Brilliant Info About Accounts In A Balance Sheet Gross Profit Net Sales

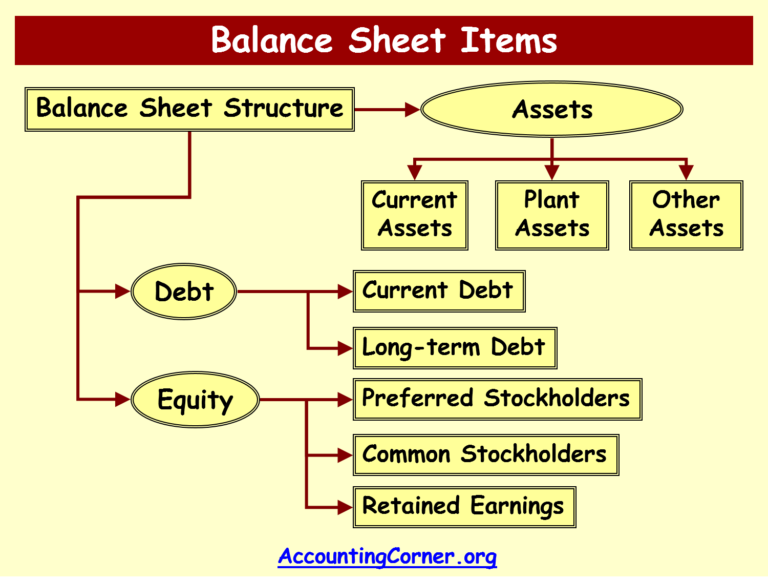

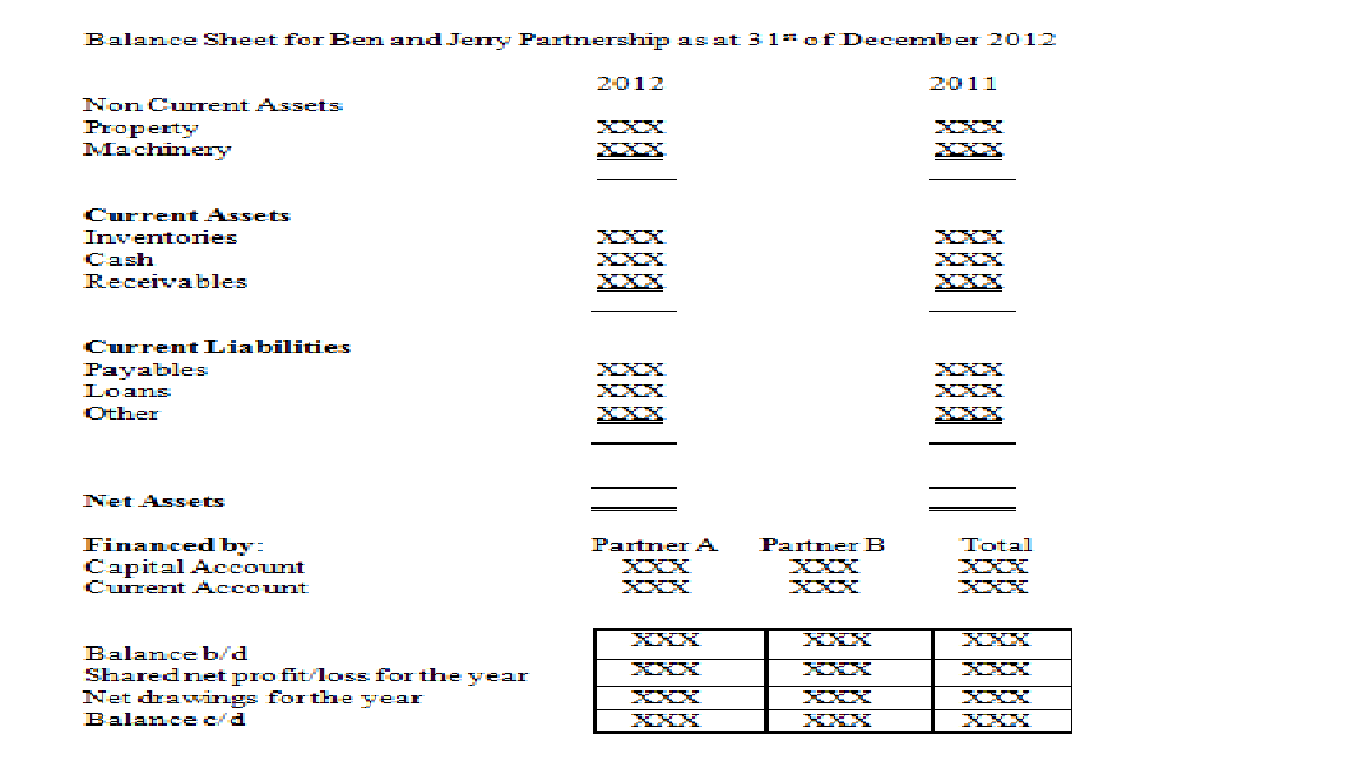

A balance sheet account can be classified as either an asset, liability, or equity account.

