Ace Tips About A Trial Balance Is Prepared To Financial Statement Income

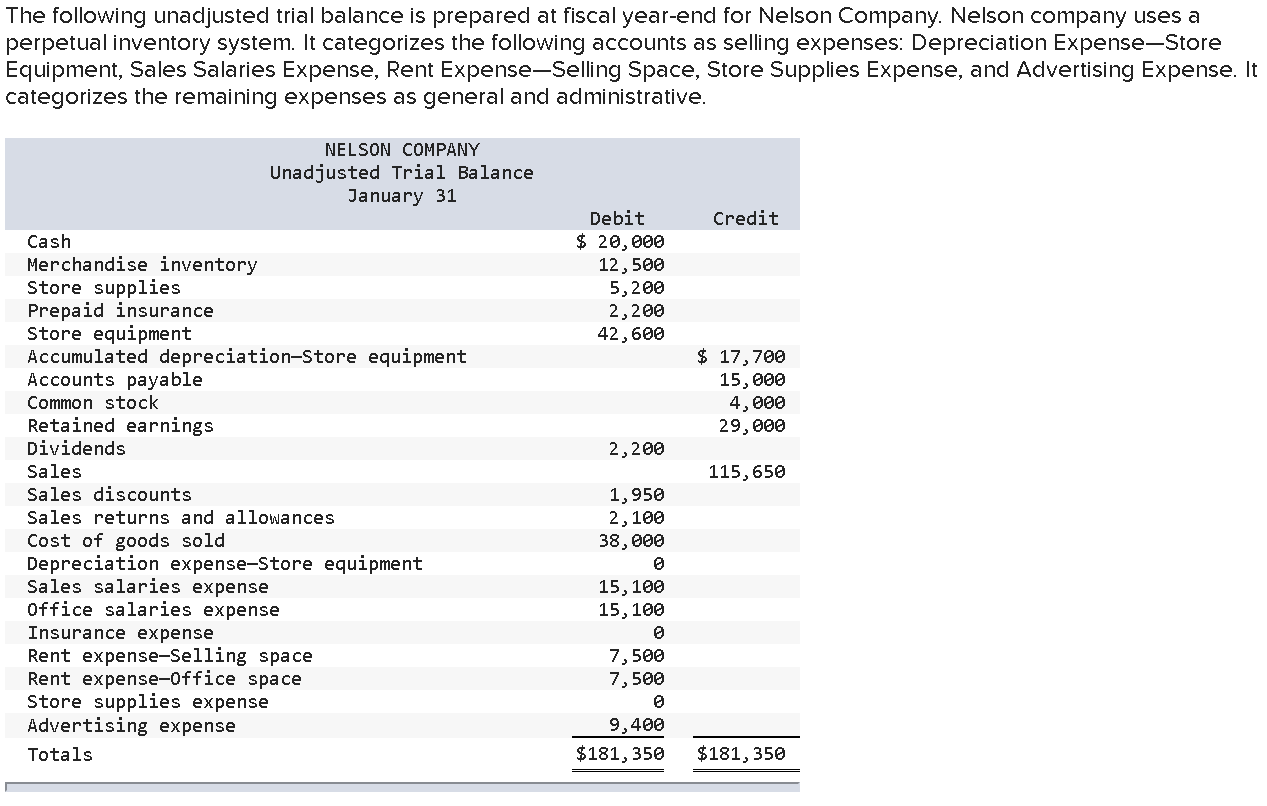

In addition to error detection, the trial balance is prepared to make the necessary adjusting entries to the general ledger.

A trial balance is prepared to. Just like in an unadjusted trial balance, the. For preparing a trial balance, it is required to close all the ledger accounts, cash book and bank book first. New york ag letitia james tells abc news that she is prepared to seize donald trump's assets if he is unable to pay the $354 million fine in his civil fraud case.

The initial trial balance is prepared to detect any mathematical errors before you make adjusting entries or start closing your books for the accounting period. Trial balance is a significant part of a company's accounting procedure. 1) santa fe, n.m.

