Outstanding Info About Profit And Loss Statement Balance Sheet Intercompany

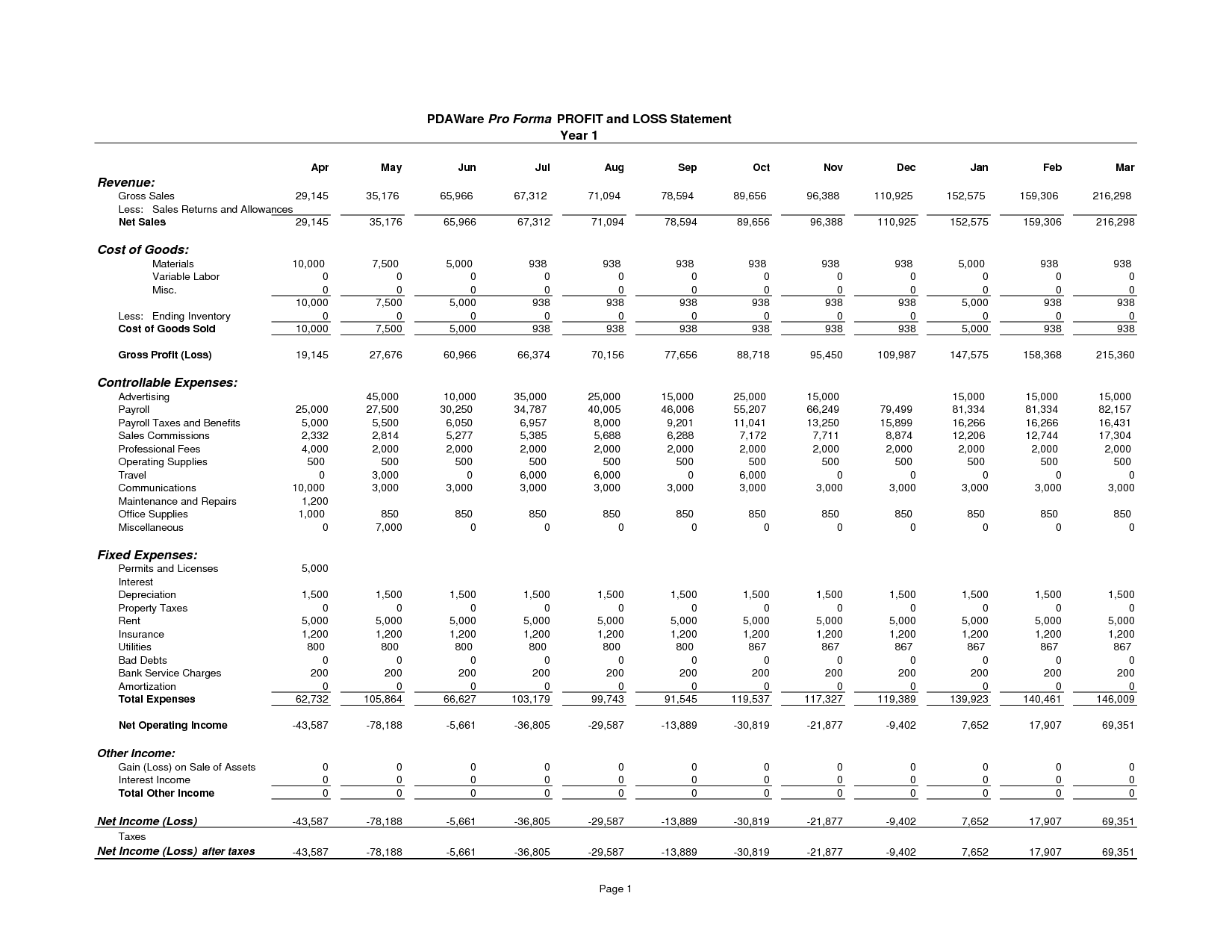

A p&l statement provides more visibility into operating costs, revenue, and earnings over time minus your expenses for a set period.

