Stunning Info About Unbalanced Balance Sheet Ocado Financial Statements

A balance sheet is out of balance when the sum of your company assets, liabilities and shareholder's equity does not balance to zero.

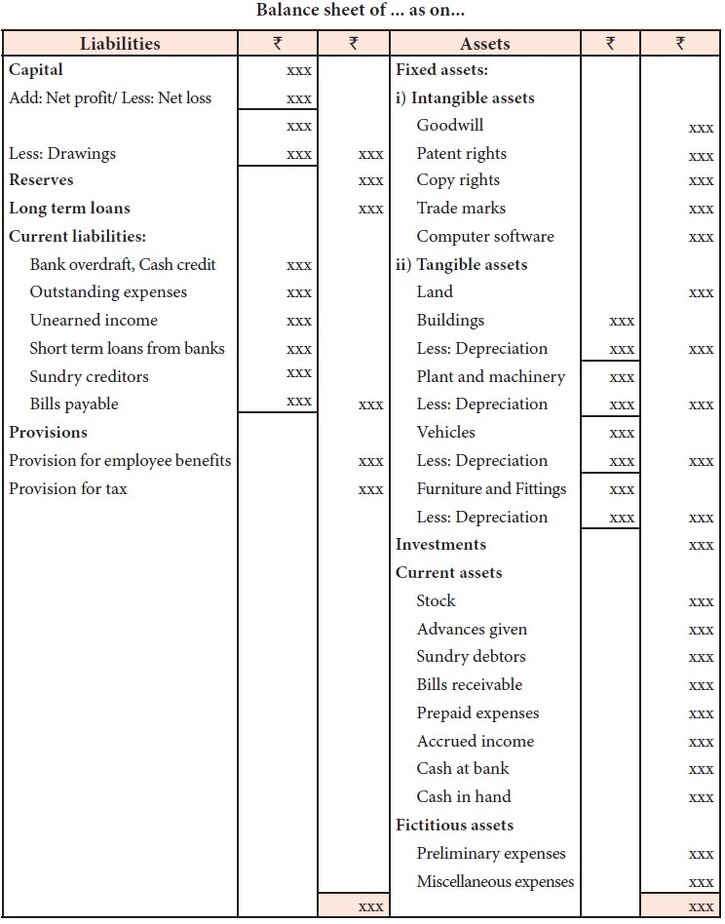

Unbalanced balance sheet. How to forecast the balance sheet? The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. Making intangibles count business models in many industries have evolved in the last decade to increasingly create economic value from investments in intangible assets, such as brands, technology, and customer relationships.

The assets and liabilities of your company should be equal to each other for your balance sheet to tally. Understanding balance sheets the assets on the balance sheet consist of. The name balance sheet is based on the fact that assets will equal liabilities and shareholders' equity every time.

Total assets is 45,486,318.79 and total equity and liabilities is 45,462,832.27. What is the balance sheet? Top 10 ways to fix an unbalanced balance sheet.

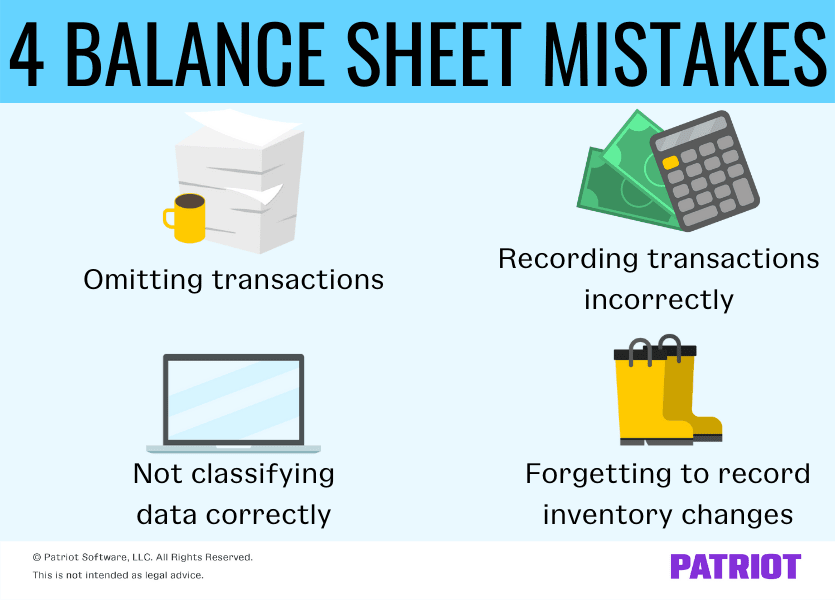

If a balance sheet doesn’t balance, it’s likely the document was prepared incorrectly. If they don’t, your balance sheet is unbalanced.

The unbalanced balance sheet: Financial statements are a series of double entries. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

Typically, errors are due to incomplete or missing data, incorrectly entered transactions, errors in currency exchange rates or inventory levels, miscalculations of equity, or miscalculated depreciation or amortization. Review the trial balance report, journal entries and. Top 10 reasons your balance sheet doesn't balance | intro.

