Casual Tips About Most Important Ratios For A Company Statement Of Changes In Working Capital Is Prepared Separately

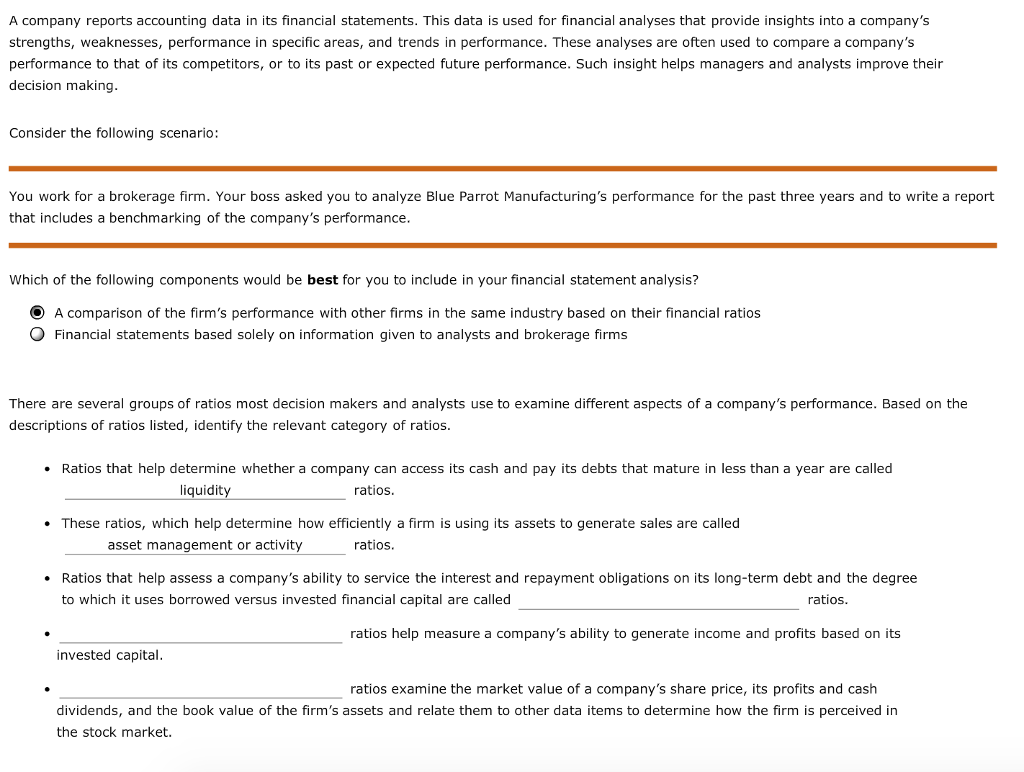

Investors tend to use some financial ratios more often or place more significance on certain ratios when evaluating business or companies.

