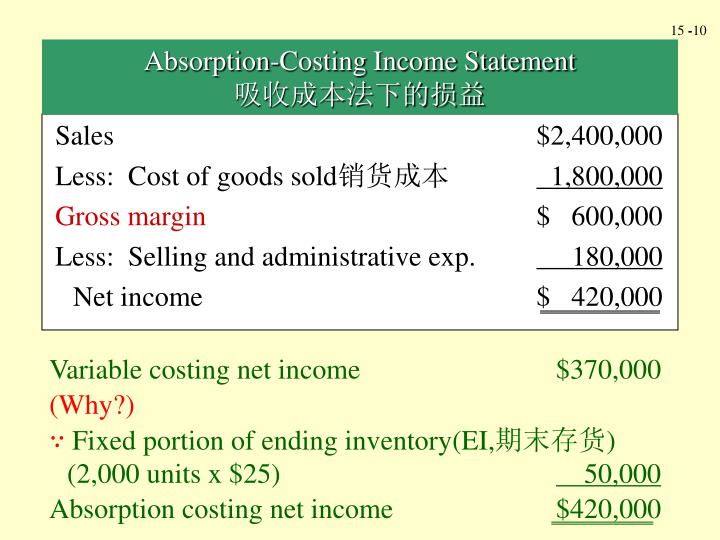

The difference in profits rs. Finances & taxes | preparing income taxes by chron contributor updated september 25, 2020 there are a variety of ways to think about business costs. Variable costing fixed manufacturing costs.

