Build A Tips About Acca Cash Flow Statement Profit And Loss Balance Sheet Format Horizontal Analysis Calculation

An introduction to acca fa f1.

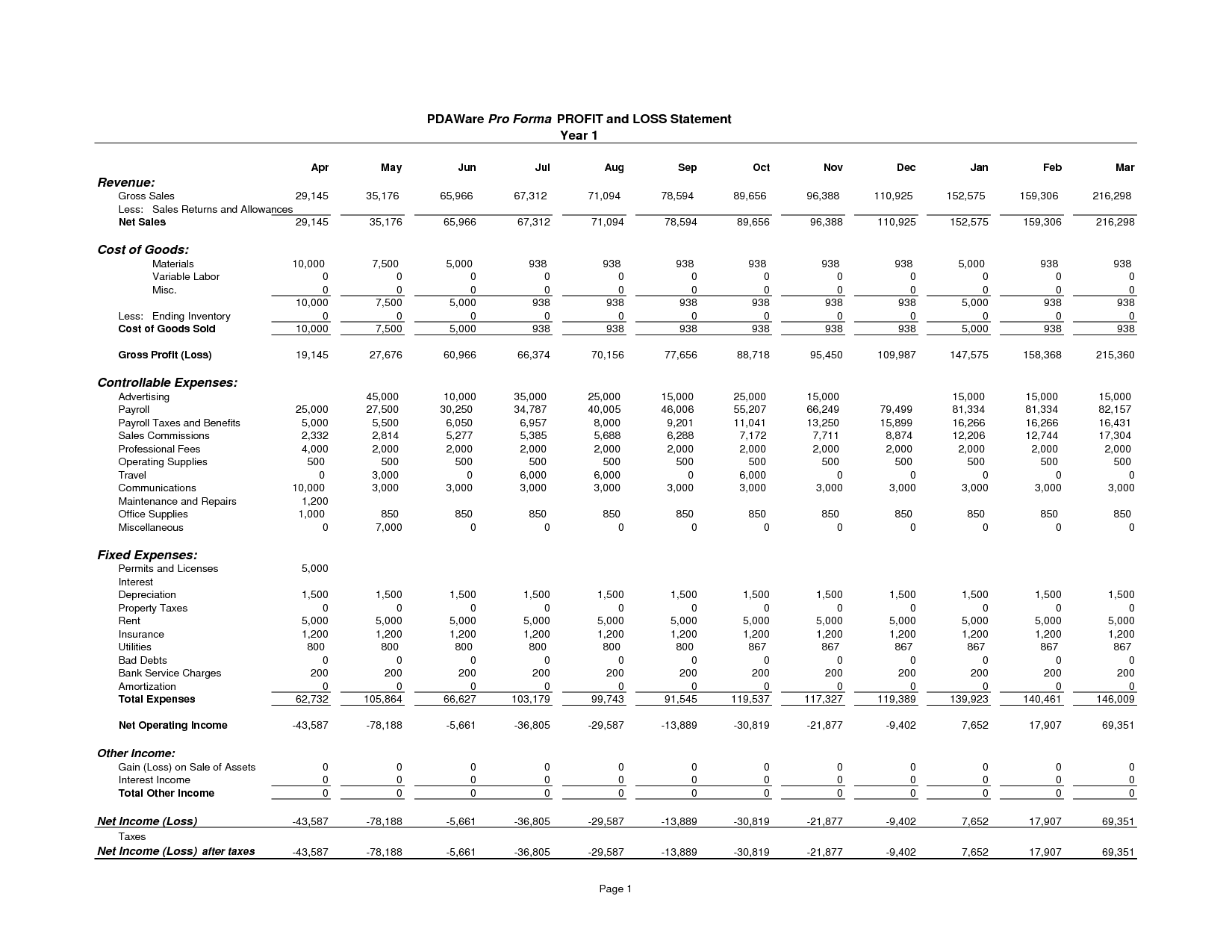

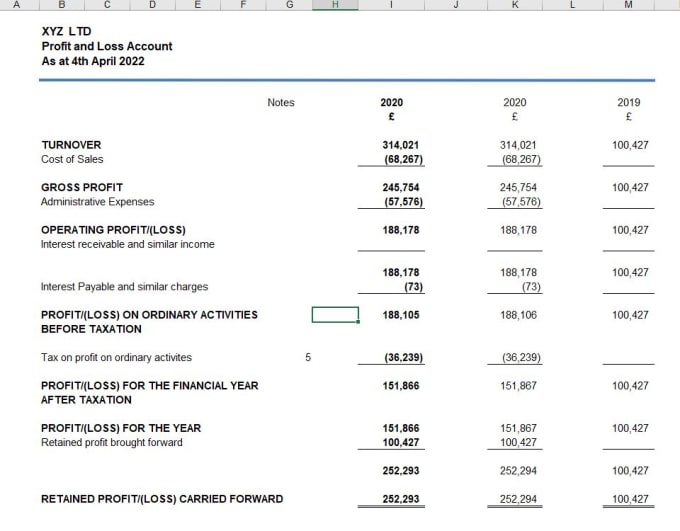

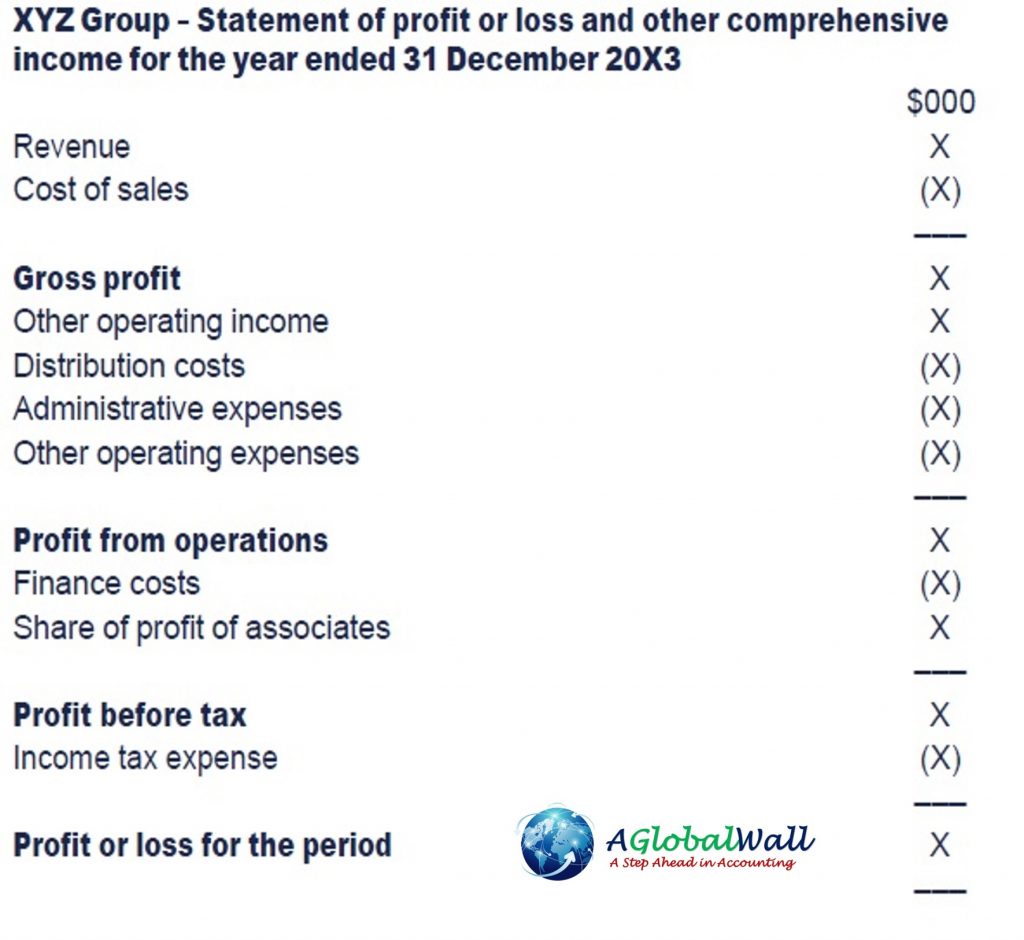

Acca cash flow statement profit and loss and balance sheet format. A statement of cash