Neat Tips About Bar Income Statement Users Of Financial Reports Include All The Following Except

It shows you how you're making and losing money (or how you plan to, if you're just getting started).

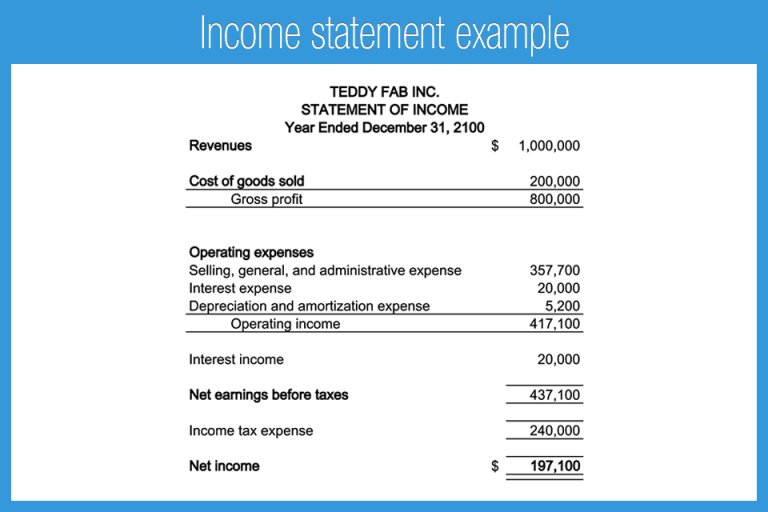

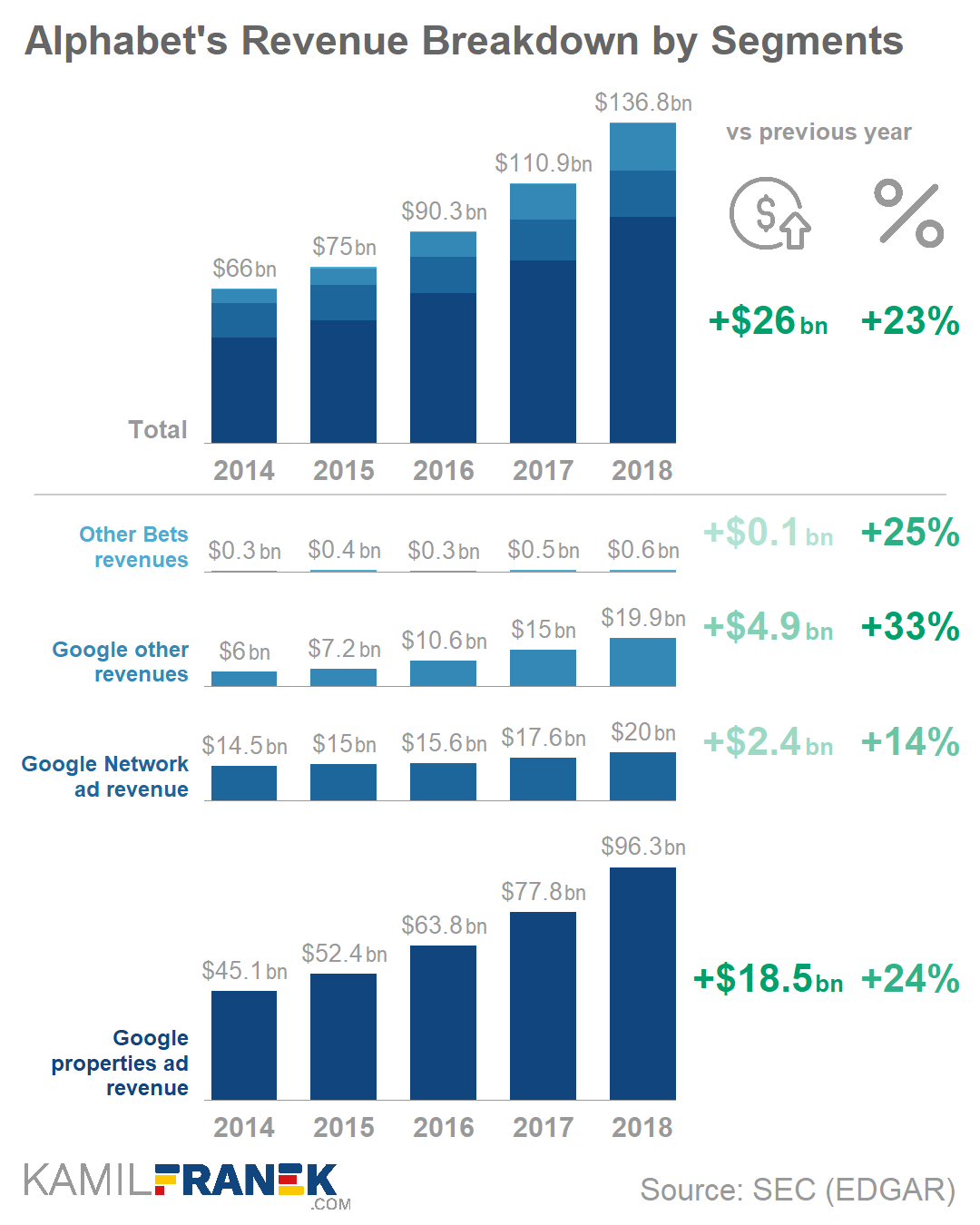

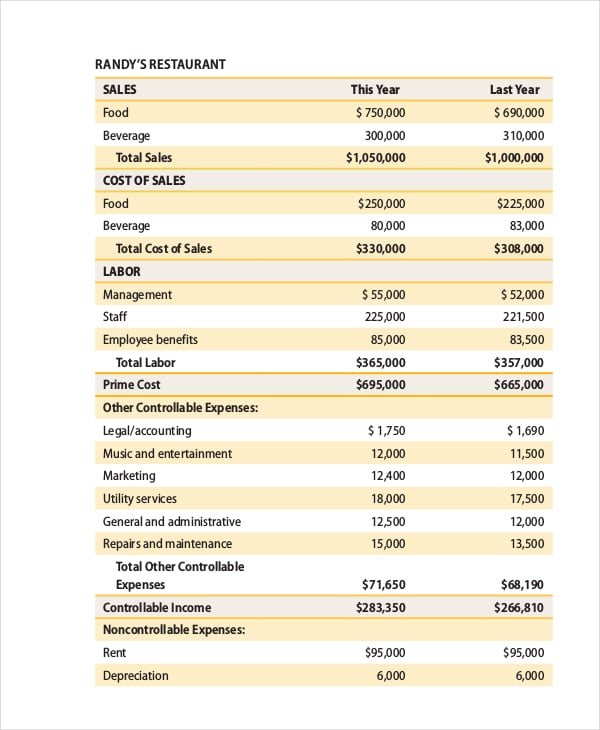

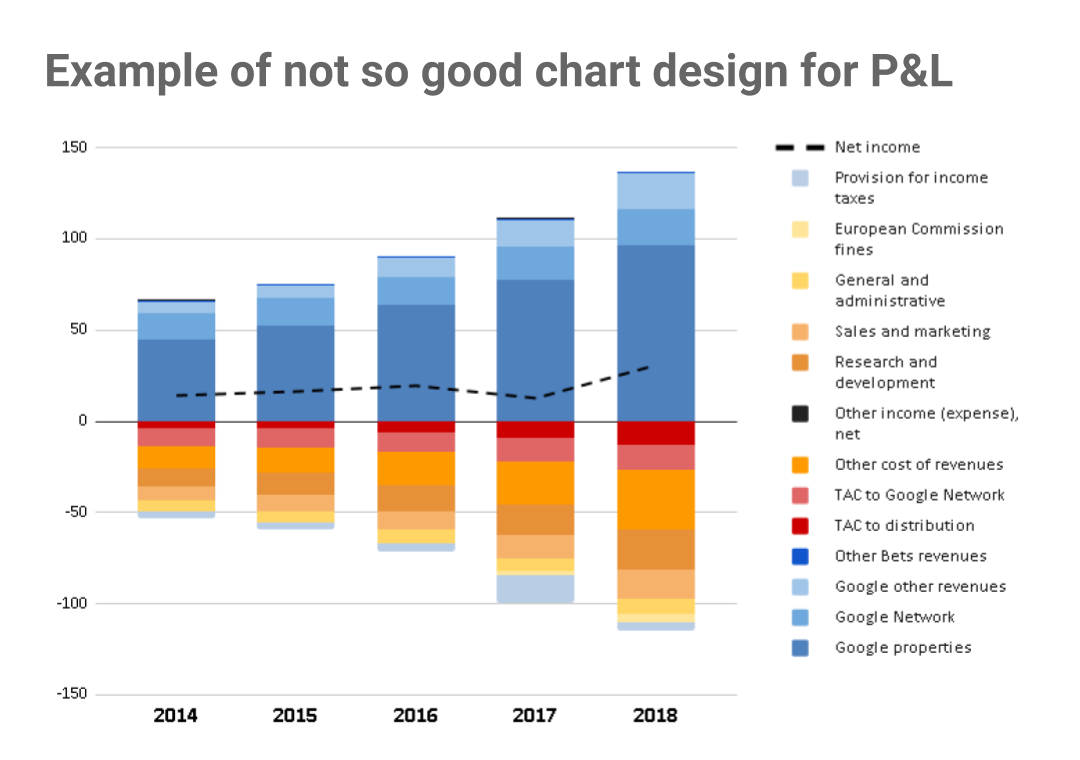

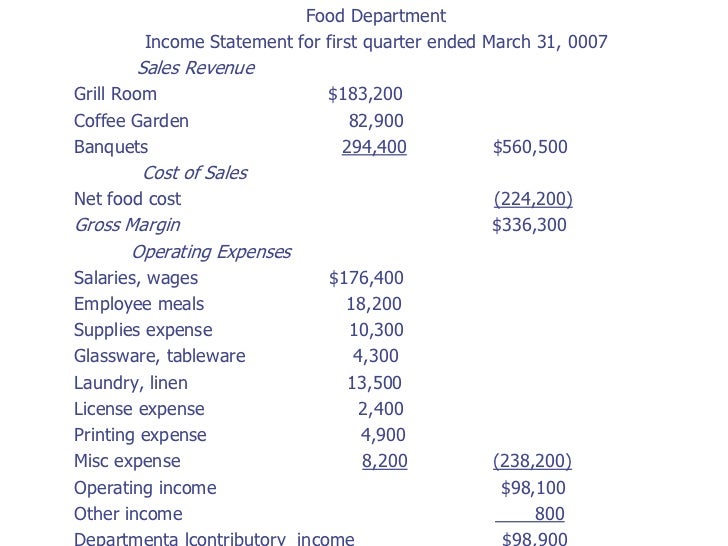

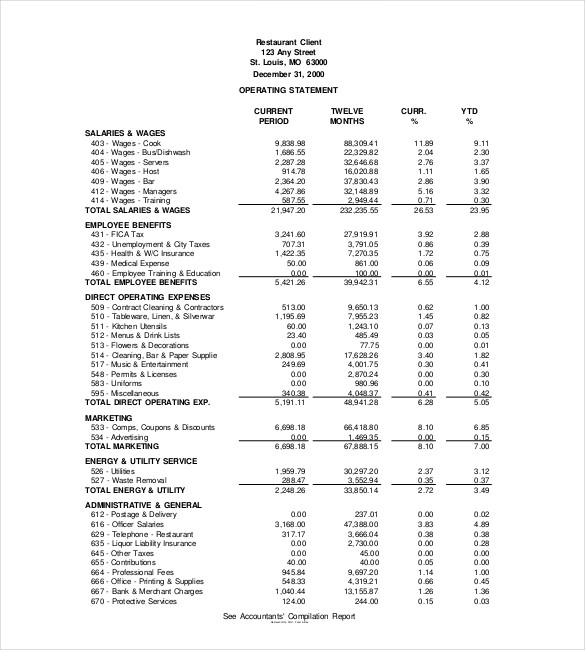

Bar income statement. When prepared on solid data, a profit and loss statement, or. Another common choice to visualize bits of an income statement is a bar chart. A restaurant profit and loss statement, also called a p&l or income statement, is a financial document that details a business’s total revenue and expenses over a specific time period.

It contains information about the company’s revenues, expenses, net income, and other key financial indicators. If you’re running a bar, you might have heard of the profit and loss statement (or “income statement”). Even without sales data, you can create a projected profit and loss statement for your bar’s business plan following.

A p&l statement, formally known as an income statement, is the most widely used financial statement in the restaurant business. The $355 million penalty that a new york judge ordered donald j. Owners, operations managers, and corporate financial teams rely on the p&l to track sales and costs, stay on budget, and achieve profits.

