Unbelievable Info About Cash Flow From Operations To Current Liabilities Ratio Preparation Of Report In Accounting

This ratio measures a company's liquidity.

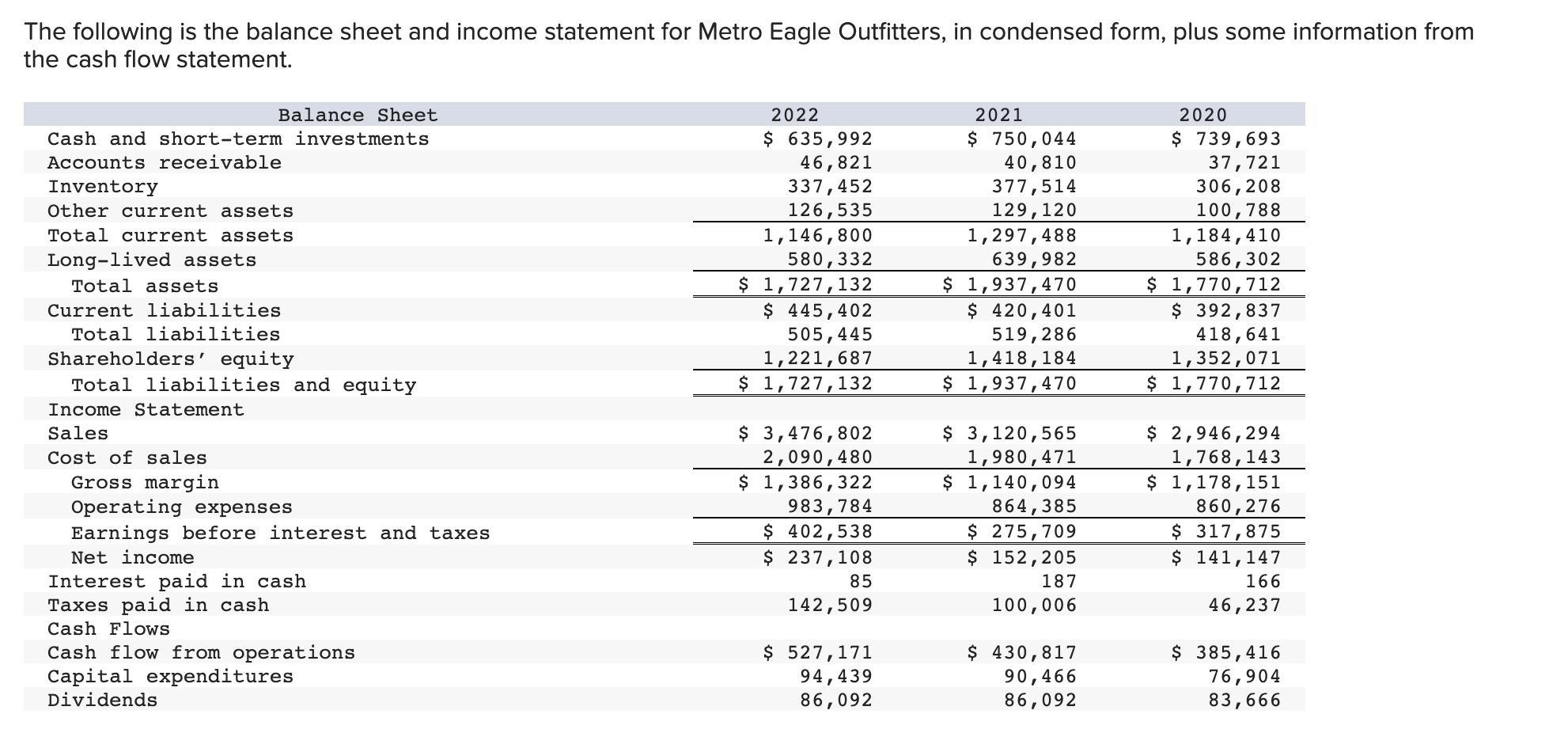

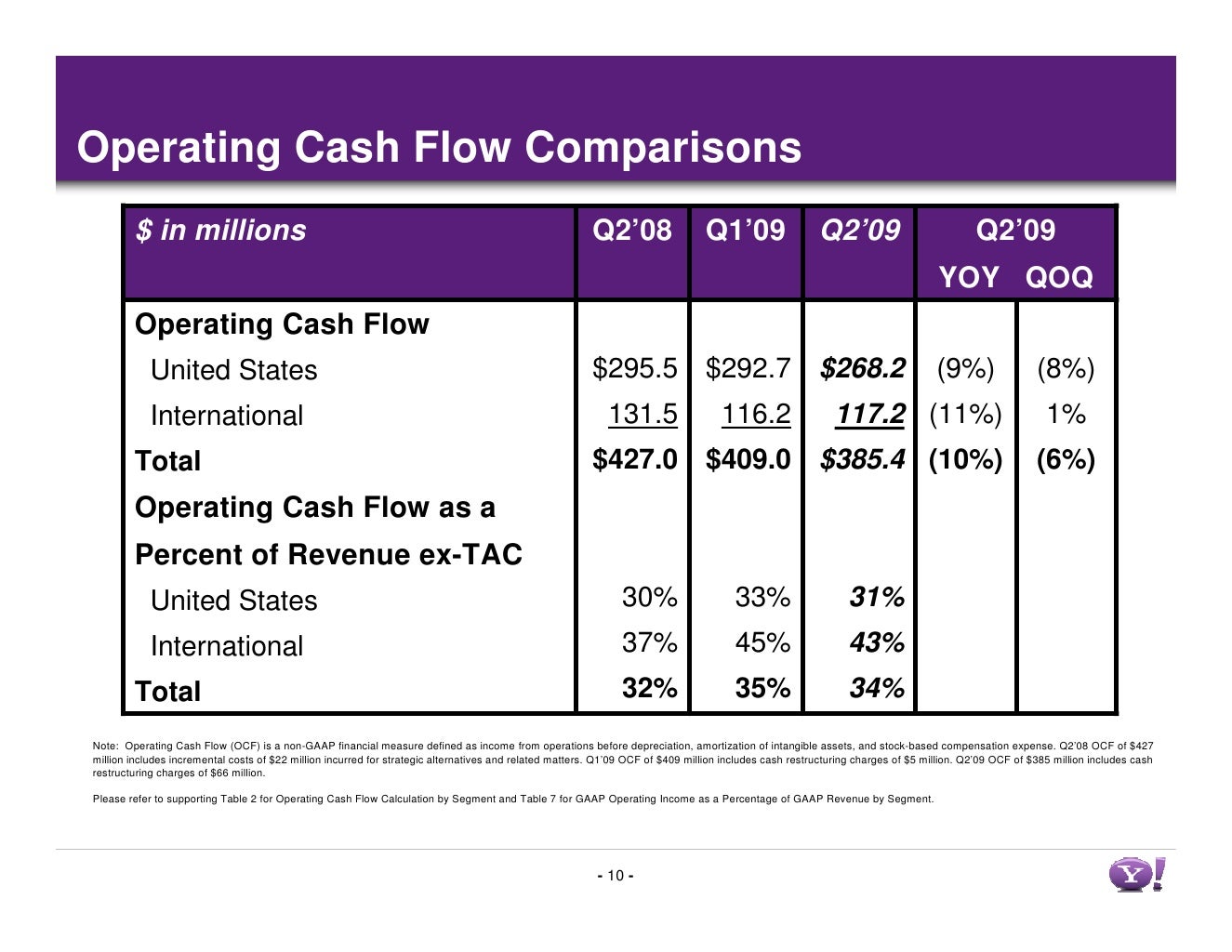

Cash flow from operations to current liabilities ratio. It is widely used by investors, creditors, and analysts to assess. Cfo ratio = $27,753 mn / $77,477 mn. Cash flow from operations ÷ current liabilities = operating cash flow ratio.

