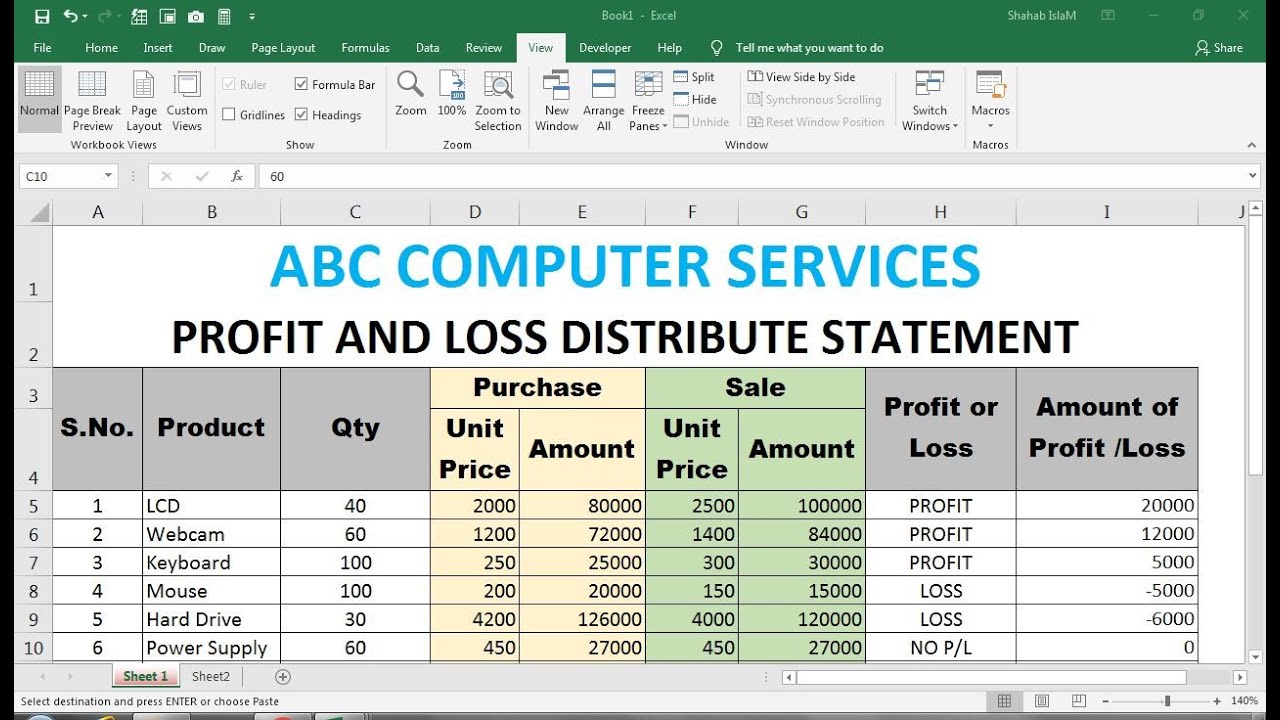

Awesome Info About Horizontal Format Of Profit And Loss Account Hotel Income Statement

A profit and loss account, in simplest terms, is a record of all the income and expenses of the business during a particular.

