Simple Tips About Bonds Payable On Balance Sheet Profit Before Tax Note Ias 1

Once repaid, the issuer removes any balance from the underlying account.

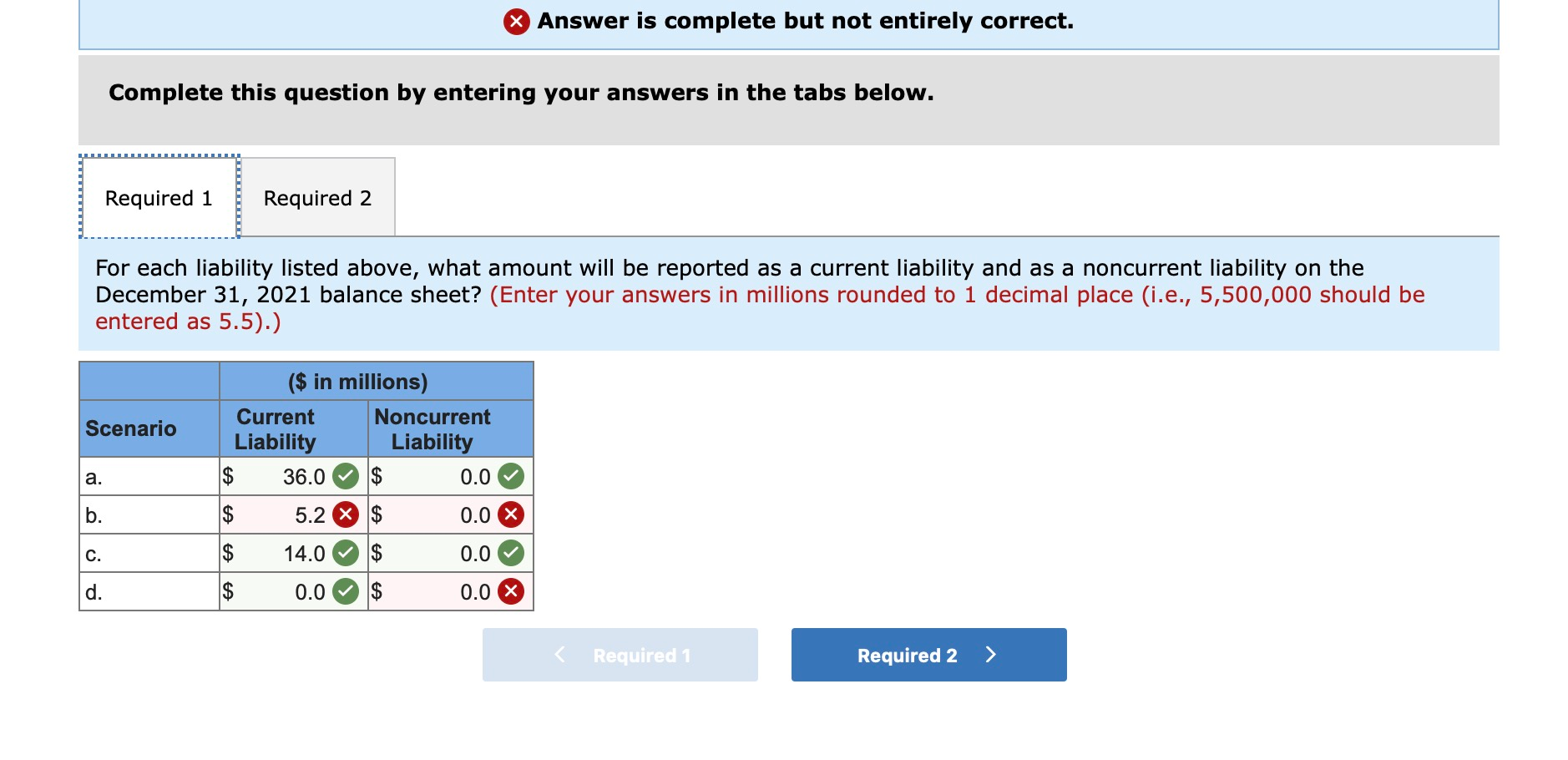

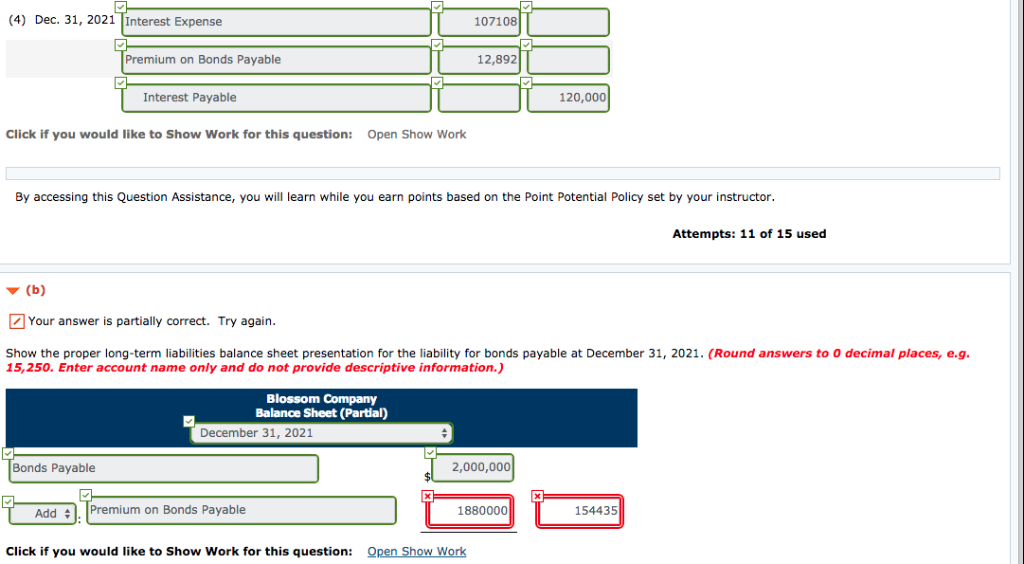

Bonds payable on balance sheet. Most companies will have these two line items on their balance sheet, as they are part of. In accounting, bonds payable fall under liabilities and appear on the balance sheet. Get your first month of bookkeeping services for free!

