Out Of This World Info About Trial Balance Is Prepared On The Statement Of Owners Equity

Liabilities & incomes shall have a credit balance.

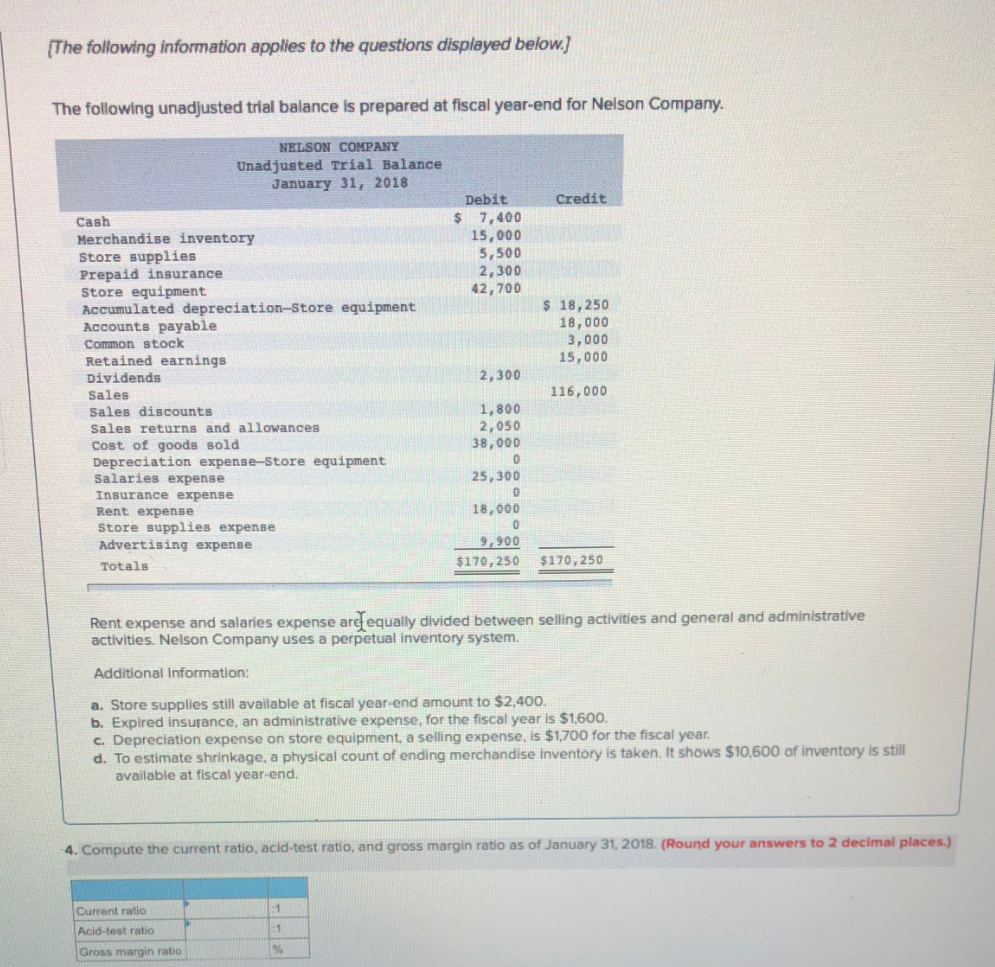

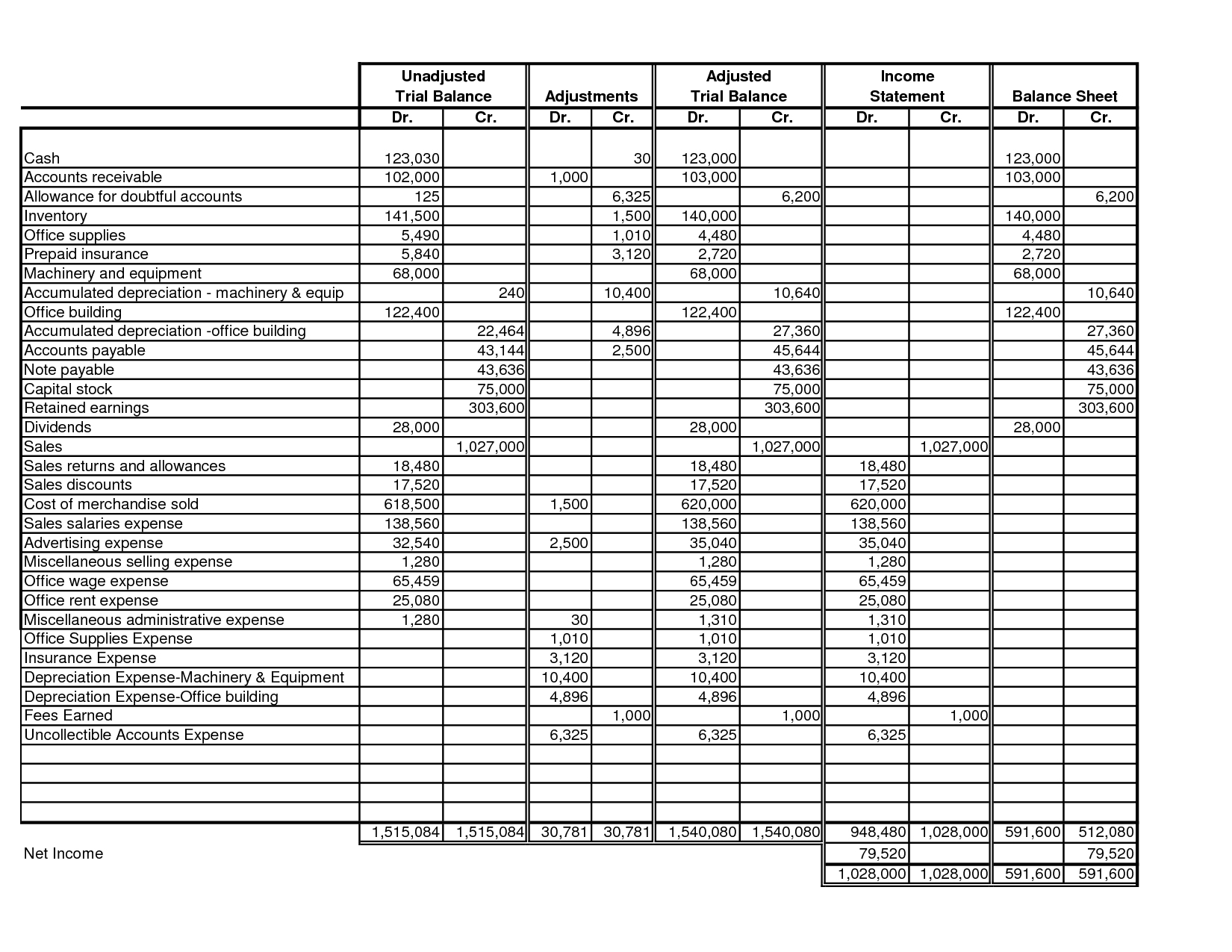

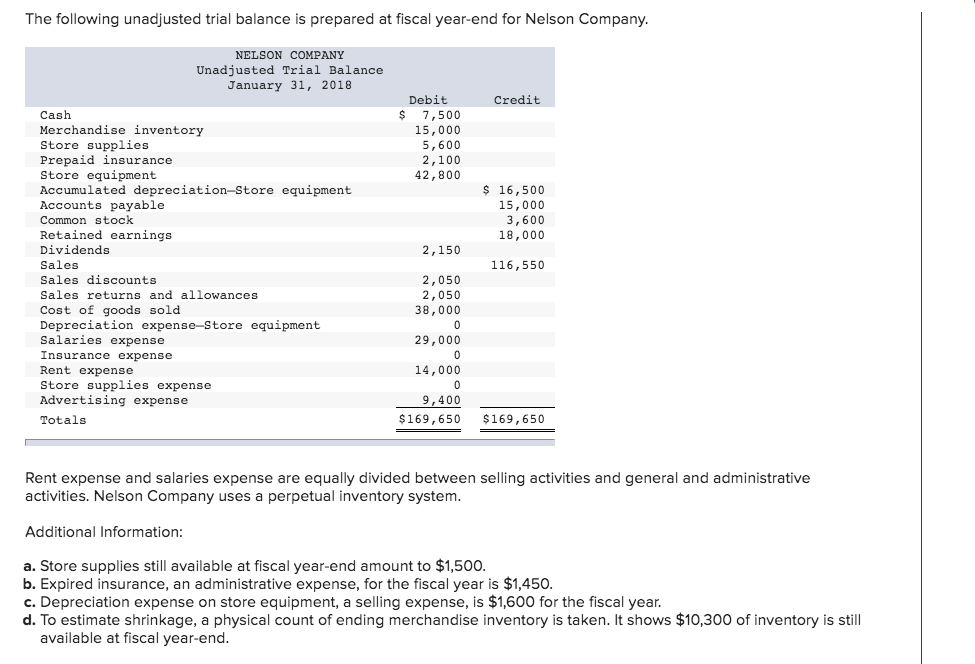

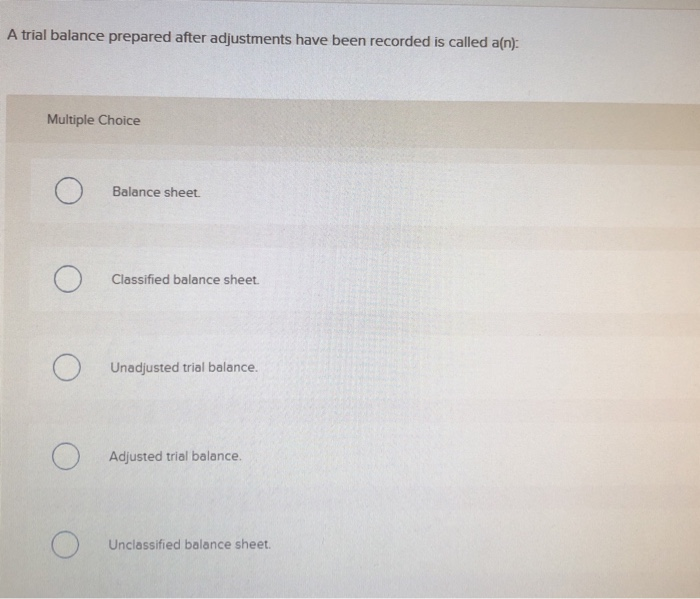

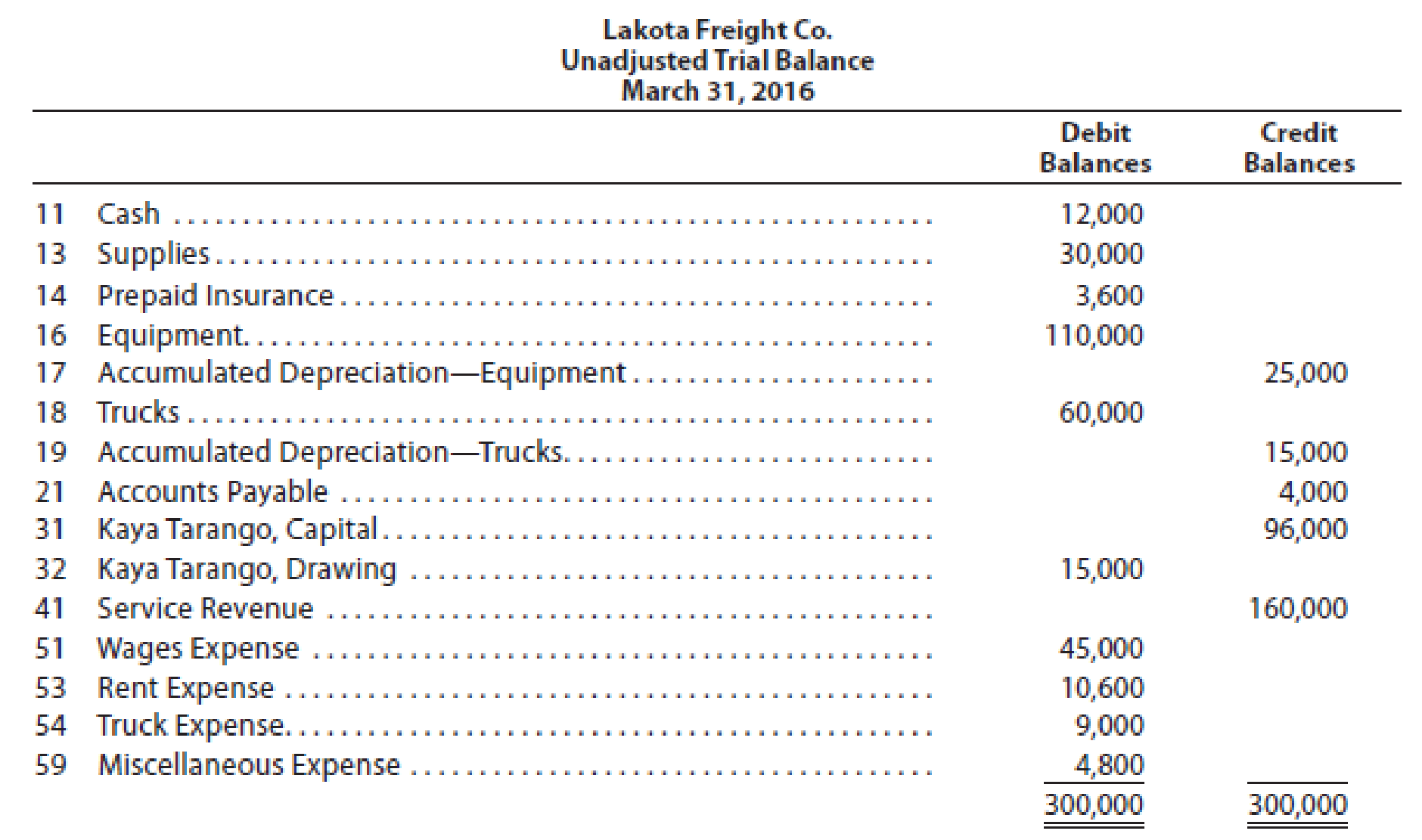

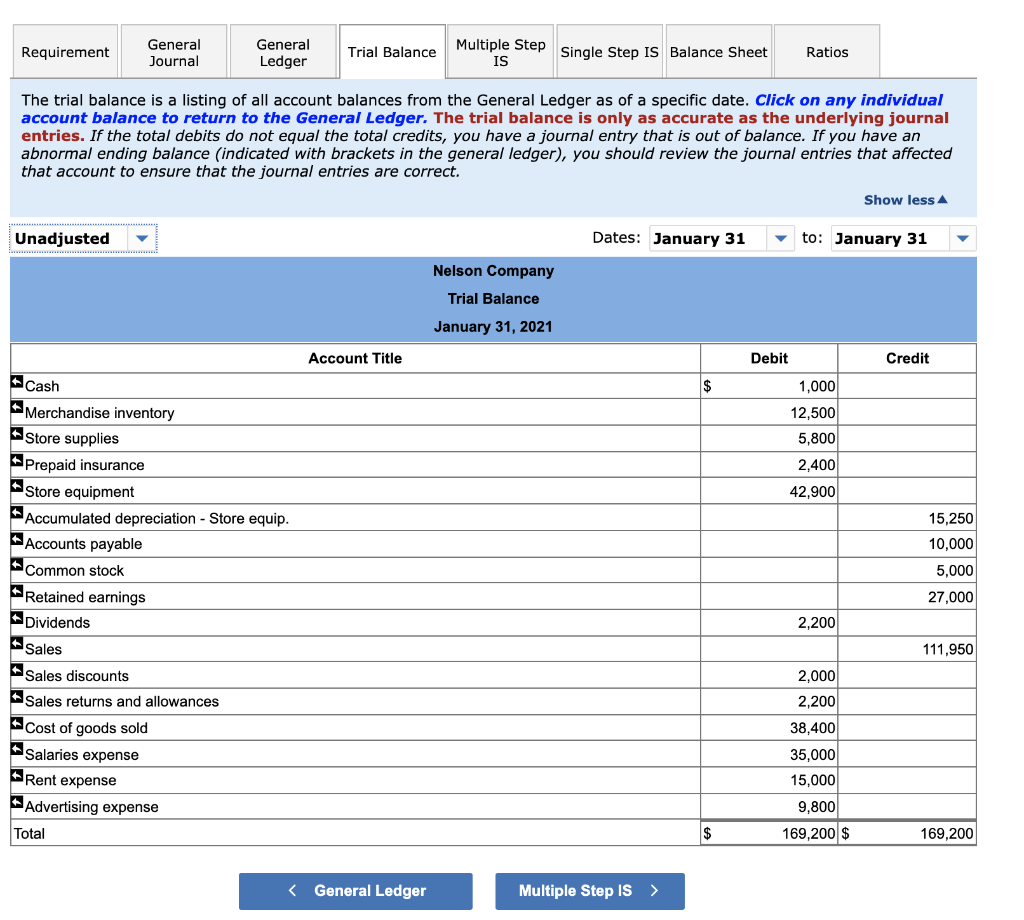

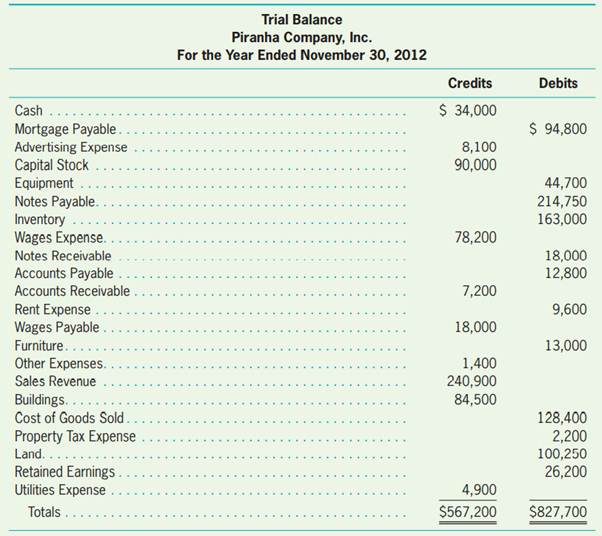