When we are setting up our financial statements, we must make sure we bring in both sides of the double entries to ensure our balance sheet balances. Current accounting guidance does not always recognize the value created by intangibles, either on the balance sheet or in the footnotes. So now i just wanted to give you 4 things to look for if your balance sheet is not balancing.

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. The balance sheet is one of the three core financial statements that are used to. Verify that the appropriate signs are shown.

Enter hardcodes across one row of the balance sheet for each year that doesn’t balance). Investments in new business models and intangible assets — such as brands, technology and customer relationships — are increasingly key to driving value creation as. What makes trial balance and balance sheet unbalanced in our application ?

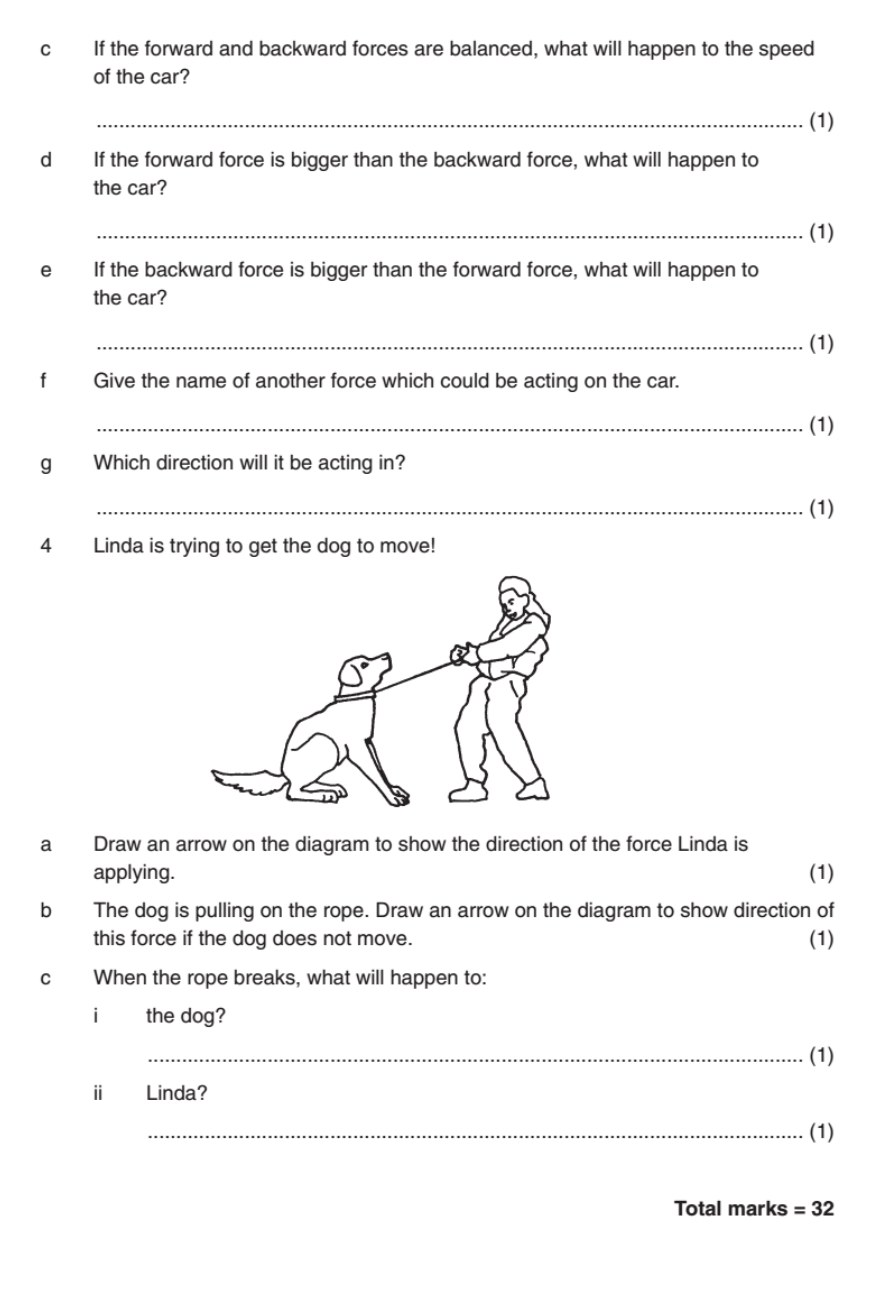

Your balance sheet won’t balance. One of the methods of balance sheet problem solving is once our check has been written, the following step is to confirm that our income, assets, and liabilities are all positive and equal. To locate the transaction or transactions causing the problem, find the date when this report went out of balance.

![Free Printable Balanced And Unbalanced Forces Worksheets [PDF] (With](https://printableshub.com/wp-content/uploads/2022/01/balanced-or-unbalanced-force-printable-worksheets.jpg)