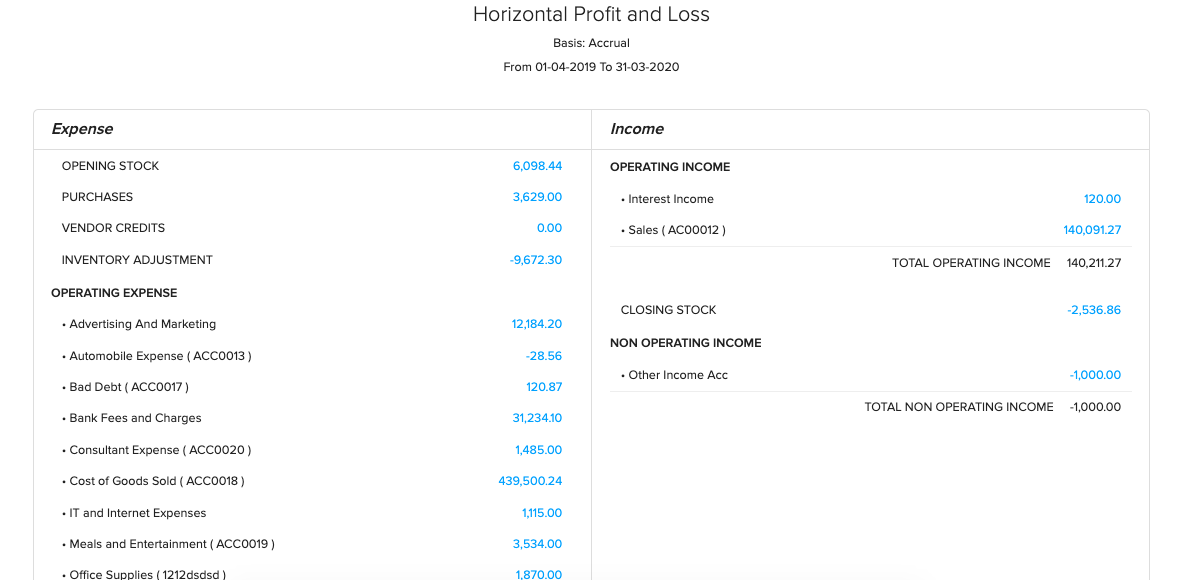

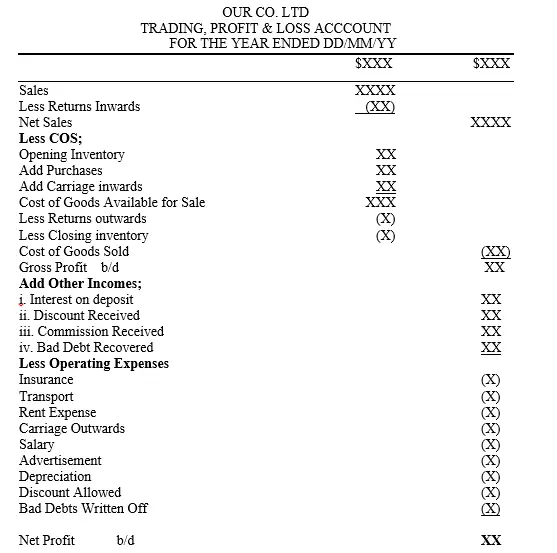

Horizontal format of profit and loss account. Updated july 13, 2023. Different formats of the profit & loss account. If your business prefers the vertical format, then you can set the option show vertical profit &.

