Sensational Info About Cash Flow And Fund Statement Difference Equity Accounts On Balance Sheet

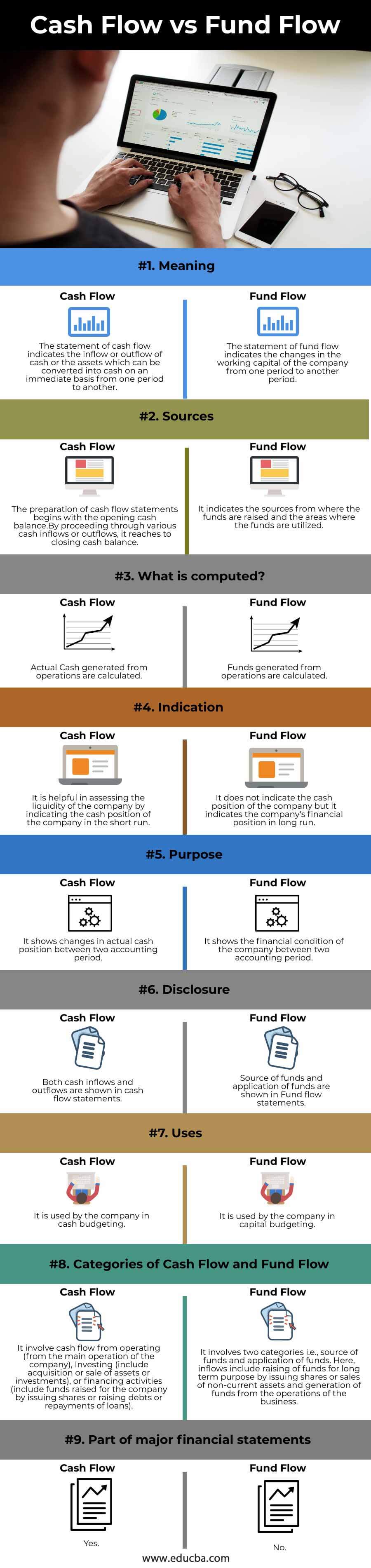

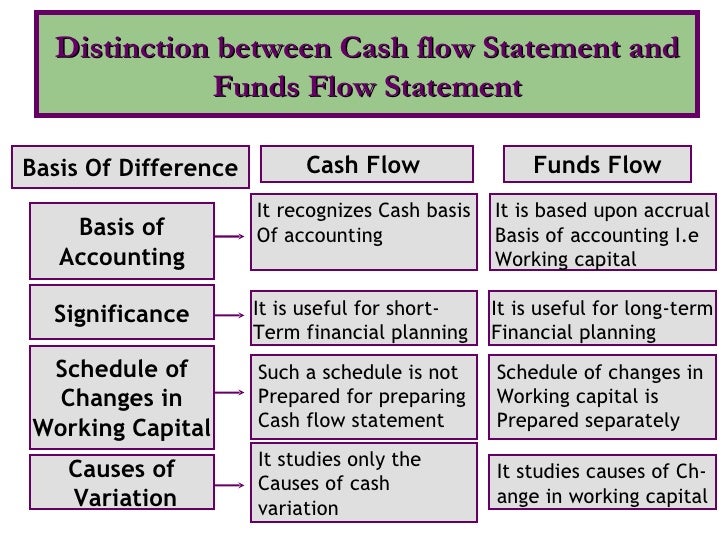

Cash flow refers to the current format for reporting the inflows and outflows of cash, while funds flow refers to an outmoded format for reporting a subset of the.

Cash flow and fund flow statement difference. Cash flow refers to the concept of inflow and outflow of cash and cash equivalents during a particular period. Key differences between cash flow statement and. A cash flow statement tracks the influx and outflow of a company’s cash and cash equivalents during a specific period.

In this article, we will dive into the differences between the cash flow statement and the fund flow statement, and explore the unique financial insights they. Learn the meaning, purpose and sources of cash flow and fund flow statements in commerce. Fund flow is accounted on the basis of accrual of funds and not actual.

