Awesome Tips About The Primary Purpose In Preparing Pro Forma Financial Statements Is Income Statement Xls

The pro forma statements are most commonly used to draw the attention and focus of prospective investors.

The primary purpose in preparing pro forma financial statements is. You can create pro forma statements by using online sample spreadsheets, templates, or existing financial statements in your accounts. What is the primary purpose in preparing pro forma financial statements? The primary purpose in preparing pro forma financial statements is.

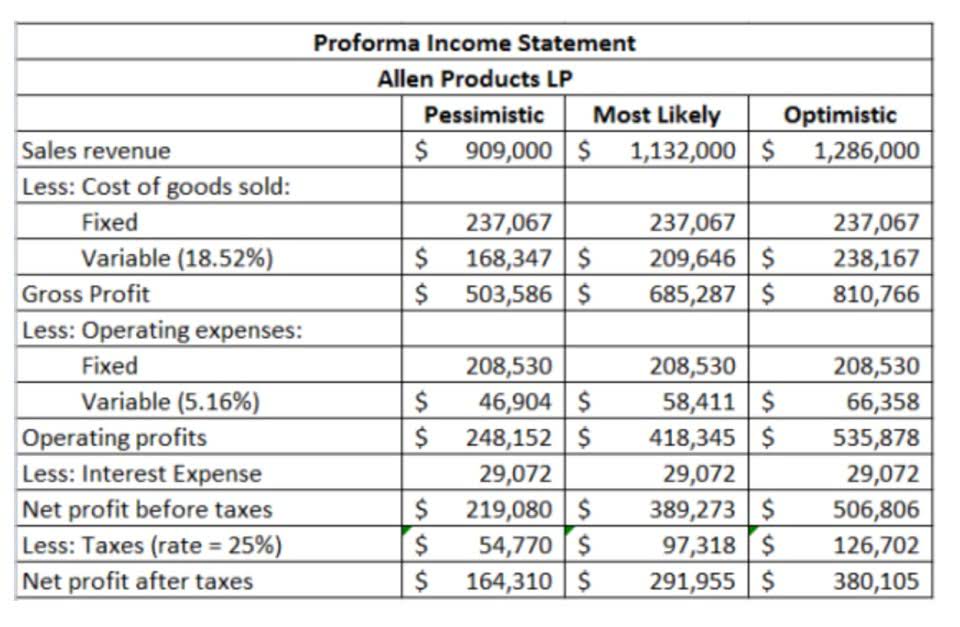

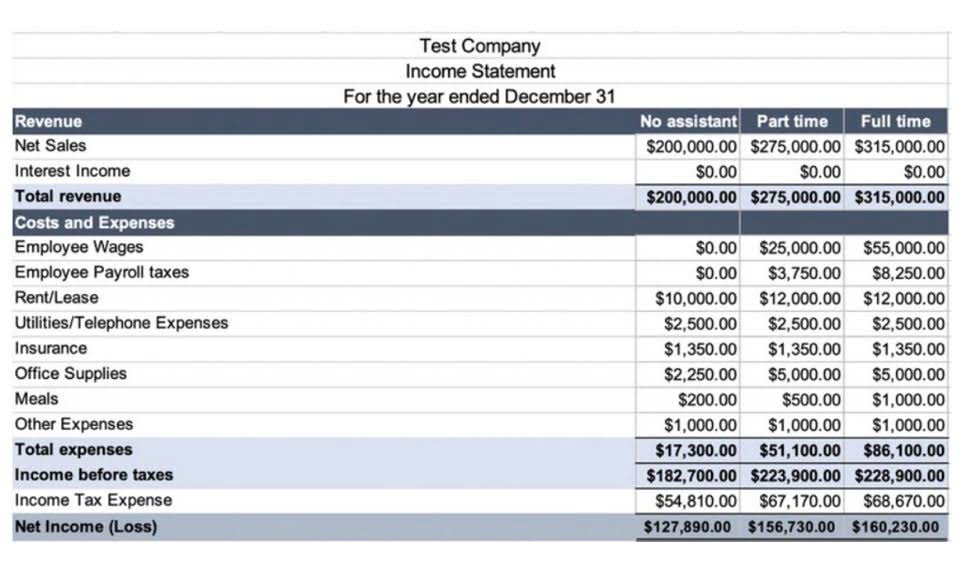

Pro forma is latin for “as a matter of” or “for the sake of form.” it is used primarily in reference to the presentation of information in a formal way, assuming or forecasting pieces of information that may be unavailable. While this provides insight into a company’s historical health, creating pro forma financial statements focuses on its future. The primary purpose in preparing pro forma financial statements is option d) for profit planning.

The primary purpose in preparing pro forma financial statements is: The main purpose of preparing pro forma statements for any business entity is to facilitate a comparison of the company’s current and past data to predict its future financial performance. Group of answer choices for cash planning to ensure the ability to pay dividends to reduce risk for profit planning this problem has been solved!