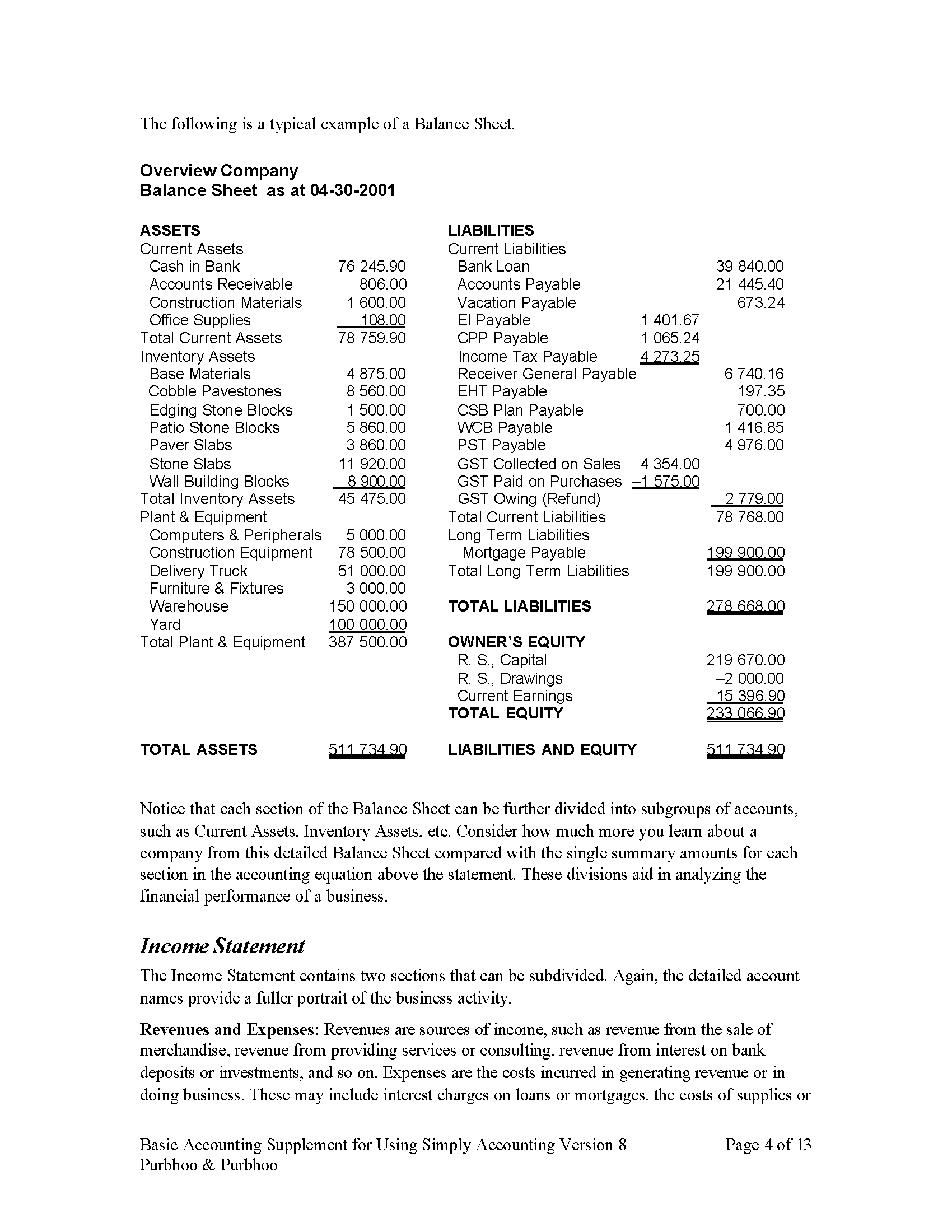

Accounts in a balance sheet. This is the cash you receive during regular transactions at your business. Goodwill accounting is a critical consideration for corporations who engage in. Given this characteristic, balance sheet accounts.

The accounting equation formula for a balance sheet is: In account format, the balance sheet is divided into left and right sides like a t account. The two sides must balance—hence the name “balance sheet.”

