Unique Tips About Partners Appropriation Account Startup Financial Projections Template Excel

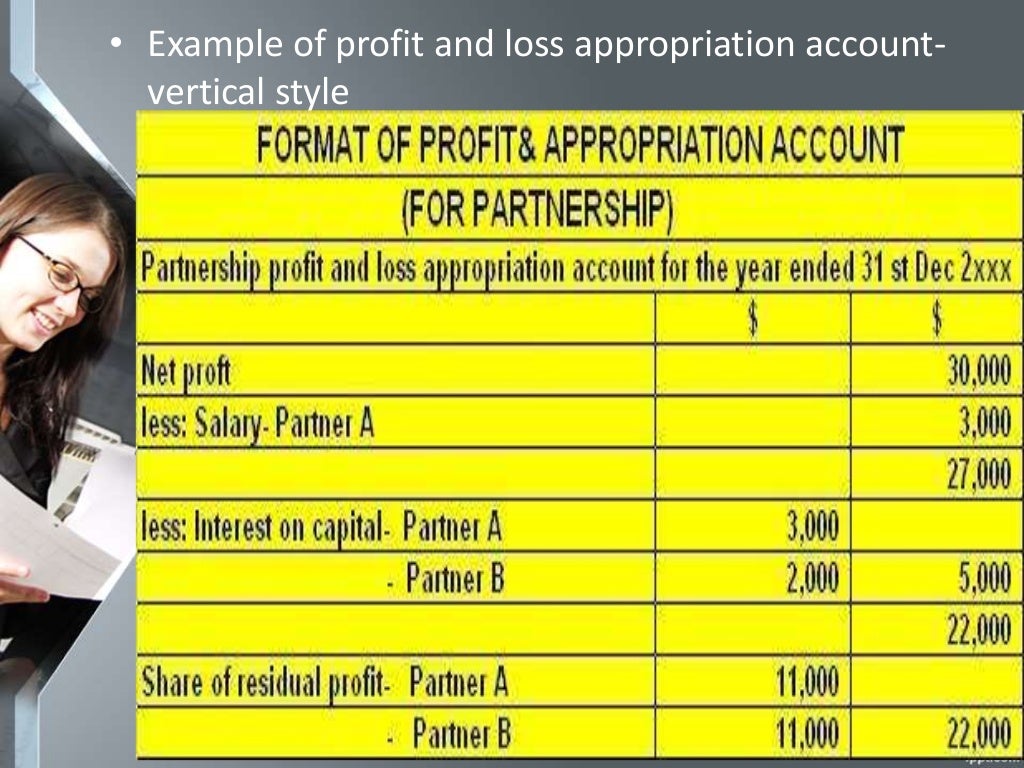

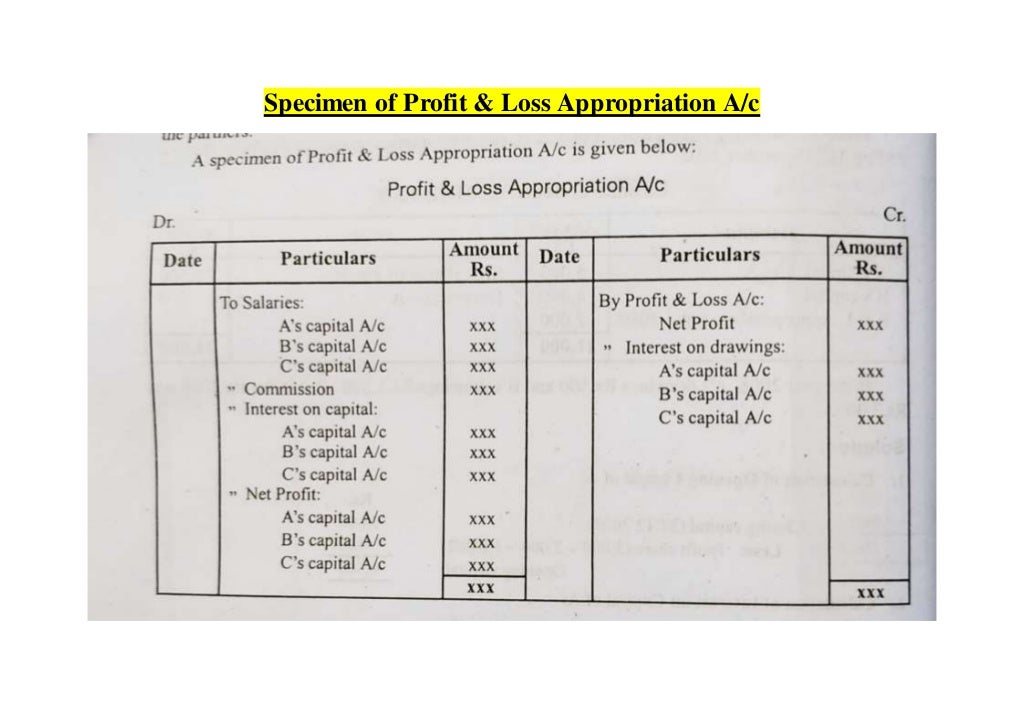

