Nice Info About Balance Sheet Is Financial Statement Snapshot Of Position

Ecb reports loss of €1.3 billion (2022:

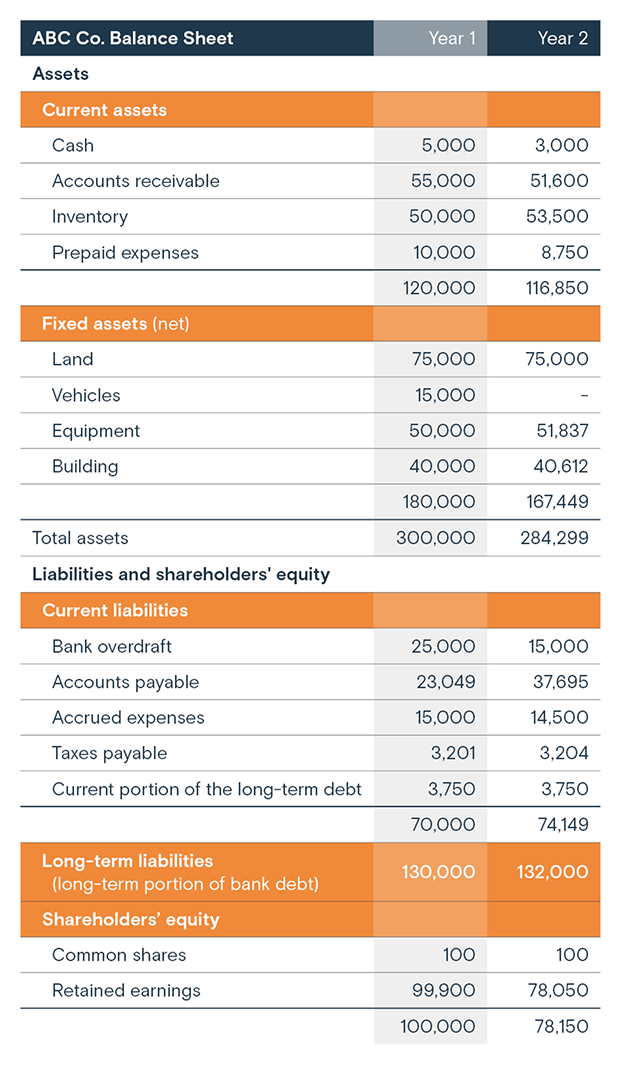

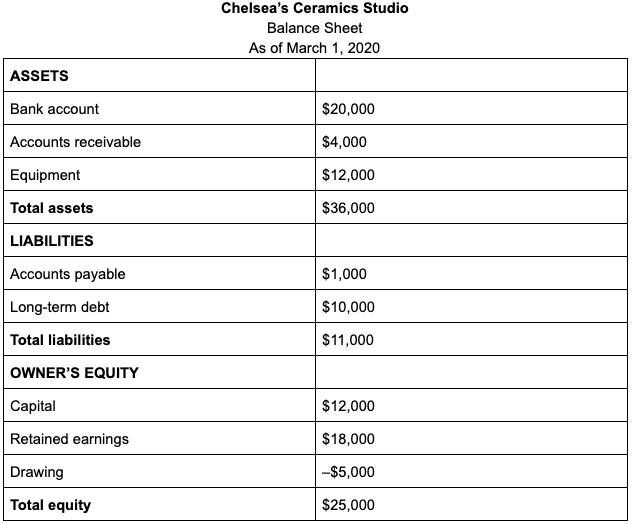

