Peerless Tips About Difference Between Operating Investing And Financing Activities Md&a Report

Step 1/5 1.

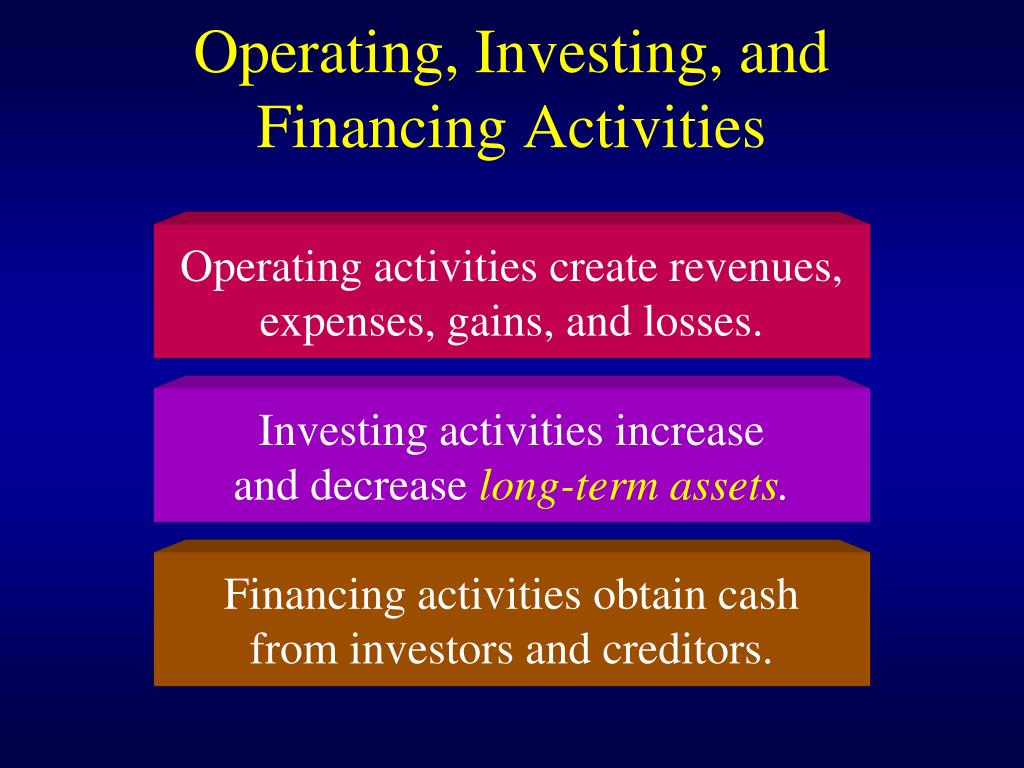

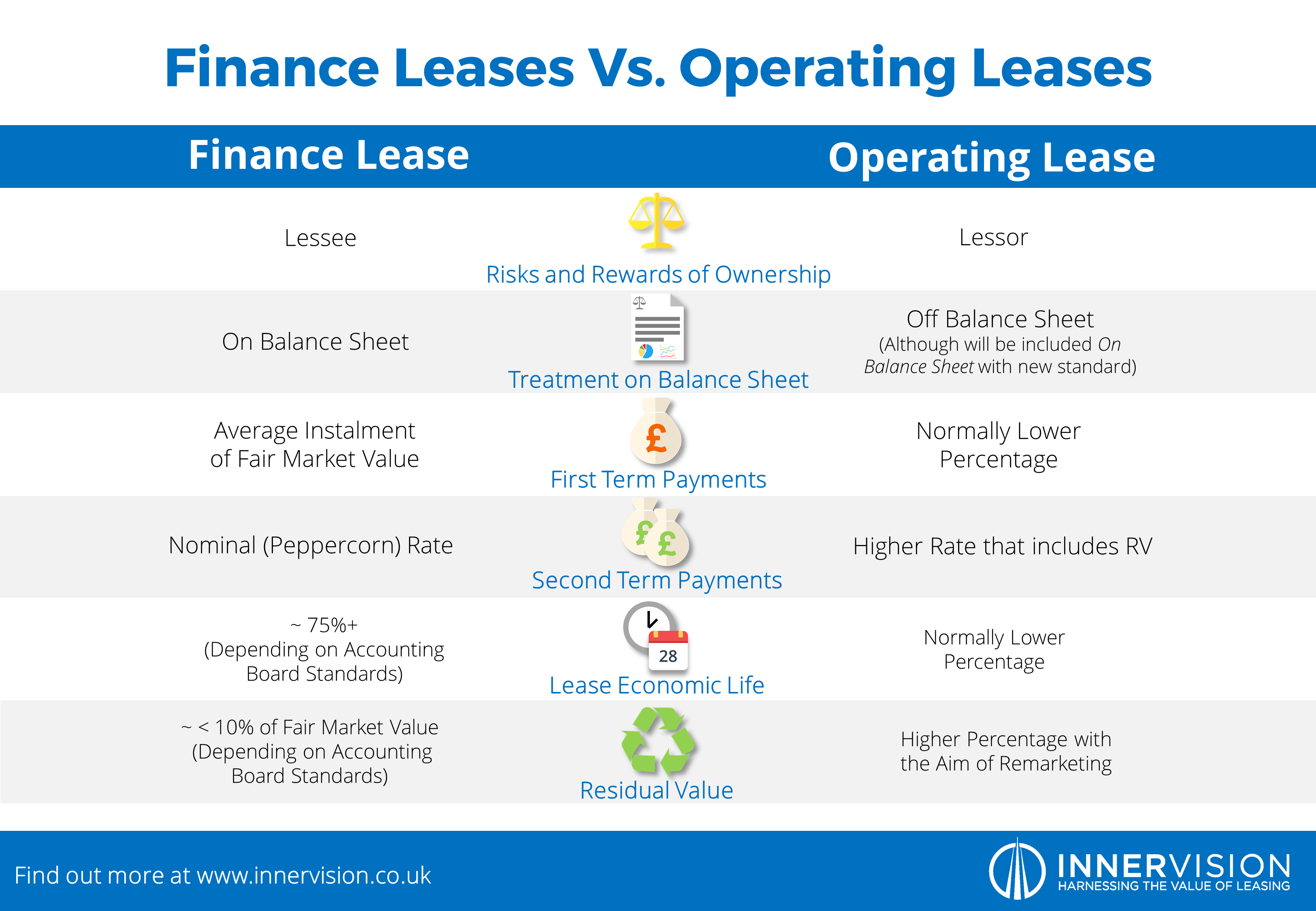

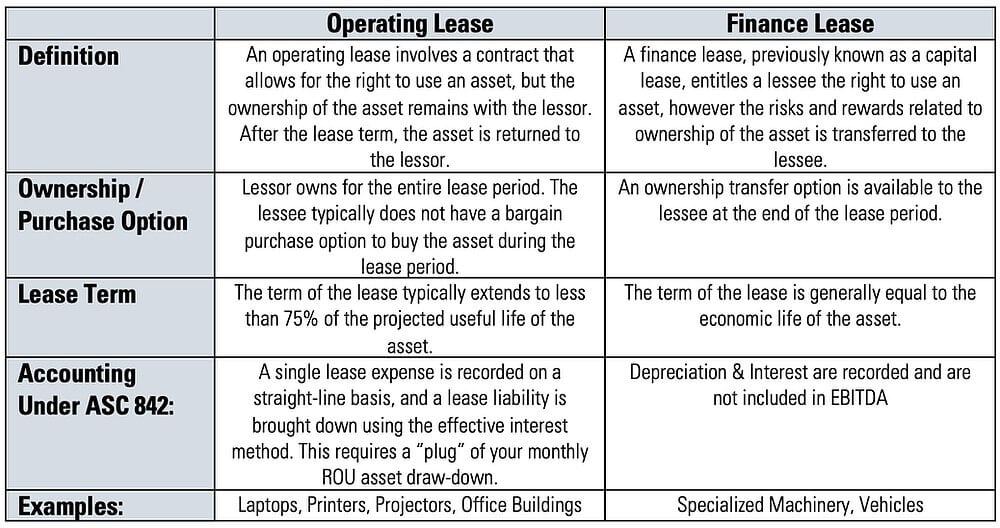

Difference between operating investing and financing activities. Research understanding operating, investing, and financing activities for financial success explore the importance of