First Class Tips About Closing Income Statement Farm Cash Flow

Statements and releases today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled.

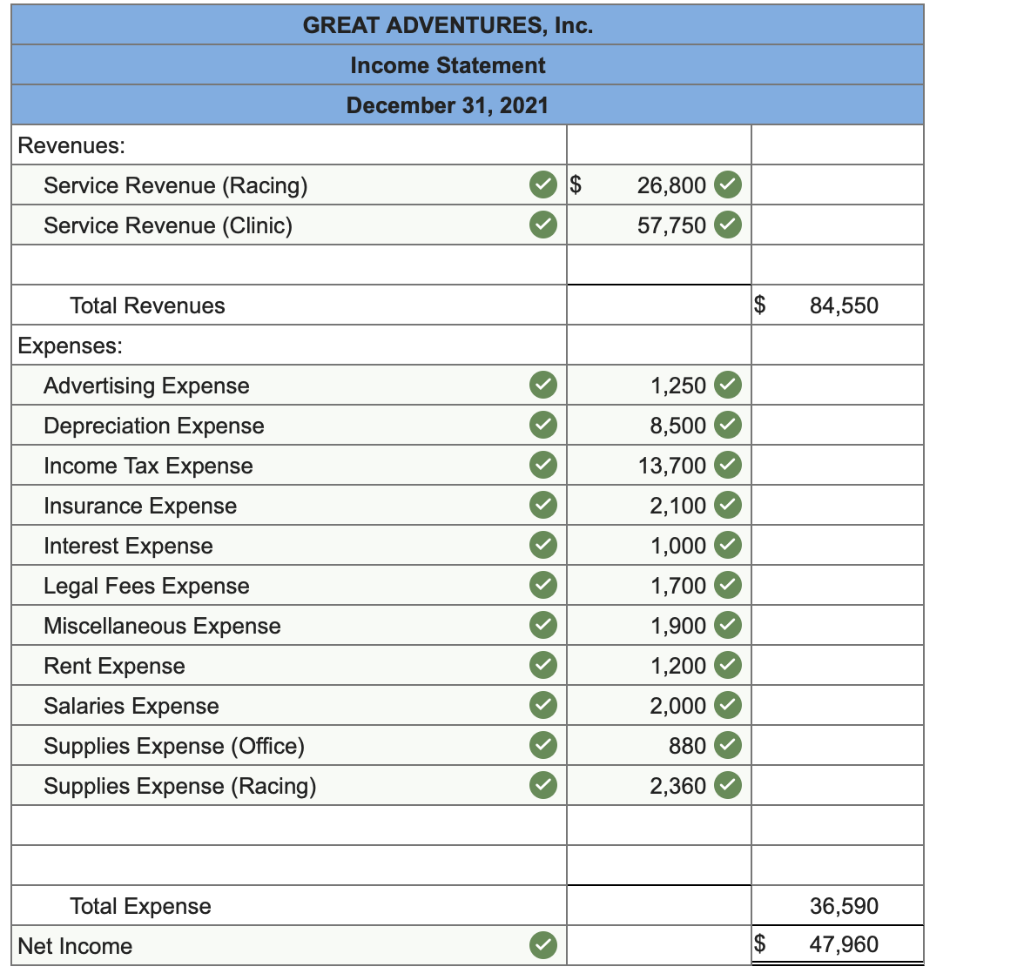

Closing income statement. Currently, there is no detail about the amount of the contractor high income threshold, which will be prescribed by the fair work regulations 2009 (cth) at a later. Full year operating income of $2.279 billion; For example, on december 31, 2020, the company abc has the income statement as below:

His decision to allow a vote on a labour. Prepare closing entry for the net income of. Deputy prime minister and minister for finance, mr.

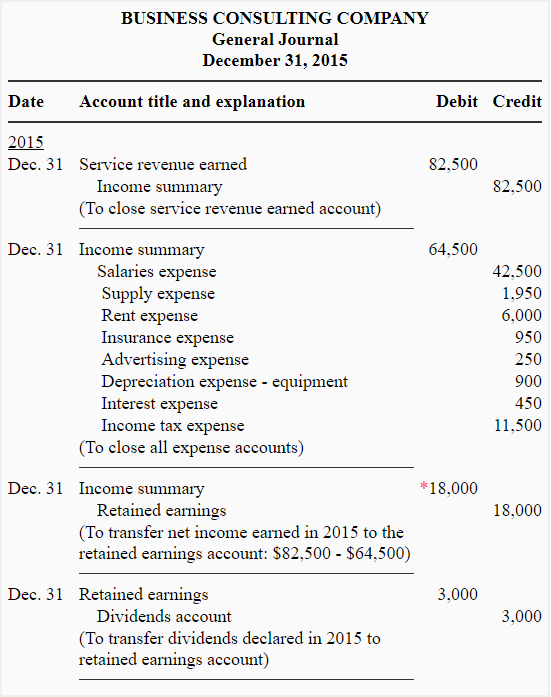

Nvidia reported $12.29 billion in net income during the quarter, or $4.93 per share, up 769% versus last year’s $1.41 billion or 57 cents per share. Lawrence wong, delivered the budget statement. Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the.

