Fabulous Info About Commission In Balance Sheet Conocophillips

The agreement means the scope of work.

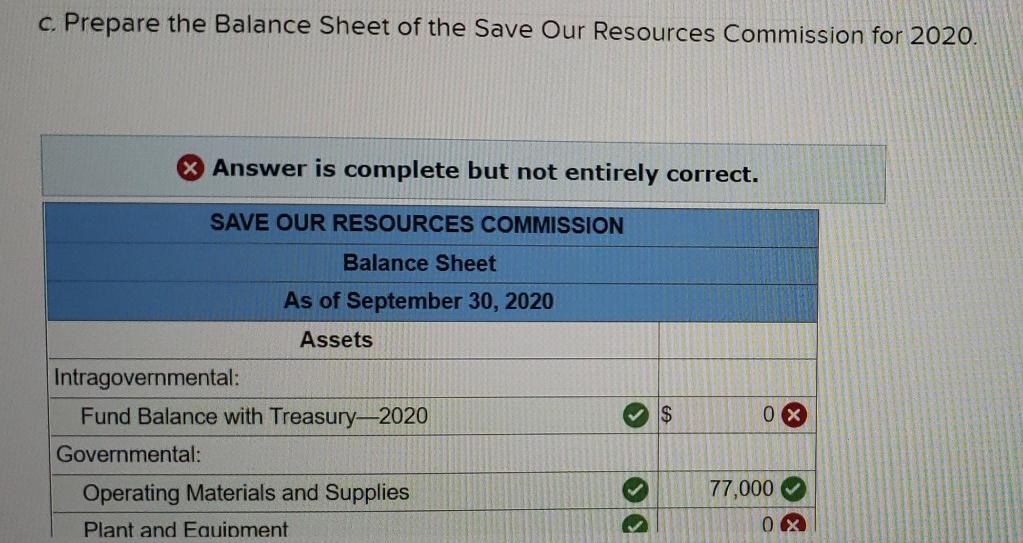

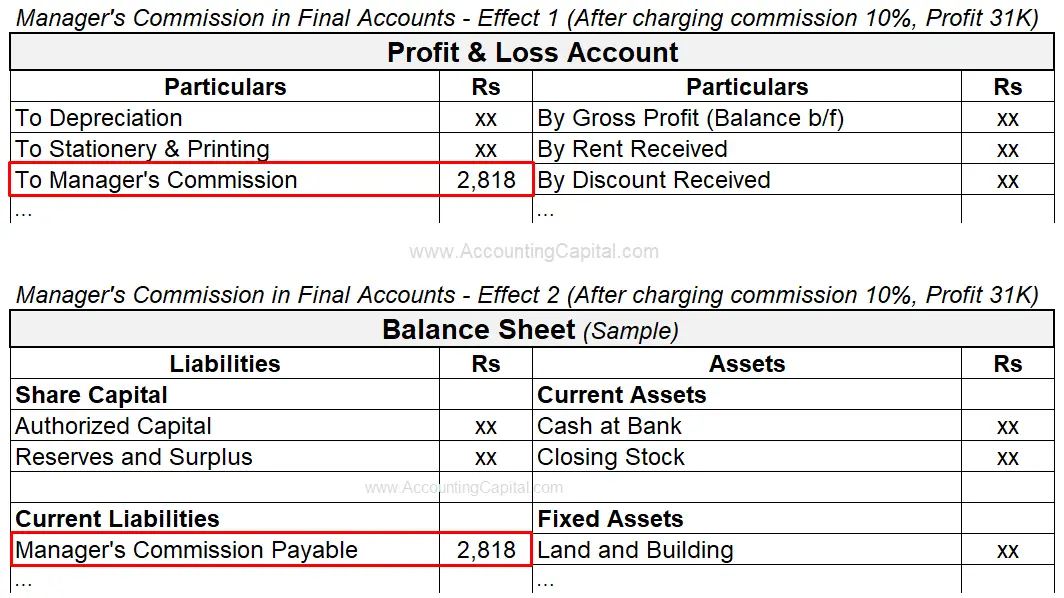

Commission in balance sheet. A commission is an amount charged by one party to another to act as a broker for transactions. The outstanding commission is a current liability like any other outstanding expense, hence it is shown on the liability side in the balance. Read the manager may be paid a commission due to an increase in sales of the business.