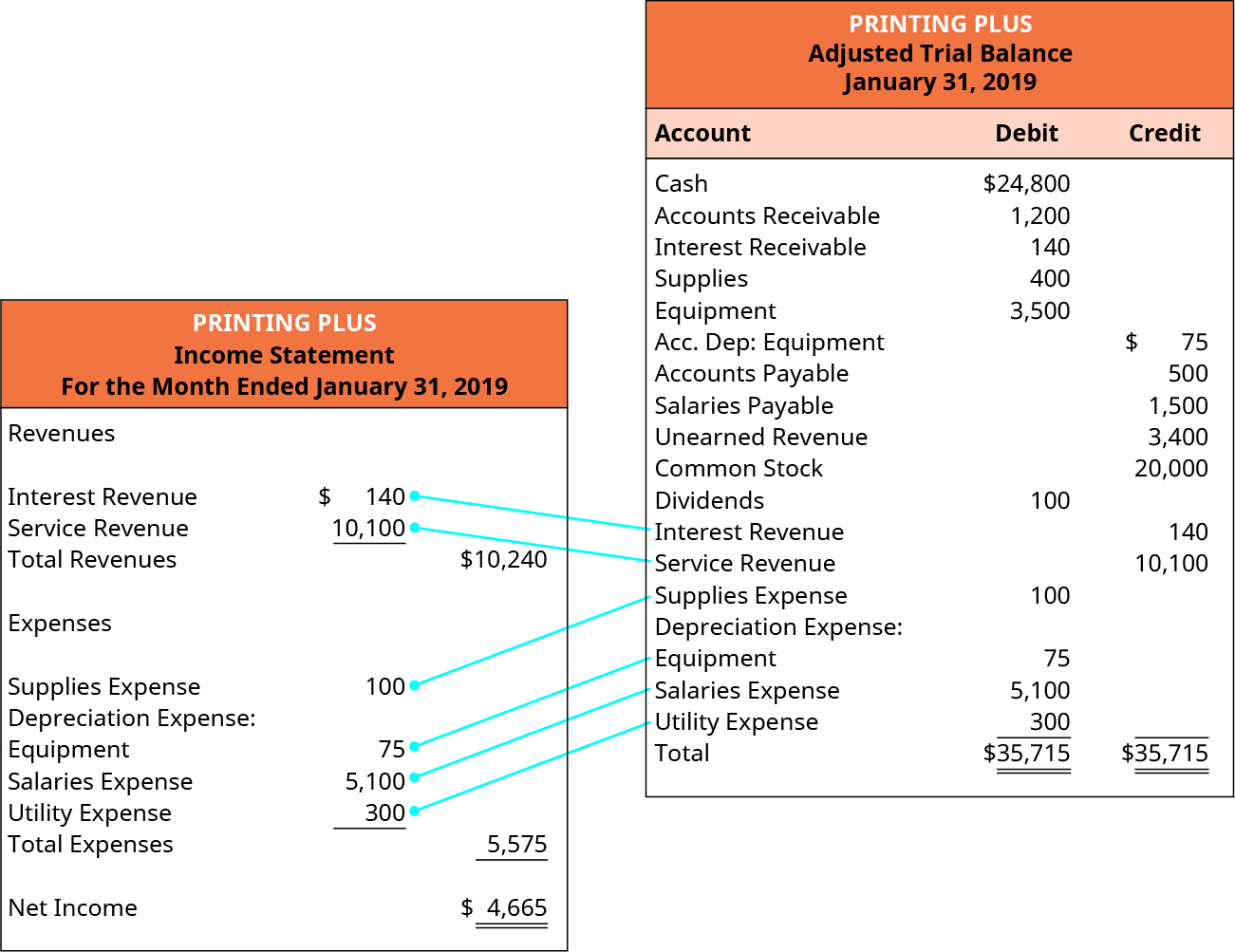

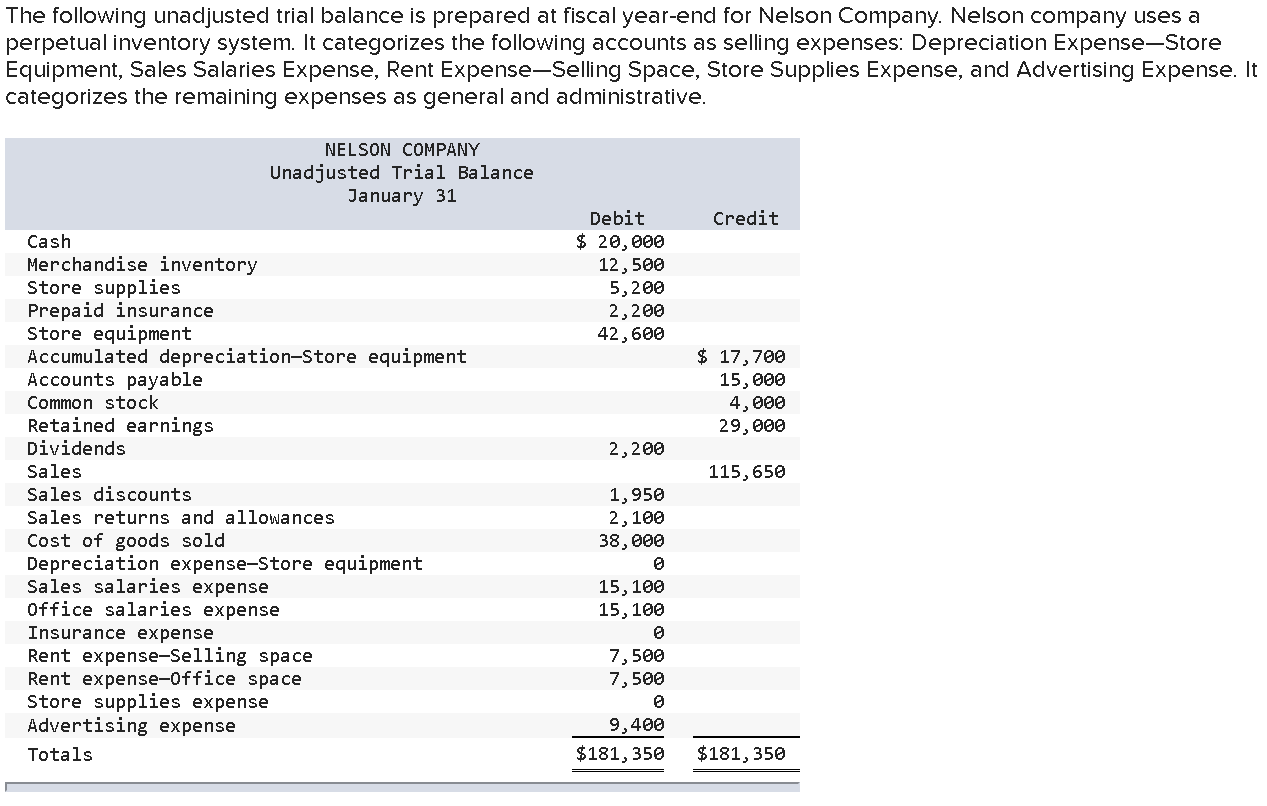

Trial balance is prepared on. When the accounting system creates the initial report, it is considered an unadjusted trial balance because no adjustments have been made to the chart of accounts. To prepare the financial statements, a company will look at the adjusted trial balance for account information. However, a business may choose to prepare the trial balance at the end of any specific period.