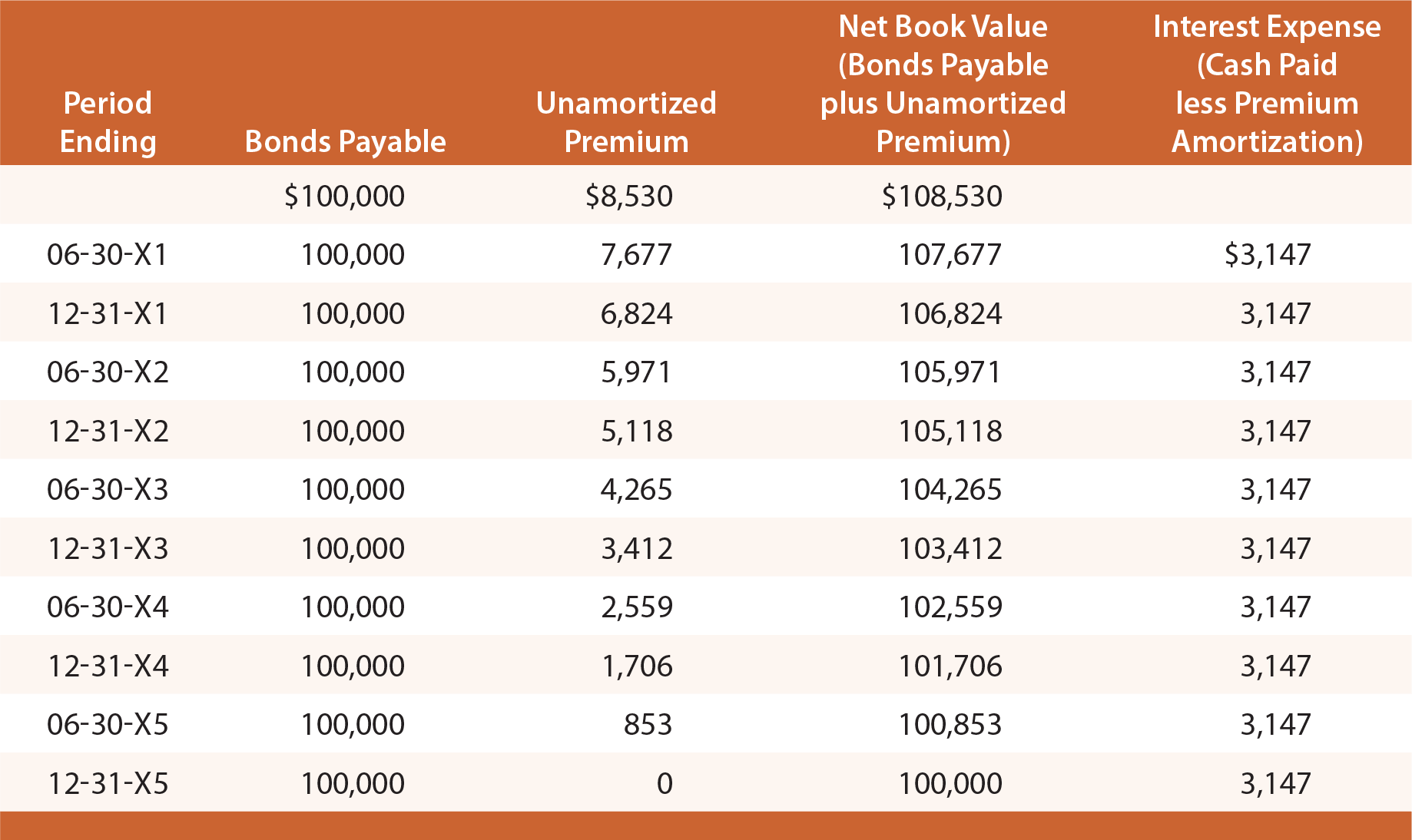

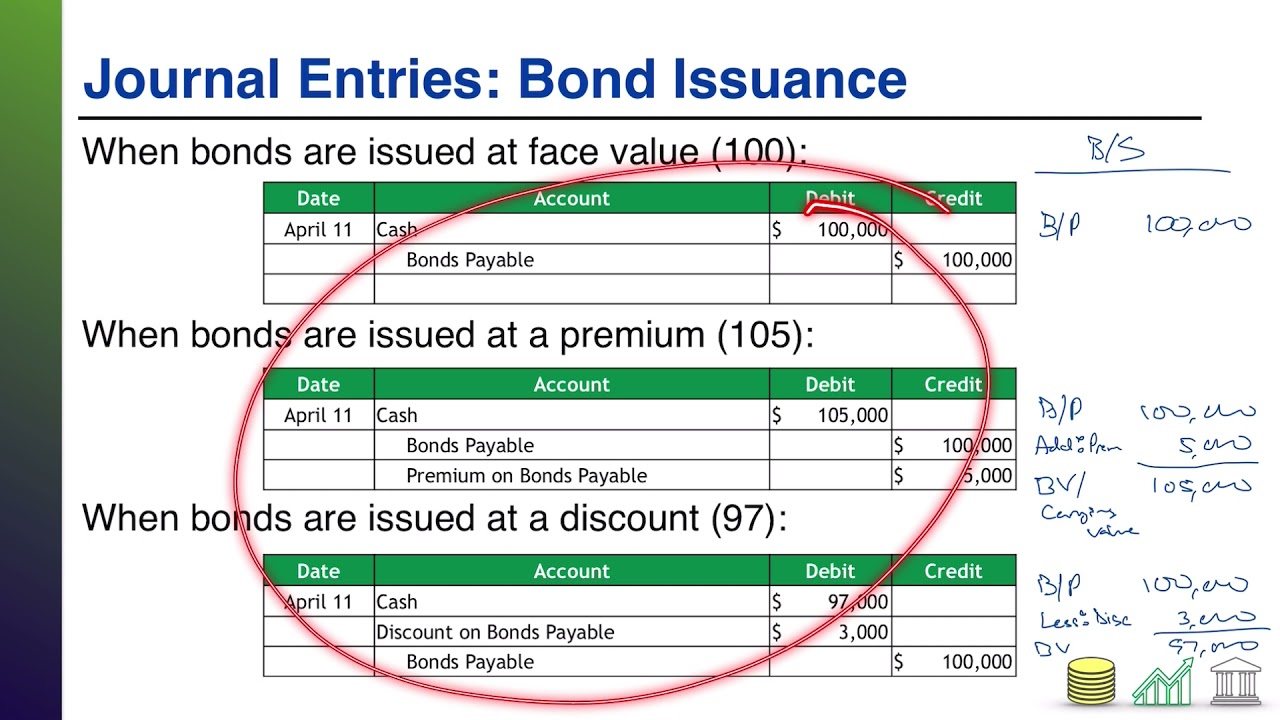

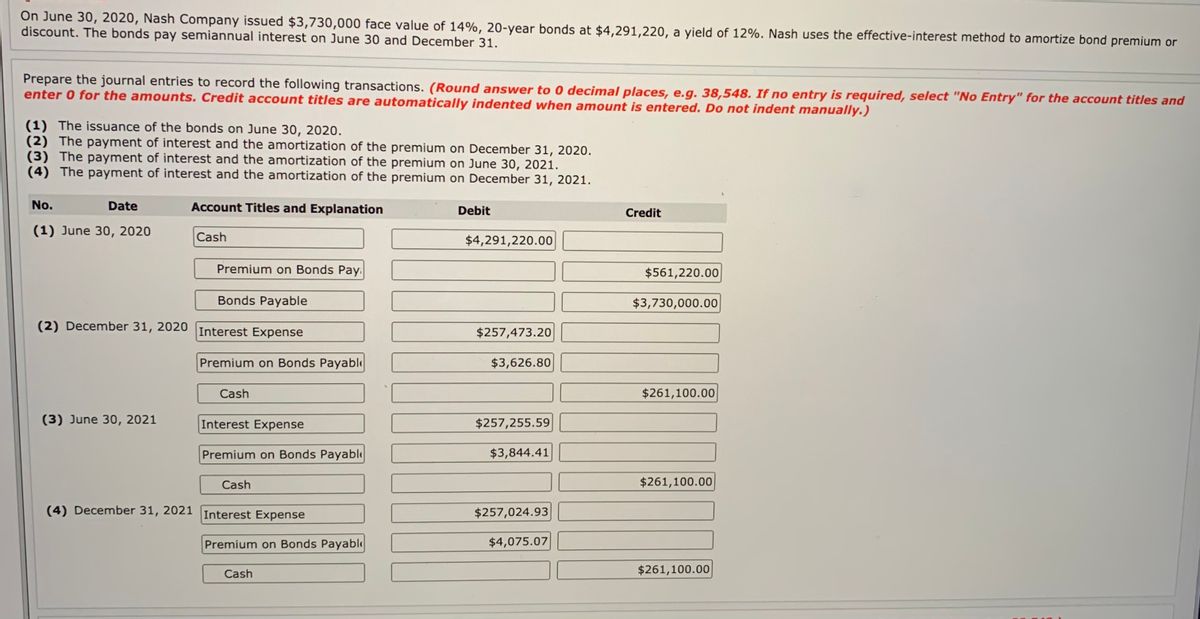

