Divine Info About 26as Tds Form It Statement

Following are the major information.

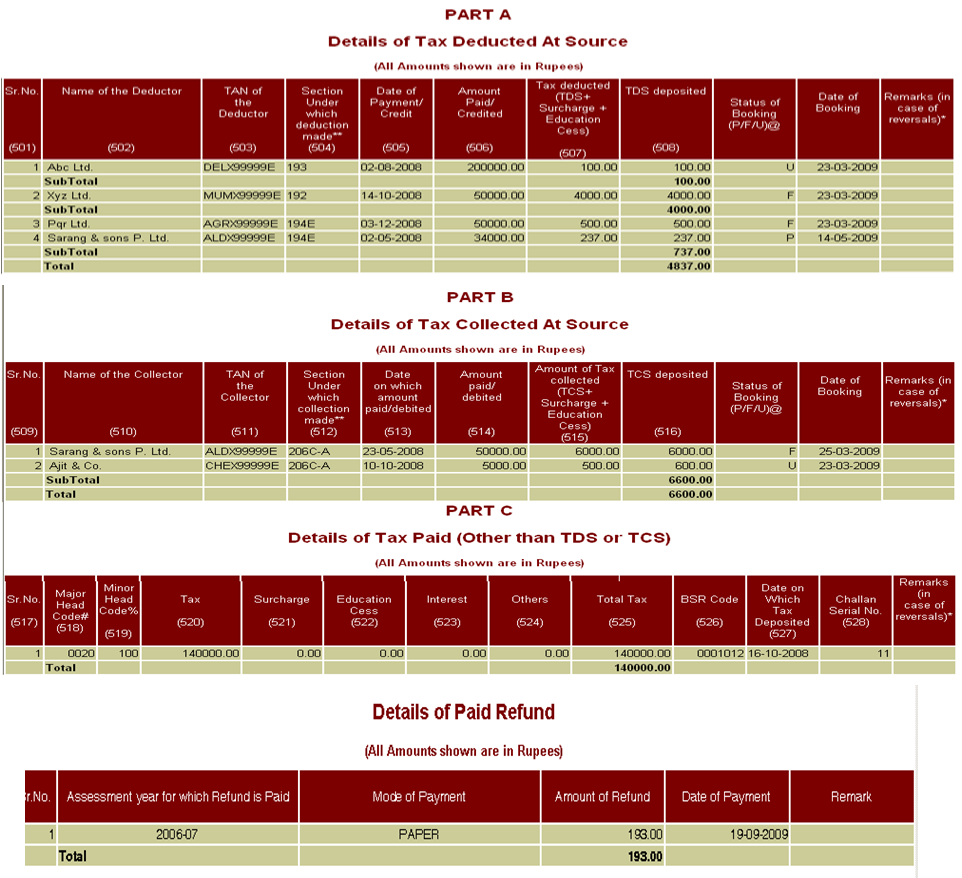

26as tds form. Steps to verify validity of form 16: Part a of form 26as reflects the income. Tax deducted at source from salary.

It is an important document needed at the time of filing itr,. A taxpayer’s form 26as is a declaration that lists all amounts withheld as tds or tcs from their different income sources. Enter your user id (pan or aadhaar number) step 3:

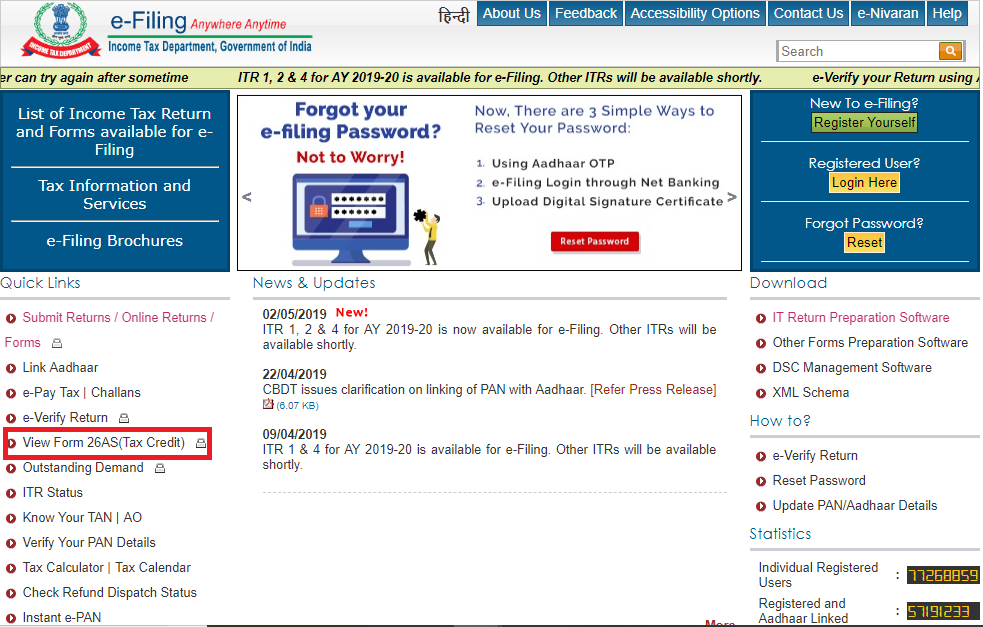

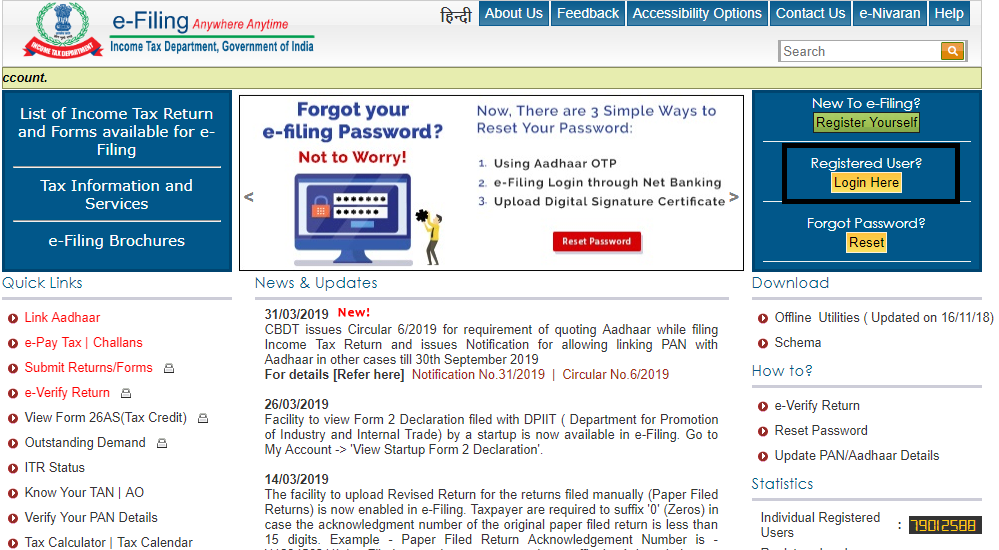

What is form 26as, and how do i get it? Form 26as can be accessed by a taxpayer from the income tax portal using the pan. Compare tds data on form 26as with your payslips to validate the accuracy.

According to the income tax faqs on ais, “ais is the extension of form 26as. The digital signature should be verified; The website provides access to the pan holders to view the details of tax credits in form 26as.

Form 26as reflects only the tds details mentioned in form 16. Form 26as is a consolidated annual tax statement that shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee along. How to view form 26as?

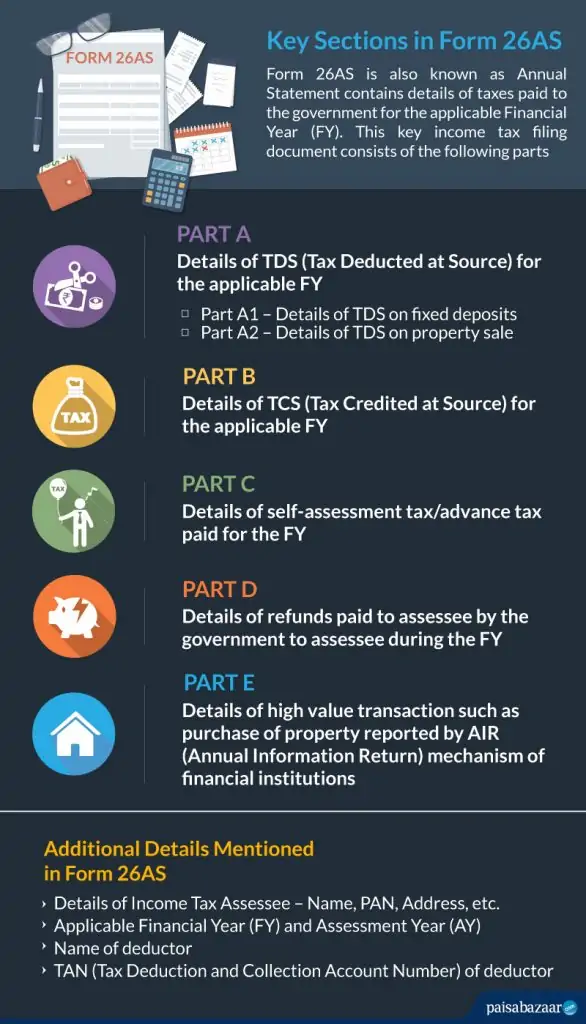

Form 26as is a tax credit statement that provides the complete record of the taxes paid by a taxpayer. Following parts of form 26as are explained in detail : Log in to your account using your pan.

It also shows information about high. If you are not registered with traces, please refer to our e. Form 26as contains the details of taxes paid and compliance information.

Can be verified online in the traces to check if the deductions by the employer are reflected in. Government gives the credit of tds on the basis of tds return and this credit gets reflected in form 26as. You may view form 26as by pan no.

To cross check as well as to prevent any miscalculation with respect to the total unclaimed tds amount, you need to simply download form 26as. Steps to verify tds certificate on traces portal : Form 26as is divided into nine parts.

On the tds reconciliation analysis and correction enabling system (traces) portal. What information available in form 26as? Click ‘view tax credit (form 26as)’ select the ‘assessment year’ and ‘view type’ (html, text or pdf).

![[PDF] Revised 26AS Form PDF Download InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/revised-26as-form-3463.jpg)