A general rule to follow here is; In order to provide a summary statement view of the balances of various accounts, the trial balance is prepared. This could be at the end of each month, quarter, half a.

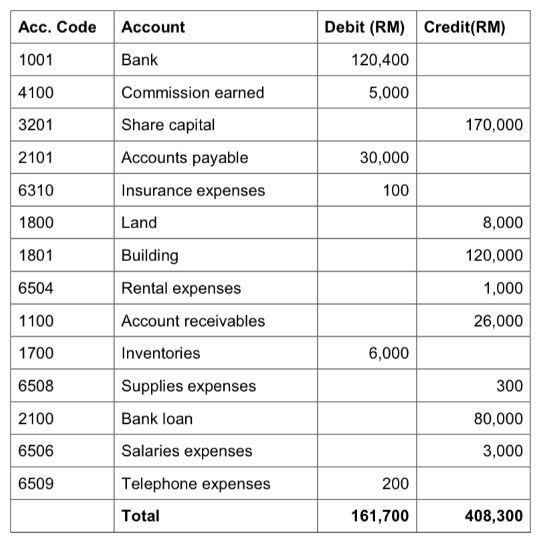

April 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. Run a trial balance on a regular basis, at least monthly; Assets & expenses shall have a debit balance.

The balances are usually listed to achieve equal. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. Aggregate the amounts of the remaining account in two separate headings that is,.

The main objective of a trial balance is to ensure the mathematical accuracy of the business transactions recorded in a company’s ledgers. The trial balance is prepared before you make any adjusting entries. This is done in order to aggregate accounting information for inclusion in the financial statements.

In addition to error detection, the trial balance is prepared to make the necessary adjusting entries to the general ledger. Prepare and adjust the balances in the trial balance. If you’ve ever wondered how accountants turn your raw financial data into readable financial reports, the trial balance is how.

In a nutshell, a trial balance is an informal accounting statement, prepared with the help of ledger account balances. Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet. Trial balance is a worksheet that leads to the final preparation of the financial statement and report, which is used by management and stakeholders to gain knowledge about the company’s financial health.

Follow the process below to prepare a balance sheet from the trial balance: These balances can be prepared either manually or by using an accounting system on a computer. Trial balance is a statement summarizing the closing balance of all the ledger accounts, prepared with the view to verify the arithmetical accuracy of ledger posting.

The totalling of the accounts is done and all the accounts are balanced. It helps you identify any problems quickly and fix them as soon as they arise. It is prepared on a particular date to summarize the records and check the arithmetical accuracy.