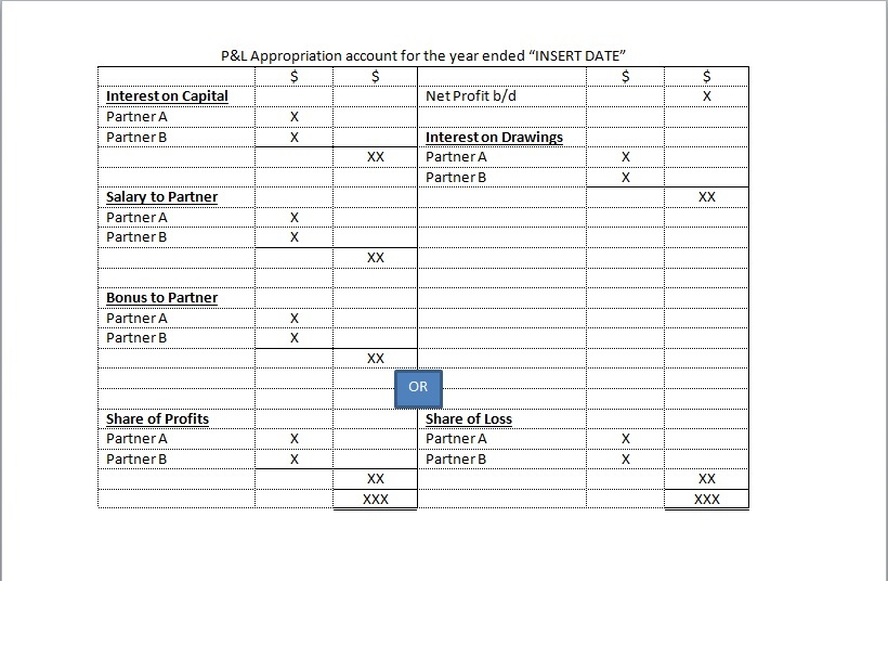

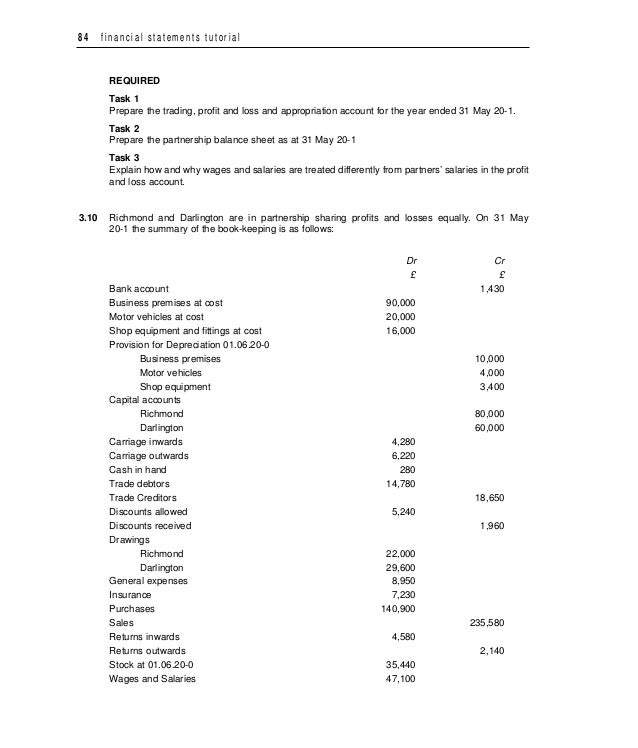

For partnerships, it shows how profits are distributed among the partners.