Traditionally, financial statement analysis is used to better understand a company’s performance over a specified period. Think of it this way: Pro forma financial statements serve as financial projections, helping businesses plan for future growth, prepare for potential challenges, and communicate financial expectations to stakeholders.

Certarus achieved record fourth quarter adjusted ebitda of $47.2 million, a 21% organic increase from the prior year quarter; A firm's operating cash flow (ocf) is defined as ______. Income sheet, balance sheet, and cash flow statement.

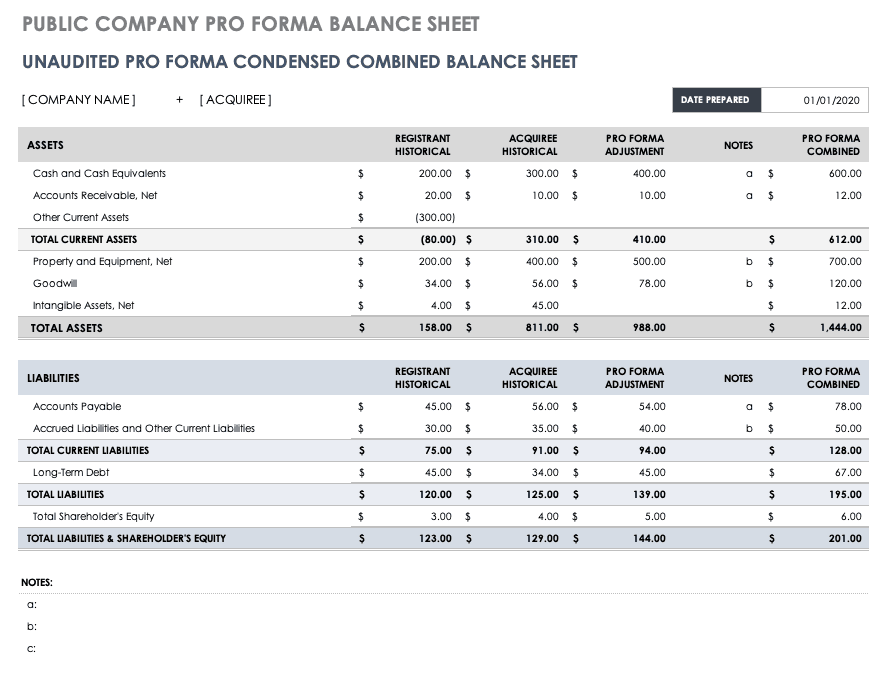

Pro forma statements can help predict cash flow, analyze risks, and secure funding. These statements are used to present a view of corporate results to outsiders, perhaps as part of an investment or lending proposal. A pro forma statement is a prediction, and a budget is a plan.