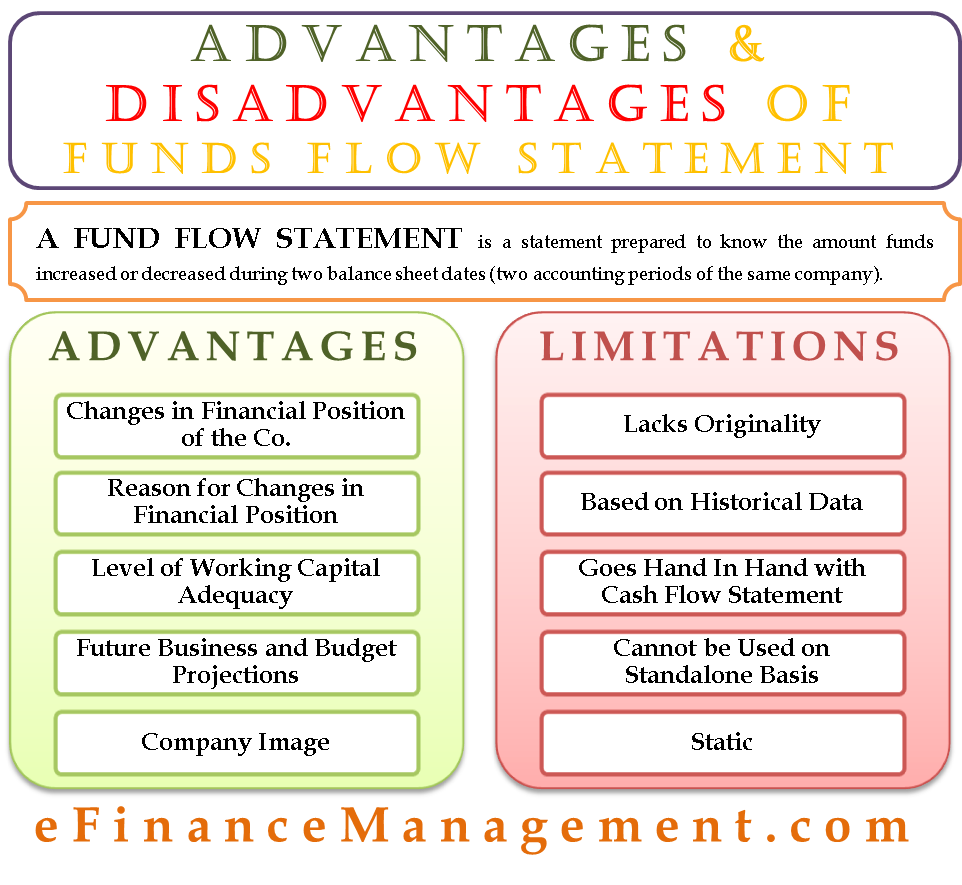

It is devised to assess the changes in the financial position of the firm between two different balance sheet dates. Compare the two statements based on the concept of outflow and inflow of. They are vital indicators of a company’s financial health.

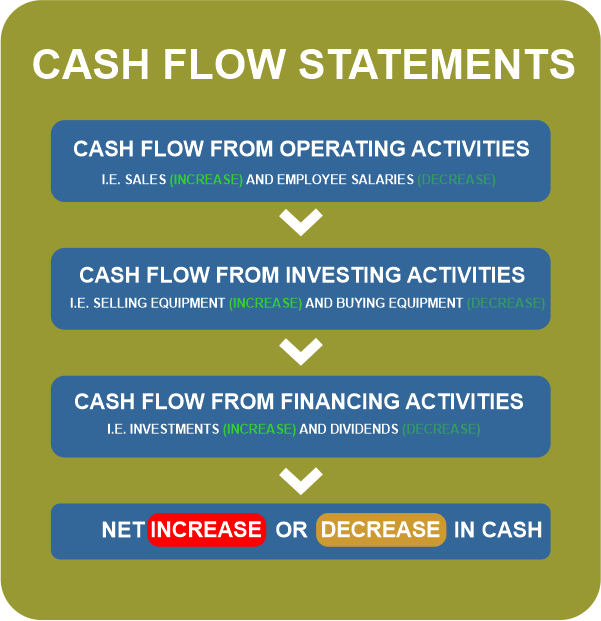

However, while cash flow from operations considers all transactions related to the production cycle of a business, a funds flow statement only considers the differences. The cash flow statement focuses on cash inflows and outflows from operating,. Rinju abraham cash and funds have different business functions and help formulate financial strategies.

