Stunning Tips About Redeemable Preferred Stock Balance Sheet Working Capital Ratio Analysis

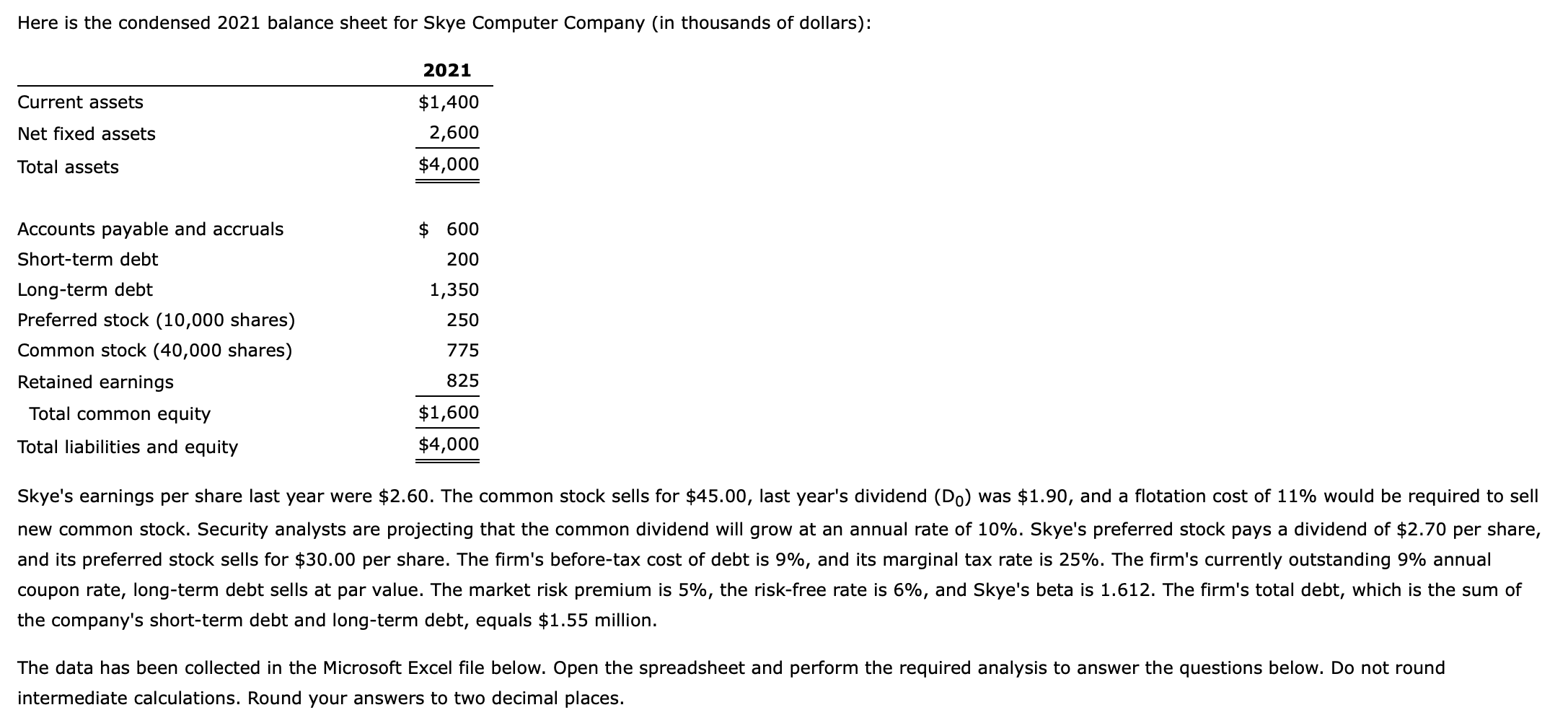

Redeemable shares have a set call price, which is the price per share that the company agrees to pay the shareholder upon redemption.

