Neat Tips About Cost Of Goods Sold For Services Balance Sheet In Good Form

Cost of goods sold, or cogs, is the total cost a business has paid out of pocket to sell a product or service.

Cost of goods sold for services. Here’s an example to further explain the above formula: Cost of goods sold (cogs) is a critical business measure that helps drive profitability in your company, product or department. Typically, calculating cogs helps you.

Calculate cogs by adding the cost of inventory at the beginning of the year to purchases made throughout the year. Company a recorded $3.5 million worth of inventory at the beginning of the 2017 fiscal year. December 03, 2023 what is the cost of goods sold?

Knowing the cost of goods sold can help you calculate your business’s profits. It includes material cost, direct labor cost, and direct factory overheads, and is directly proportional to revenue. These costs can include labor, material, and shipping.

How to calculate the cost of goods sold for services 1. The cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while attempting to. The factory gate price (output price) is the amount received by uk producers for the goods that they sell to the domestic market.

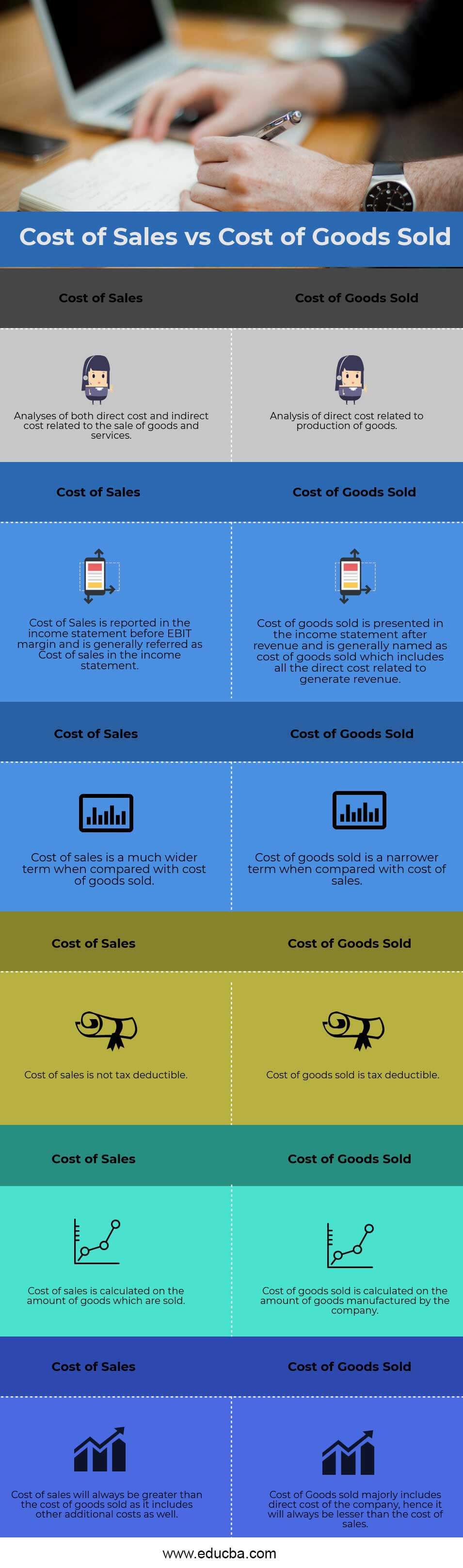

Cogs are listed on a financial report. Cogs excludes indirect costs, such as distribution expenses. Cost of goods sold (cogs) includes the direct costs associated with the production of goods and services, while cost of service sold (coss) is a broader term that includes both direct and indirect costs associated with the sale of goods and services.

Cost of goods sold is the total of all costs used to create a product or service, which has been sold. How to calculate cost of goods sold (cogs)? The cost of goods sold (cogs) refers to the cost of producing an item or service sold by a company.

The final number will be the yearly cost of goods sold for your business. Cogs can also inform a proper price point for an item or service. Cost of goods sold best practices

Keep reading for our breakdown of each part of the cogs formula. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct costs incurred by a company while selling its goods or services. How to calculate the cost of goods sold.

By accurately calculating your cogs, you can determine the minimum price at which you need to sell your services to cover these expenses. Both of these costs refer to the direct costs of a business that it incurs on its revenues. Cost of goods sold, (cogs), can also be referred to as cost of sales (cos), cost of revenue, or product cost, depending on if it is a product or service.

There are two ways to calculate cogs. However, the requirements for calculating this are the same. Sales revenue minus cost of goods sold is a business’s gross profit.

![Cost Of Goods Sold Audit Procedures 80+ Pages Summary [1.5mb] Latest](https://www.wikihow.com/images/thumb/1/10/Account-for-Cost-of-Goods-Sold-Step-16.jpg/aid1565032-v4-1200px-Account-for-Cost-of-Goods-Sold-Step-16.jpg)

![Cost of Goods Sold [Basics Explained & Made Easy]](https://learnaccountingskills.com/wp-content/uploads/2023/02/cost-of-goods-sold-explained.jpg)