The operating cash flow to current liabilities is an alternative to the current ratio. Current liabilities are all liabilities stated on a firm’s balance sheet that are due for payment within one year. Operating cash flow ratio= operating cash flow / current liabilities.

Operating cash flow ratio = cash flow from operations / current liabilities. Cash flow from operations is reported on a company’s statement of cash flows and the current liabilities is presented on a company’s balance sheet. What is operating cash flow ratio?

Cash flow from operations ratio = cash flow from operations / current liabilities. If this ratio is less than 1:1, a business is not generating enough cash to pay for its immediate obligations, and so may be at significant risk of bankruptcy. Operating cash flow is the cash.

Cash flow from operations ratio is the ratio that helps in measuring the adequacy of the cash which are generated by the operating activities that can cover its current liabilities and it is calculated by dividing the cash flows from the operations of the company with its total current liabilities. Let’s take each component individually to understand what number needs to be plugged in. High & low operating cash flow ratio high cash flow from operations ratio indicates better liquidity position of the firm.

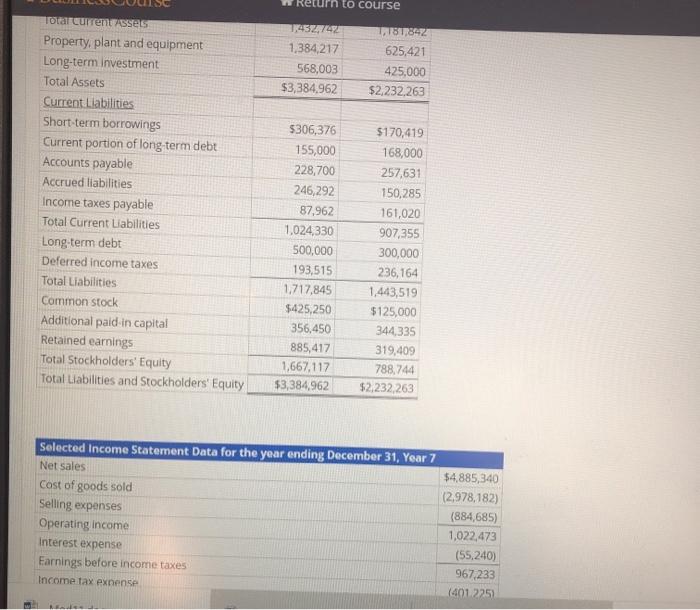

What is your business bringing in each month? Cash flow from operations (cfo) divided by current liabilities (cl) or: Cash to operating to current liability ratio = ($100,000 + $50,000) / $120,000 = $150,000 / $120,000.

Operating cash flow ratio = operating cash flow / current liabilities¹ ². This financial metric shows how much a company earns from its operating activities, per dollar of current liabilities. Price to cash flow ratio

The operating cash flow ratio, also known as the cash ratio or cash flow ratio, ascertains if the cash flows obtained from the operations of a firm are adequate to cover the current liabilities. The current liability coverage ratio, also called the cash current debt coverage ratio, calculates how much money a business has available to pay off its debt. You want this number to be as realistic and consistent as possible.

Operating cash flow ratio is calculated by dividing the cash flow from operations (also called cash flow from operating activities) by the closing current liabilities. The cash to operating to current liability ratio of 1.25 indicates that the company has enough cash and operating cash flow to. The current ratio is a measure of currents assets to current liabilities, but this alternative uses a direct measure of cash inflows from the ordinary course of business.

This ratio can help gauge a. Suppose you’re tasked with calculating the operating cash flow ratio of a company, given the following assumptions. The operating cash flow ratio is a financial metric that shows the efficiency of a company’s operating cash flow in covering its current liabilities.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/WORKINGCAPITALFINALJPEG-4ca1faa51a5b47098914e9e58d739958.jpg)