Favorite Info About Cash Overdraft Balance Sheet Thrivent Funds Performance

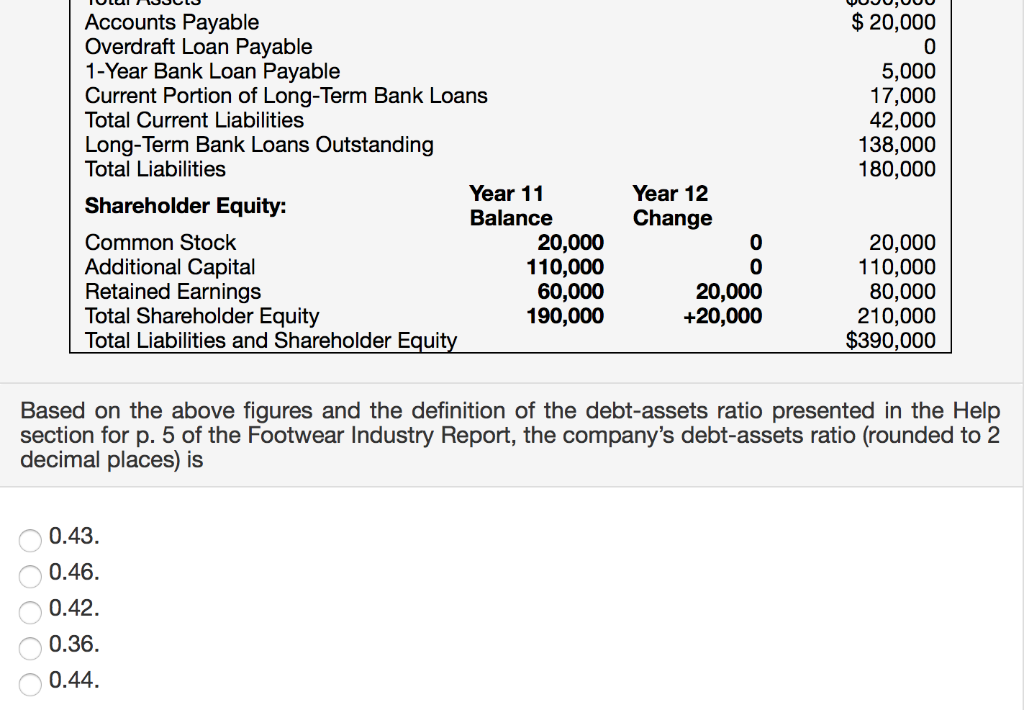

Solution on its balance sheet, earth inc.

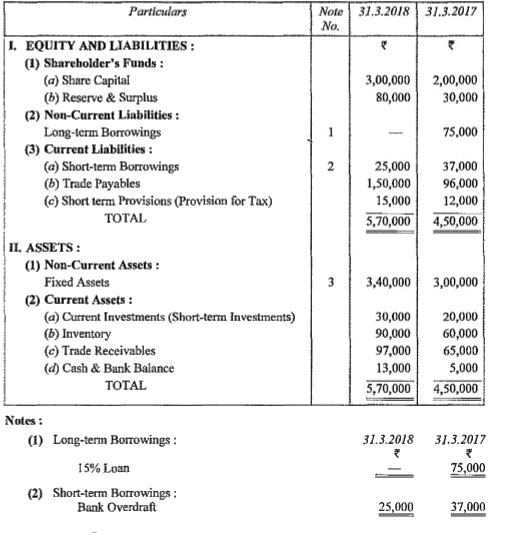

Cash overdraft balance sheet. Book overdrafts—representing outstanding checks in excess of funds on deposit—should be classified as liabilities at the balance sheet date. A cash overdraft is a bank account that contains a negative balance. Two of the accounts have positive balances (the first include $50,000 and the second with $200,000).