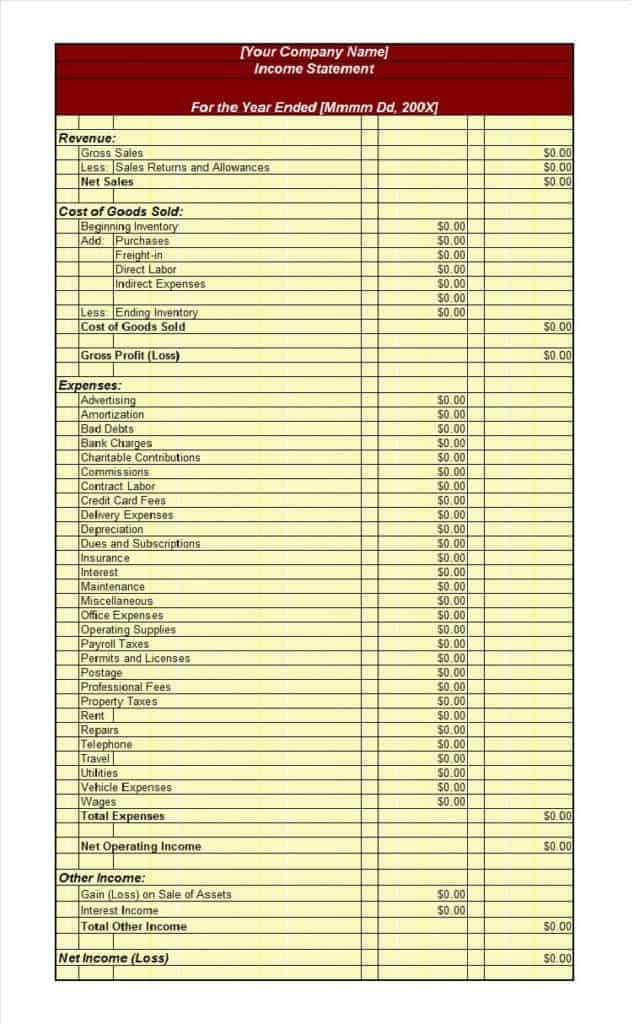

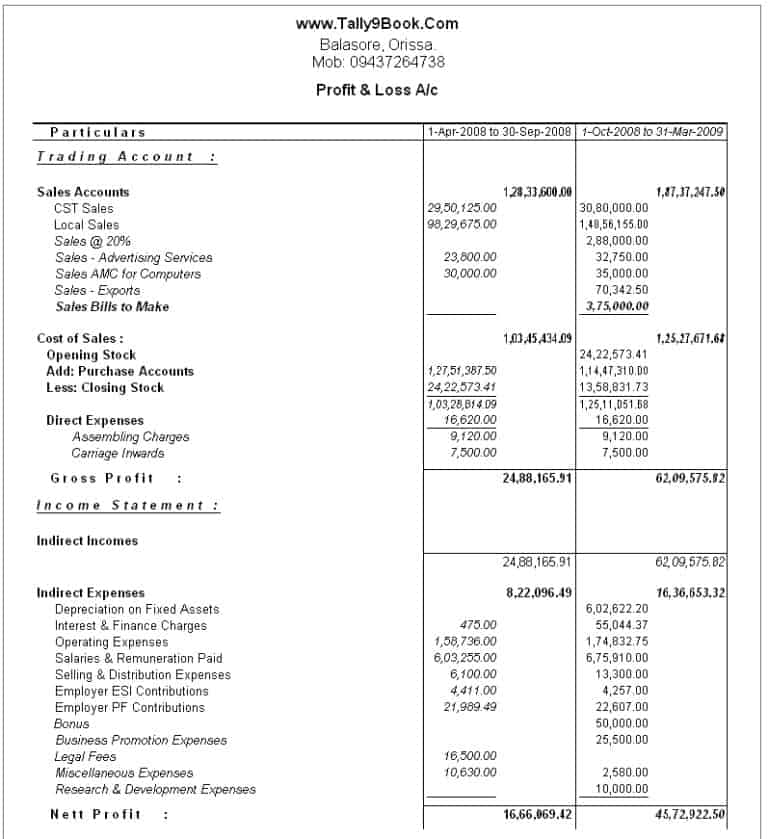

Click here to download all financial analysis excel templates for ₹299. Profit and loss a/c show the net result(net profit or loss) of the business for the particular accounting period. The profit and loss statement, abbreviated as p&l, is a financial statement that summarises revenues, expenditures, and expenses incurred during a specific time.

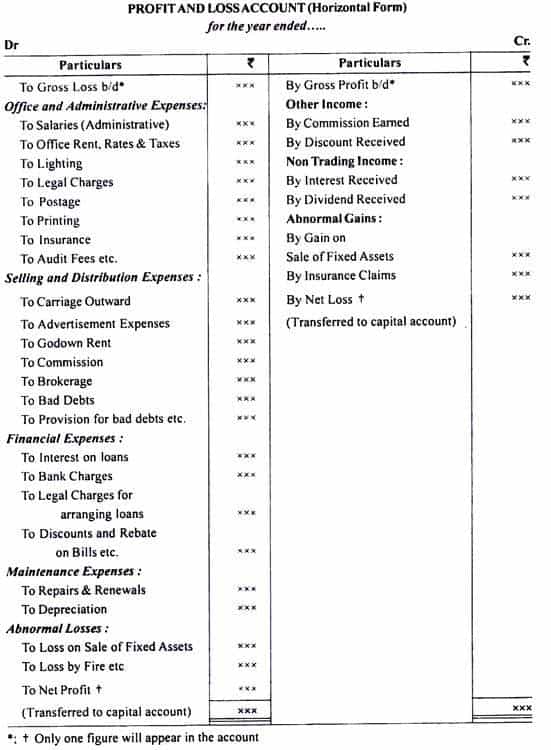

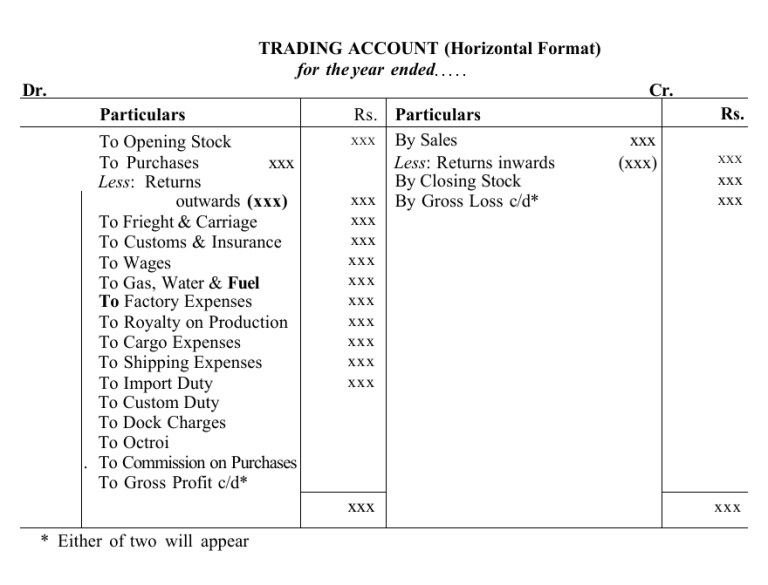

Horizontal format (“t” shape) before preparing the profit and. When preparing an income statement, it is customary to prepare one single statement. Definition of profit and loss statement format.

The four formats given for profit and loss accounts by the companies act:• vertical format, analysing costs by type of operation and function;• vertical format,. Total of balance sheet rs. You can also download other.

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. But usually, the profit and loss account will be prepared in a “t” shape. Only indirect expenses are shown in this account.

Prepare trading and profit and loss account and balance sheet of. What is profit and loss account? Profit & loss a/c, by default, is in horizontal form.

Whether you are just beginning to prepare your profit and loss statement or are analyzing profit and loss statements vertically or horizontally, use our quick. Select the required format, and click ok:. Indian companies must prepare the profit & loss account as per schedule iii of the companies act, 2013.

In india, there are two formats of p&l statements. Let us take you through different formats of the profit & loss account: The provisions of this part shall apply to the income and expenditure account referred to in subclause (ii) of clause (40) of section 2 in like manner as they apply to a.

However, you can view the report in vertical format by opting for it in. In a partnership, net profit or net loss should be transferred to the partners' capital accounts in accordance with the agreed profit sharing ratio. Horizontal form of profit & loss account.

All the items of revenue and expenses. The profit and loss statement is the report that shows the results of the organization throughout the. Format for sole traders & partnership.