A restaurant p&l provides a snapshot of the most fundamental metric a business has: Also called income statements or cash flow statements, a profit and loss statement will be useful throughout the life of your business. Undeniably the most important financial statement of all, your profit and loss (p&l) gives a clear overview of the profitability of your bar by listing all your sales and expenses.

p & l , can be one of the most helpful reports a bar or restaurant owner can have in their business toolkit. The reasoning behind the adjustment, however, is that free cash flow is meant to measure money being spent right now, not transactions that happened in the past. The income statement is one of a company’s core financial statements that shows their profit and loss over a period of time.

This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees. A profit and loss statement, also known as an income statement, is a necessary document for determining the profitability of your bar and reporting taxable income. The document contains financial information for a ktv bar business including:

The most important financial statement, the wins also loss helps us to assess the profitability of a bar. A restaurant income statement will tell you exactly that. Sometimes called a profit and loss (or p&l) statement, this standard accounting tool helps you check the health of your business.

With examples and comparison of their strengths and weaknesses Profit and loss statements allow bar and restaurant operators to understand their net earnings or loss. Balance sheets track your bar’s assets, liabilities, and equity, which may change over time and.

What is a restaurant income statement? In order to have useable, effective reports, certain criteria must be met, which we will examine in. You can use it to analyze data for a specific period, such as a month, quarter, or year.

Trump to pay in his civil fraud trial might seem steep in a case with no victim calling for redress and no star witness pointing. How much profit is being made, and from where. Perfect for small business loans and business plans.

![[User Guide] “Chart” Tab TRV Stock Analyzer](http://www.trvanalyzer.com/wp-content/uploads/2018/01/Chart-2-Income-Statement.png)

![FREE What Is in an Statement? [ With Samples ]](https://images.sampletemplates.com/wp-content/uploads/2017/07/Income-Satement-Template.jpg)

![Bar Profit and Loss Complete Guide [Free template]](https://sharpsheets.io/wp-content/uploads/2022/12/Screenshot-2022-12-16-at-17.08.04.png)