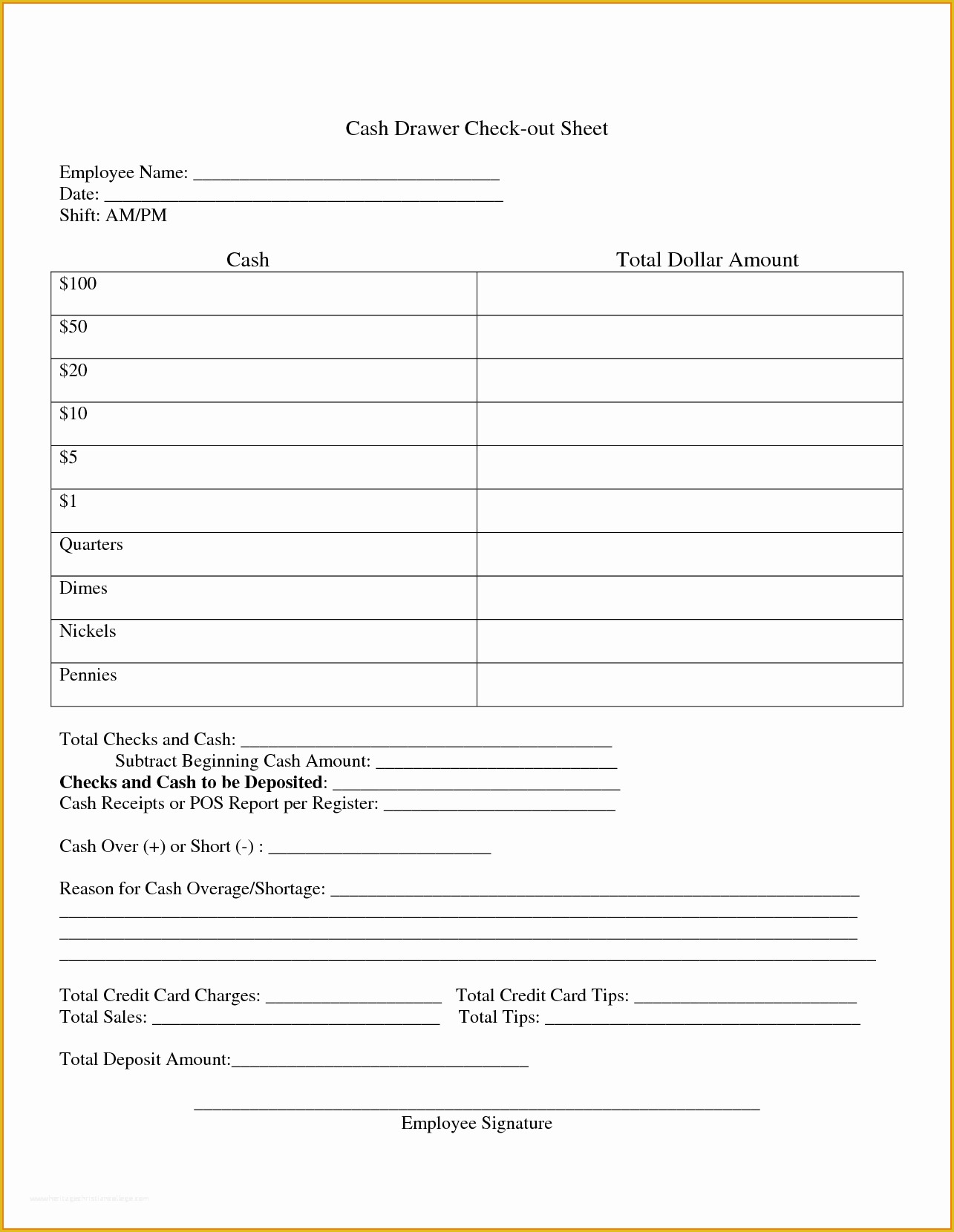

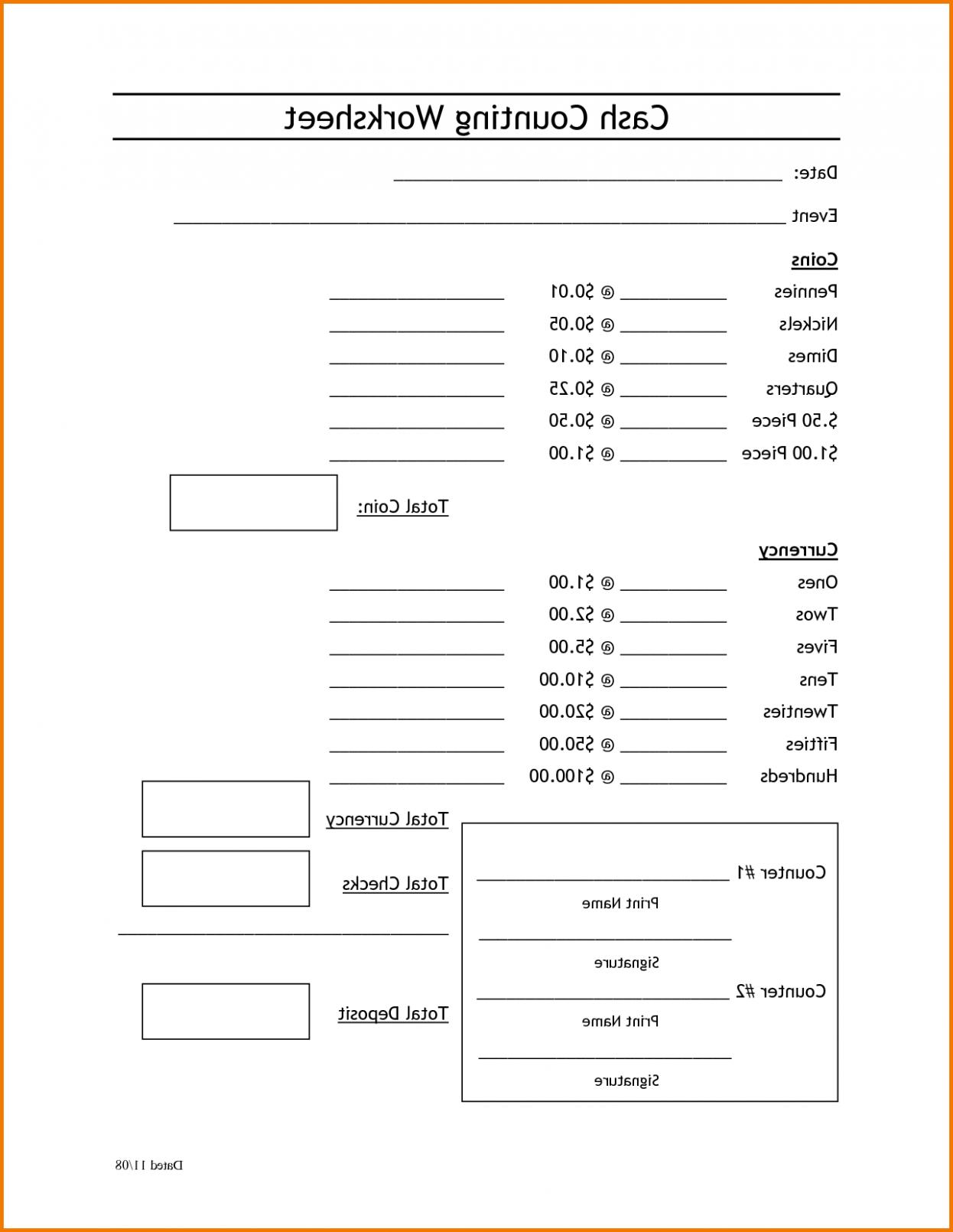

Bank overdrafts and cash and cash equivalents. If you bury the overdraft in accounts payable, the financial statement reader. Cash on hand and demand deposits (cash balance on the balance sheet).

In the balance sheet, show the negative cash balance as cash overdraftin the current liabilities. Differences in the guidance covering the offsetting of assets and liabilities under master netting arrangements, repurchase and. The beginning and ending balance of cash, cash equivalents, restricted cash, and restricted cash equivalents and any other segregated cash and cash equivalents shown.

A cash budget has also been prepared that. This situation typically arises when a person or business is too optimistic in assuming that. Jim has prepared a budgeted profit and loss account for the initial four months trading, showing a budgeted profit of $3,000.

Bank overdrafts (a negative bank balance) can be netted and reported with cash on the balance sheet if the overdraft is repayable on demand and there are other positive. Cash and cash equivalents refers to the line item on the balance sheet that reports the value of a company's assets that are cash or can be converted into cash. If an entity records the overdraft balance in the accounts payable, it should reflect the same cash flow under the operating activities of the cash flow statement.