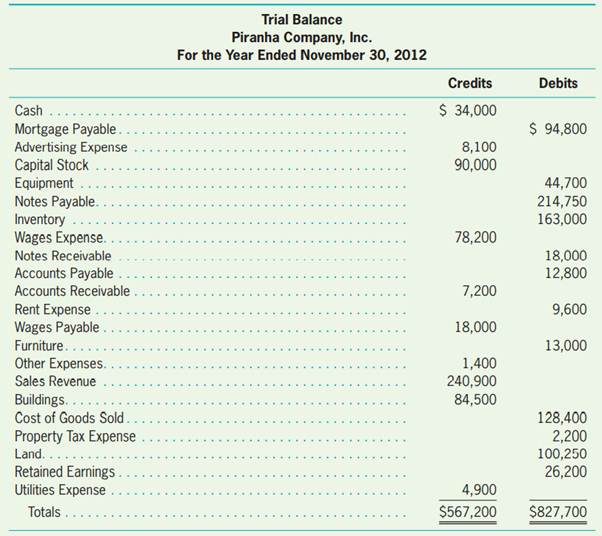

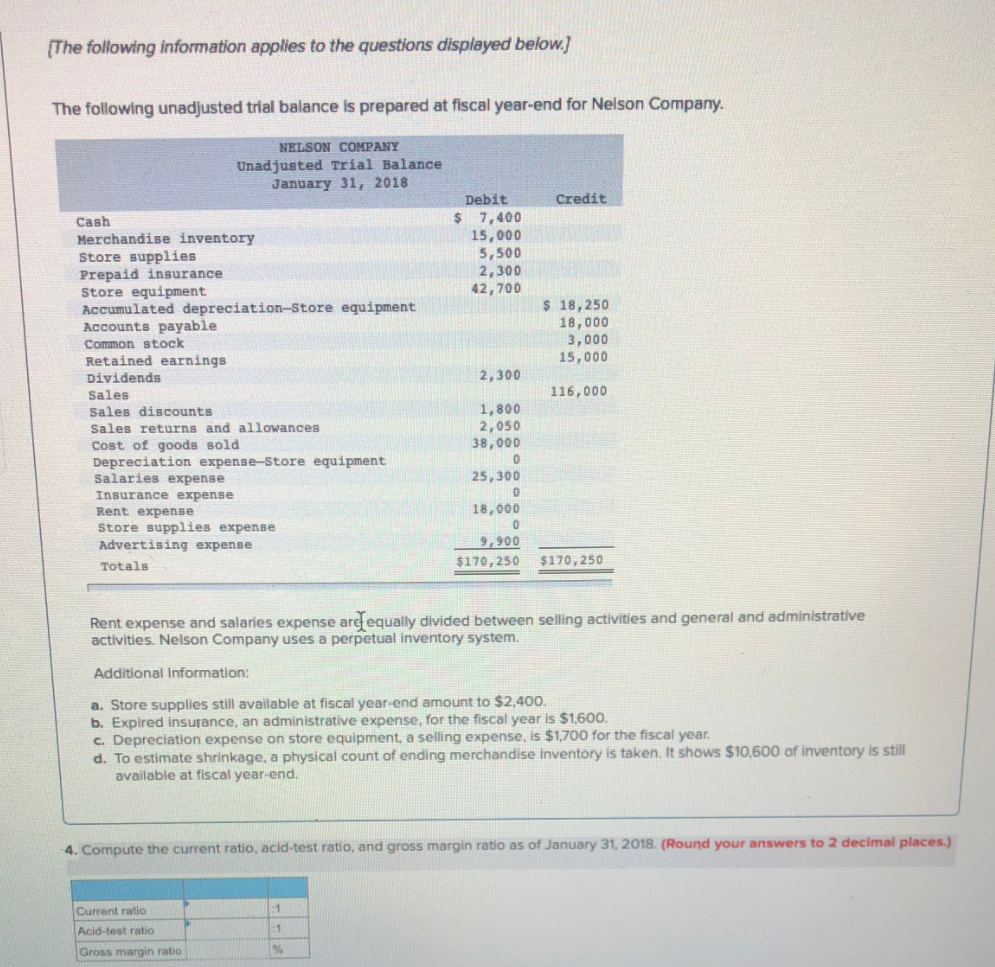

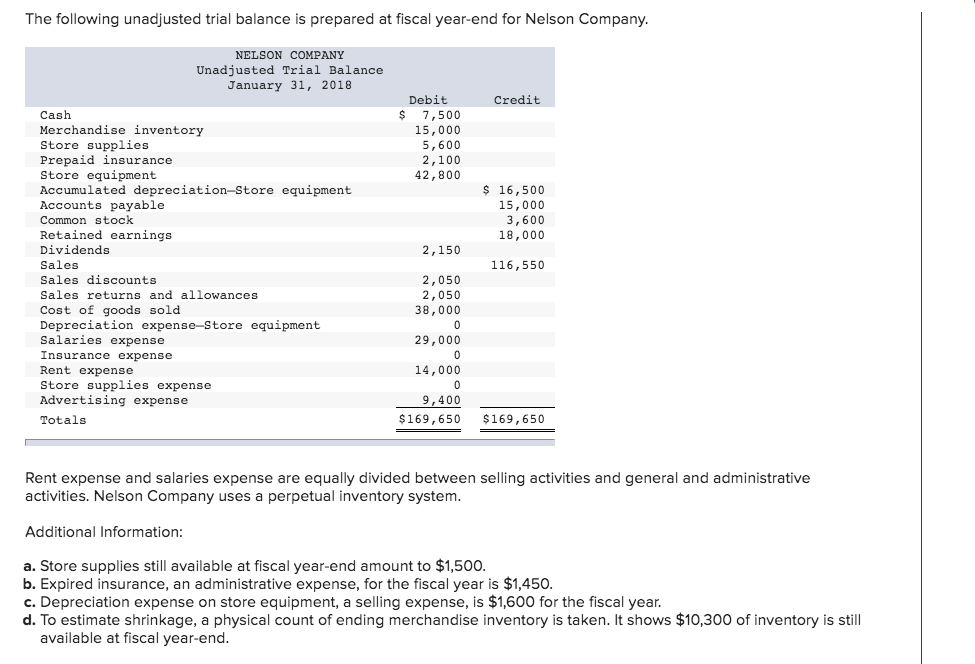

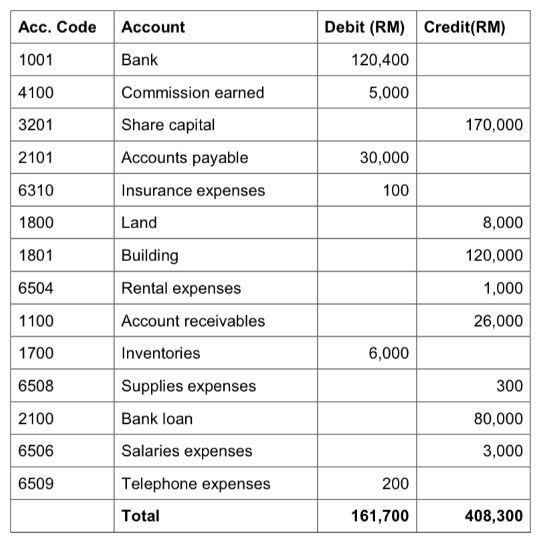

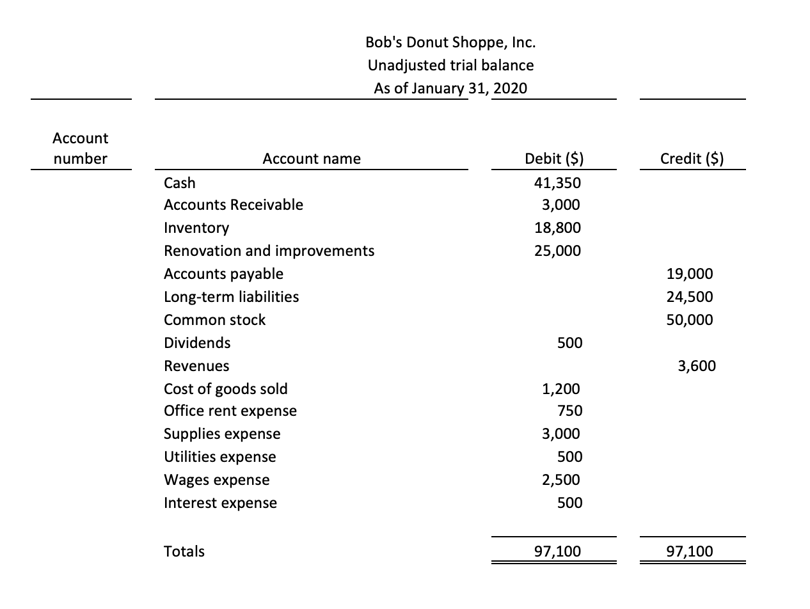

After the preliminary unadjusted trial balance, also known as the trial balance, is