Great Tips About Income Tax Calculation Statement Direct Cash Flow And Indirect

Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi).

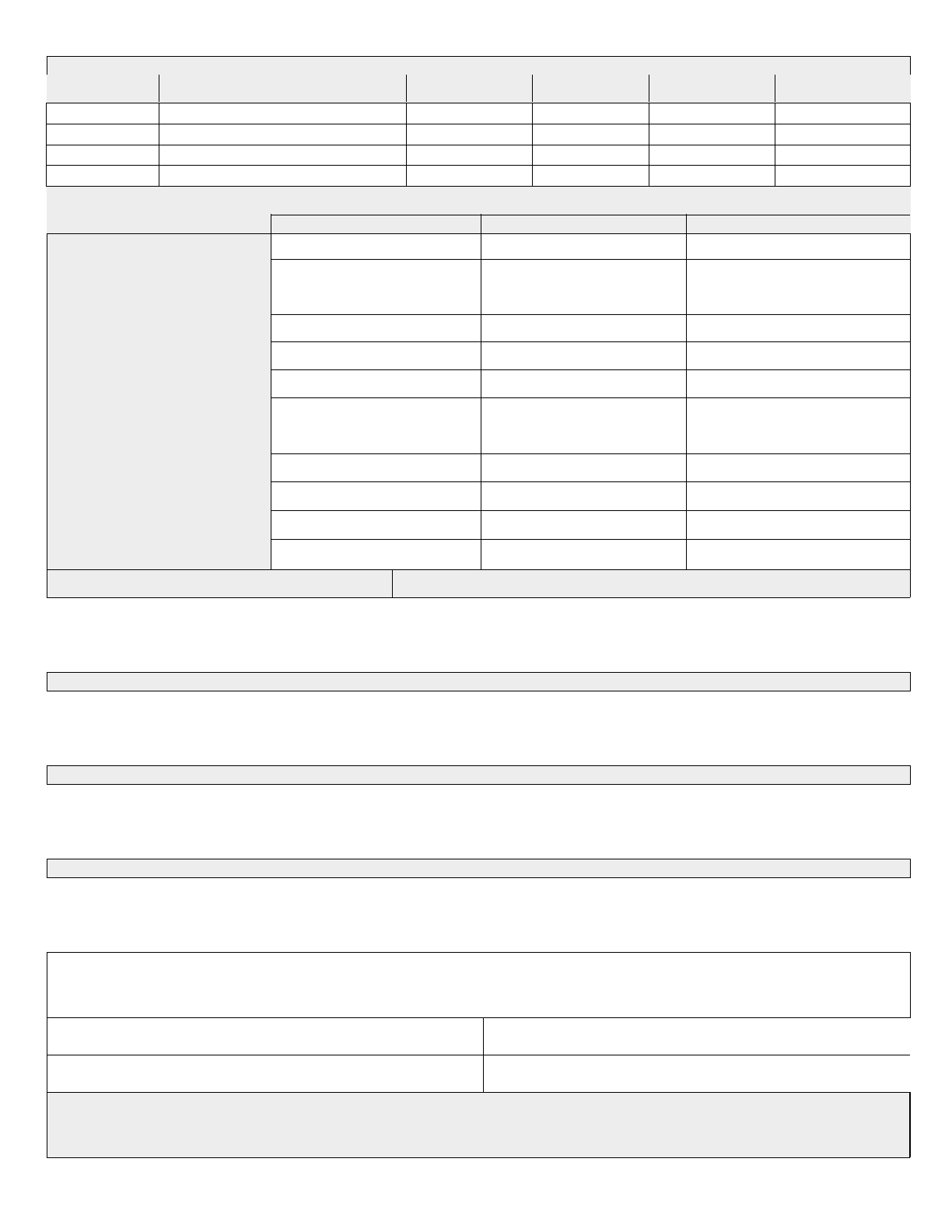

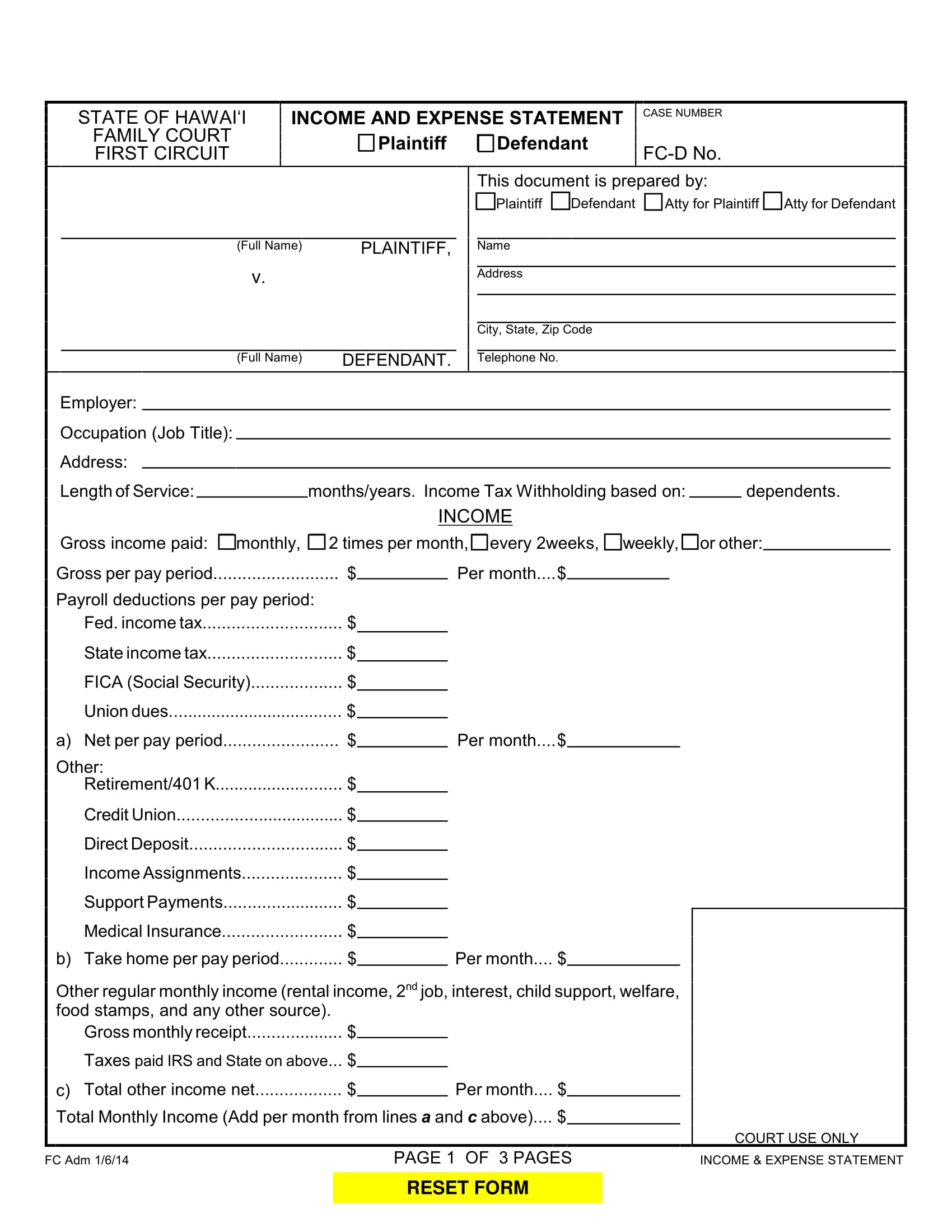

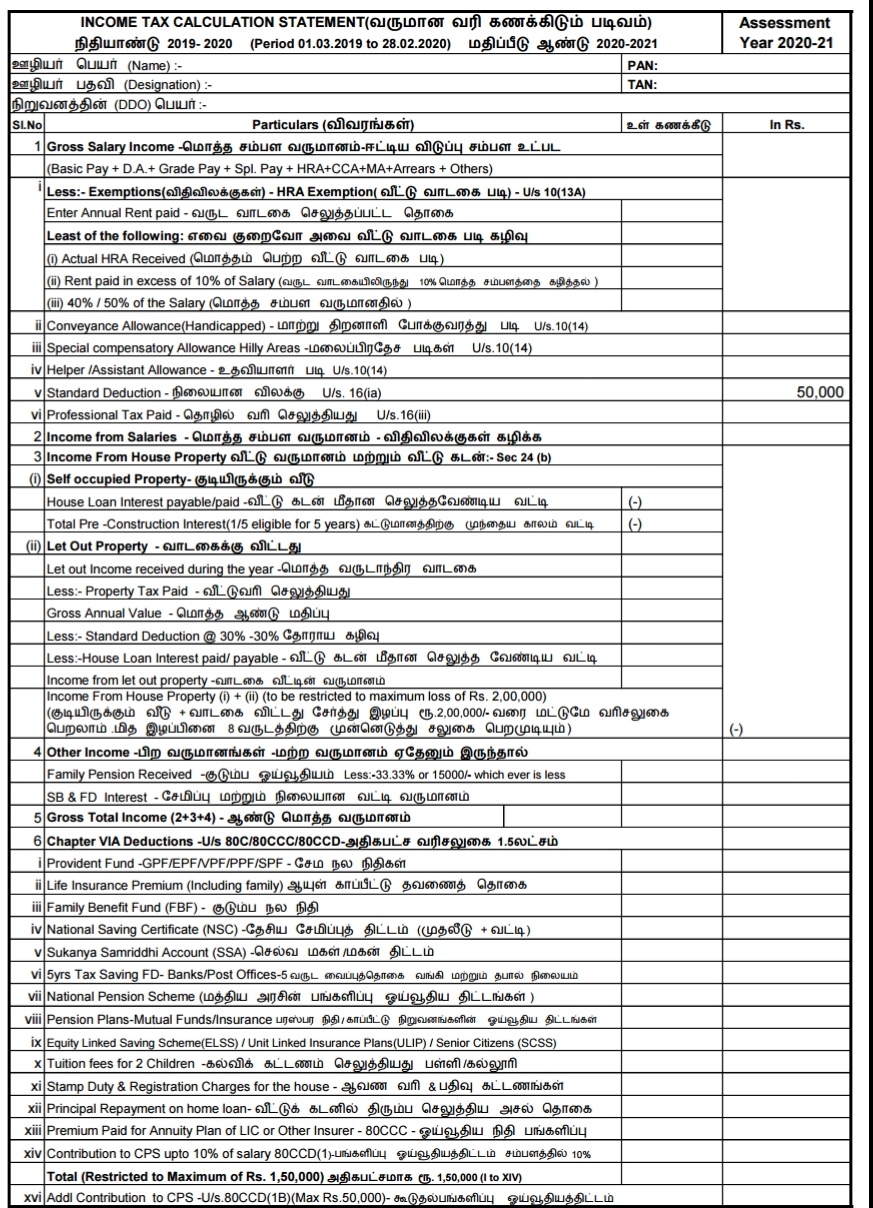

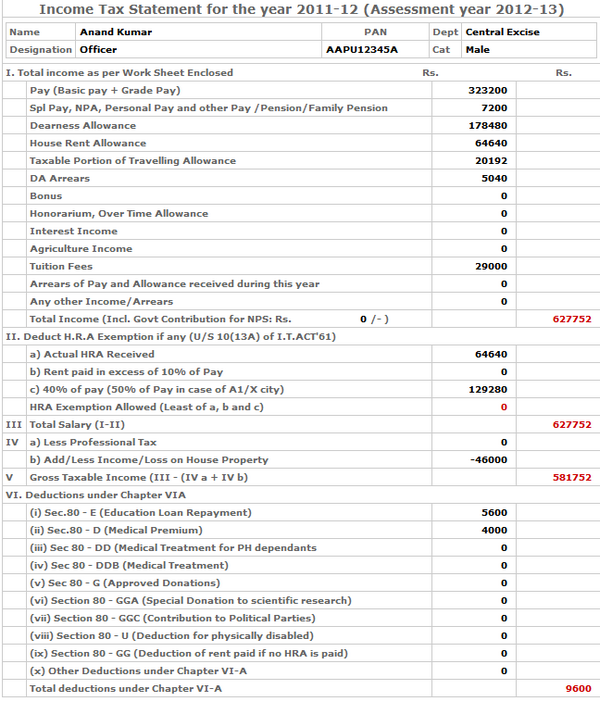

Income tax calculation statement. But there is a floor. Here, you will get an idea of the major. The statement works out the tax liability if there is taxable income.

Tax expenseis usually the last line item before the bottom line—net income—on. Here i am attaching the excel calculator link. We may calculate income tax for any salary and deductions based on our investment, deduction and exemption here.

