The Secret Of Info About Accounts Receivable Are Reported On The Balance Sheet At Suspense Account Trial

These are considered liability accounts.

Accounts receivable are reported on the balance sheet at. A) in the investment section. Accounts receivable is the money owed to that company by entities outside of the company. Investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable assurance of being paid by its customers at a defined date.

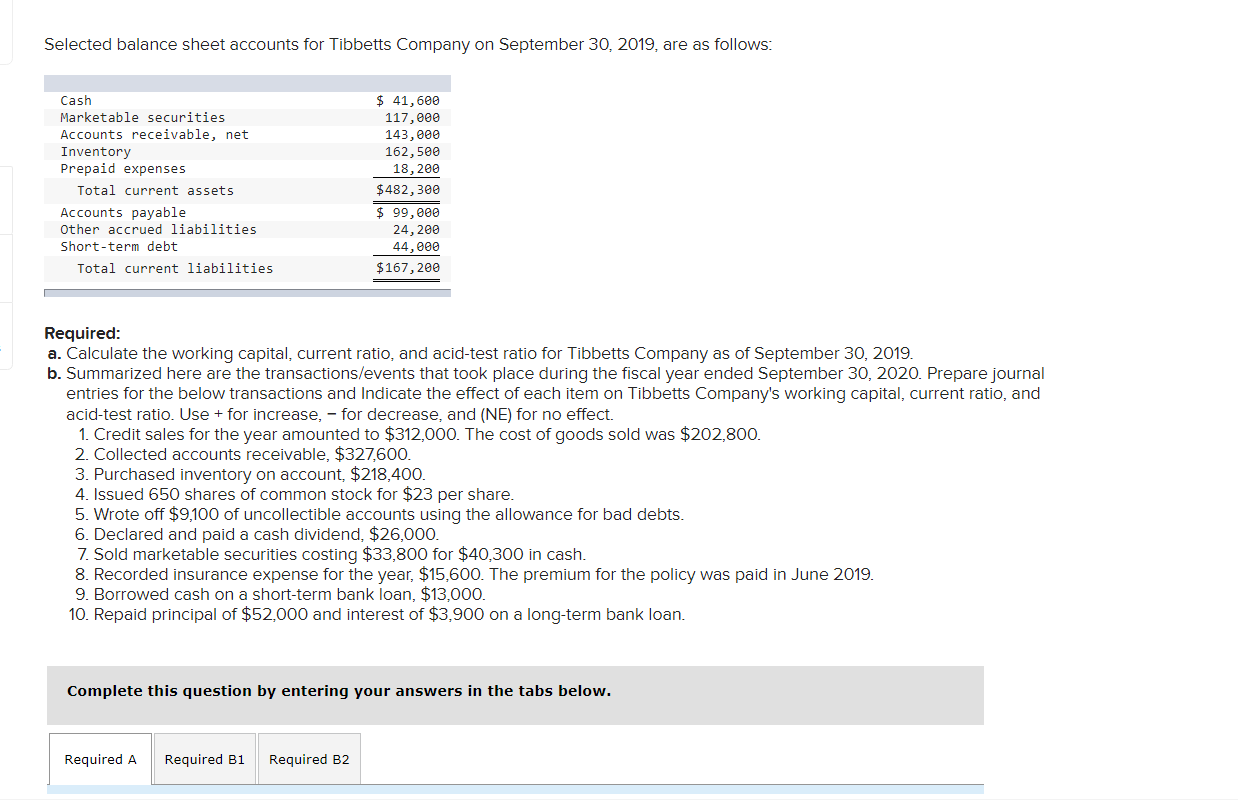

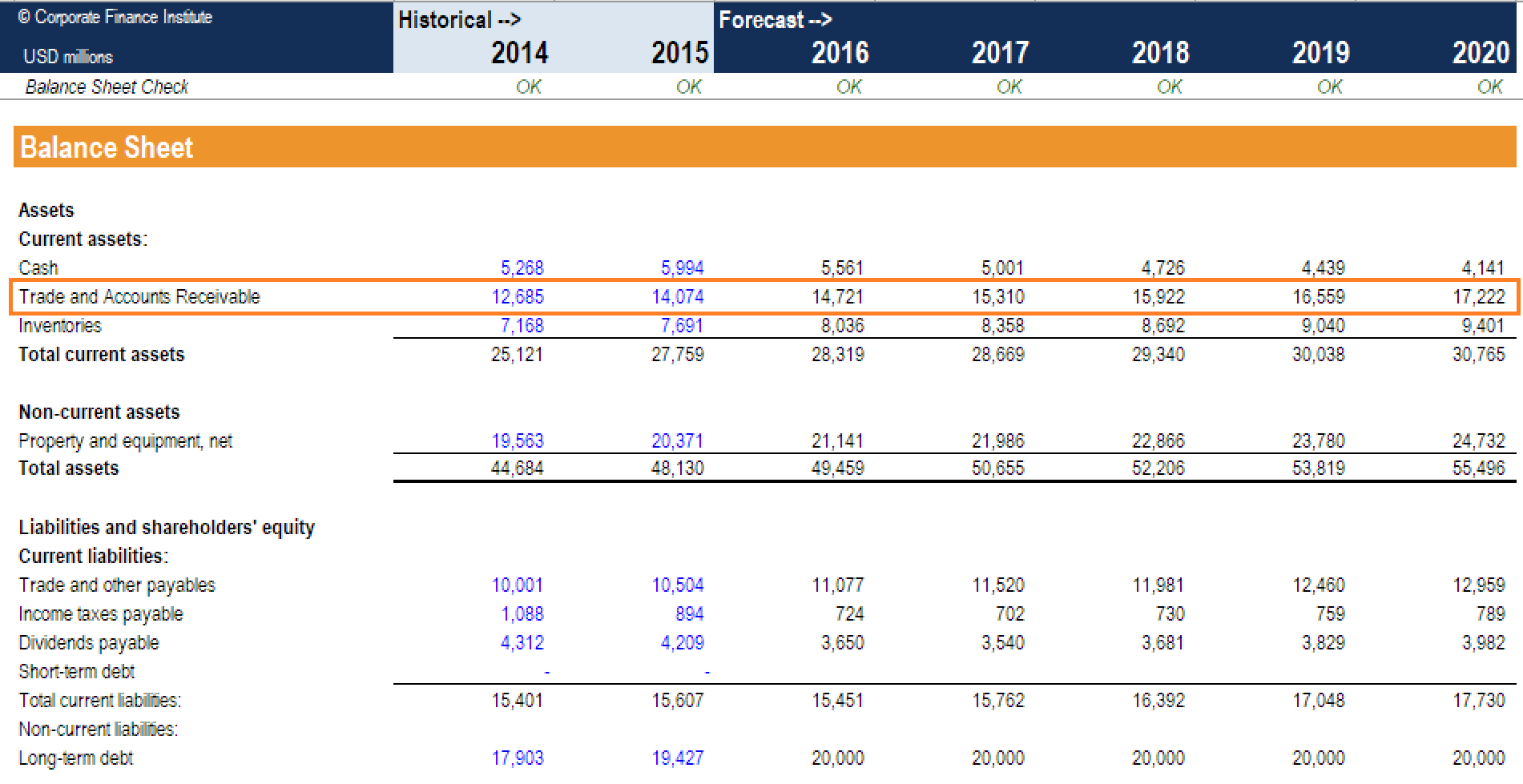

The balance sheet data of waterway company at the end of 2025 and 2024 follow. If someone owes the company money, it’s called “accounts receivable” (a/r) on the books. Accounts receivable (ar) → accounts receivable is a current asset recorded on the balance sheet that captures the outstanding cash payments still owed from customers, i.e.