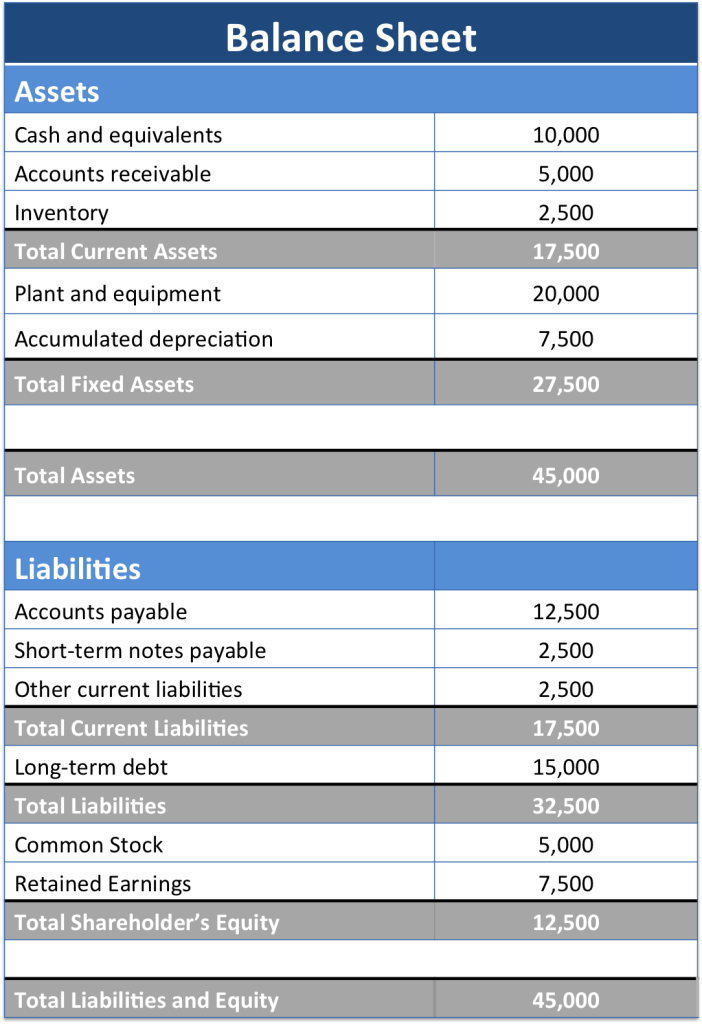

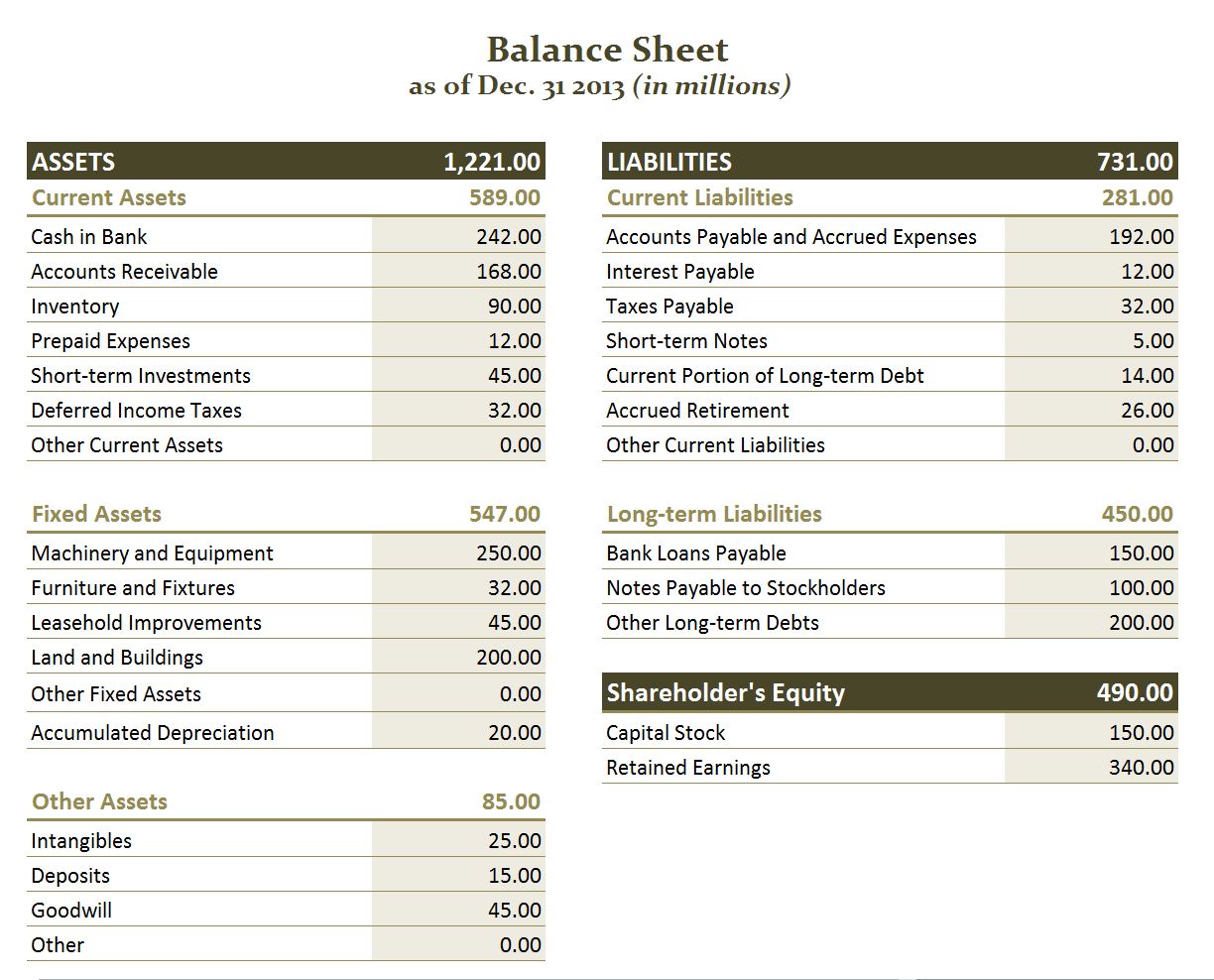

Balance sheet is financial statement. It provides useful data for financial ratio. What is a balance sheet? Sales and balance sheet update, further trading statement, strategic response and cautionary announcement pick n pay stores limited incorporated in the republic of south africa registration number:

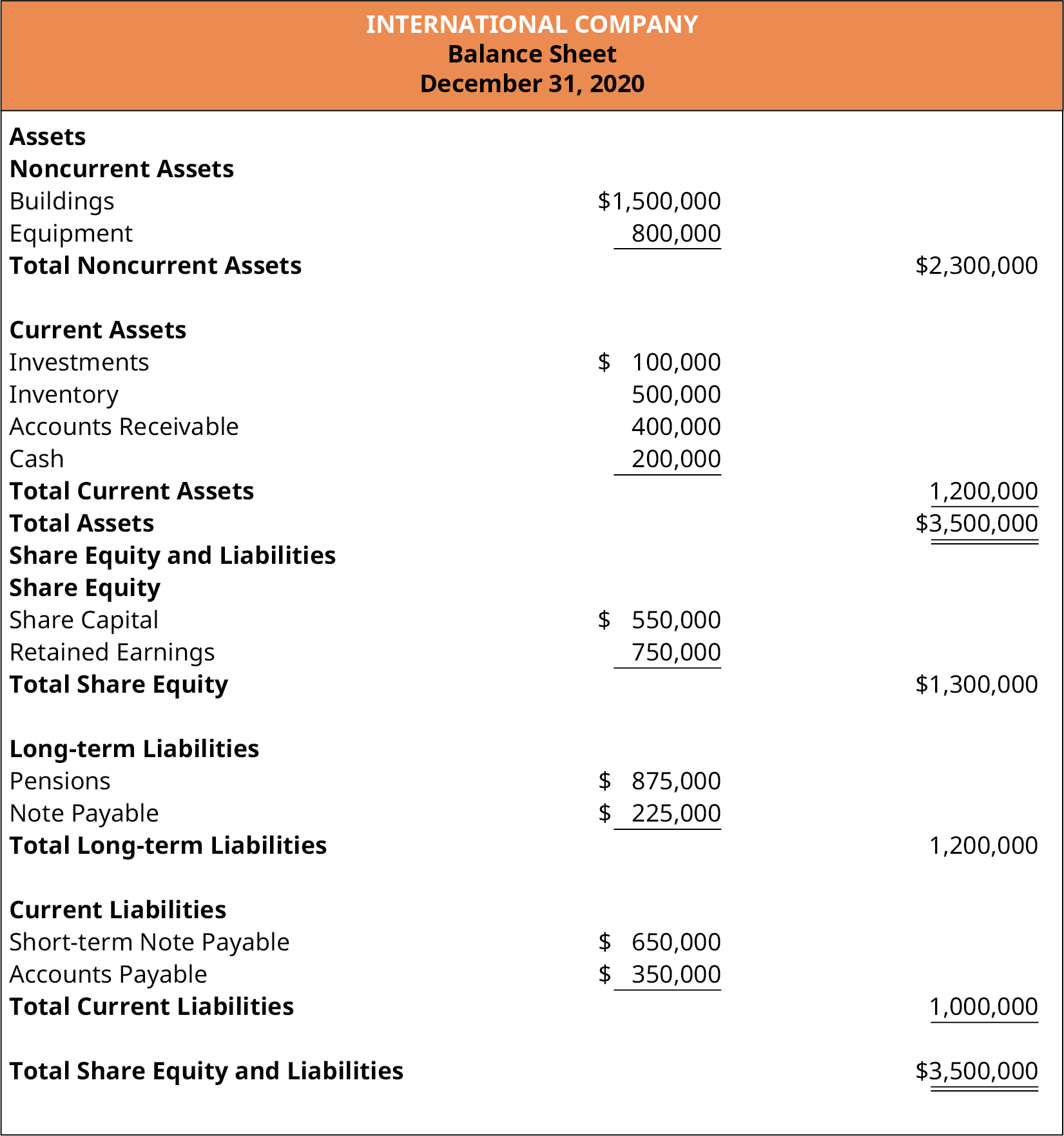

Data found in the balance sheet, the income statement, and the cash flow statement is used to calculate important financial ratios that provide insight on the company’s financial. While a balance sheet helps businesses evaluate their assets, details from the entire financial statement are necessary to give this information context. And balance sheets are projected into the future for business plans or financial modeling in m.

Ecgi) (ecgi or the company), a diversified holding company, is pleased to announce a new initiative to strengthen our financial structure and enhance shareholder value. What is a balance sheet? Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