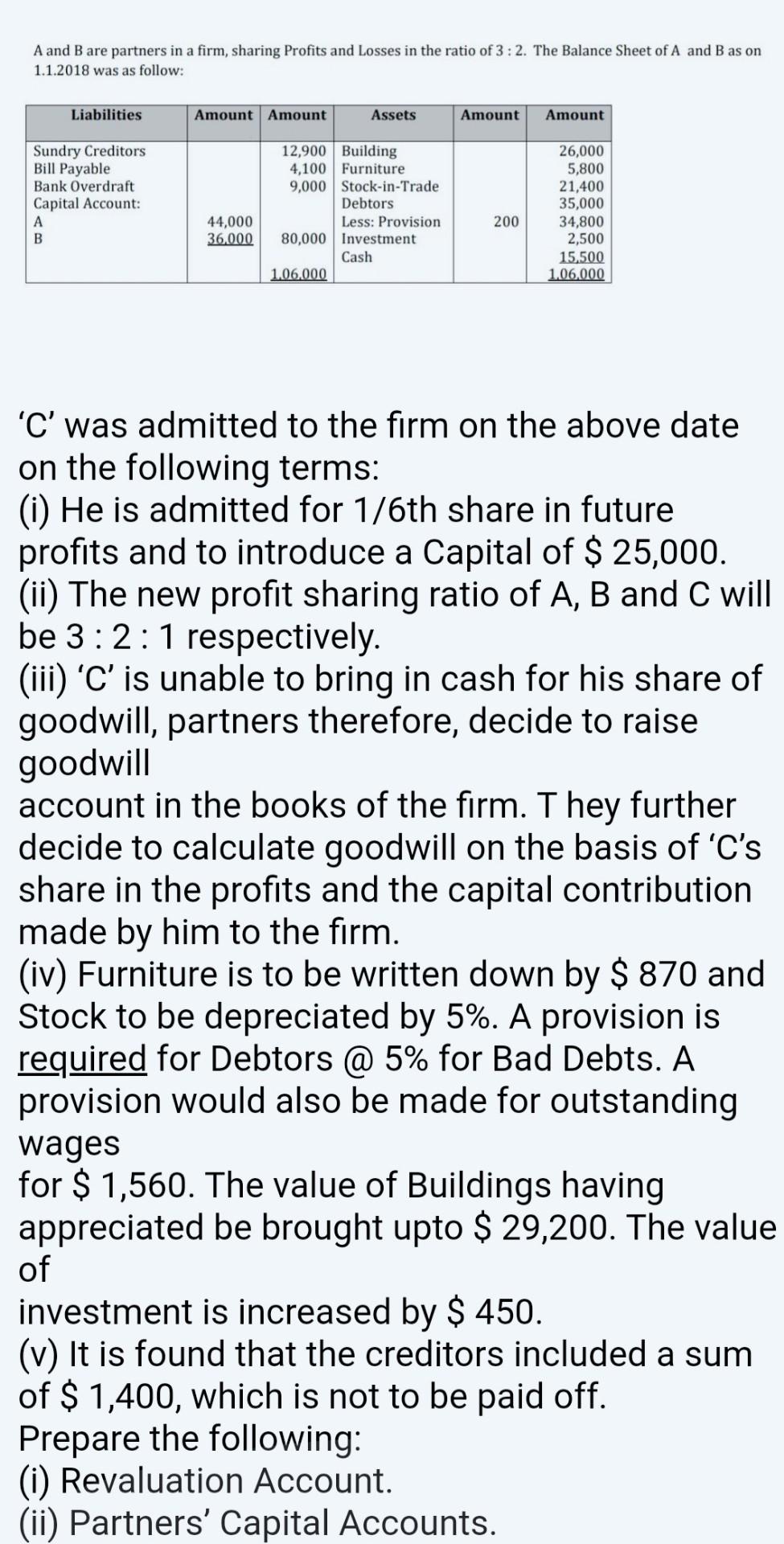

Partners appropriation account. In the business world, an appropriation account is used to provide information on how profits are divided between shareholders, partners and departments. Transfer of profit to reserves, 3. The partnership deed is silent on interest on loan from partners.