prepared, accountants review it and determine if corrections are required for determining adjusted balances. Sum up, and identify the trial balance errors, if any. If you find you have an unbalanced trial balance, in other words, the debits don't equal the credits;

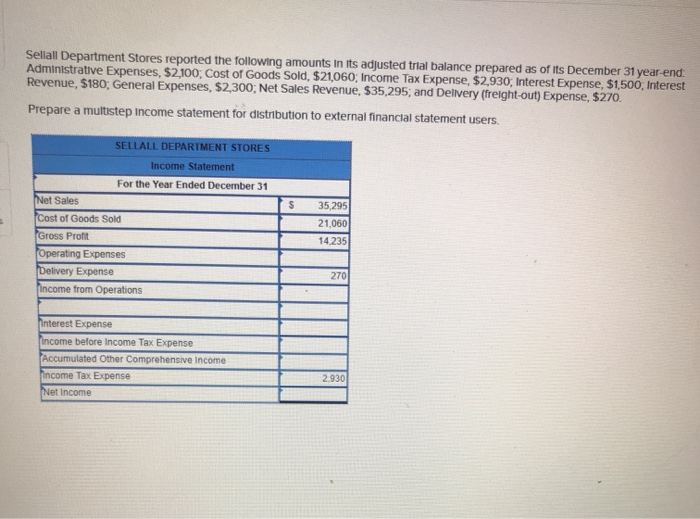

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. Preparing and adjusting trial balances aid in the preparation of accurate financial statements. Based on such financial statements, the monetary position and health of the business are checked, and decisions to make changes are taken.