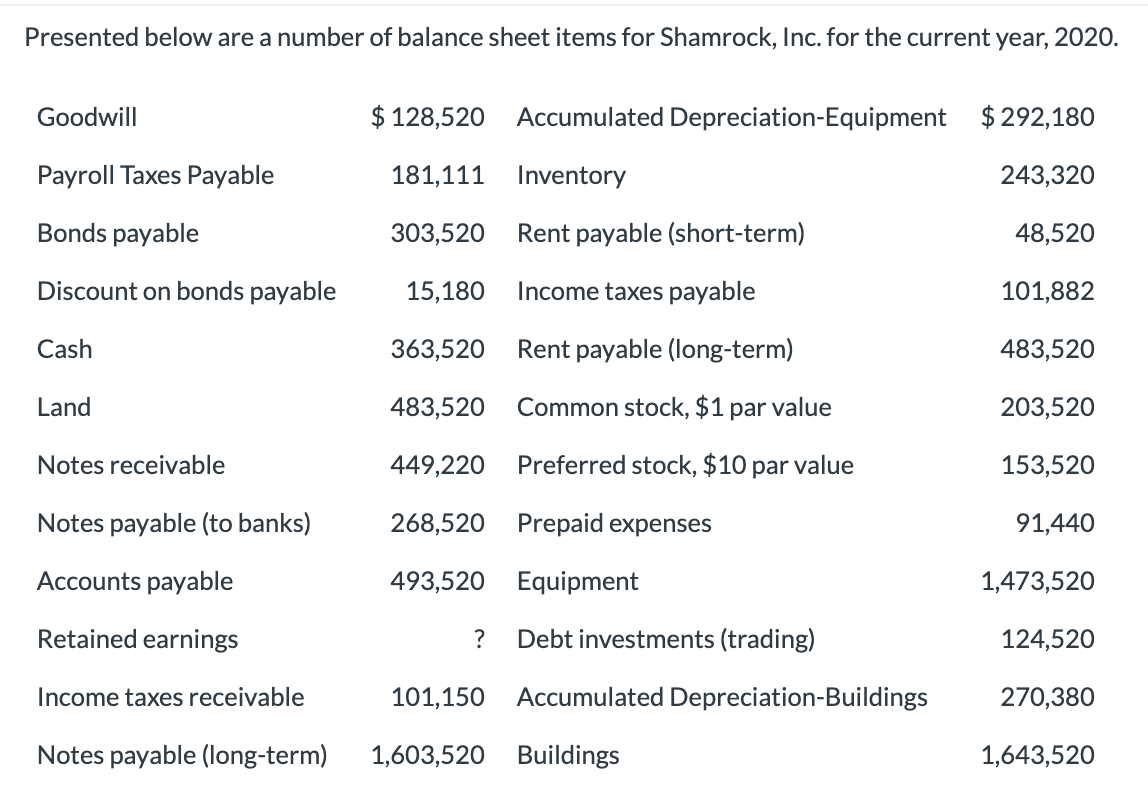

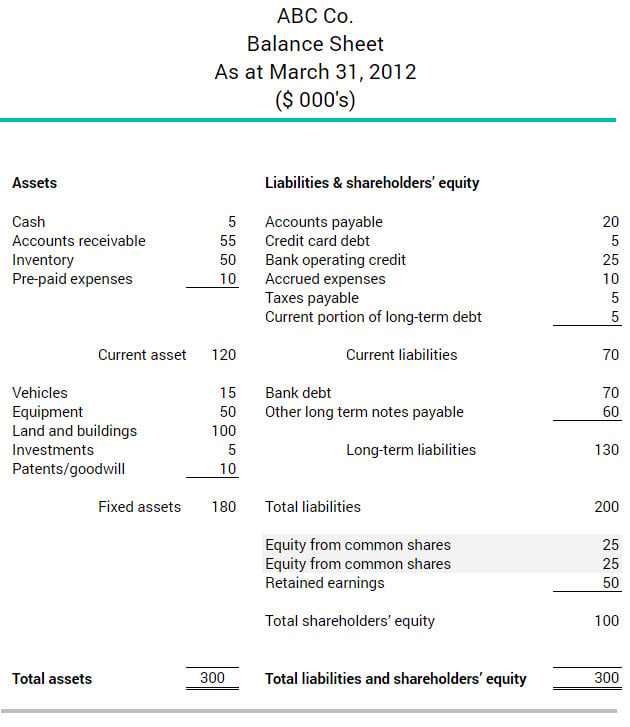

Redeemable preferred stock balance sheet. Study with quizlet and memorize flashcards containing terms like mandatorily redeemable preferred stock is reported as a liability. Preference shares, also known as preferred stock, are a type of stock that companies issue. While the classification and impact of preferred stock on the balance sheet have been discussed, there are other important considerations to keep in mind when.