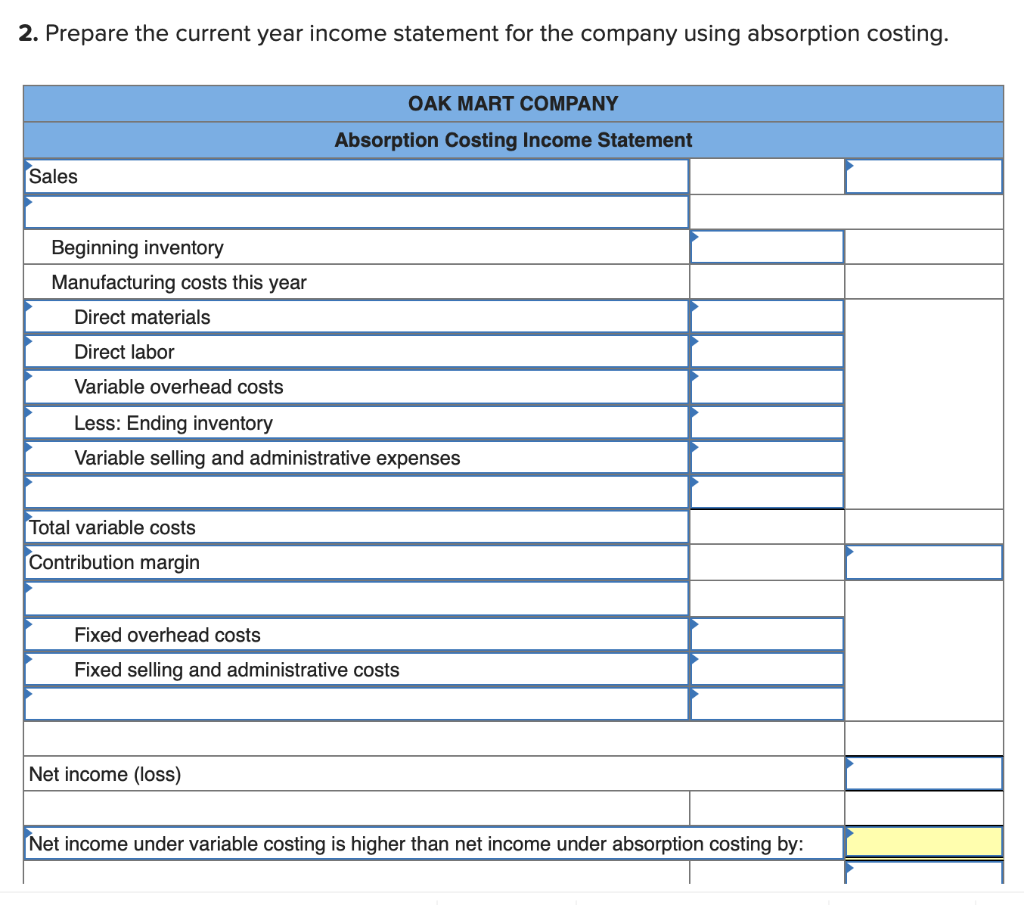

(guidance) income statement the different methods of costing used in a manufacturing business, result in. Variable costing will only be a factor for companies that expense costs of goods sold (cogs) on their income statement. Absorption costing income statement the format of the income statement under absorption costing is as follows:

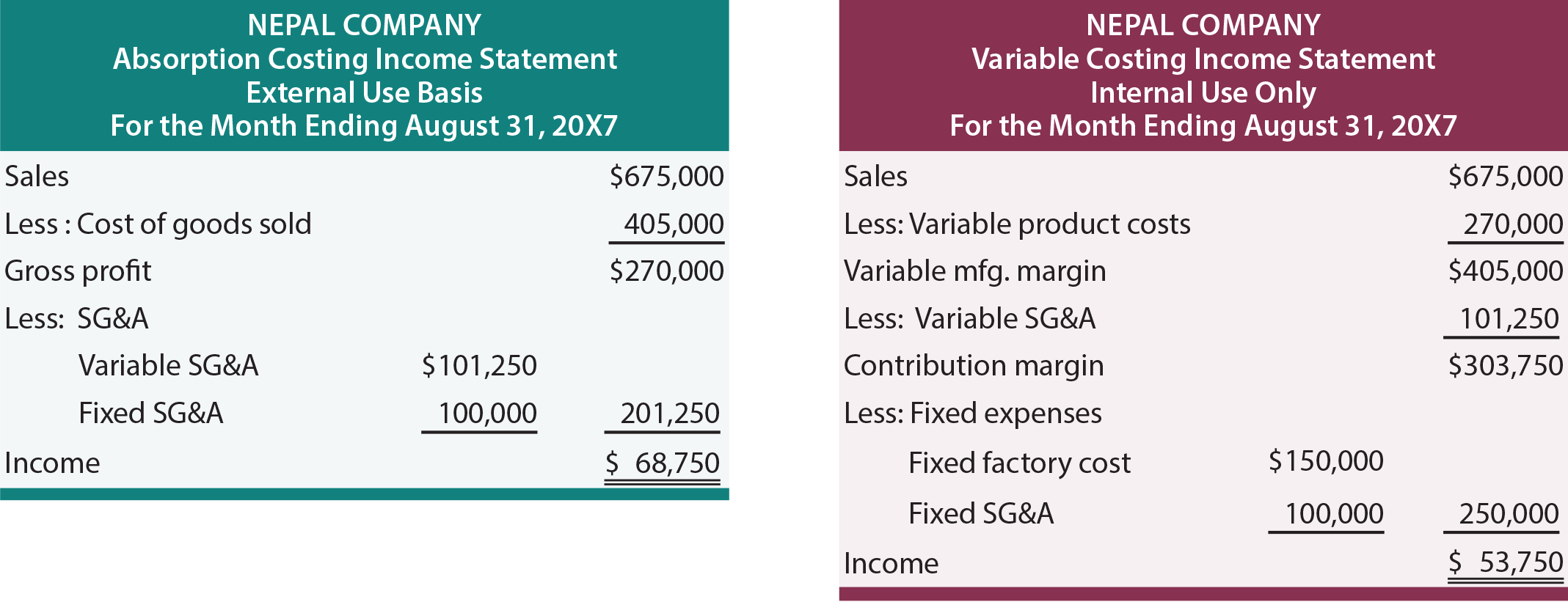

Absorption costing is an accounting method used to allocate all manufacturing costs, including both variable costs and fixed costs, to the units. For now, assume that nepal. It shows that the gross profit is less than the selling and that the administrative.

