Fantastic Tips About Aasb 16 Special Purpose Financial Statements Of Llp In India

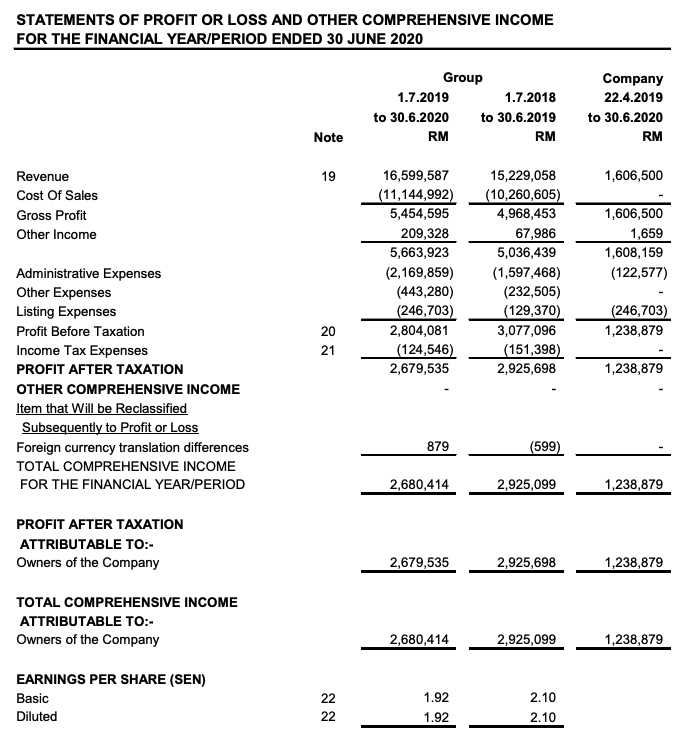

Leases) which brings in all leases.

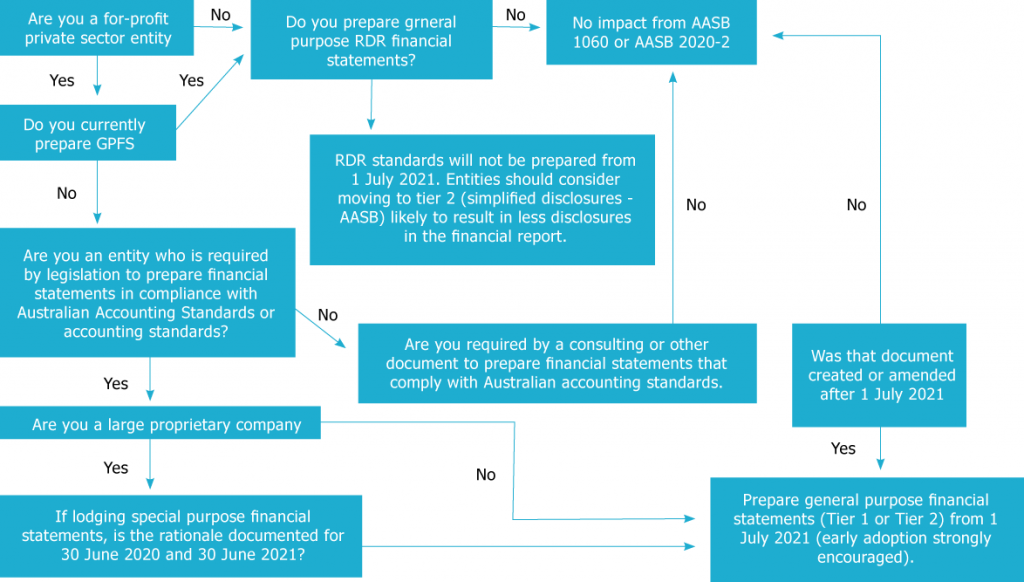

Aasb 16 special purpose financial statements. (a) to expand the objective of ifrs 7 to enable users of financial statements to understand how an entity is financed and what its ownership structure is, including potential dilution. In our first report1 we provided a. These special purpose financial statements comply with all the recognition and measurement requirements in australian accounting standards (except for the.

(a) disclose the basis on which the decision to prepare special purpose financial. Legislation) to prepare financial statements that comply with australian accounting standards.

This publication is intended to assist users in preparing special purpose annual financial statements in accordance with australian accounting standards (aasbs) and must be. Thursday, june 23, 2022. This information gives a basis for users of financial statements to assess the effect that leases have on the financial position, financial.

Entities preparing special purpose financial statements under the corporations act 2001 for annual reporting periods beginning before 1 july 2021 may. This is the second report of a project examining the introduction of aasb 16 leases (aasb 16), the australian equivalent of ifrs 16 leases. Standards on revenue (ifrs/aasb 15) and financial instruments (ifrs/aasb 9) become effective.

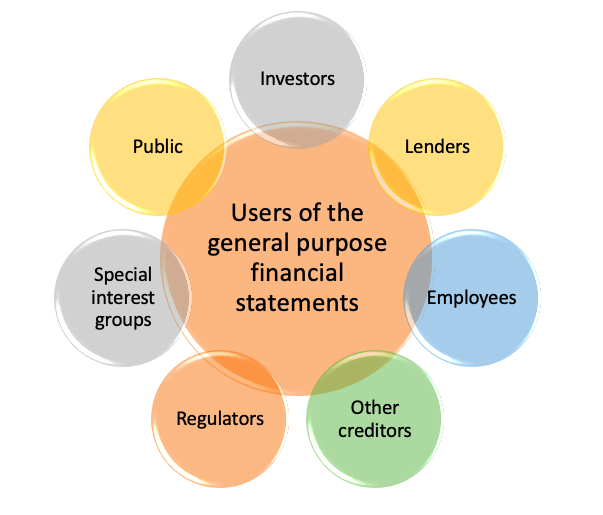

Entity will be required to produce general purpose financial statements (gpfs) in accordance with aasb 1057 application of australian accounting standards (assuming. In our september 2019 edition of accounting news, we looked at the australian accounting standards board’s (aasb’s) exposure draft, ed 297, which proposed the scrapping of. Faithfully represents those transactions.

Special purpose financial statements (spfs) and be required to prepare gpfs. They do not have any legislative requirement to prepare such financial. Reporting framework consisting of two tiers of reporting requirements for preparing general purpose financial statements.