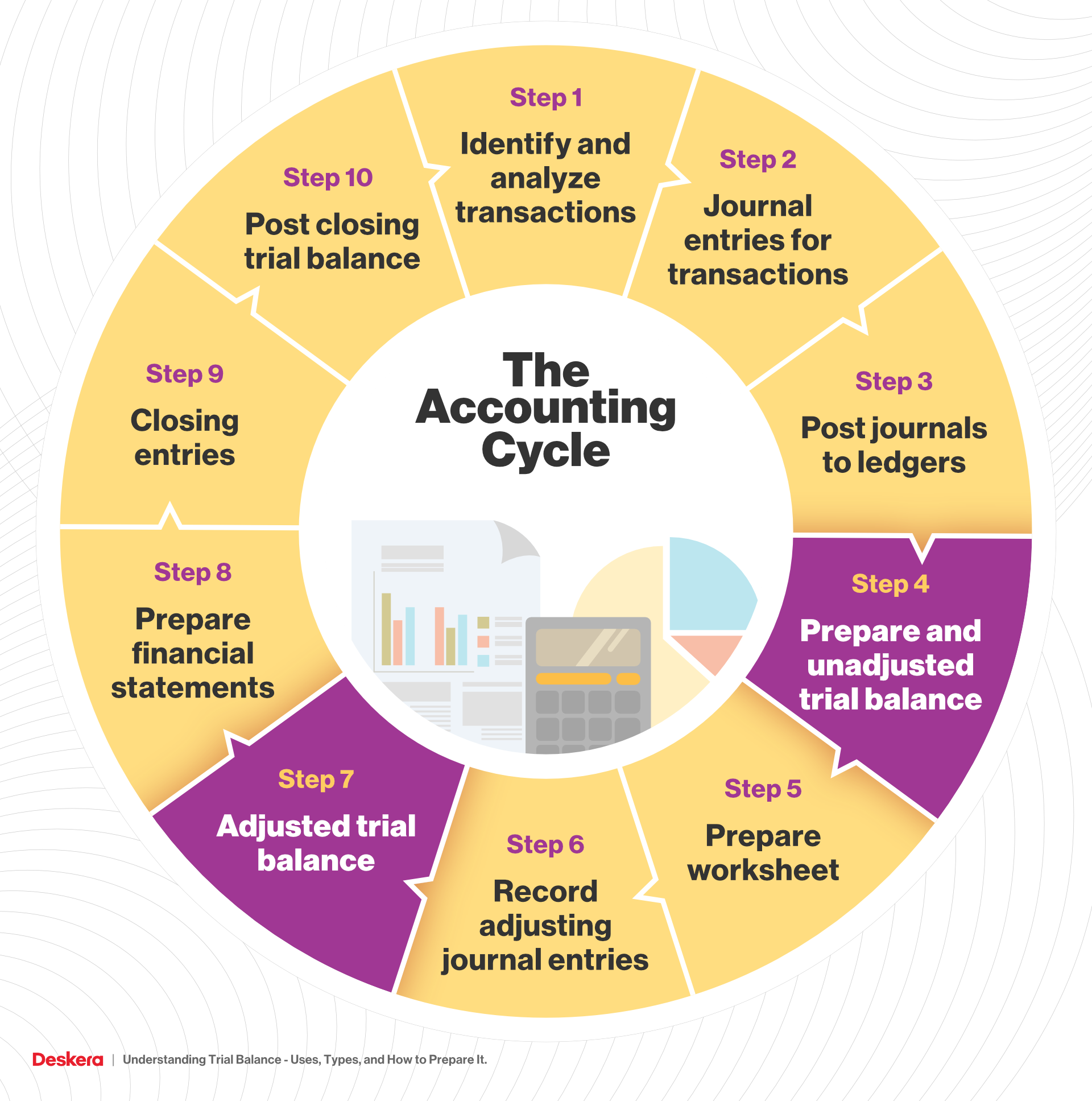

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. To prepare a trial balance, follow these steps: A company prepares a trial balance.