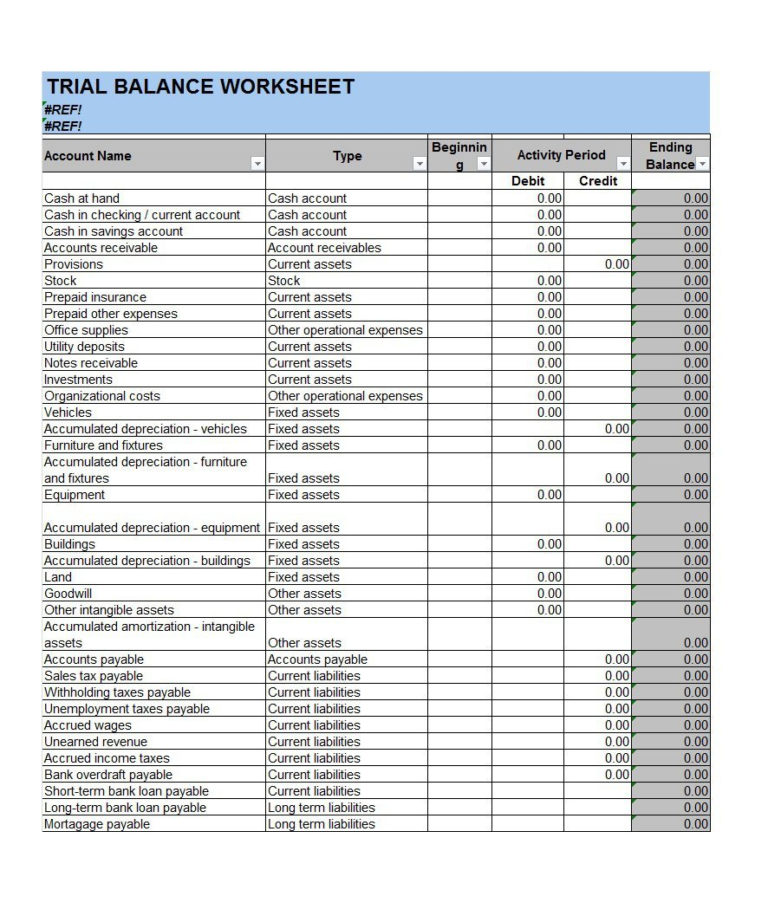

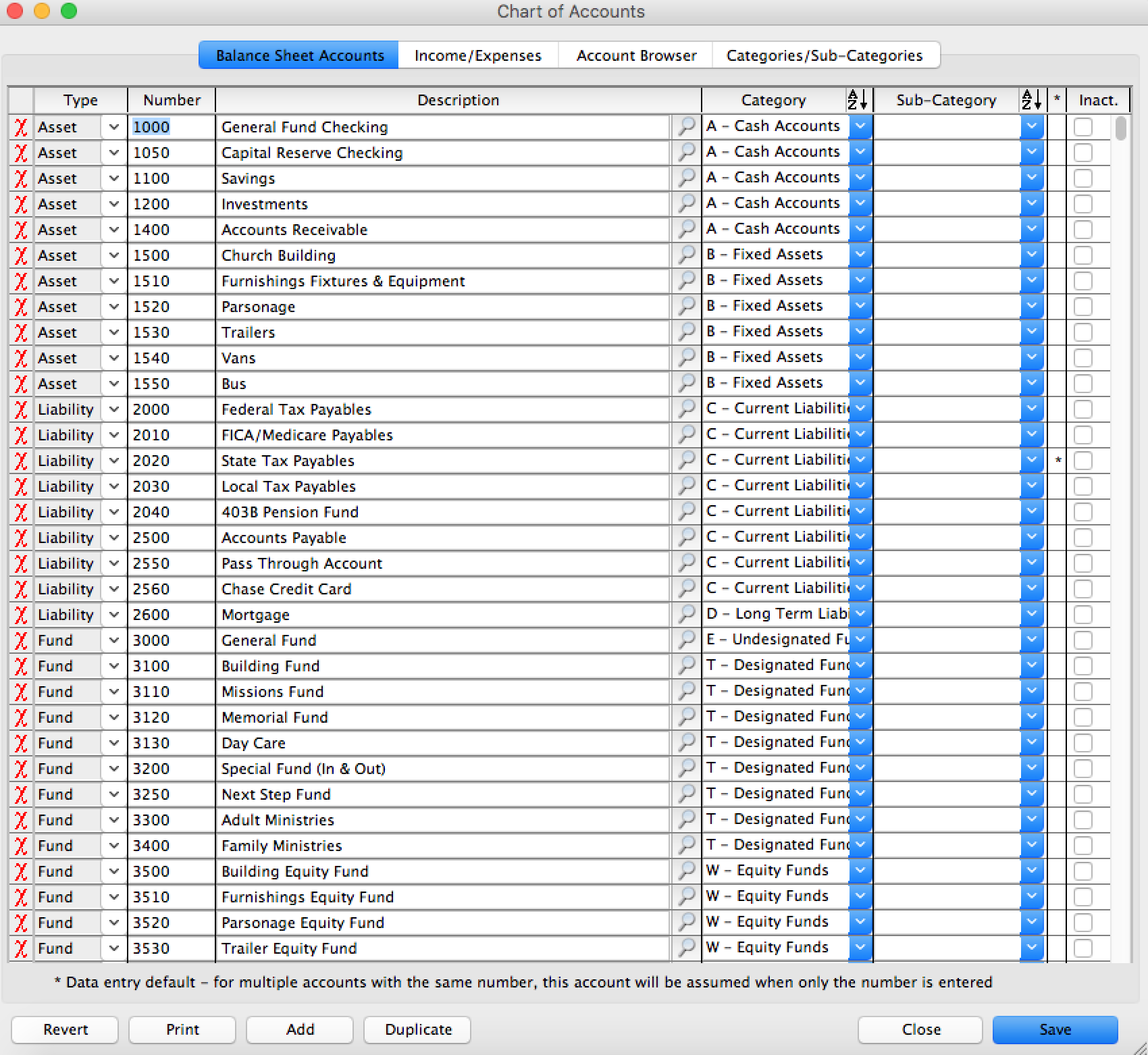

Most balance sheets are arranged according to this equation: Your balance sheet accounts list, will include: The items reported on the balance sheet correspond to the accounts outlined on your chart of accounts.

The balance sheet is a key financial statement that provides a snapshot of a company's finances. Balance sheets report a company's assets, liabilities, and equity at a certain time. Also, the balance sheet report draws information from the accounts, whether they are associated with items or not.

The balance sheet is just a more detailed version of the fundamental accounting equation—also known as the balance sheet formula—which includes assets, liabilities, and shareholders’ equity. Accounts payable is listed on a company's balance sheet. The balance sheet adheres to the following accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balance out:

Assets = liabilities + owners’ equity It can also be referred to as a statement of net worth or a statement of financial position. The inventory valuation reports draw information from items only.