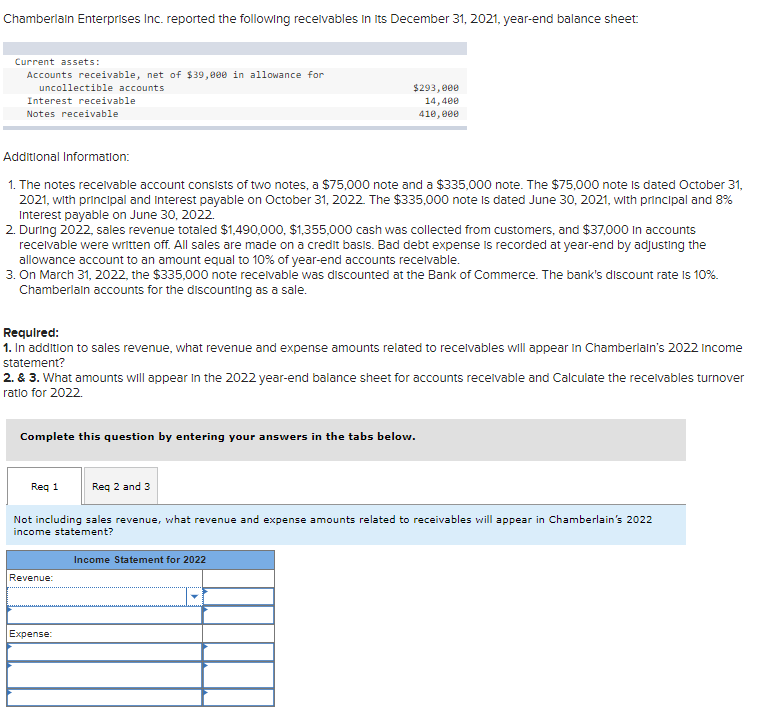

The accounts receivable turnover ratio is calculated by dividing net annual credit sales by average accounts receivable. If you have a credit card for just your small business, you’re not alone. Please explain why a is the correct answer.