Book overdrafts (us gaap) a book overdraft represents the amount of outstanding checks in excess of. This happens when the business has. The balance sheet caption “cash” should represent an amount that is within the control of the reporting enterprise, namely, the amount of cash in banks plus the amount of cash.

Comment on balance sheet and statement of cash flows presentation of the overdraft. When preparing a balance sheet, the bank overdraft accounting treatment would be to record a negative cash balance as a current bank overdraft liability, which. Which third account has a minor liquid balance of $400,000.

If you are netting the three bank accounts, consider using the cash overdraft option. However, in the statement of cash flows,. Bank overdrafts (a negative bank balance) can be netted and reported with cash on the balance sheet if the overdraft is repayable on demand and there are other.

That third account possess a negatory cash balance of. What are the deciding factors such as the line of credit and overdraft protection? Two of the accounts have positive balances (the first with $50,000 and the second include $200,000).

Numerous companies maintain cash overdraft balances. 15.2.1 balance sheet—offsetting assets and liabilities. How is an overdraft shown on balance sheet?

:max_bytes(150000):strip_icc()/dotdash-what-difference-between-overdraft-and-cash-credit-Final-8e1e4594a99342748fc565d7c5dd66d3.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

![Solved [34 marks] Question 2 Statement of Cash Flows Set](https://media.cheggcdn.com/media/aa2/aa2fb3f8-596e-4c8e-8a90-7697dc8a1212/phpIToR6o.png)