Impressive Tips About Minority Interest In Profit And Loss Account Financial Ratios Chart

Understand the concept of trading account here in detail.

Minority interest in profit and loss account. A profit and loss (p&l) account shows the annual net profit or net loss of a business. It is disclosed on the face of the consolidated profit and loss account under “profit on ordinary activities after taxation.” Other standards affecting section 9 where.

You can use this simple example to understand: Under old gaap there was no requirement for this. Profit attributable to shareholders other than holding company, so that profit attributable to the owners of the holding company can be identified.

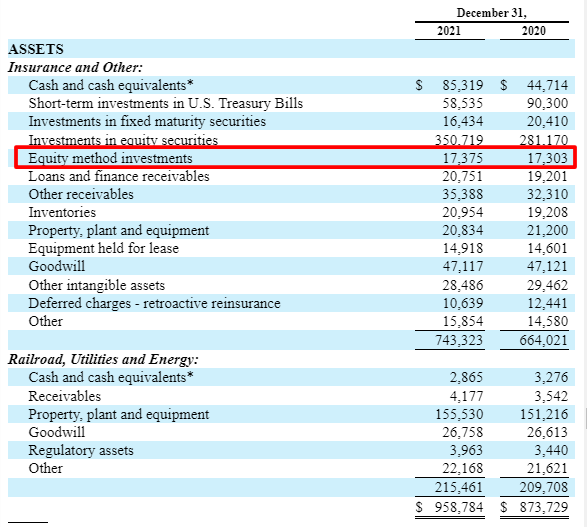

It is prepared to determine the net profit or net loss of a trader. When a business has a minority interest in another entity and it has no substantial influence over that entity, the business accounts for its ownership share using the cost method. In the context of the profit and loss account , minor interest is the portion of the consolidated profits and losses that fall from normal activities after taxation.

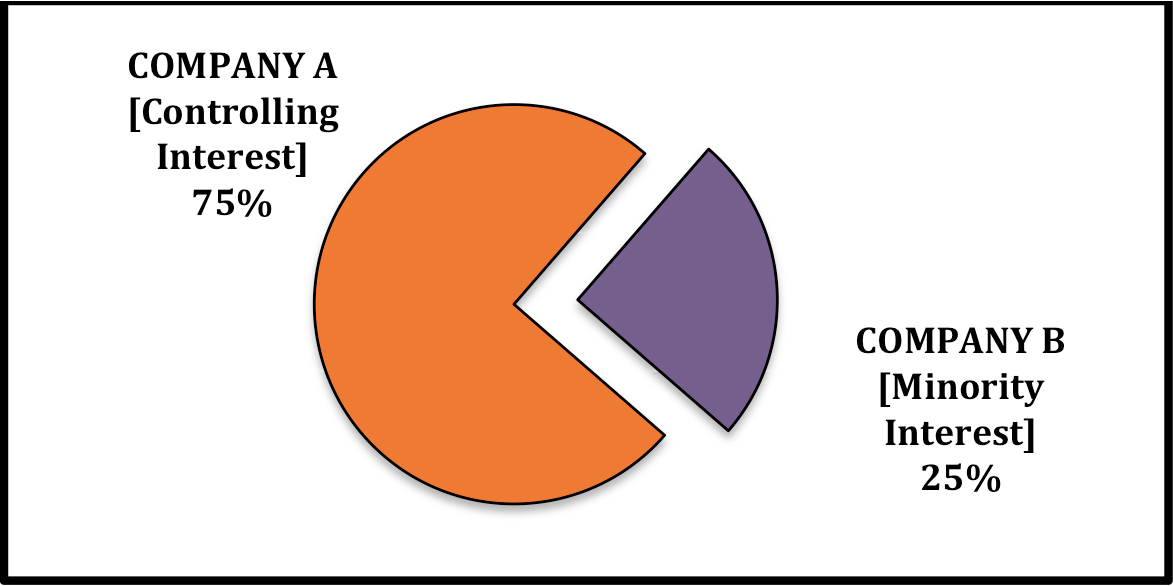

Minority interests develop when businesses merge or a seller retains a small percentage of his recently sold company. Under this method, the investing entity records its original investment at cost. It also has a 75% stake in a subsidiary that makes a post tax profit of £100m.