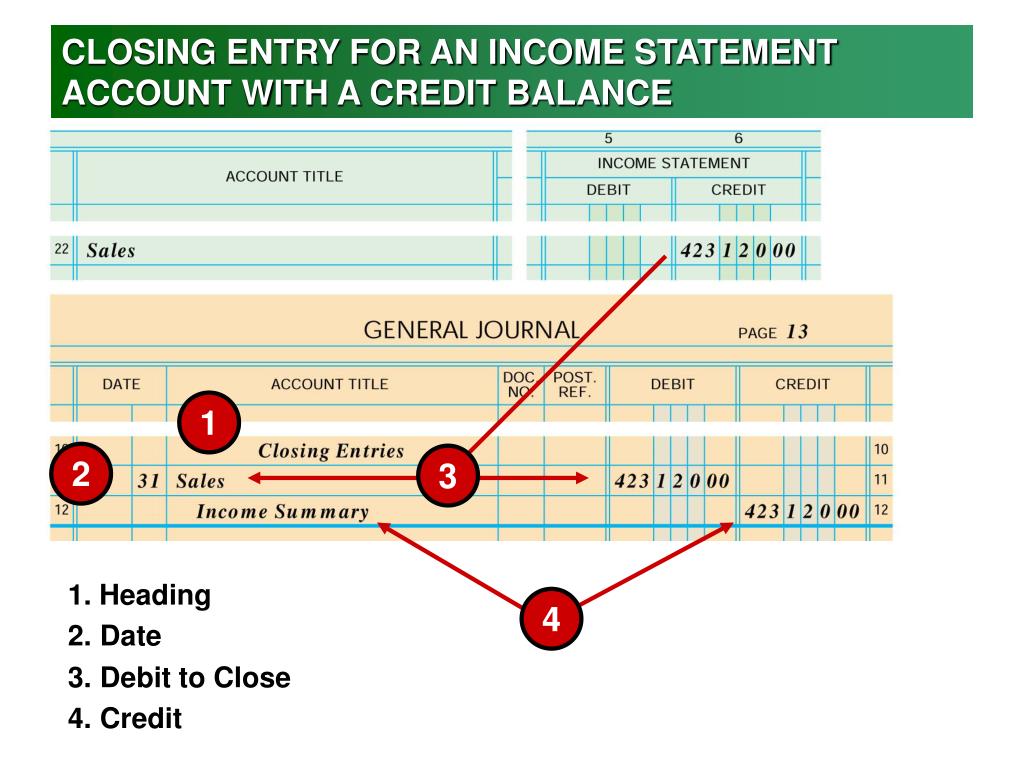

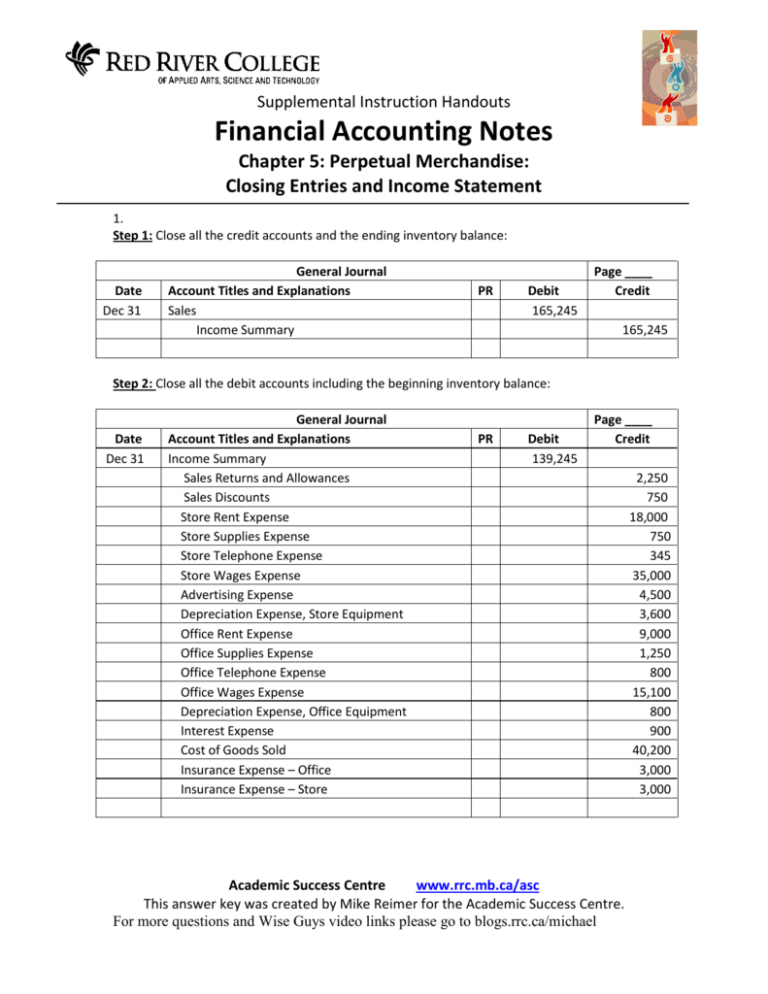

What are closing entries? Having a zero balance in these accounts is important so a company can compare performance. Tax changes and enterprise disbursements.

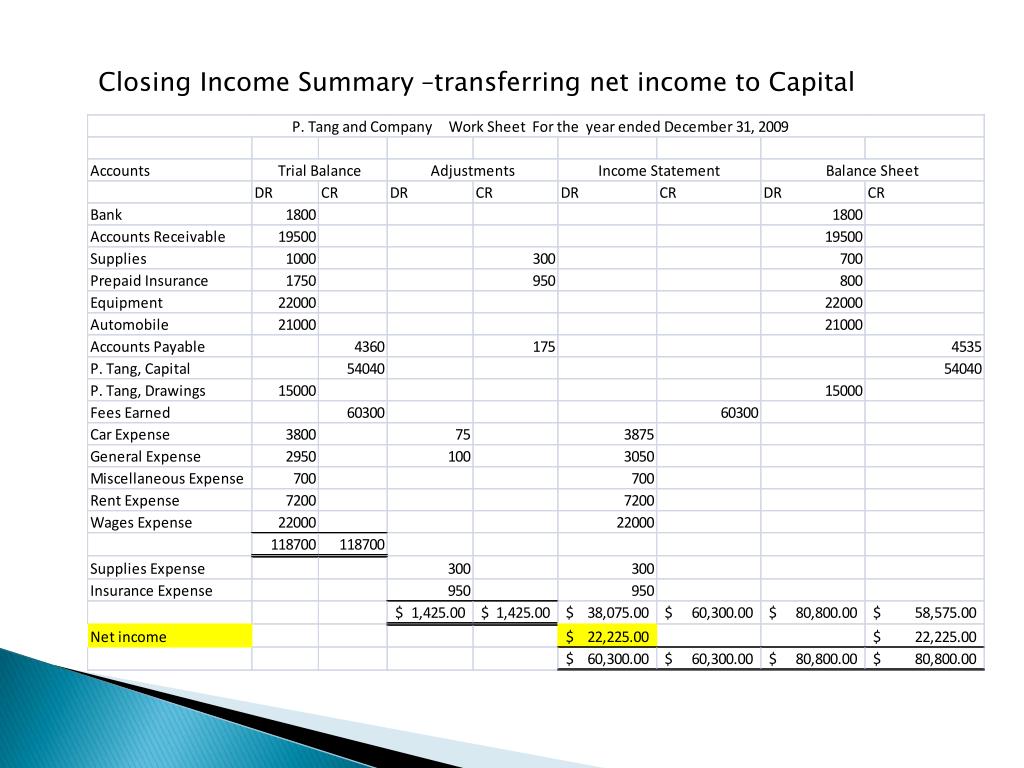

Closing entries are journal entries used to empty temporary accounts at the end of a reporting period and transfer their balances into. Closing, or clearing the balances, means returning the account to a zero balance. These statements, which include the balance sheet, income statement, cash flows, and shareholders equity statement, must be prepared in accordance with prescribed and.

To run the close income statement batch job close the fiscal year. Close revenue accounts close means to make the balance zero. Close all income accounts to income summary in the given data, there is only 1 income account, i.e.

Commons speaker sir lindsay hoyle is under pressure this morning over his handling of the snp's motion for a ceasefire in gaza. All these accounts are nullified by posting closing entries. The temporary accounts are closed by transferring the balances to permanent accounts.

The income summary is a temporary account used to make closing entries. Closing entry for net income example. What is the significance of closing.

Record full year operating revenues of $21.833 billion, reflecting strong demand for air travel; How closing journals for income statement accounts are created. To do this, their balances are emptied into the income summary account.

Use the create income statement closing journals process to meet audit requirements. All temporary accounts must be reset to zero at the end of the accounting period. Closing entries can either be made directly by closing temporary balances to the owner’s capital (or retained earnings) or through an intermediate account known as the income.