Balance sheet (a) there is a separate capital account for each partner instead of just the one required for a sole trader (b) we often maintain a separate current account for each. Agreement:partnership is the result of an agreement between two or more persons to do business and share its profits and losses. Net loss transferred from p&l account, 2.

1k share 61k views 3 years ago in this accounting lesson, we explain what the appropriation account for a partnership is, and why we complete it. Teresa clarke explains all you need to know about partnership appropriation statements and current accounts. As each appropriation is dealt with, the double entry is completed through entries in both the appropriation account and the partner’s current account (if current accounts are.

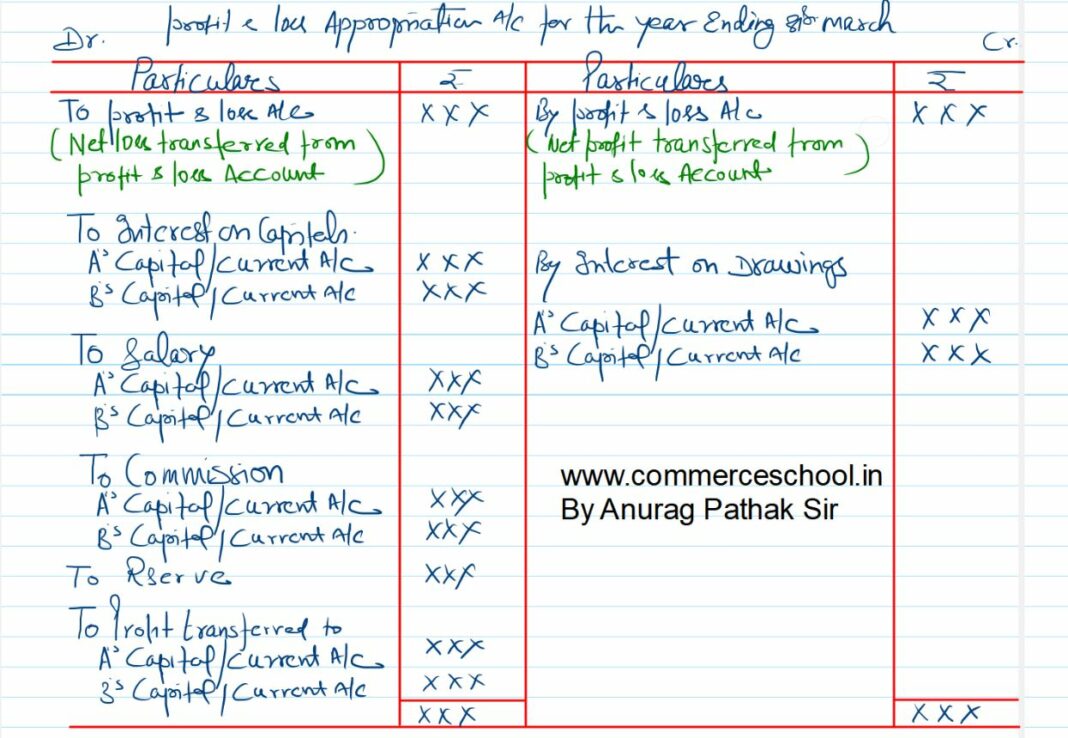

Partners’ capital account & interest on capitals. The appropriation account is another account that is prepared by a partnership firm. The final figure of profit and loss to be distributed among the partners is ascertained by the profit and loss appropriation account.

In contrast to a sole proprietorship, the earnings of a partnership are. An appropriation account shows how an organization’s funds are distributed among partners, shareholders, and departments. To make an appropriation account,.

For companies, an appropriation account shows how the company’s profits are divided and retained. In the case of partnership companies, the profit and loss appropriation account (p/l appropriation account) is debited for goods like interest on capital,. Profit for current year was rs.

In case of a partnership, profit and loss appropriation account is created to demonstrate the change in each partner's individual capital as a result of profit or loss. The agreement becomes the basis of. Prepare profit and loss appropriation account at the end of.

An appropriation account shows how an entity divides the firm’s net profit to calculate how much is used to pay income tax, paid as a dividend to shareholders, and set aside as.