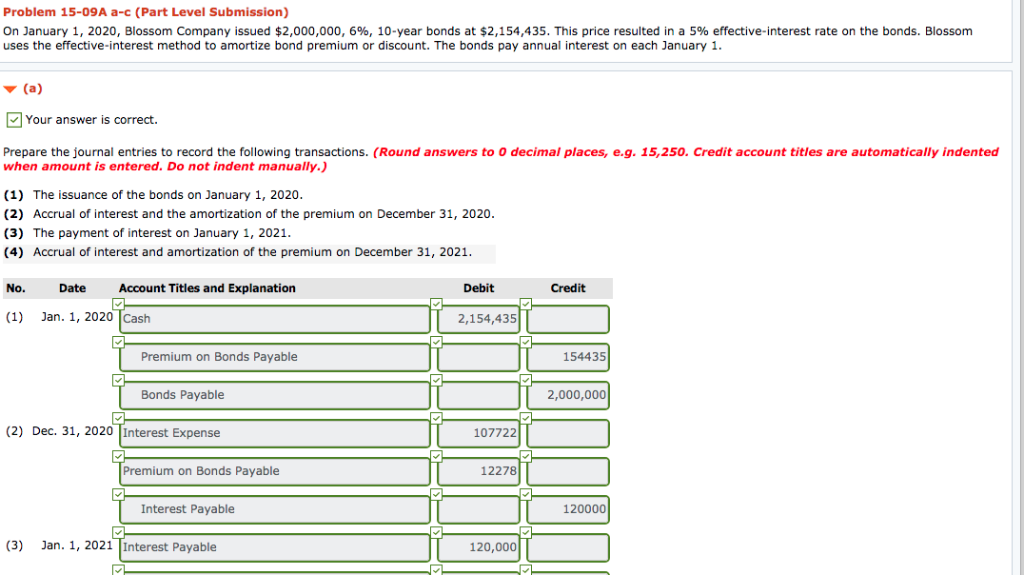

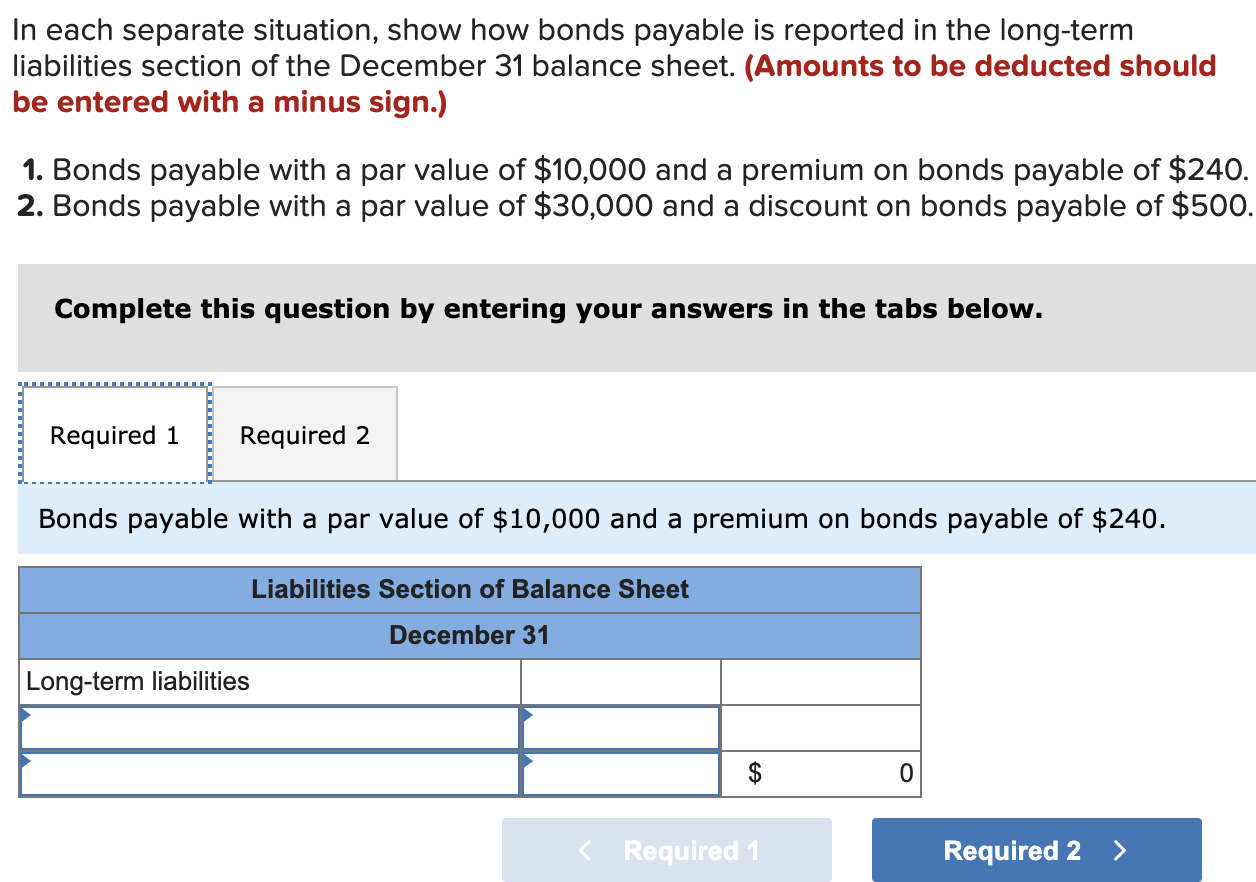

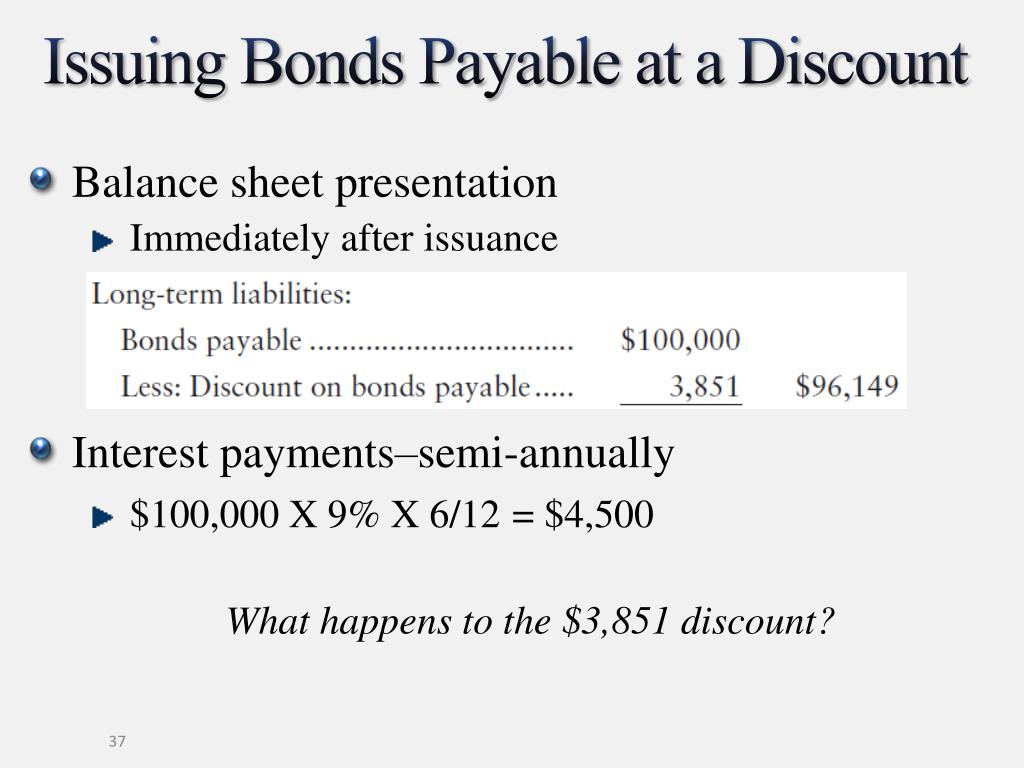