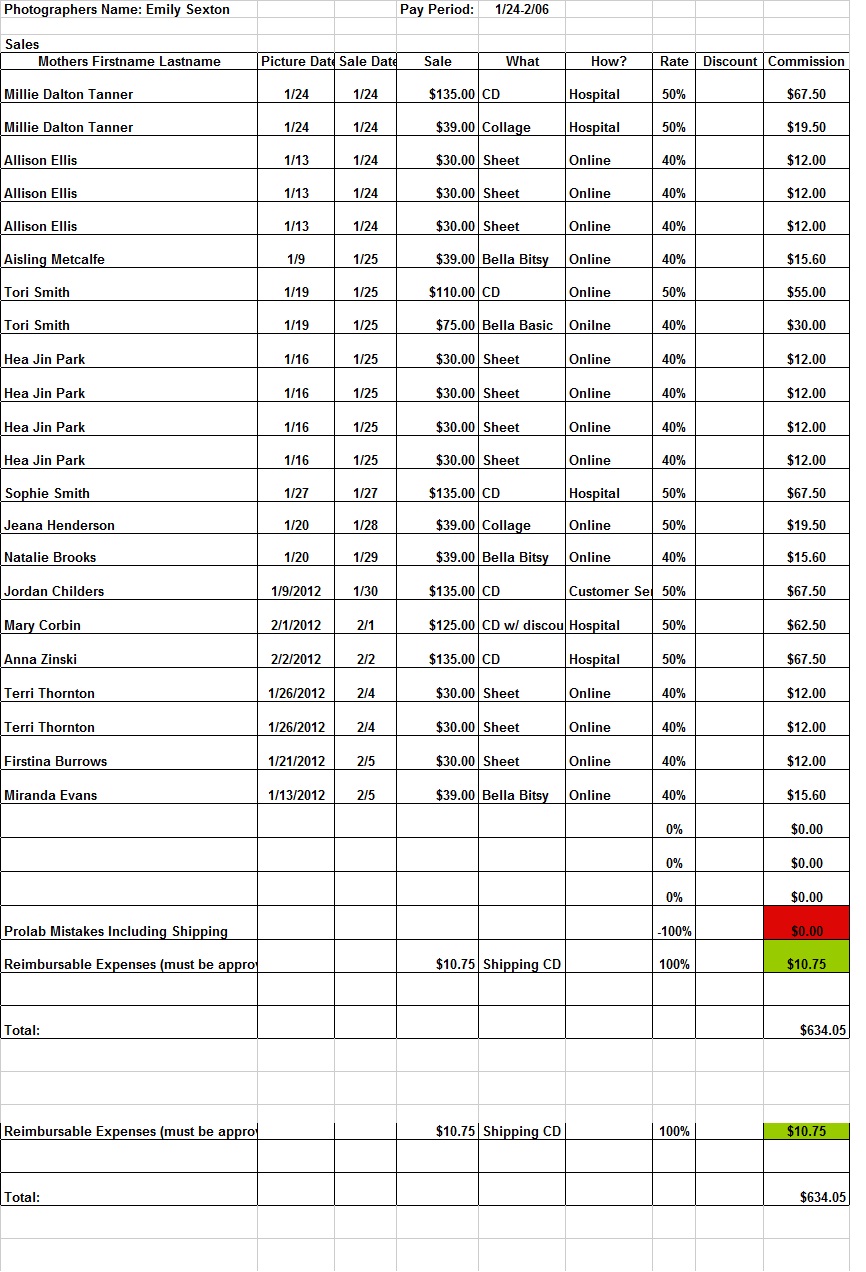

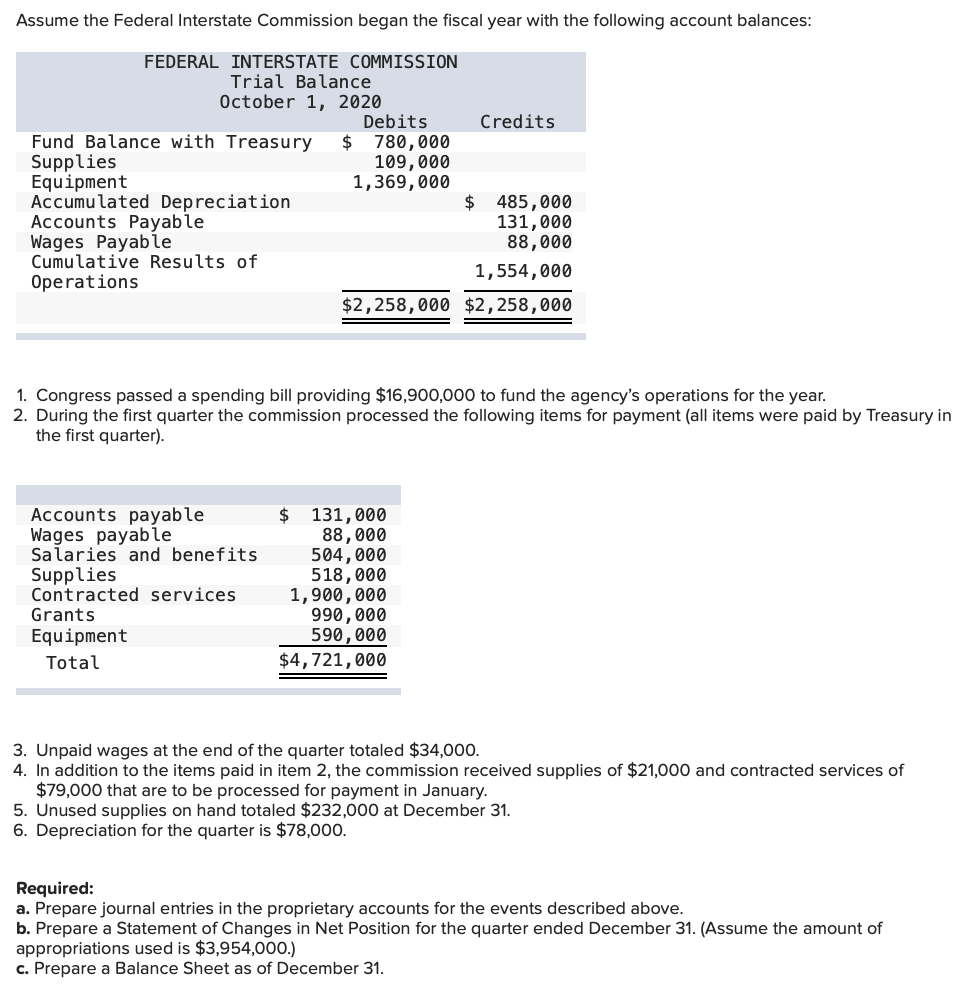

The journal entry is debiting deferred commission and credit cash paid. Your annual salary is $40,000. The commission is an expense of the business which is recorded with the following journal entry.