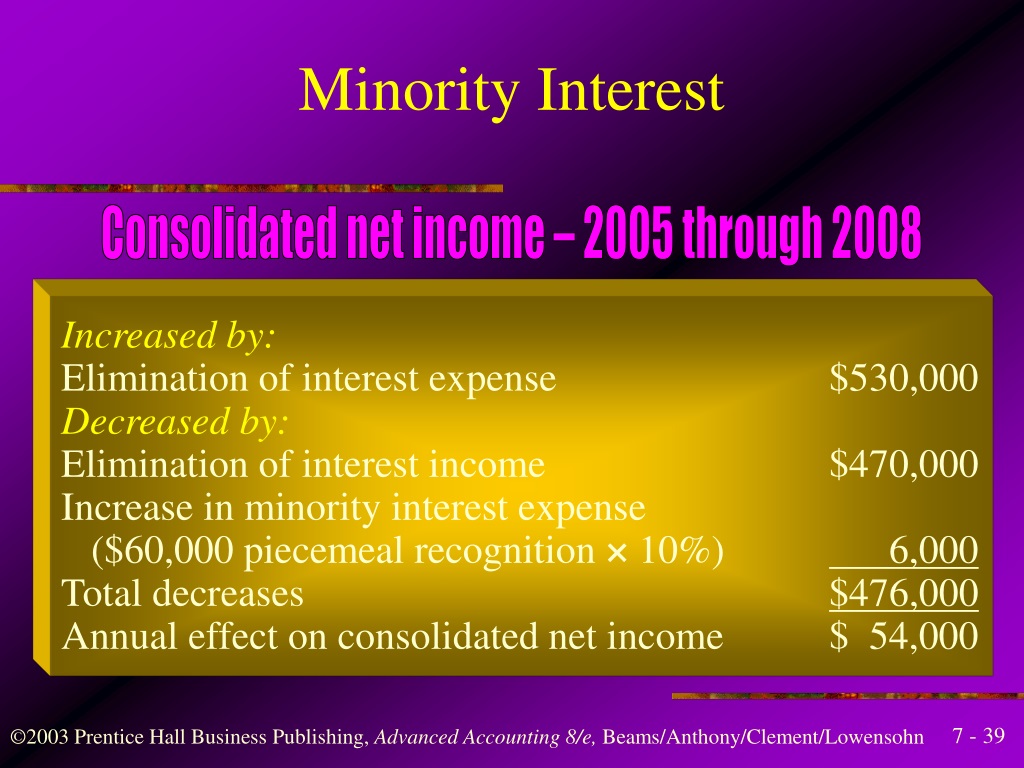

Interest receivable and similar income. Minority interests in the profit or loss of the group should also be separately disclosed. The p&l account is a component of final accounts.

For accounting purposes, noncontrolling interest is classified as equity and shows up on the balance sheet of the company that owns the majority interest in the subsidiary. Minority interest is defined as the ownership value of an individual or business that owns less than 50 percent of a business. Estimated selling price less costs to complete and sell.

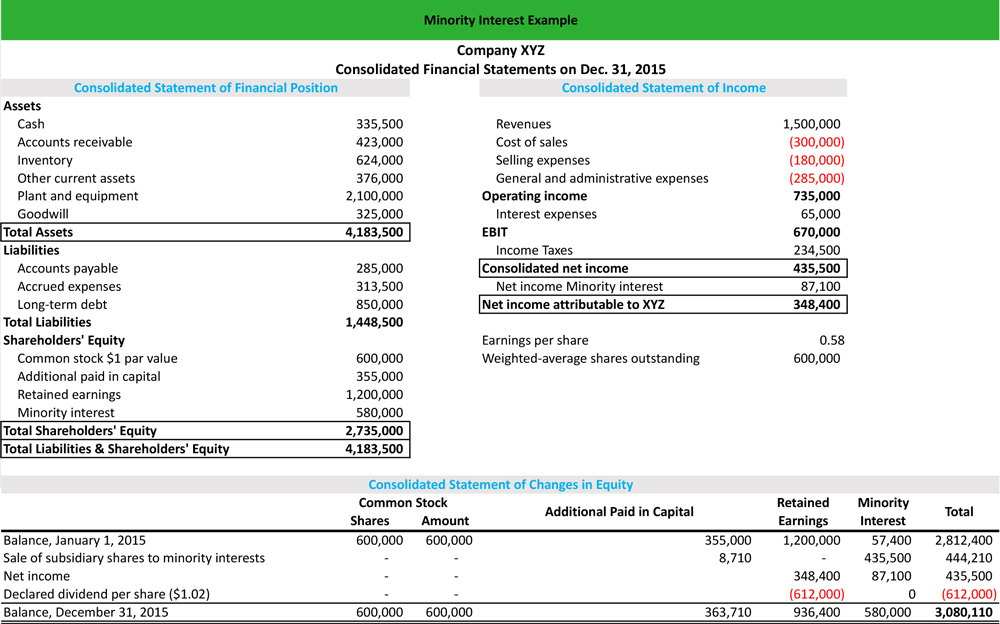

Profit/loss of the minority interest should also be shown separately, instead of leaving it to be deducted from the consolidated income statement. Minority interests generally range between 20% and 30% of the company's equity, compared to the majority interest of over 50%. The parent company consolidates the financial results of the.

Accounting for a minority interest. [ias 27.33] where losses applicable to the minority exceed the minority interest in the equity of the relevant subsidiary, the excess, and any further losses attributable to the minority, are charged to the group unless the minority has a binding. As 21, consolidated financial statements, defines minority interest as that part of the net results of operations and of the net assets of a subsidiary attributable to interests which are not owned, directly or indirectly through subsidiary(ies), by the parent.