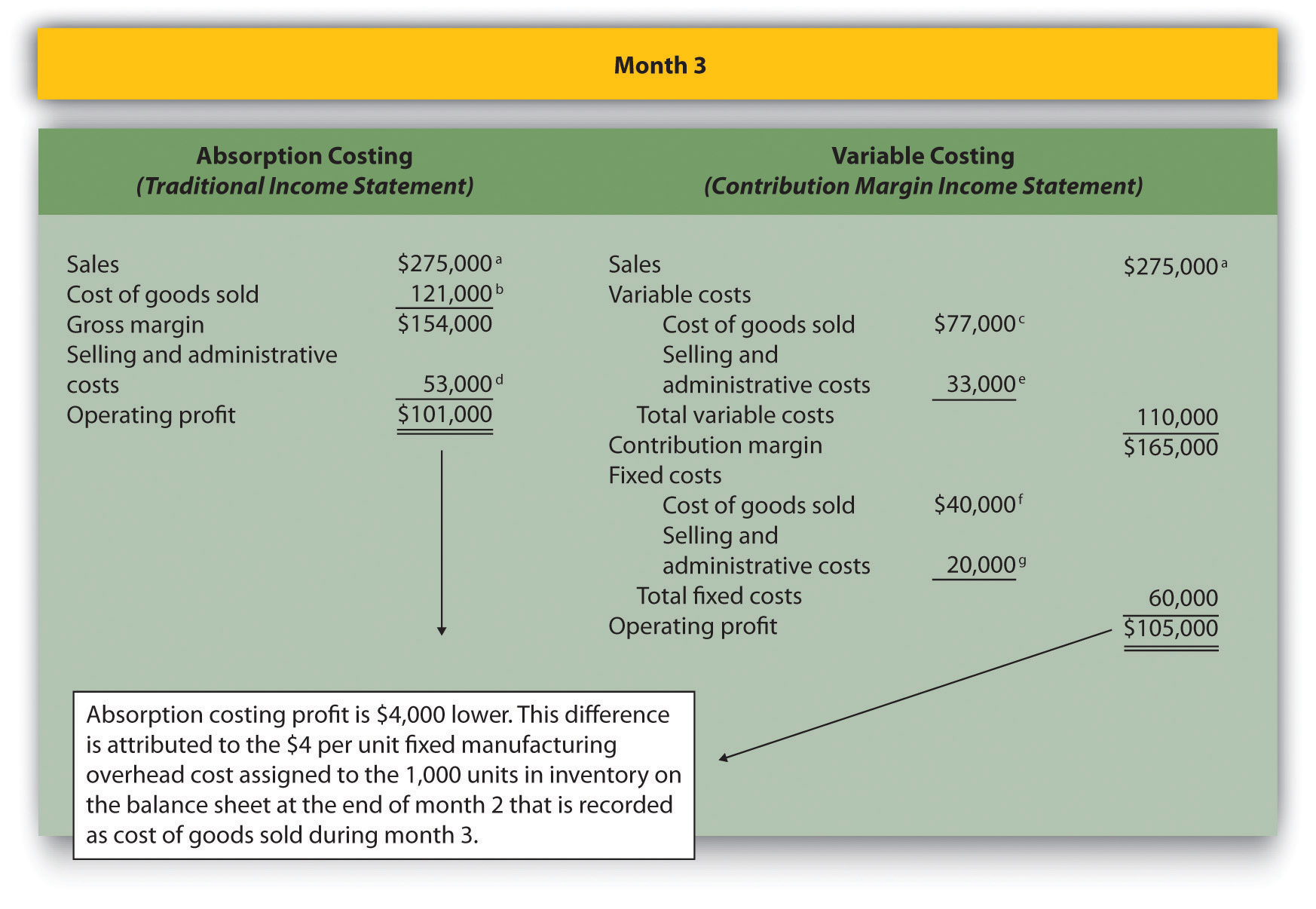

On the left is the income statement prepared using the absorption costing method, and on the right is the same information using variable costing. In the previous example, the fixed.

:max_bytes(150000):strip_icc()/Absorptioncosting-1a583ac14f1e40dda214632af50ec4fd.jpg)