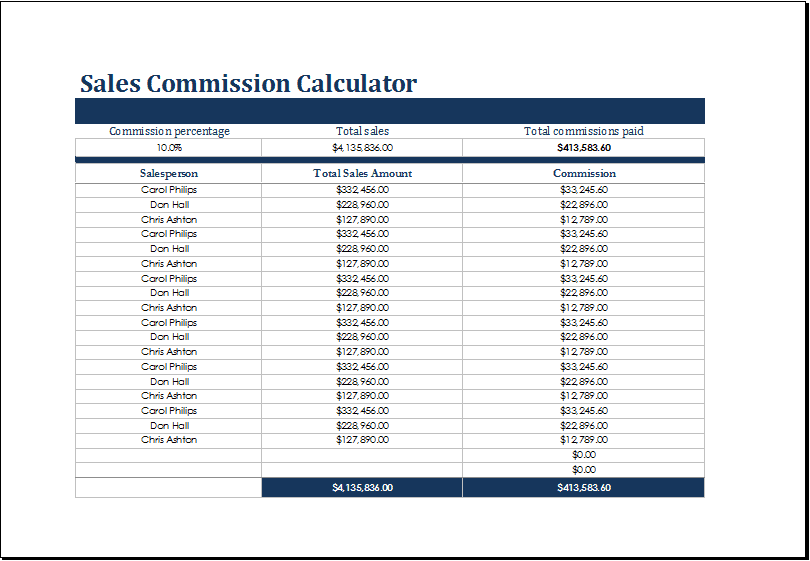

Commissions are not typically recorded on a balance sheet. And (4) statements of shareholders’ equity. October 01, 2023 what are sales commissions?

