Amazing Tips About Audited Financial Accounts Non Profit Statement Template Free

Cost of an online accounting degree.

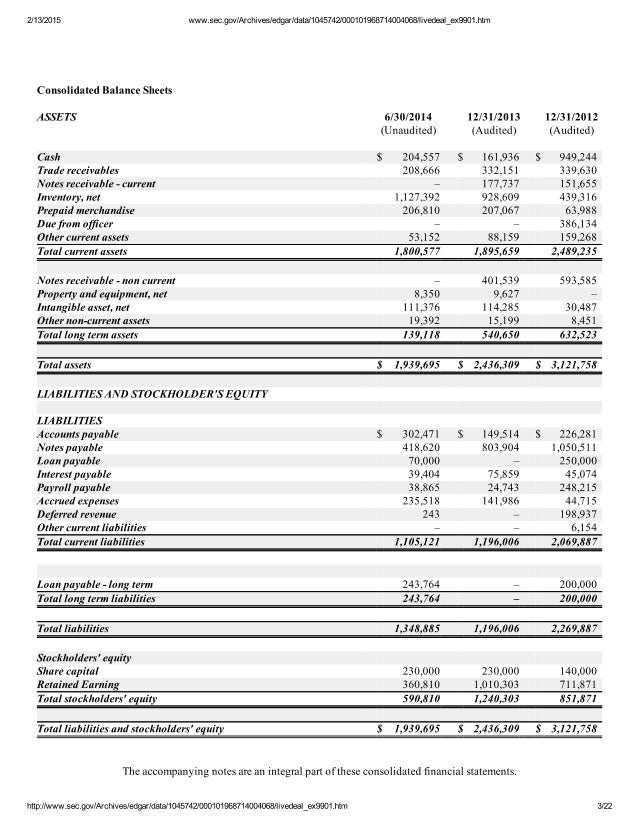

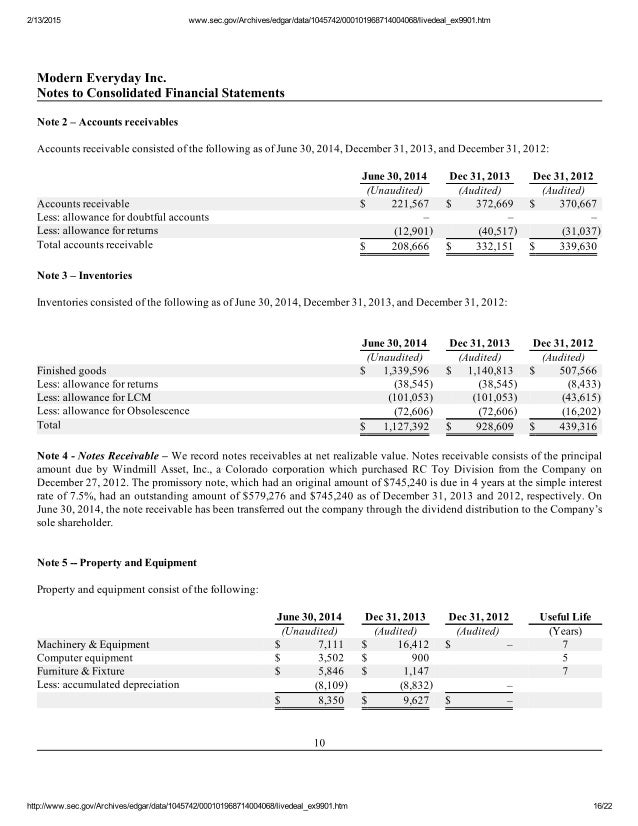

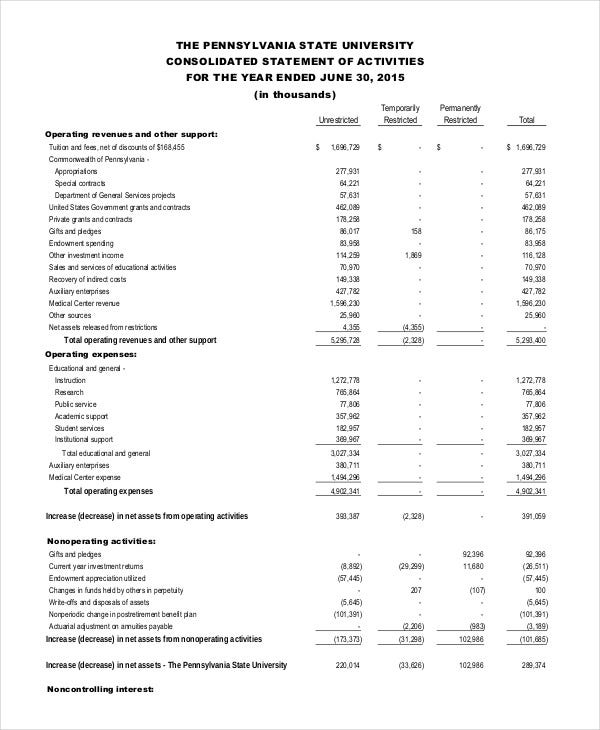

Audited financial accounts. It will be addressed to the company’s board of directors or whoever the top management of the company. An audited financial statement is any financial statement that has been audited by a certified public accountant (cpa). It allows you to see what resources it has available and how they were financed as of a specific date.