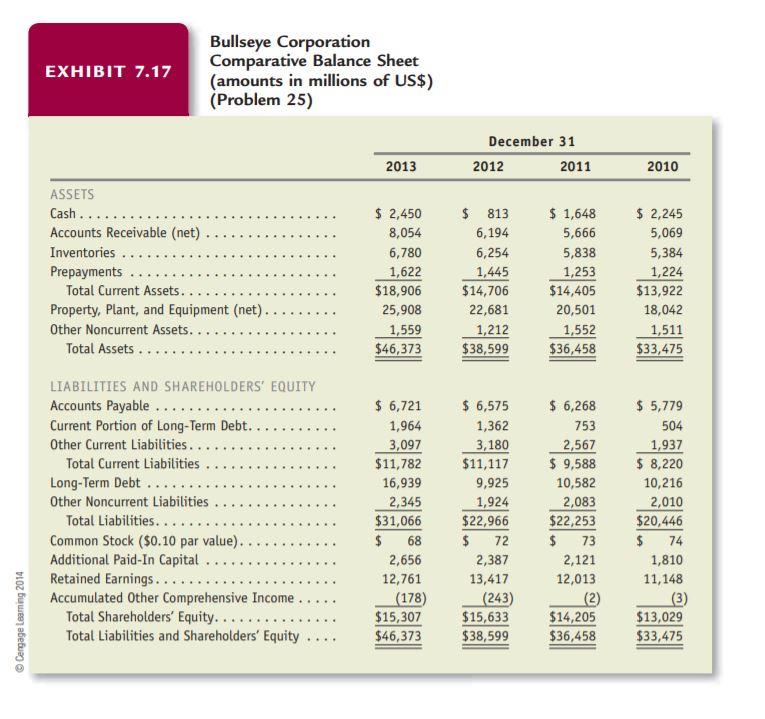

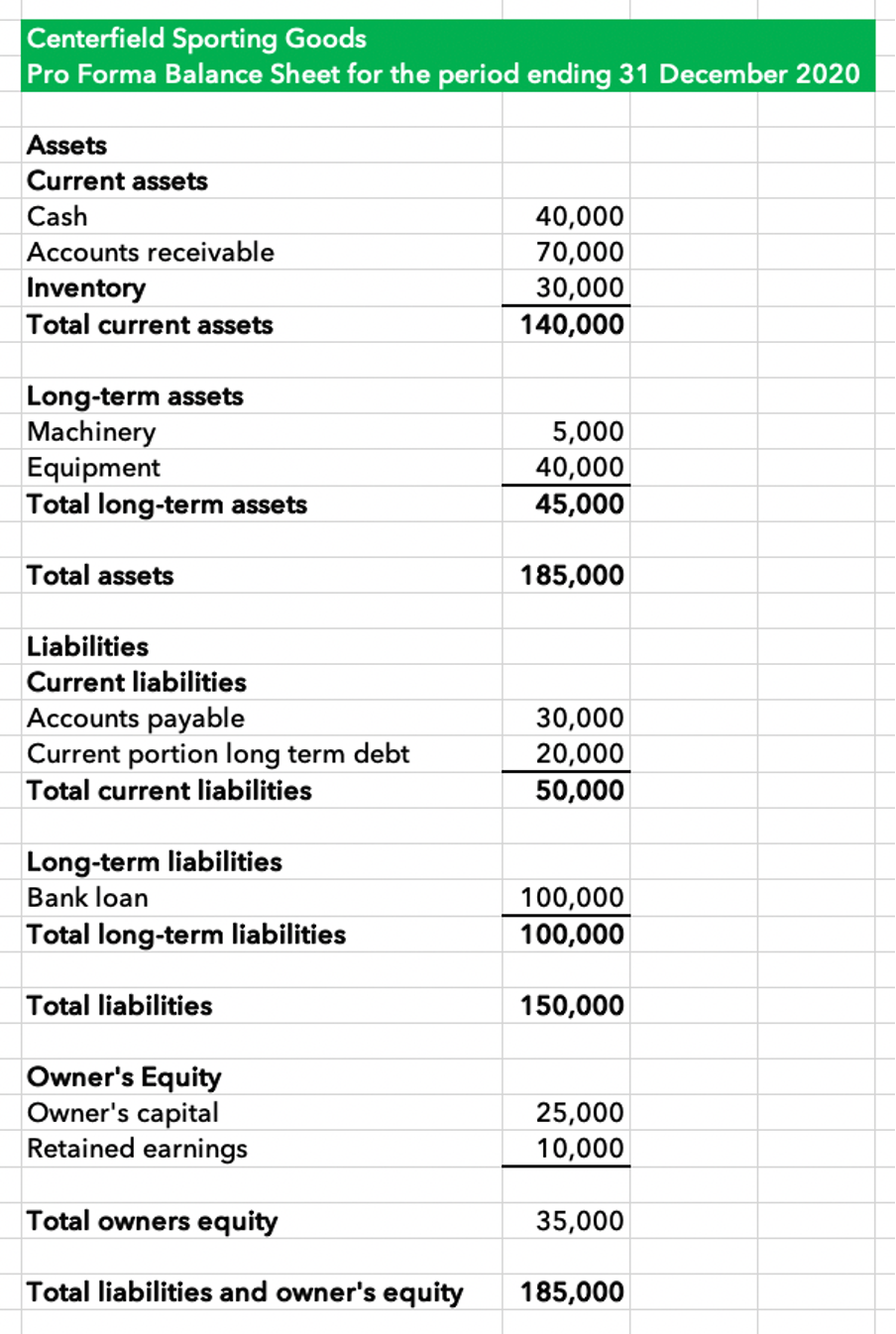

There are three main types of pro forma statements: As financial analyst for best value supermarkets, you have prepared the following sales and cash disbursement estimates for the period august through december of the current year. Definition a pro forma financial statement is a projection showing numbers that do not reflect the actual results from a company’s history.

The primary purpose in preparing pro forma financial statements is _____. (b) to ensure the ability to pay dividends. Your budget may be based on the financial information of your pro forma statements—after all, it makes sense to make plans based on your predictions.

The method of developing a pro forma income statement forecasts sales and values for the cost of goods sold, operating expenses, and interest expense that are. A) for cash planning b) to ensure the ability to pay dividends c) to reduce risk d) for profit planning answer: Record fourth quarter 2023 adjusted ebitda (1) of $213.6 million, a 17% increase from the prior year quarter;

Superior’s md&a, the unaudited consolidated financial statements and the notes to the audited consolidated. Pro forma financial statements are projected or forecasted financial statements, which are often utilized by managers for profit planning. Accountants prepare financial statements in the pro forma method ahead of a proposed transaction such as an acquisition, merger, a change in a company's capital structure, or new capital.