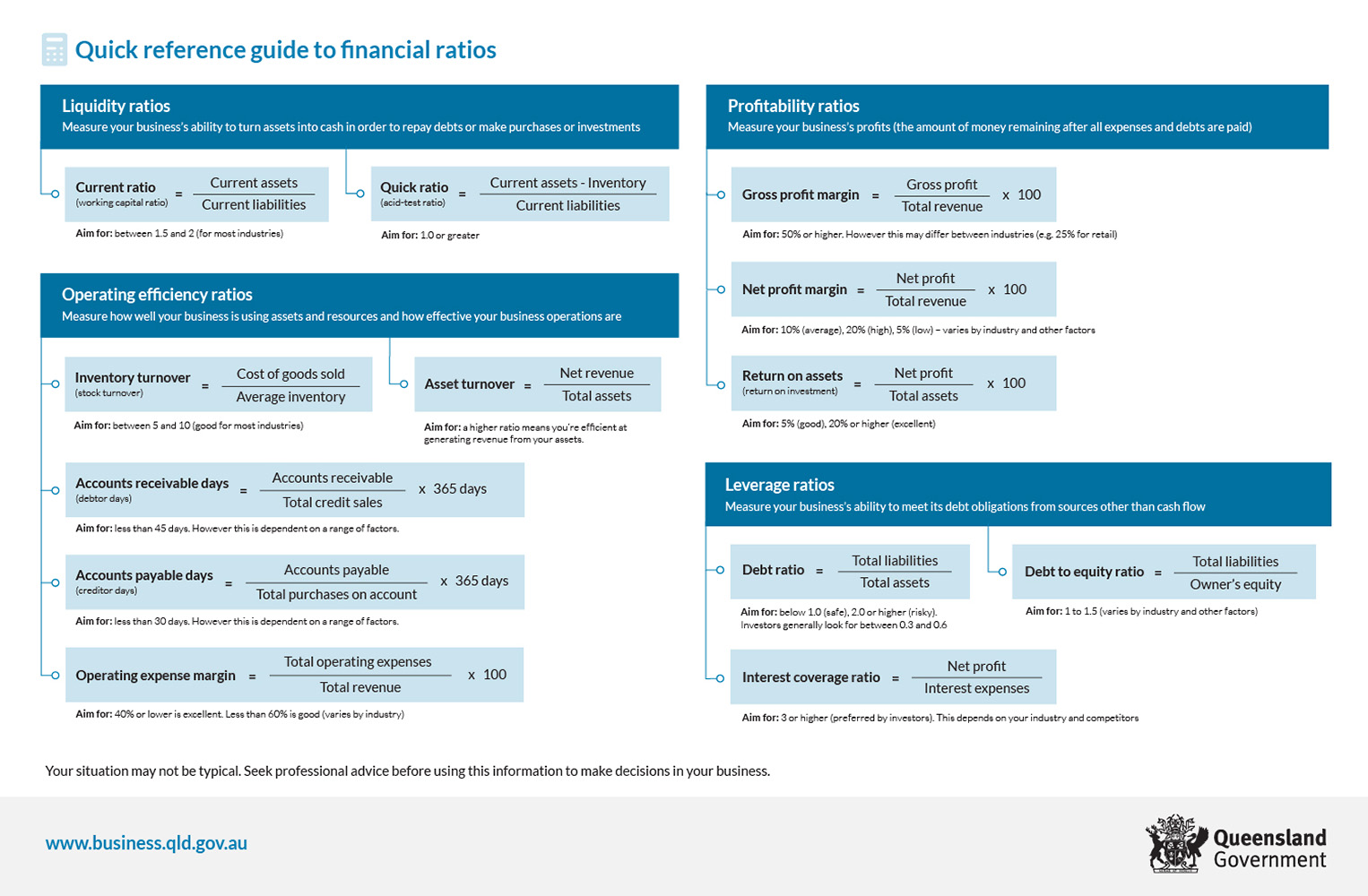

Most important ratios for a company. Liquidity ratios 1. Some of the commonly known categories of financial ratios include liquidity ratios, profitability ratios, efficiency ratios, leverage ratios, and market value ratios. In this article, we will take a look at the 12 most important financial ratios to analyze a company.

For example, comparing the return on assets between companies helps an analyst or investor to determine which company is making the most efficient use of its assets. They are used to get insights and important information on the company’s performance, profitability, and financial health. Ltv:cac ratio the ltv:cac ratio compares the lifetime value of a customer —how much they spend with you in their entire time as a customer—to the customer acquisition cost —the amount you had to spend to acquire.

Given the choice, most companies and their stakeholders would choose faster growth over slower growth. (total a/r outstanding ÷ total sales) x number of days = a/r turnover. Liquidity leverage profitability asset management we’ll look at 10 ratios across these four categories and provide a detailed walkthrough for each.

Even though there are plenty of important financial ratios out there, investors only tend to focus on a handful of them. The p/e is the amount of money the market is willing to pay for every $1 in earnings a company generates. Pe ratio is calculated by:

Earnings per share (eps) earnings per share or eps measures earnings and profitability. P/e ratio = (market price per share/ earnings per share) Investopedia / theresa chiechi what does ratio analysis tell you?