cash flow and the different activities. Understand how these examples differentiate investing, financing, and operating. Operating activities, investing activities, and financing activities.

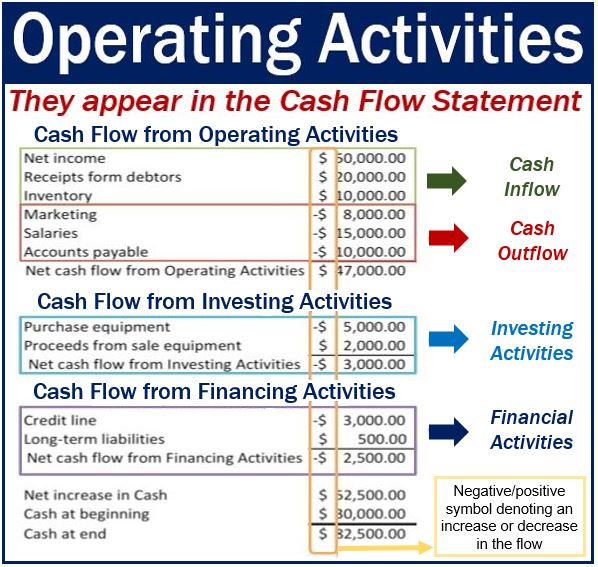

The statement of cash flows presents sources and uses of cash in three distinct categories: Cash flows from operating activities, cash flows from investing. The md&a section of apple's.