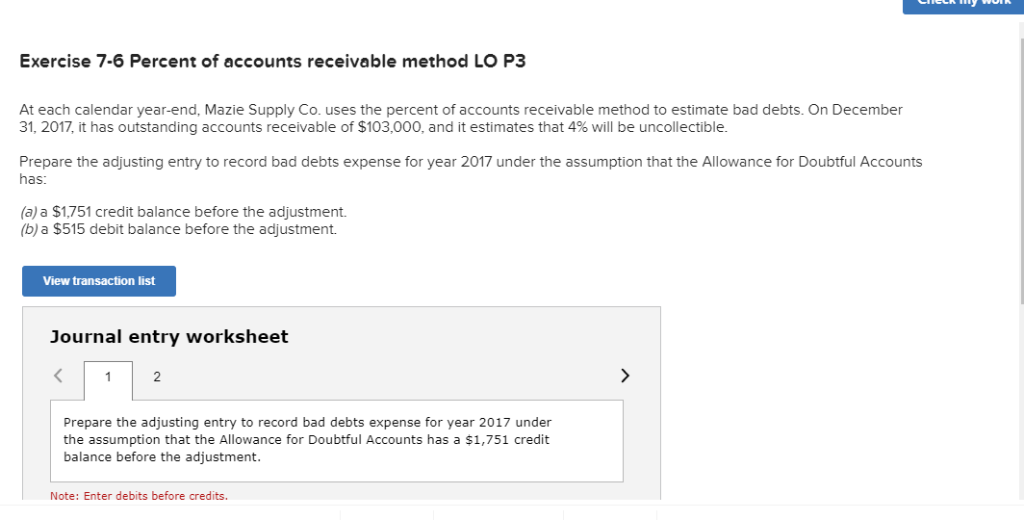

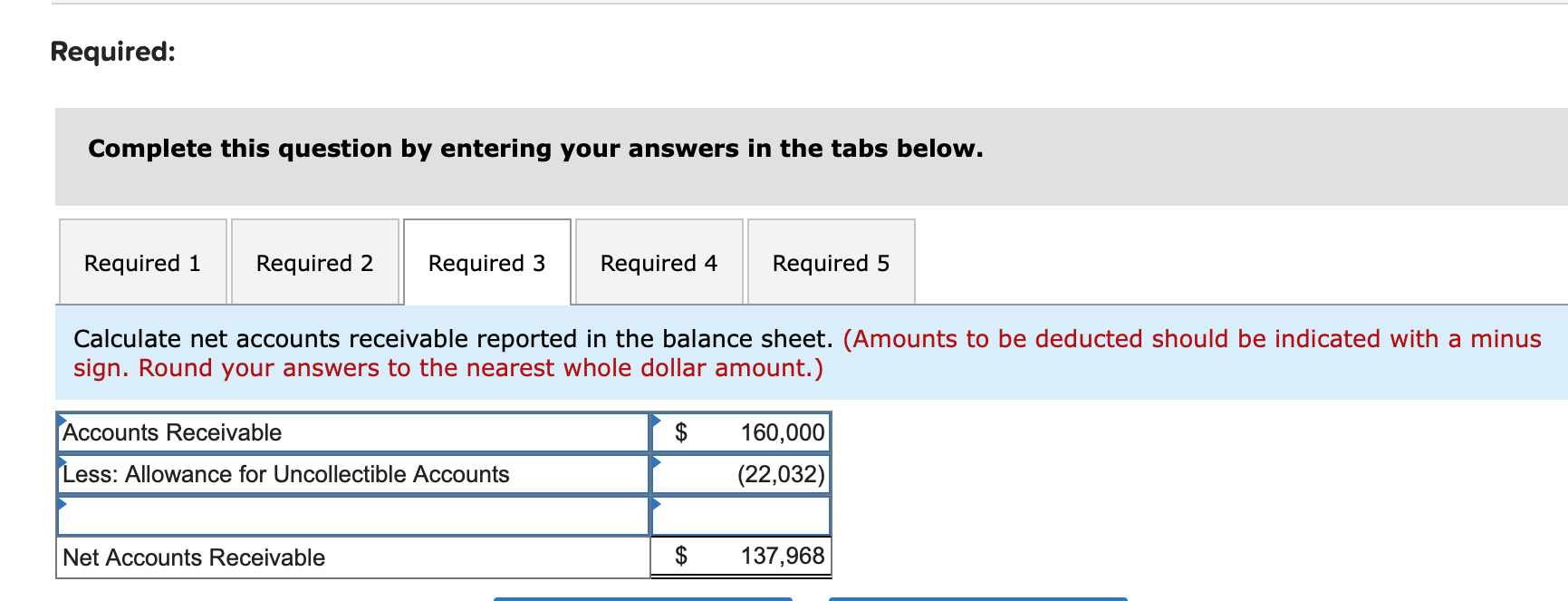

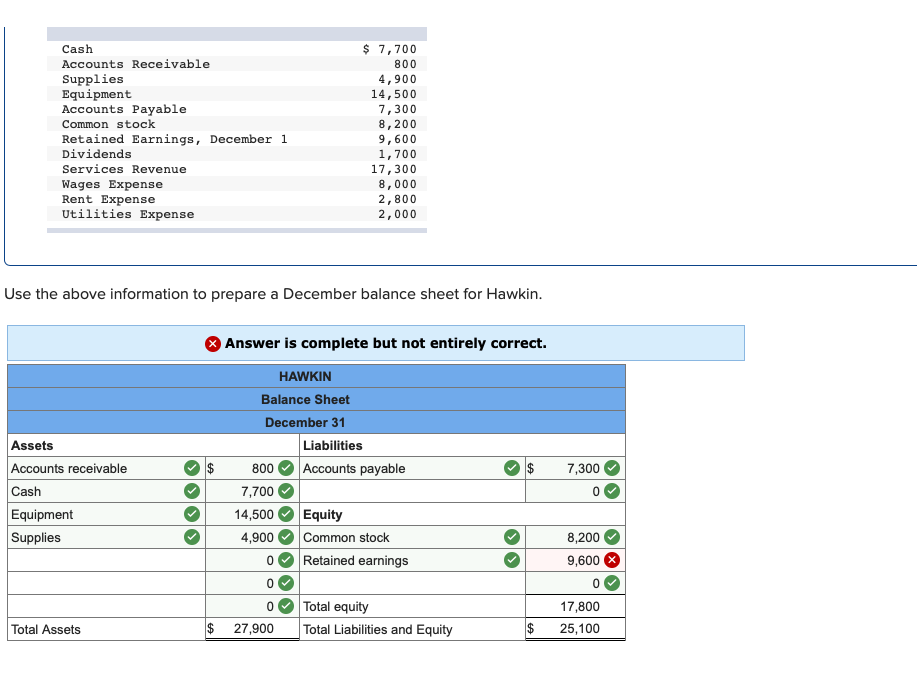

This account represents money that is owed to the company by its debtors, within one year of the reporting date. At what amount will accounts receivable be reported on the balance sheet if the gross receivable balance is $55,000 and the allowance for uncollectible accounts is estimated at 16% of gross receivables? The direct write off method of accounting for uncollectible accounts is not (blank) accepted as a basis for estimating bad debts.