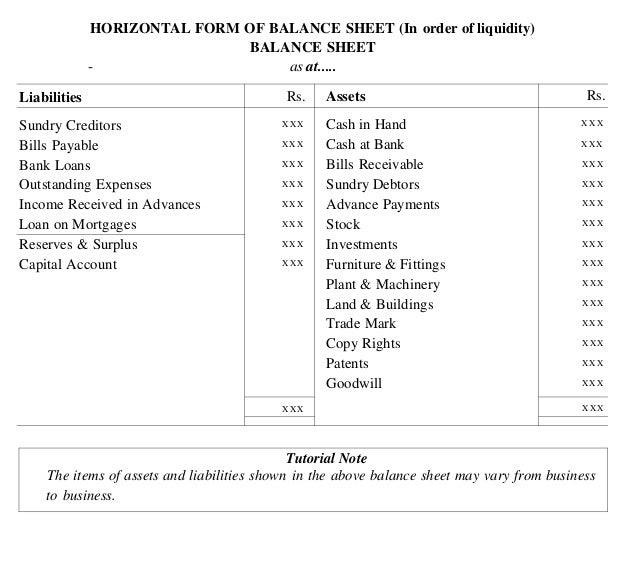

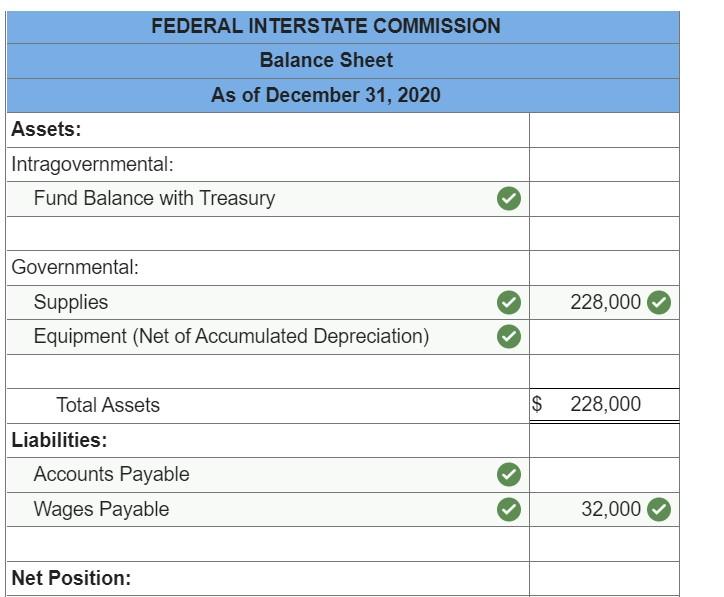

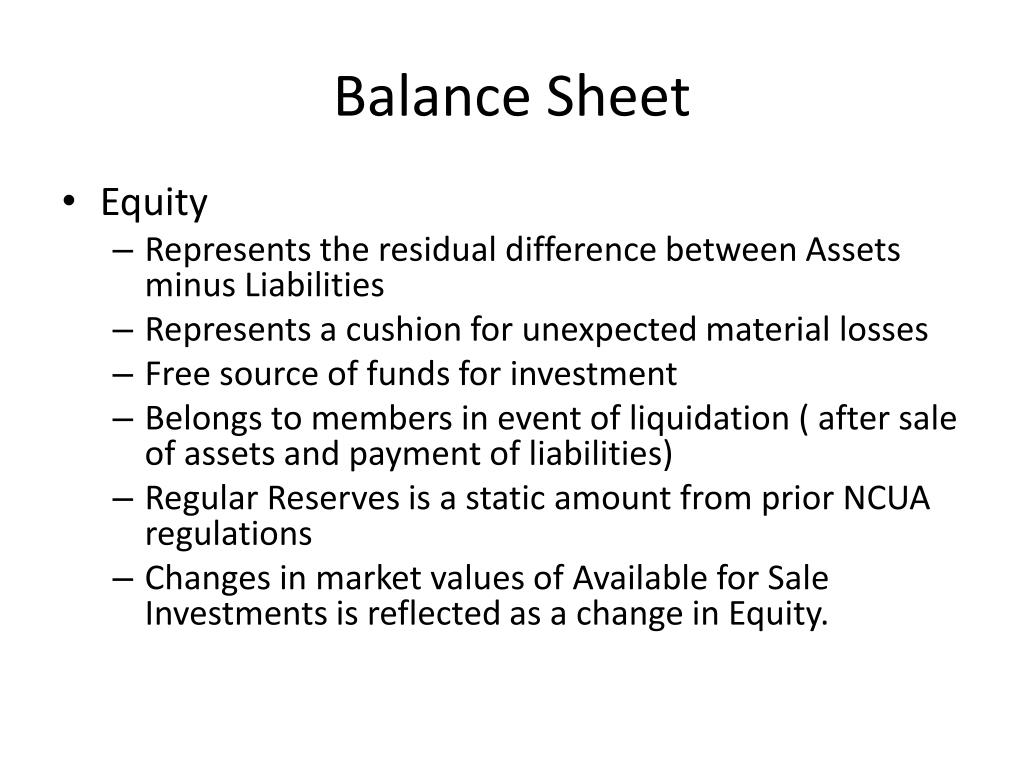

Balance sheets show what a. On a company’s balance sheet, owners’ equity shows what the owners of the business (or shareholders) would have if the company paid off all its debt with its. Features of manager’s commission.

The journal shown above debits the commission expense. Glossary what is accrued commission? The balance sheet is the third statement prepared after the statement of retained earnings and lists what the organization owns (assets), what it owes (liabilities), and what the.

Definition of sales commissions sales commissions are amounts earned by selling another company's goods or services and paid by the company whose goods or services. Under the cash basis of accounting, you should record a commission when it is paid, so there is a credit to the cash account and a debit to the commission expense account. This commission is paid on the net profit of the company.

The commission is the cost to acquire the project, so it must be allocated based on the project life. Accrued commissions, those that are owed to employees but have not been paid out, also appear on the balance sheet as a liability. Asc 606 is the new revenue recognition standard for all businesses, public or private, that enter into contracts or sales agreements with.

In most cases, it includes the service charge from. It is similar to the principle error described above, but commission error is. Accruals are adjustments made to financial statements to recognize revenue or expenses that have been earned or incurred but.

Write “sales commissions payable” and the amount you owe your employees as a line item in the current liabilities section of your balance sheet. Learn what a balance sheet should include and how to create your own. A balance sheet includes a summary of a business’s assets, liabilities, and capital.

It depends on what the two parties agree. A sales commission is the amount of compensation paid to a person based on the amount of sales generated. The transaction amount is correct, but the account debited or credited is wrong.