T/f, noncash assets received as consideration. If the preferred stock is redeemable at the option of the holder on a specified date and convertible at the option of the holder in the event of the ipo, it is inappropriate to. Preferred stocks which are not redeemable or are redeemable solely at the option of the issuer.

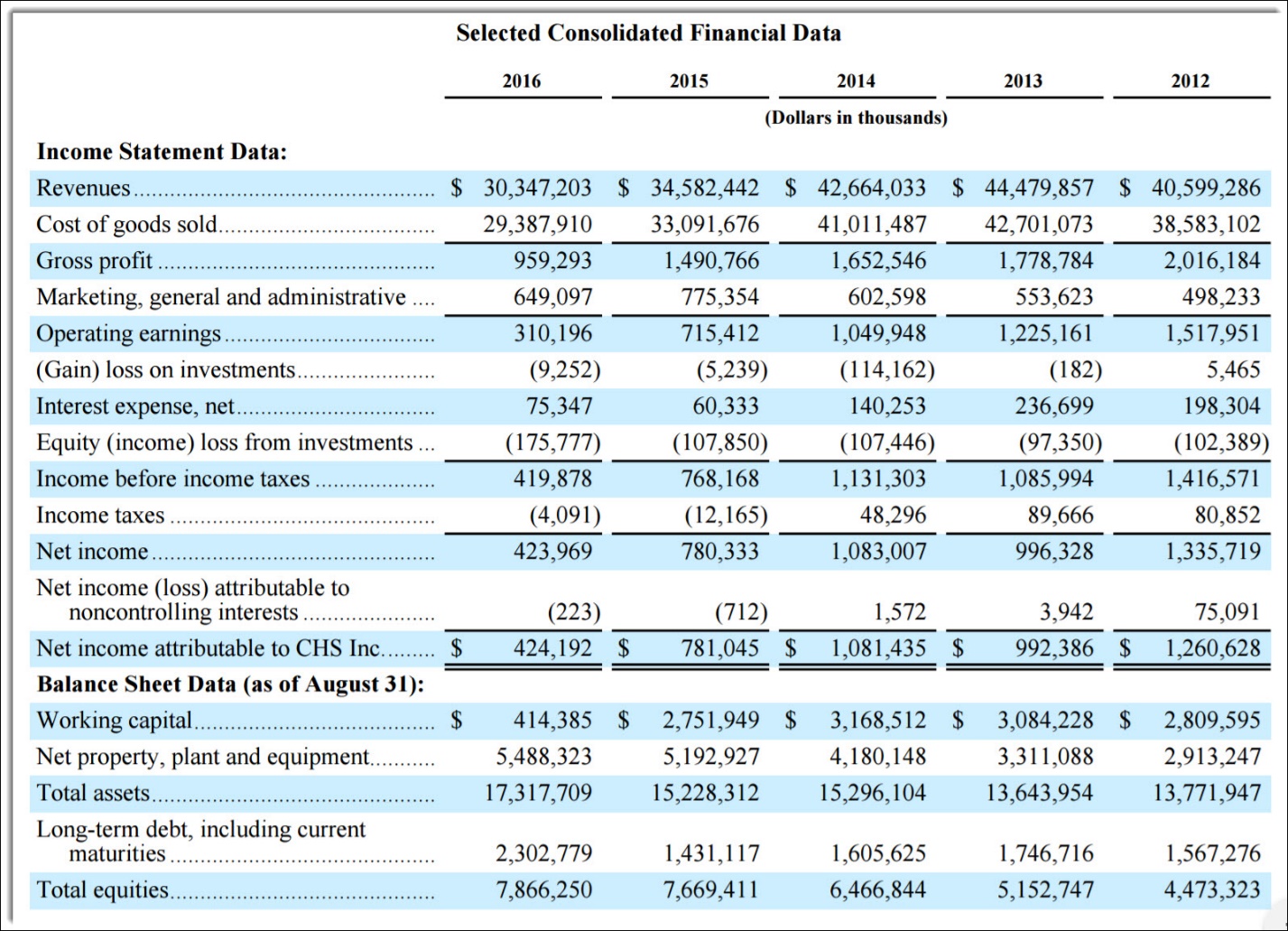

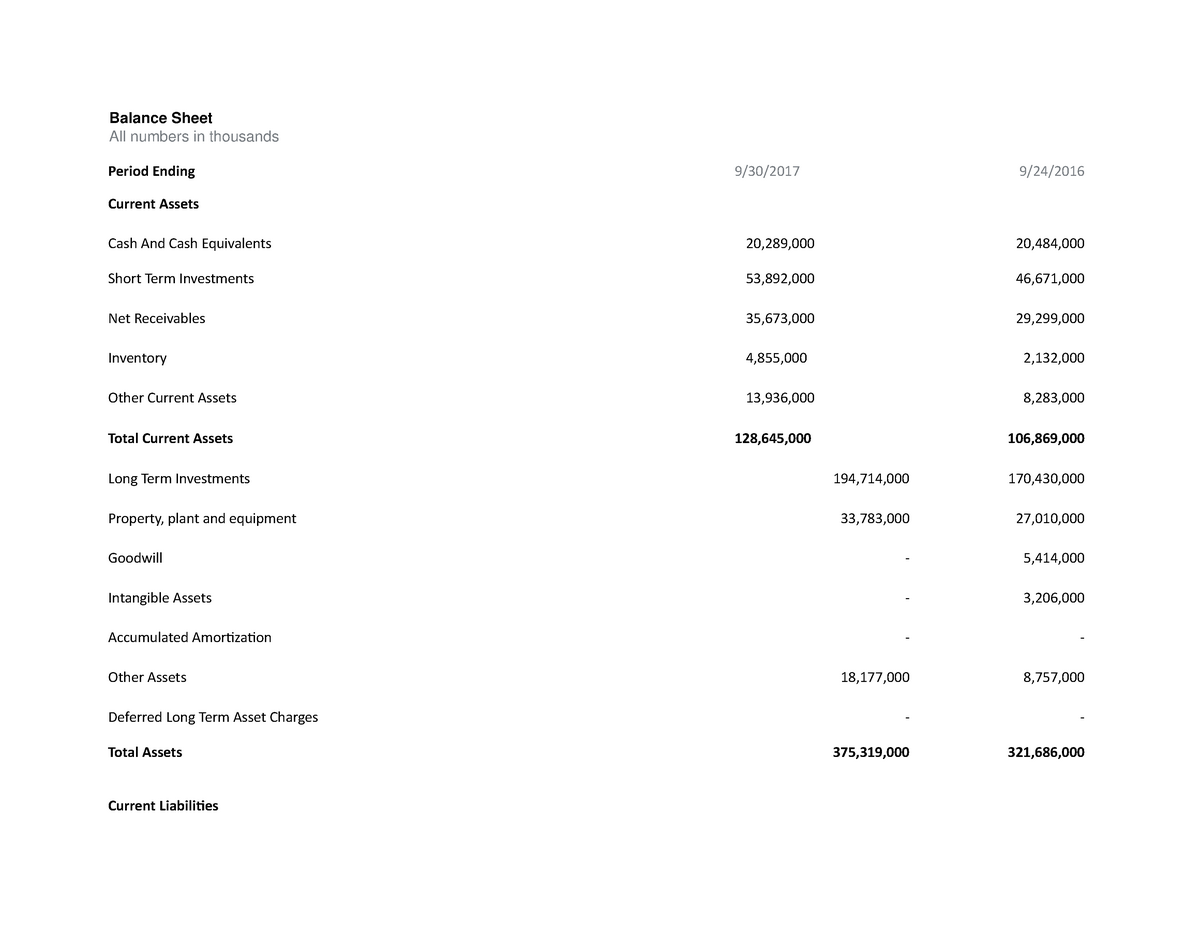

The determination of how to classify. This fixed dividend is not. View chscp assets, liabilities, investments, debt, and.