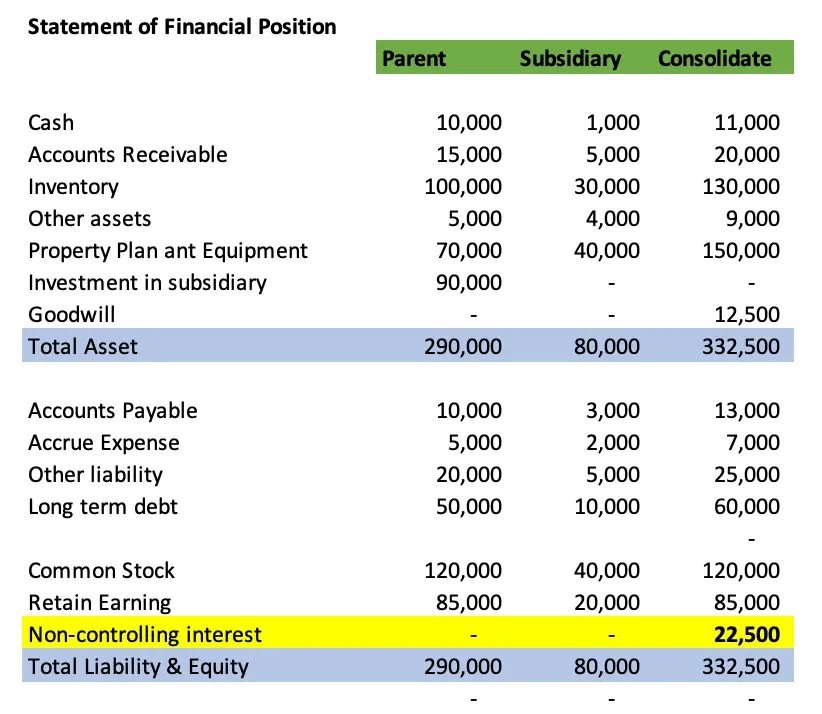

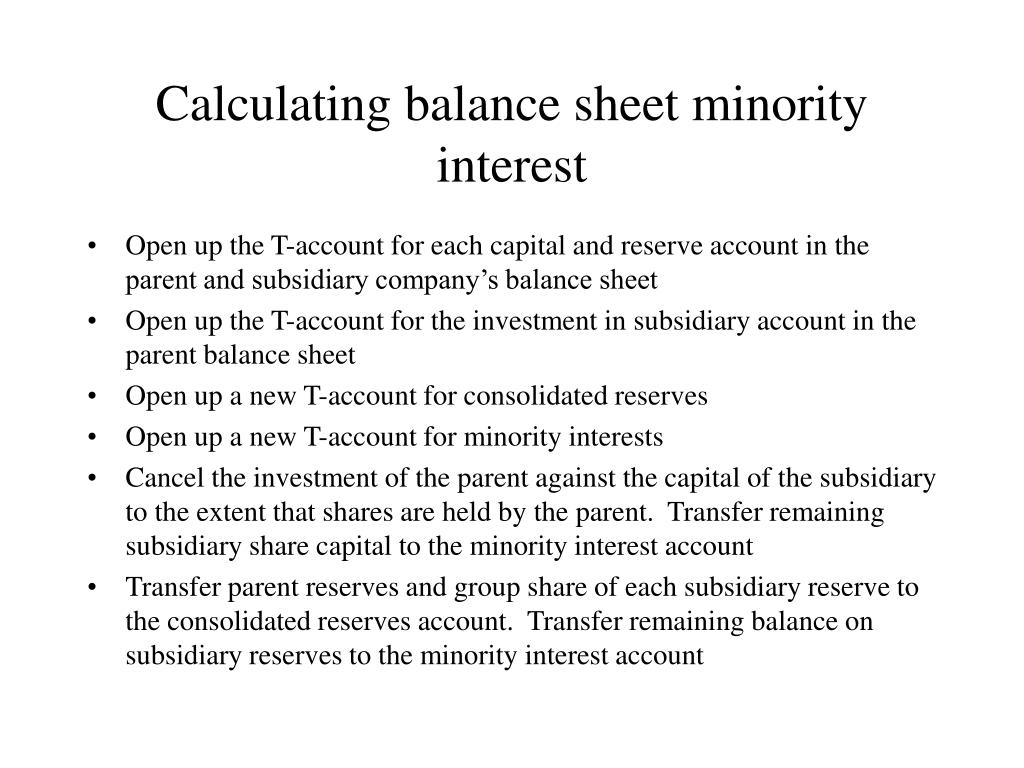

Calculation of minority interest with regard to profit and loss statement and balance sheet. The profit and loss account starts with gross profit at the credit side and if there is a gross loss, it is shown on the debit side. It is a scenario in which a shareholder holds less than half of the overall outstanding shares and thereby not having any control over the decisions made in the company.

Yes minority interest can be negative or zero. Minority shareholders are those who own less than 51% of a company’s voting shares and must be aware of their rights to ensure equitable treatment. The correct place to put it in the profit and loss account is, in my experience and in my opinion, where you say.

:max_bytes(150000):strip_icc()/dotdash_Final_How_To_Calculate_Minority_Interest_Oct_2020-01-54830679f6a34b8581810db05d008661.jpg)