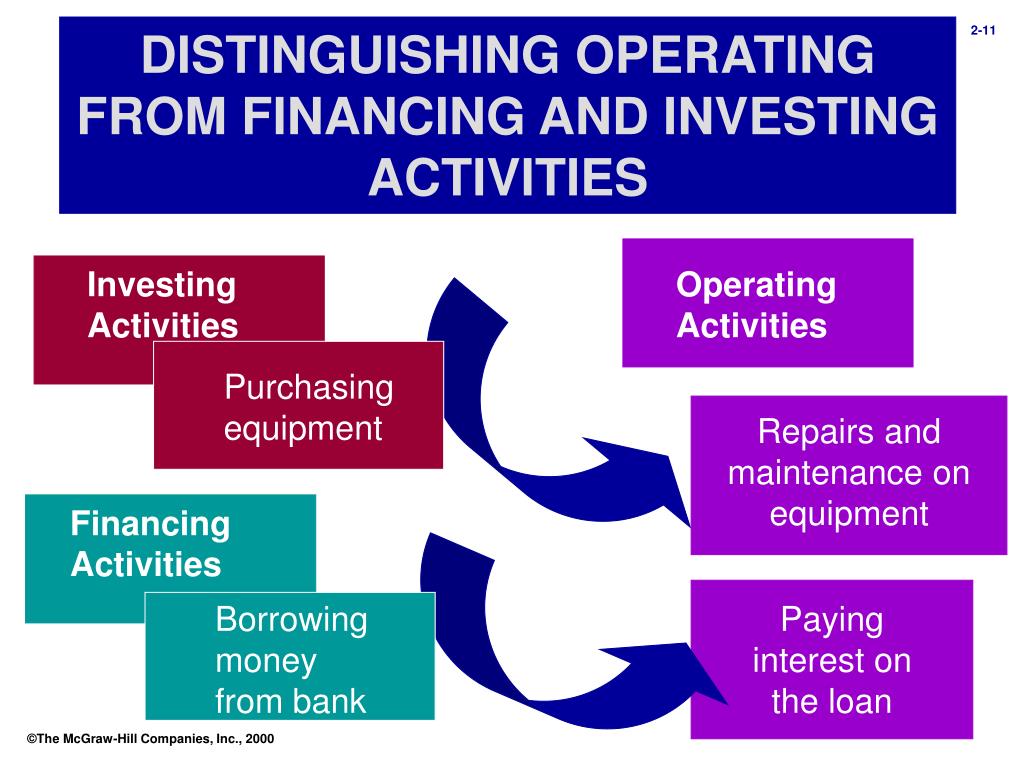

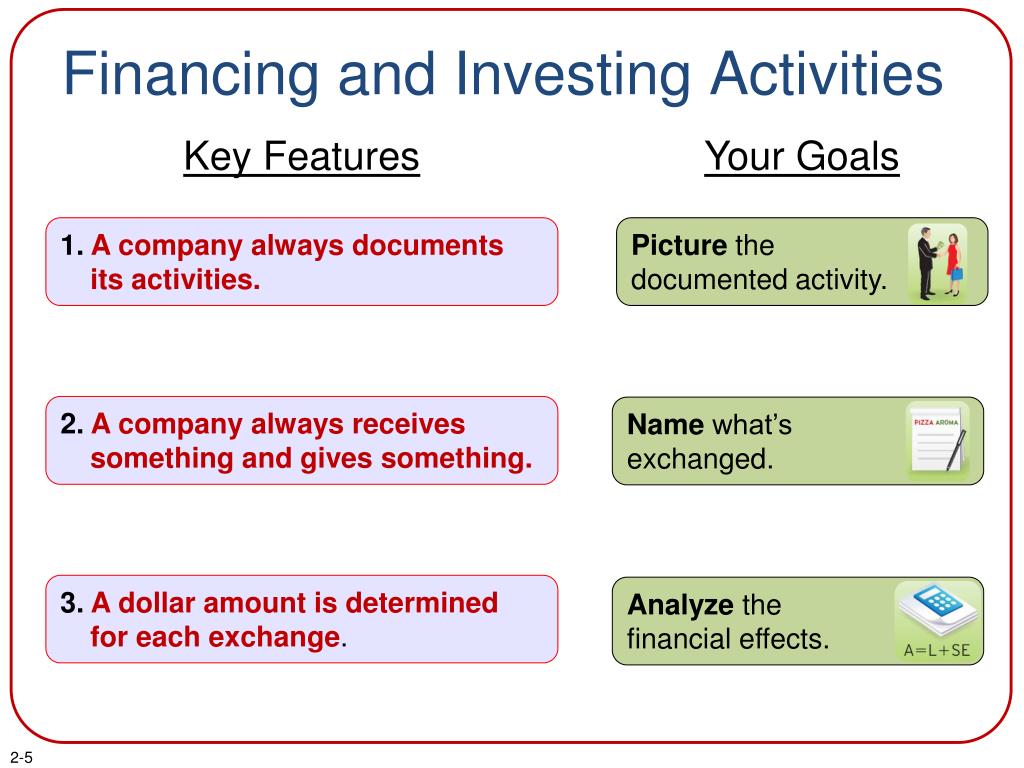

An entity purchases a building and pays in equity shares of the entity. Transactions must be segregated into the three types of activities presented on the statement of cash flows: The first cash outflow is an operating activity.

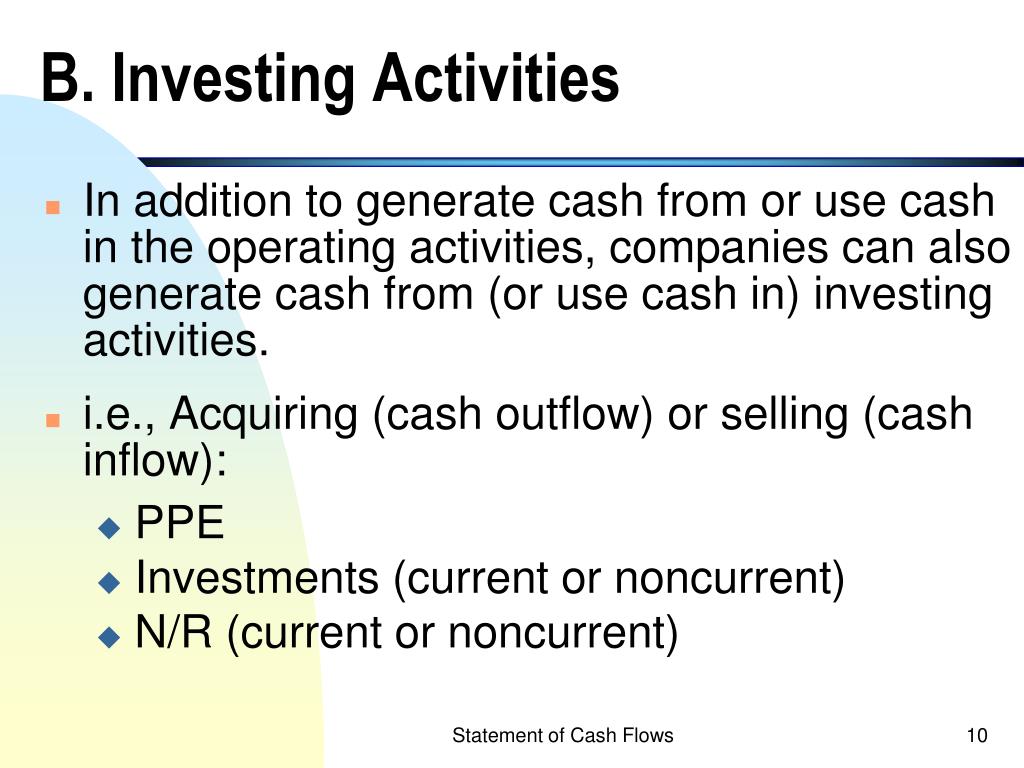

The equivalent terms in ias 7 are “income,” “income statement,” and “equity.”. Lo 14.2 differentiate between operating, investing, and financing activities mitchell franklin. Suzanne kvilhaug investopedia / laura porter what is cash flow from investing activities?

The statement of cash flows presents sources and uses of cash in. The statement of cash flows classifies cash receipts and cash payments by operating, investing, and financing activities. The correct answer is c.

The main components of the cfs are cash from three areas: Comparative analysis of operating, investing and financing activities with special reference to canara bank and kotak mahindra bank. Cash flows from operating activities, cash flows from investing activities, and cash flows from financing activities.

For this assignment, let's consider the company apple inc. Ipsas 2 contains a different set of definitions of technical terms from ias 7 (paragraph 8). Here is the operating activities section of example corporation's scf which.

Learn about cash flow statements and cash flows from operating activities. This does not belong in a. Differentiate between operating, investing, and financing activities.

The statement of cash flows presents sources and uses of cash in three distinct. This is because it is related to the production activities of the company. Operating, investing, and financing activities are the three main categories of a company’s cash.

Cash flow is typically broken down into cash flow from operating activities, investing activities, and financing activities on the statement of cash flows, a. Classification of cash flows: Common activities that must be reported as investing activities are purchases of land, equipment, stocks, and bonds, while financing activities normally relate to the.

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)