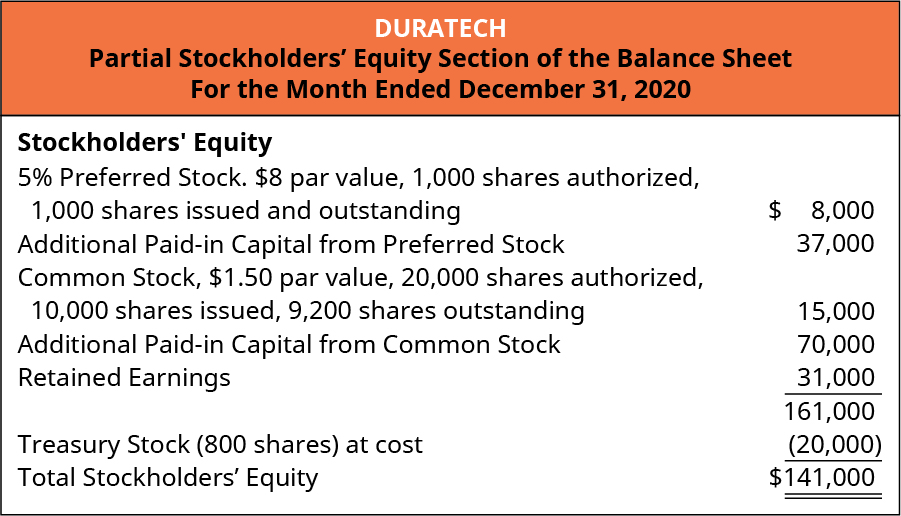

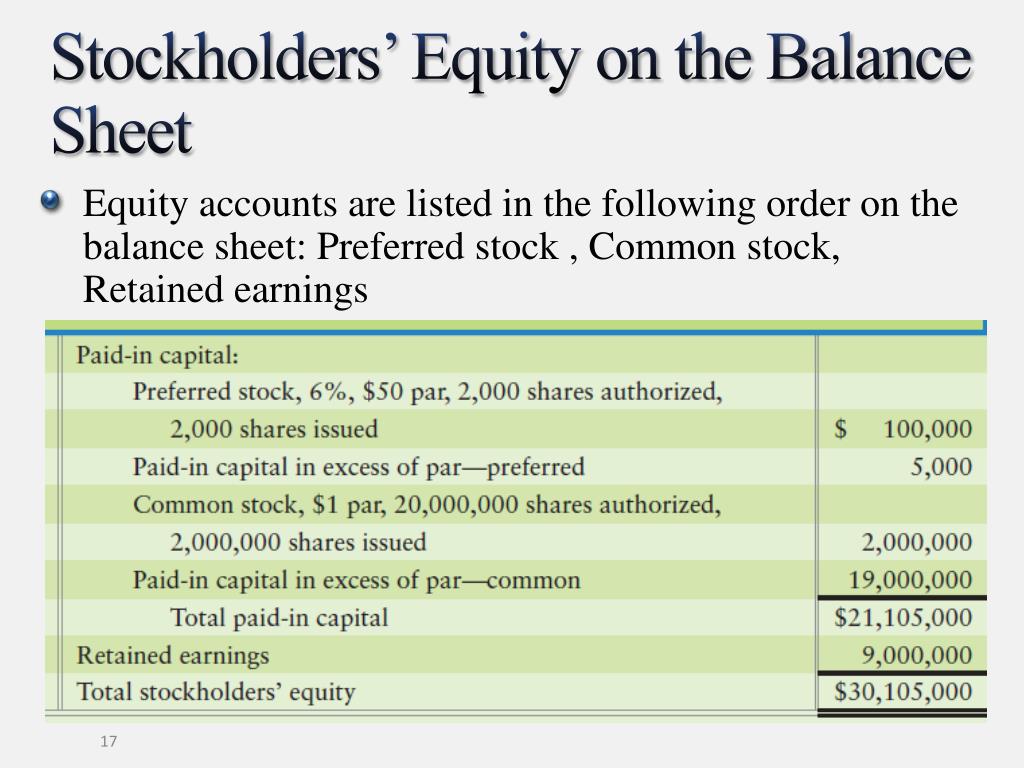

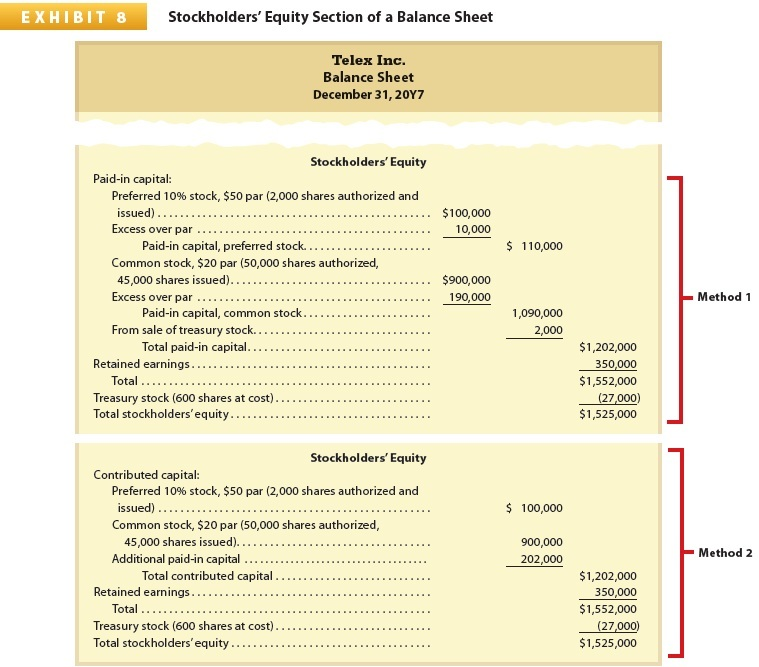

Preferred stock normally is recorded at the top of the shareholders' equity section on the balance sheet. When a company issues shares of preferred stock, it records a credit to. State on the face of the balance sheet, or if more than one issue is outstanding.

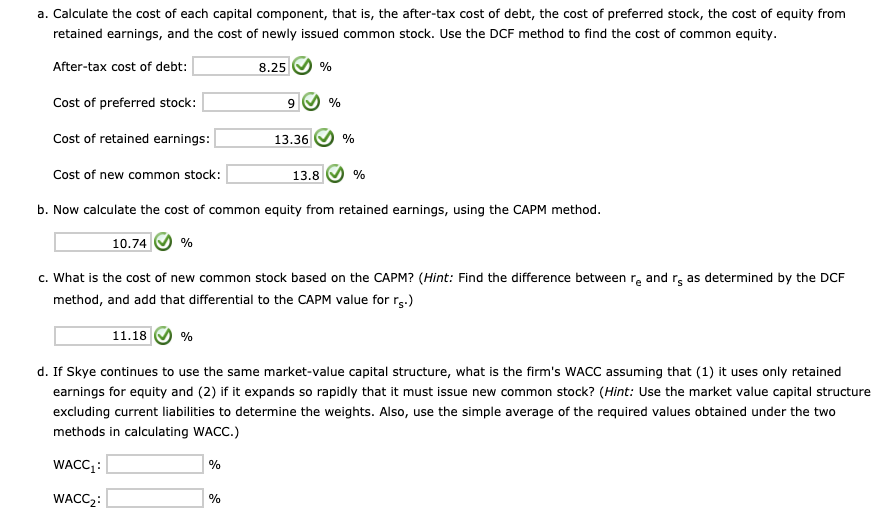

If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day. The differences between preferred stock and convertible. Redeemable preferred stock is a type of preferred stock that allows the issuer to buy back the stock at a certain price and retire it, thereby converting the stock.

What are preference shares?

![Free Printable Classified Balance Sheet Templates [Excel, PDF] Example](https://www.typecalendar.com/wp-content/uploads/2023/08/Classified-Balance-Sheet-Format.jpg)