Accounts receivable is a current asset account (remember that “current” means they are due within 1 year) shown on the statement of financial position (ifrs)/ balance sheet (aspe). She mentions one asset joe hadn't considered—accounts receivable. Accounts receivable is listed on the balance sheet as a current asset.

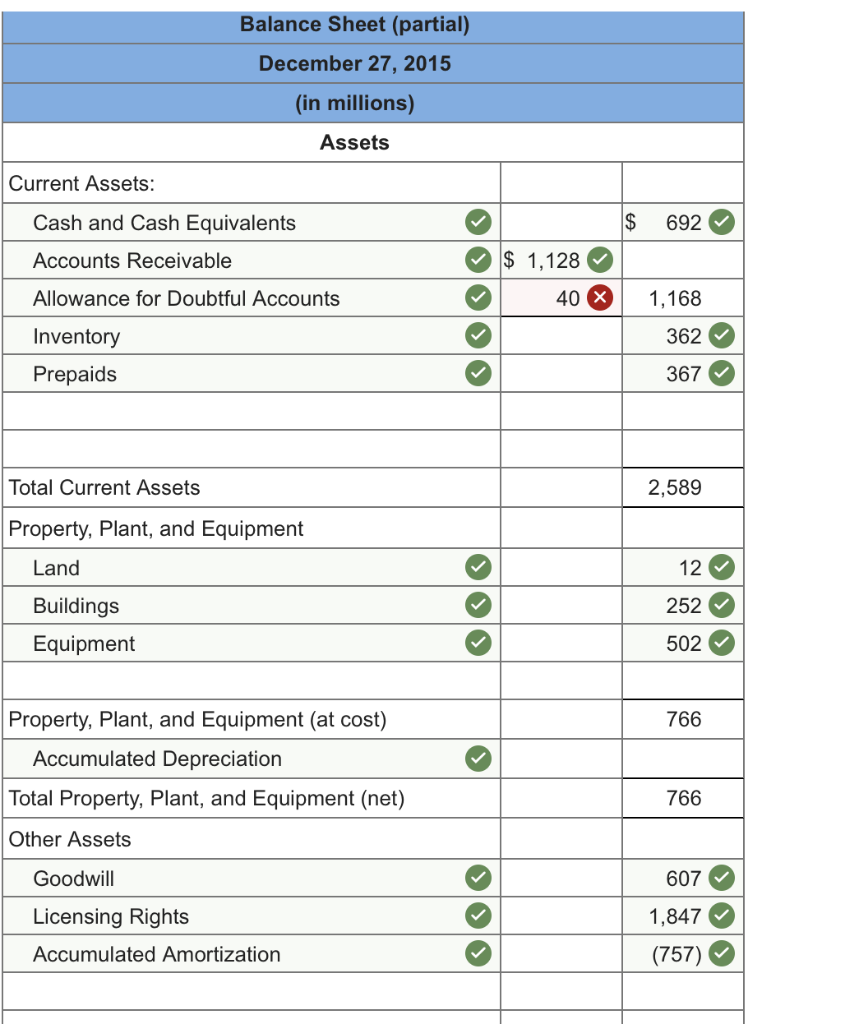

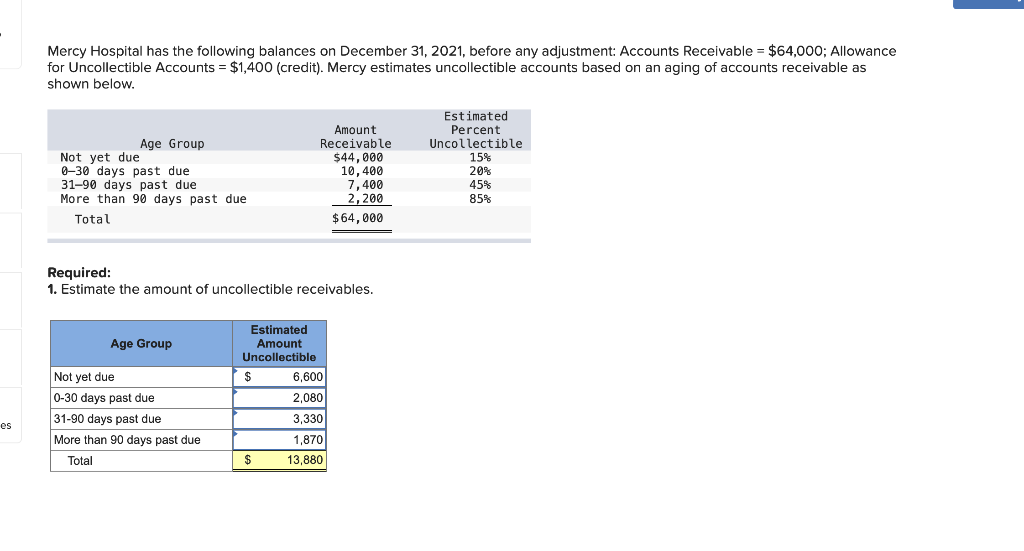

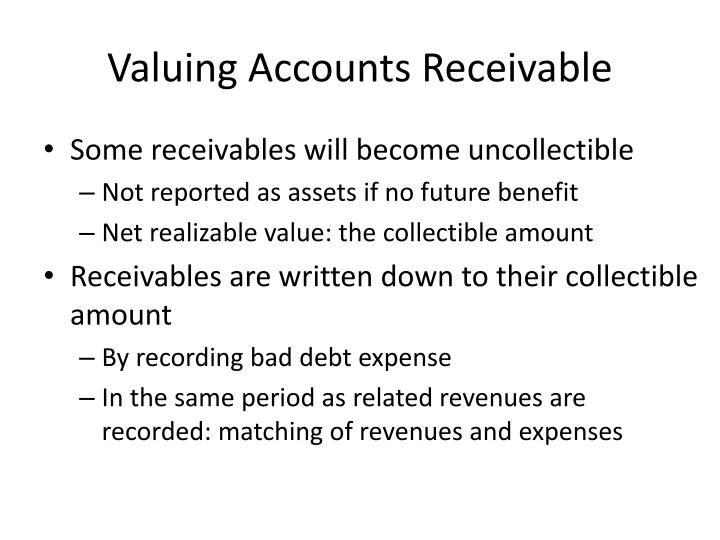

As described in the “accruals” article,. Valuing accounts receivable involves determining the amount at which they are reported on the balance sheet. Current assets include cash and cash equivalents.

These can include wages, interest, utilities, repairs, bonuses, and taxes. This is an asset because, at some point, the money will arrive in the form of cash. At their cash (net) realizable value.

If joe delivers parcels, but isn't paid immediately for the delivery, the amount owed to direct delivery is an asset known as accounts receivable. Unearned discounts (other than cash or quantity discounts), finance charges, or prepaid interest should be reflected as deductions from the related receivable. Businesses record their accounts receivables as an asset on their balance sheet as there’s a legal obligation for their customers to pay their debt.

Receivables that are held for sale should be presented separately on the balance sheet from other receivables. The difference between accounts receivable and accounts payable is as follows. Accurate valuation is crucial as it reflects the expected realizable value of the outstanding payments and provides insights into a company’s financial position.

On a business’s balance sheet, accounts receivables are considered current assets. Understand that accounts receivable are reported at net realizable value. Accounts receivable are valued and reported on the balance sheet a.

:max_bytes(150000):strip_icc()/accounts-receivables-on-the-balance-sheet-357263-final-911167a5515b4facb2d39d25e4e5bf3d.jpg)

![[Solved] Physicians' Hospital has the following balan](https://media.cheggcdn.com/media/2da/2da4850e-42ad-4dae-9385-744984705a2a/phpX0AIBj)