Wonderful Tips About Explanation Of Financial Ratios Total Ifrs Standards

3) leverage, and 4) operating or efficiency—with several.

Explanation of financial ratios. Types of ratio analysis 1. They are used to get insights and important information on the company’s performance, profitability, and financial health. Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc.

A financial ratio or accounting ratio states the relative magnitude of two selected numerical values taken from an enterprise's financial statements. Financial ratio analysis assesses the performance of the firm's financial functions of liquidity, asset management, solvency, and profitability. Financial ratios are powerful tools to help summarize financial statements and the health of a company or enterprise.

Learn the most useful financial ratios here. Often used in accounting, there are many standard ratios used to try to evaluate the overall financial condition of a corporation or other organization. Financial ratios help break down complex financial information into key details and relationships.

The resulting ratio can be interpreted in a way that is more insightful than looking at the items separately. These relationships between the financial statement accounts help investors, creditors, and internal company management understand how well a business is performing and of areas needing improvement. For the required calculations that.

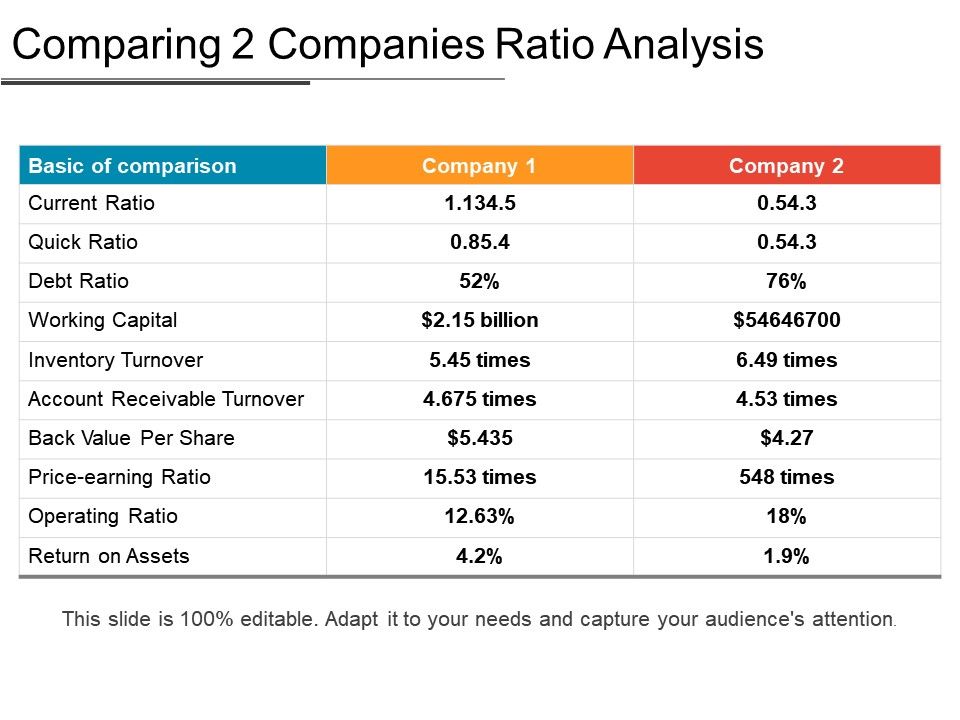

To calculate it, we divide one financial statement item by another, expressed as a percentage or multiple. They can also aid in comparing two companies. These ratios are applied according to the results required, and these ratios are divided into five broad categories:

Our discussion of 15 financial ratios ratio #1 working capital ratio #2 current ratio ratio #3 quick (acid test) ratio ratio #4 debt to equity ratio ratio #5 debt to total assets But, the interpretation may not be as simple as the calculation. Financial ratios are used by the investment community to analyze a company’s finances.

List of financial ratios here is a. Financial ratios are the ratios used to analyze the company’s financial statements to evaluate performance. There are many different financial ratios held within 5 main categories:

Financial ratios such as the turnover ratios and the return on ratios will need 1) an amount from the annual income statement, and 2) an average balance sheet amount. Financial ratios are quantitative relationships between two or more numbers in financial statements. Financial ratios can provide insight into a company, in terms of things like valuation, revenues, and profitability.

An average balance sheet amount is needed since the balance sheet reports the amount for only the final moment of the accounting year. Ratio calculation is relatively easy. Leverage ratios measure the amount of capital that comes from debt.

Definition and importance of financial ratios. The term liquidity refers to how easily a company can turn assets into. Using the price to earnings ratio.