These accounts are not flushed out at the end of a reporting year; As bond markets have already recalibrated bets on rate cuts for this year, with the ecb remaining on hold for longer,. Yet, the process is often reactive and highly manual, resulting in wasted time, errors, and limited capacity for analysis.

In other words all accounts which are related to. A balance sheet is made up of the following elements: Assets = liabilities + equity.

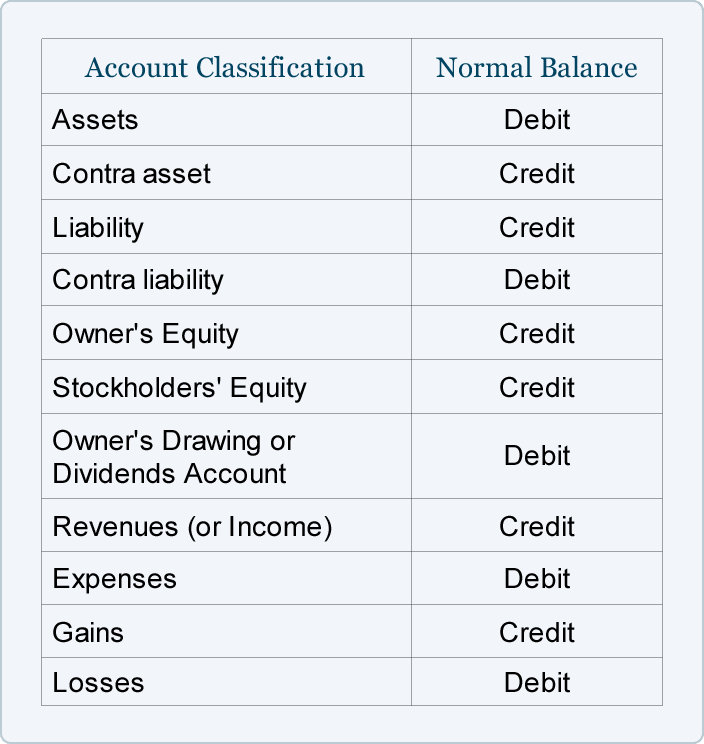

(the other accounts in the general ledger are the income statement accounts.) balance sheet accounts are used to sort and store transactions involving a company's assets, liabilities, and owner's or stockholders' equity. Balance sheets serve two very different purposes depending on the audience reviewing them. The balance sheet is split into two columns, with each column balancing out the other to net to.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. Assets = liabilities + owner’s equity. It’s a snapshot of a company’s financial position, as broken down into assets, liabilities, and equity.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)