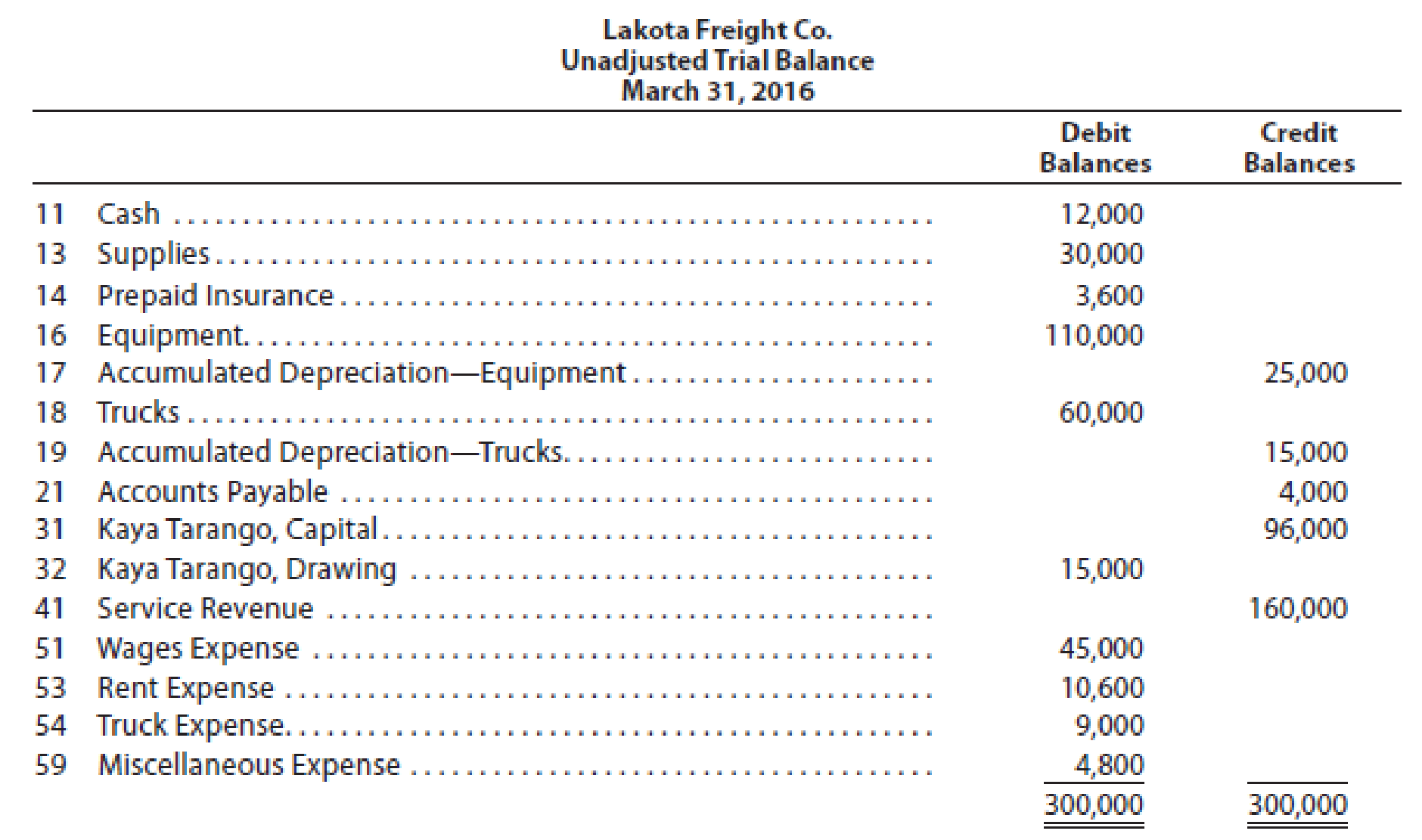

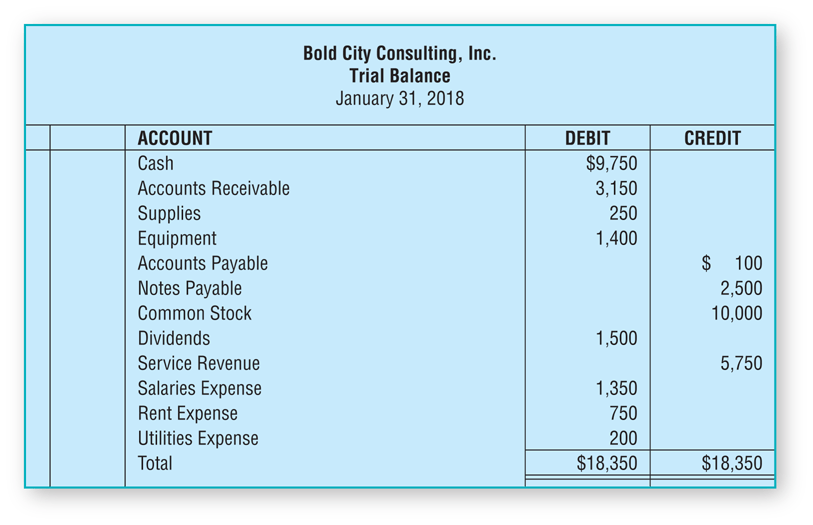

This is simply a list of all the account balances straight out of the accounting system. The trial balance is prepared after posting all financial transactions to the journals and summarizing them on the ledger statements. The trump organization prepared statements of financial condition.

Trial balance example. Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet. It acts as one of the pillars based on which the financial statements are prepared.

It is prepared again after the adjusting entries are posted to ensure that the total debits and credits are still balanced. The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

Your business transactions are initially recorded in. It should look exactly like your unadjusted trial balance, save for any deferrals, accruals, missing transactions or tax adjustments you made. When the accounting system creates the initial report, it is considered an unadjusted trial balance because no adjustments have been made to the chart of accounts.

The first step in the process of creating financial statements is to prepare a trial balance. How to prepare a trial balance. This also indicates the correct nature of the balances of different accounts.

A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. To prepare the financial statements, a company will look at the adjusted trial balance for account information. Before baldwin’s case progresses, the movie’s weapons supervisor is being tried on charges of involuntary.

![Unadjusted Trial Balance [Definition + Examples]](https://crushthecpaexam.com/wp-content/uploads/2019/03/Unadjusted-Trial-Balance..png)