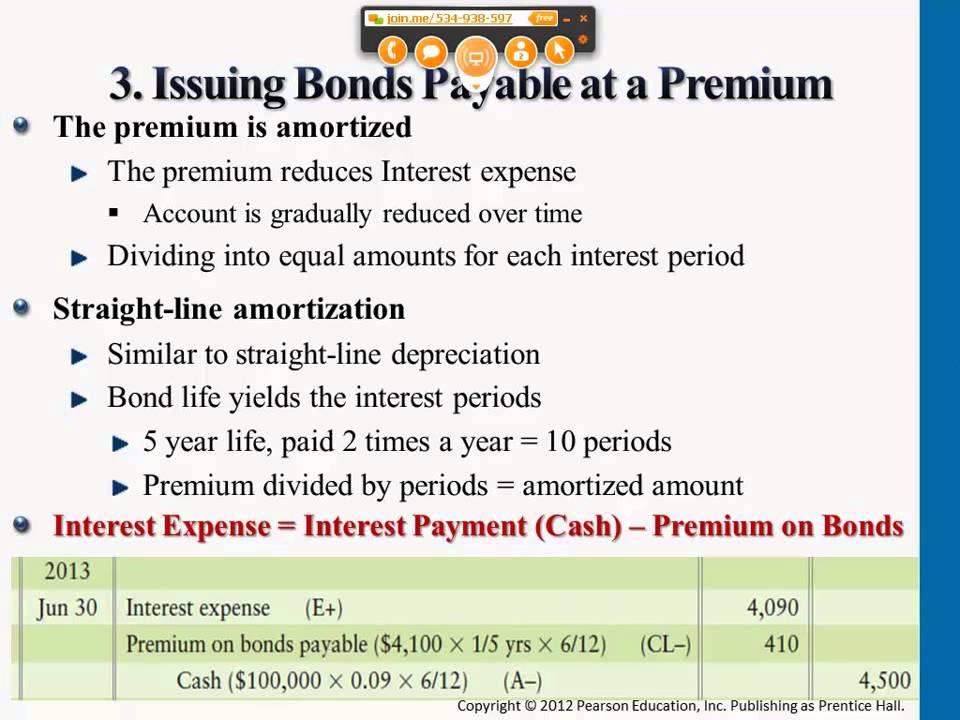

Bonds can be issued at a premium, at a discount, or at par. Since bonds are financing instruments that represent a future outflow of cash — e.g. The premium or discount on bonds payable is the difference between the amount received by the corporation issuing the bonds and the par value or face amount of the bonds.