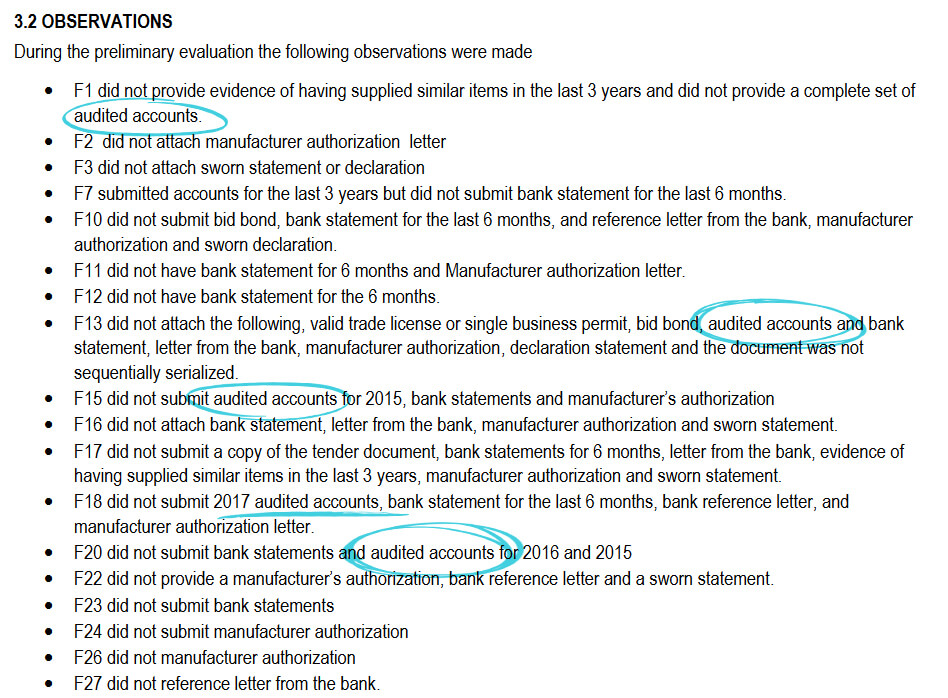

Audits provide investors and regulators with confidence in the accuracy of a corporation’s financial reporting. The negative effect is more pronounced when the two signatory auditors are partners in their audit firms or when financial irregularities exist in their. Inventors and lenders may be sceptical of the assertion you provide if you don't have this cpa proof.

A financial audit is the examination of the financial records of an entity by a certified third party examiner. What is an audited financial statement? Typically, those that own a company, the shareholders, are not those that manage it.

Overview purpose of a financial statement audit companies produce financial statements that provide information about their financial position and performance. A cpa will guarantee that a financial statement follows general accounting concepts and auditing standards when auditing it. The result of this examination is a report by the auditor, attesting to the fairness of presentation of the financial statements and related disclosures.

Over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Financial statements are often audited by government agencies and accountants to ensure accuracy and for tax, financing, or investing purposes. This information is used by a wide range of stakeholders (e.g., investors) in making economic decisions.

Auditors conduct financial audits and check them against the generally accepted auditing standards (gaas), published by the financial accounting standards board (fasb). Department of the treasury published the 2024 national risk assessments on money laundering, terrorist financing, and proliferation financing. Internal audit leaders can be agile by embracing change and adapting quickly in uncertain times, but shifting to an agile mindset requires an environment safe for learning.

An audit is an examination of the financial statements of a company, such as the income statement, cash flow statement, and balance sheet. Audited financial statements are the financial statements of an organization that have been examined by a certified public accountant (cpa). An audited financial statement is any financial statement that a certified public accountant (cpa) has audited.

When a cpa audits a financial statement, they will ensure the statement adheres to general accounting principles and auditing standards. How to read a balance sheet. Auditing in accounting and finance simply explained.

An annual audit of a company's financial accounts, including the income statement, balance sheet, and cash flow statement is standard practice for virtually all businesses. For audits that go beyond the finances, the client and auditor must agree on the benchmark prior to the audit. It shows its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the amount invested by shareholders).

The final budget for 2022 came in at $30.2 million against a projection of $29.7 million. Records were 'really, really bad' i'm confident we'll fix this financial disaster we are in, said. Complaints received by the accounting and financial reporting council (afrc) almost tripled to 169 in january this year compared with 56 cases in 2019, while the number of investigations jumped.