Importance of cash flow and fund flow statment analysis: Both cash flow and fund flow statements analysis are vital tools for financial analysis and decision. Clearone payments difference between cash flow and fund flow difference between cash flow and fund flow by annapoorna | updated on:

Investing activities financing activities the cash flow statement has been required by the financial accounting standards board (fasb) since 1988, when it issued its statement. Cash flow fund flow; Accounting for cash flow is done only when liquid cash is involved in the form of currency or bank transfer.

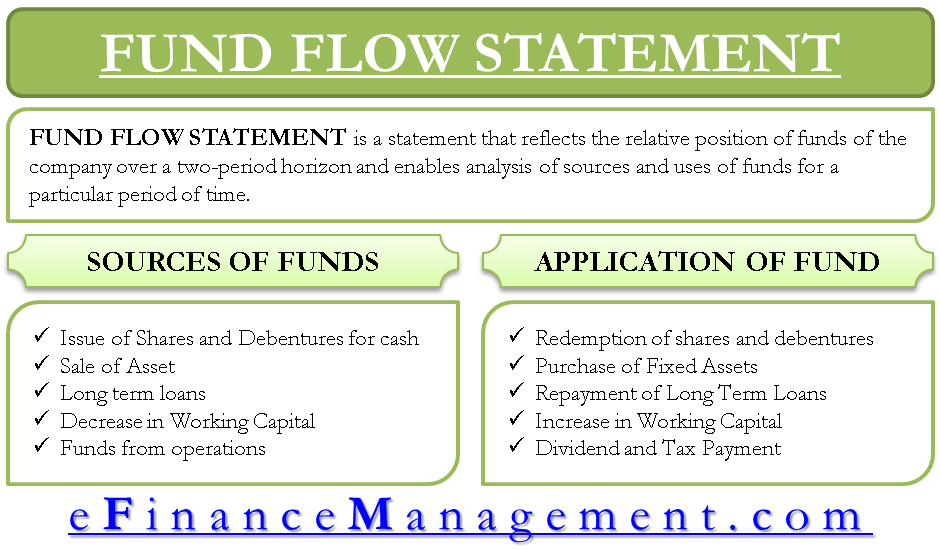

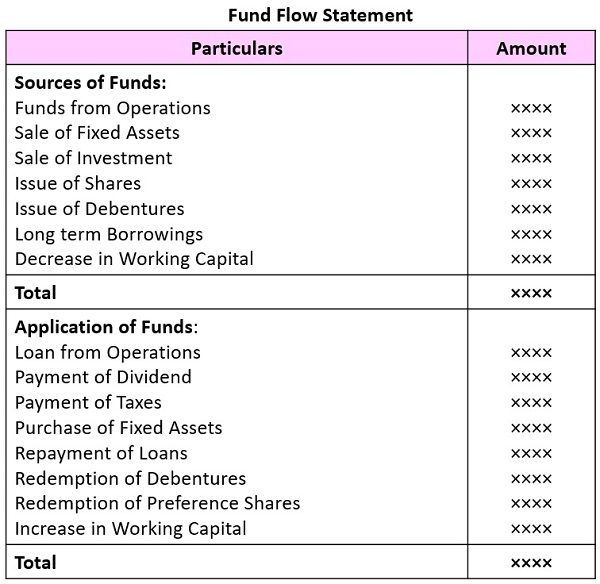

Fund flow statement refers to a statement depicting the means by which the business gets funds and the usesof the funds, between two balance sheet dates. Fund flow statements also help improve resource usage and better allocation of limited resources. It is a record of the movement of.

The fund flow statement, on the other hand, is generated using the accrual accounting. A cash basis of accounting is used to generate the cash flow statement. A fund flow statement is prepared to see the sources and uses of funds during a particular period and how that “change in the funds” affects the company’s working capital.

The physical currency available with a business is known. One of the four financial statements that every investor analyzes to assess a company's financial health is the. Cash inflows from financing activities include funds obtained from issuing stocks or bonds, while cash outflows can result from dividend payments or debt.

Table of contents fund flow and cash flow are two concepts fundamental to financial accounting. Difference between cash flow and fund flow. 10 rows while the cash flow statement primarily tracks the movement of cash in and out of a.

/GettyImages-1163745146-8e67b32f7c8042d5b10b799dd850cec7.jpg)