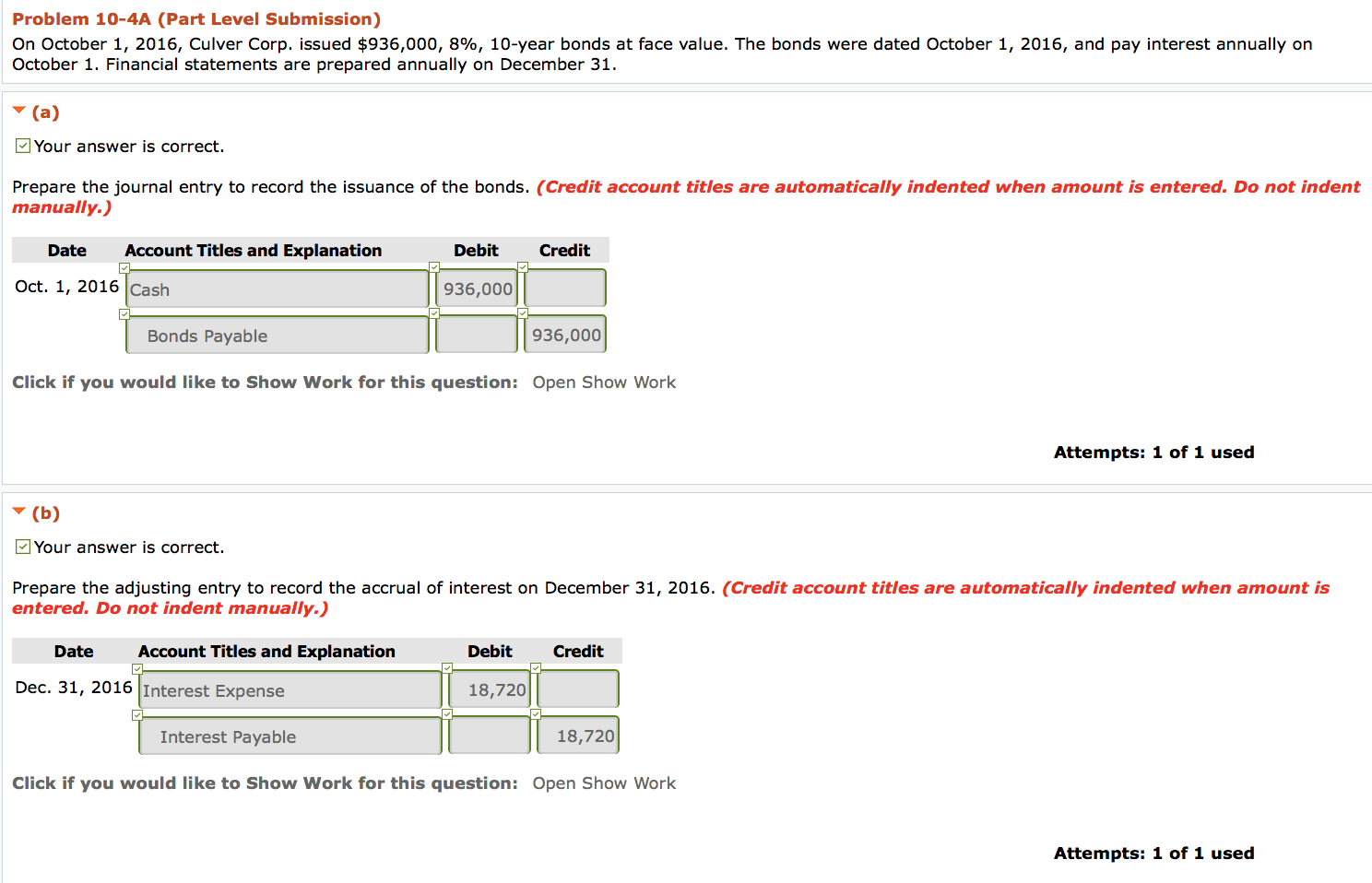

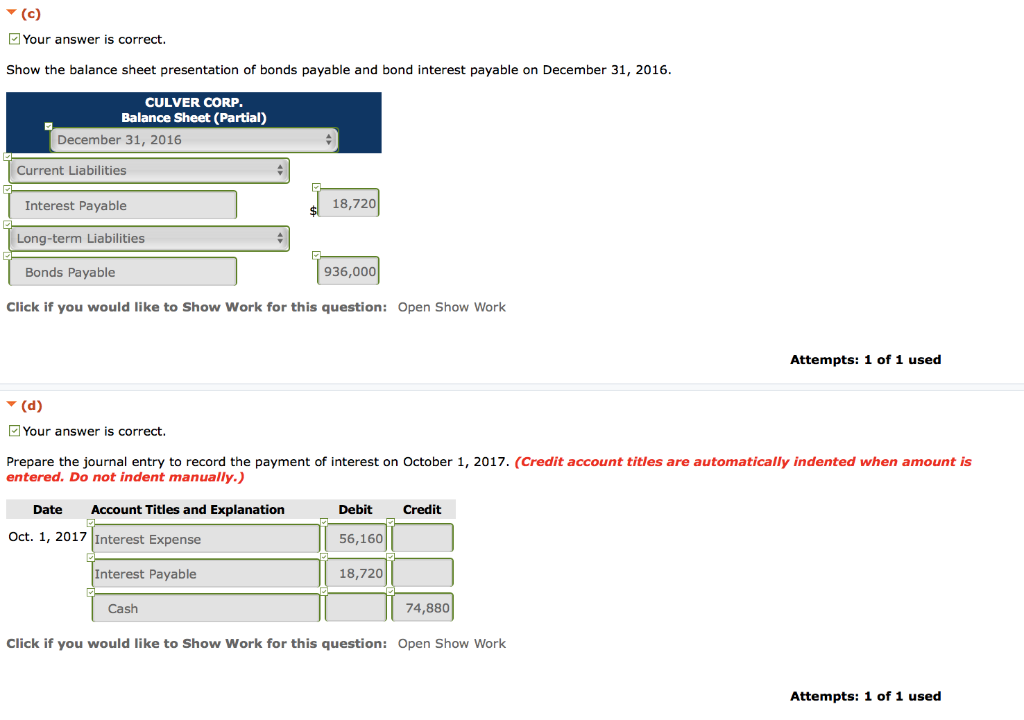

Since no interest is payable on december 31, 2022, this balance sheet will not report a liability for. The bond payable will stipulate the interest rate and the term, known as the maturity date. What is bonds payable?

Those bonds are thus listed as liabilities on the company’s balance sheet. Thus, bonds payable appear on the liability side of the company’s balance sheet. The interest expense and principal repayment — bonds payable are considered liabilities.

Home study guides accounting principles ii bonds payable bonds payable one source of financing available to corporations is long‐term bonds. The “bonds payable” line item can be found in the liabilities section of the balance sheet. The tightening of the btp/bund spread, european corporate spreads, and swap spreads below historical average levels are not putting pressure on the ecb to cut rates nor to steer away from the unwinding of its balance sheet.

The runoff of the bond portfolio has brought the total size of the fed’s balance sheet down by more than $1 trillion as of november, from a record peak of near $9 trillion reached in early 2022. The illustration below shows the balance sheet disclosure as of june 30, 20x3. 13.3 bonds payable when the amount to be borrowed is significant, bonds can provide a source of cash that is compiled from many investors.

If the amount received is greater than the par value, the difference is known as the premium on bonds payable. The bank of canada is not selling bonds as part of its qt program — it is only allowing bonds that come due to roll off its balance sheet. The issuer of bonds makes a formal promise/agreement to pay interest usually every six months (semiannually) and to pay the principal or maturity amount at a specified date some years in the future.

A business will issue bonds payable if it wants to obtain funding from long term investors by way of loans. Such bonds trade at a price less than their face value. The entire transaction of bonds payable on balance sheet is recorded affecting different accounts in balance sheet of the company.

As bond markets have already recalibrated bets on rate cuts for this year, with the ecb remaining on hold for longer,. Promissory notes, debenture bonds, and foreign bonds are shown with their amounts, maturity dates, and interest rates. What is premium on bonds payable?

On a company’s balance sheet, owners’ equity shows what the owners of the business (or shareholders) would have if the company paid off all its debt with its assets. The process to issue bonds is initiated by a bond indenture that contains details such as the denomination or face value of the bonds, the annual interest rate and payment dates (usually twice per year), and the face.