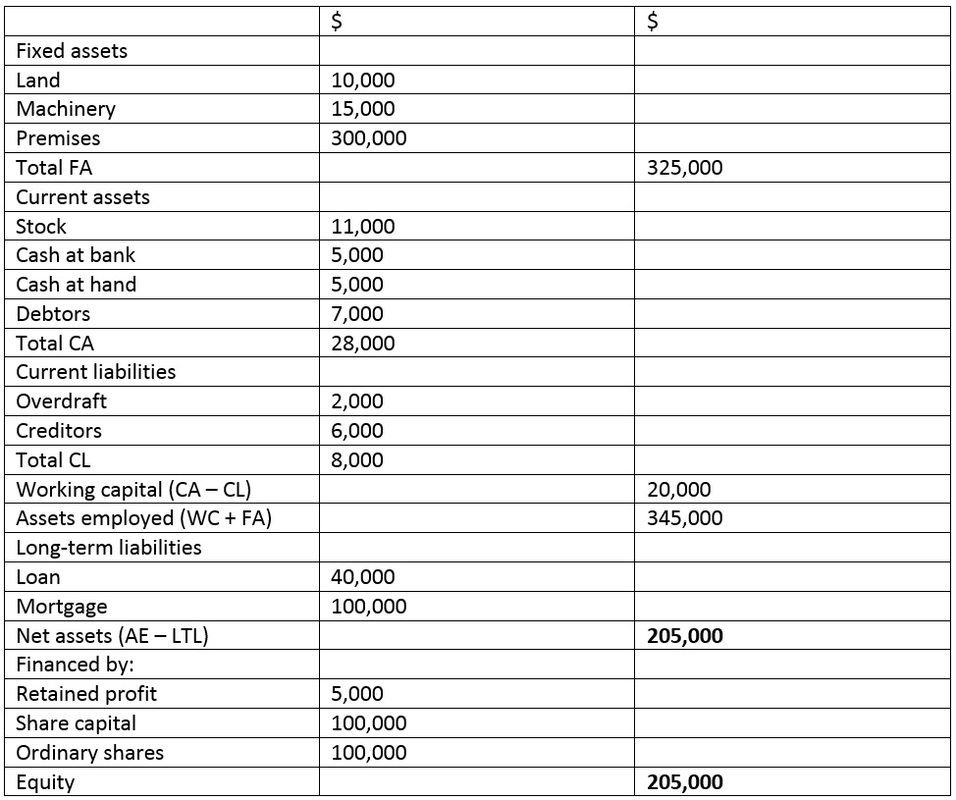

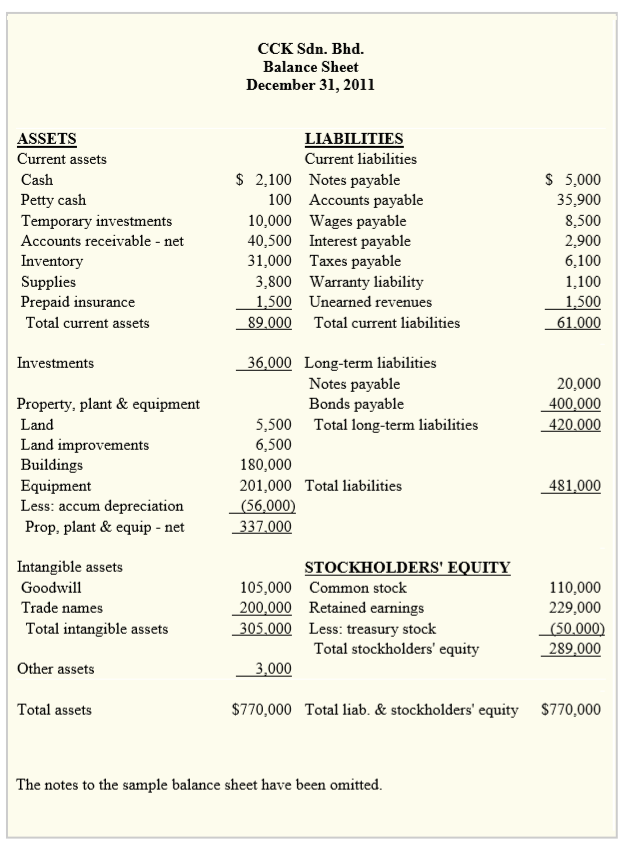

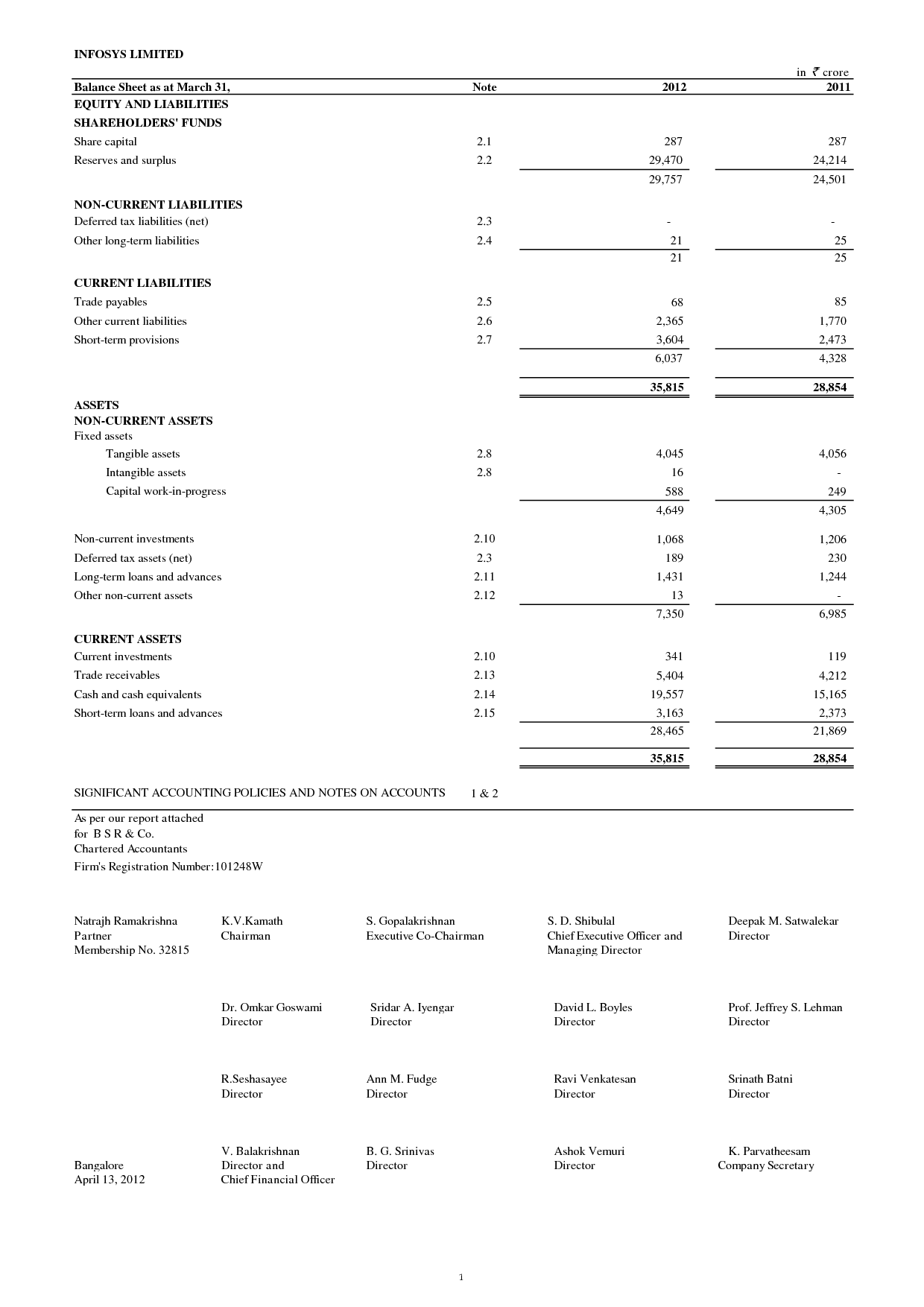

Profit and loss statement balance sheet. There are several key differences between the p&l and balance sheet, particularly the information presented and what it means. It allows you to see what resources it has available and how they were financed as of a specific date. Profit and loss statements summarize the money that’s coming in and going out.

It captures a snapshot of the business’s assets, debts, and equity in a single moment, whereas a p&l statement demonstrates the performance of the overall business. A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Assets (what the company owns) = liabilities (what the company owes) + shareholders’ equity (the amount of money invested.

It is a statement which shows the financial position of the company on a specific date. Have you ever confused these two terms? The profit loss statement can be run at any time of the fiscal year to determine profitability and compare one period of time to another to show growth.

Evaluates a company's financial performance over a specific period, such as a month, quarter, or year. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. The main difference is that the balance sheet yields information regarding a company’s assets, liabilities, and shareholders’ equity, while the profit and loss statement summarizes information about revenues, and expenses.

It shows all the company’s income and expenses incurred over a given period. The p&l summarizes the company’s performance over a specific period, while the balance sheet reflects the company’s value at a specific date. It lists all the ownership, i.e.

Provides a snapshot of the company's financial position at a specific point in time. Companies and accountants can use these statements to assess the financial health of an organization. In particular, the p&l statement shows the operating performance of the company as well as the costs and expenses that impact its profit margins.

A balance sheet is different from a profit and loss statement. The balance sheet and the profit and loss statement are financial statements that your partners or your banker will ask you regularly to assess the health of your business. Updated june 24, 2022 balance sheets and profit and loss statements are both financial documents.

Create the report either annually, quarterly, monthly or even weekly. Your p&l statement shows your revenue, minus expenses and losses. A balance sheet is also called the statement of financial position.

In addition, the preparation of the balance sheet and the profit and loss statement is mandatory for most businesses. P&l reports are different from balance sheets in that a balance sheet only tells you about a business's financial status at a particular point in time. Profit and loss (p&l) statement balance sheet;

Represents the financial position at a specific point. As we’ve covered, a p&l statement is an overview of your profits and losses over a particular period of time, such as a month, quarter or year. Along with your balance sheet, your profit and loss statement (p&l) is the most significant financial document your business will produce.

![Balance Sheet vs. Profit and Loss Account [2024]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)