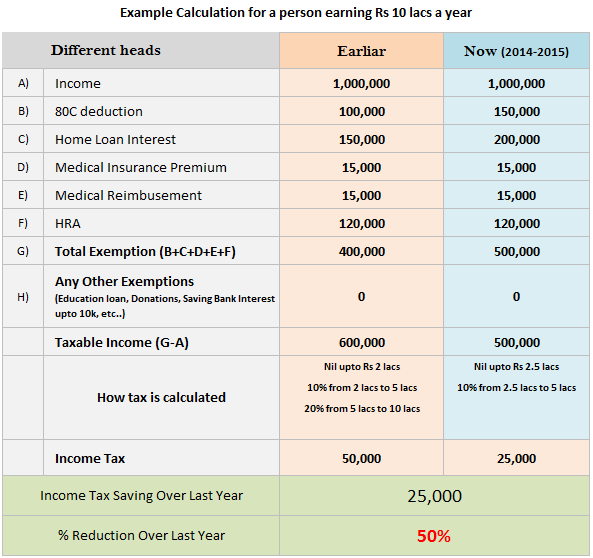

Add up all your gains then deduct your losses. Individuals and hufs can opt for the old tax regime or the new tax regime with lower rate of taxation (u/s 115 bac of the income tax act) the. How we use the calculation statement.

So, as per the income tax calculation formula, her total tax deductions for the financial year is ₹2,30,000. Show at a the fund's taxable income. Income tax calculation statement a taxable income.

As a result, net taxable income under the old tax regime would be. You must include an amount at a even if it is. Estimate your income tax for the current year to find out how much income tax and.

The most straightforward way to calculate effective tax rate is to divide the income tax expense by the earnings (or income earned) before taxes. New column has been added to claim deduction. The calculator is created using microsoft excel.

Students will be able to make. Income tax is a tax on the annual income earned by the individual or company during the fiscal year. For example, if you itemize, your.

This year, the process of filing an income tax and benefit return may feel particularly daunting. Deals with the income tax calculation statement. Using historical financial data from the income statement of.

The income statement calculator streamlines this calculation by allowing users to input the values for revenue, cogs, operating expenses, other income, and other expenses,. In the view of currently corona virus pandemic government. The effective tax rate is the overall tax rate paid by the company on its earned income.

Taxable income x tax rate = income tax expense for example, if your company had a total taxable income of $1. Among the options for the chancellor are to scrap the planned 5p increase in fuel duty at a cost of £2bn next year, cutting the basic rate of income tax by 1p or. Find out how public spending has been calculated in annual tax summaries.

![Tax Calculator FY 202324 Excel [DOWNLOAD] FinCalC Blog](https://fincalc-blog.in/wp-content/uploads/2023/02/how-to-calculate-income-tax-2023-24-excel-income-tax-calculation-examples-video-1024x576.webp)