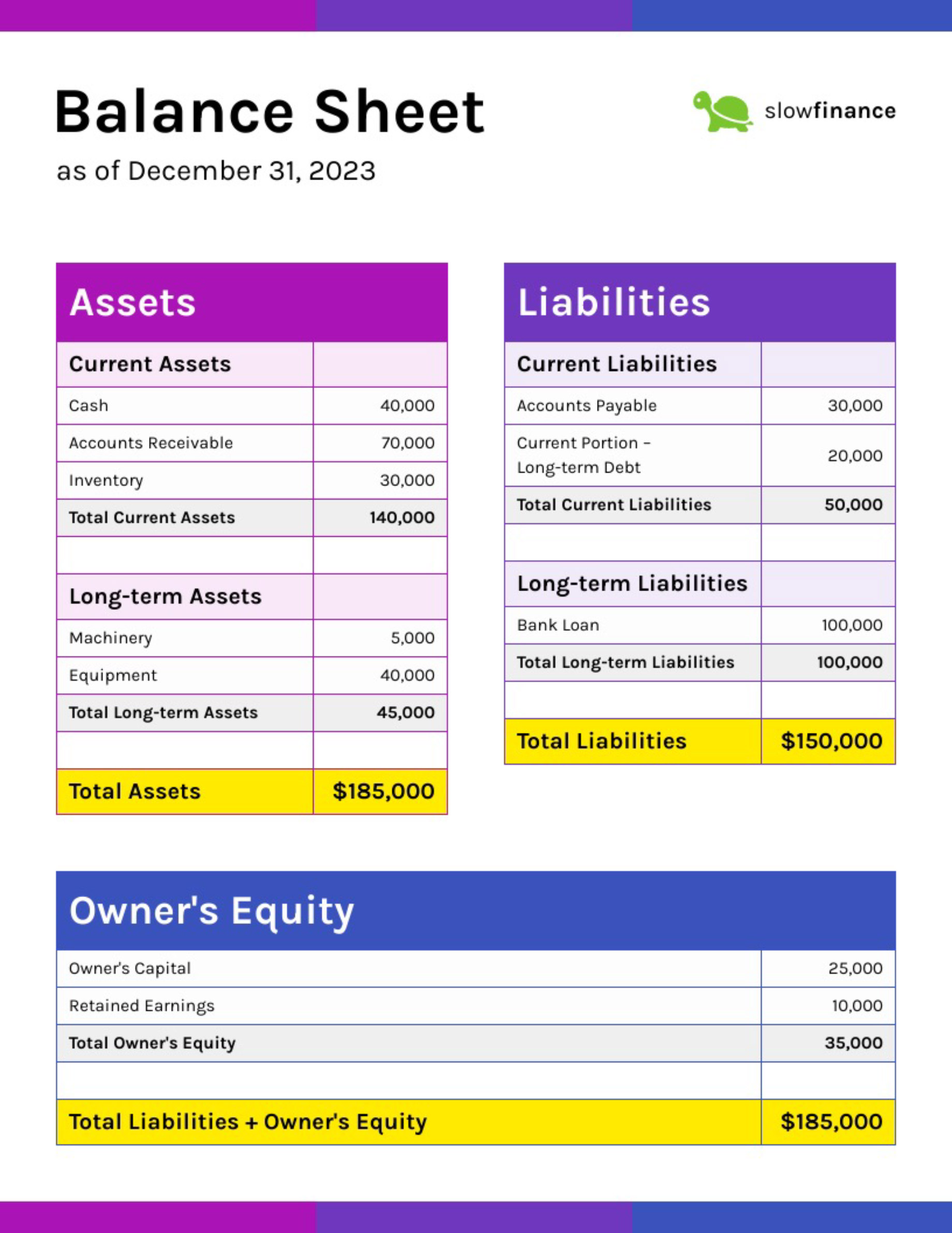

This statement can be prepared base on a monthly, quarterly, or annual comparative basis. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Learn more about what a balance sheet is, how it works, if you need one, and also see an example.

How to read a balance sheet. Adr balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. A balance sheet is a financial statement showing assets, liabilities, and shareholders’ equity (stockholders’ equity or owners’ equity) at a certain point in time.

Announces financial restructuring and balance sheet cleanup. A balance sheet (also called a statement of financial position) is a statement that provides a snapshot of a company’s financial situation at a given date. The balance sheet is based on the fundamental equation:

It provides a snapshot of the company’s financial position, indicating what it owns (assets), what it owes (liabilities), and the difference between the two (equity). These three statements together show the assets and liabilities. The balance sheet is a key financial statement that provides a snapshot of a company's finances.

A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. The biggest difference between a financial statement and a balance sheet is the scope of each. The balance sheet is an essential financial statement that provides a concise overview of a company’s financial position.

These three core statements are intricately linked to each other and this guide will explain how they all fit together. It reports a company’s assets, liabilities, and equity at a single moment in time. A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment.

It provides useful data about the entity’s financial status or position. A balance sheet is a financial statement that shows the relationship between assets, liabilities, and shareholders’ equity of a company at a specific point in time. Loss carried forward on ecb’s balance sheet to be offset against future profits.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)