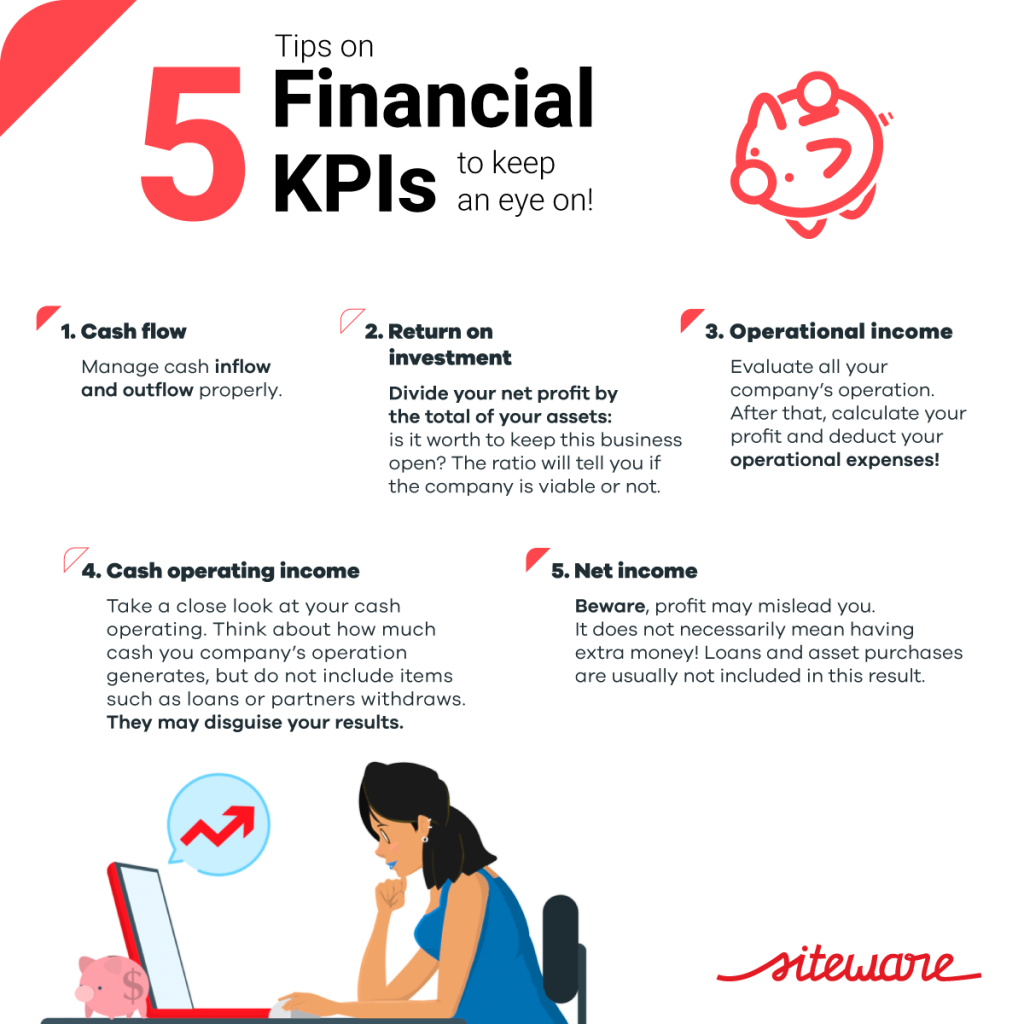

If you want to skip our detailed analysis, you can go directly to 5 most important financial. Measure period of cash inflow and outflow. Here are some of the most important financial ratios to know.

Here are a few of the most important financial ratios for investors to validate a company’s valuation. 6 basic financial ratios and what they reveal 1. The most common liquidity ratios are the current ratio and the quick ratio.

Do financial ratios impact stock prices? Updated on august 23, 2023 what are financial ratios? 5 important financial ratios that show the health of the company 1) liquidity ratios.

Earnings per share (eps) earnings per share, or eps, is one of the most common ratios used in the financial world. To calculate pe, divide the stock price by earnings per share (eps)eps. It's another measure of liquidity.

From profitability to liquidity, leverage, market, and activity, these are the 20 most important ratios for financial analysis. The quick ratio is also called the acid test. Price to earnings (pe) ratio.