flows is needed as a consequence of the above differences between profits and cash. The statement of profit or loss and oci is designed to be useful to a broad range of users. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income.

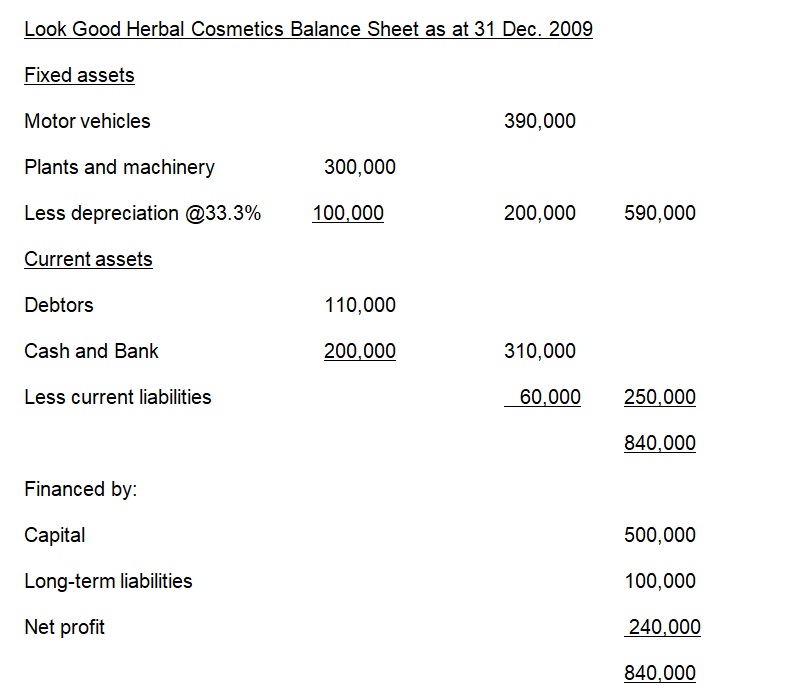

These consolidated financial statements present the results for acca and its subsidiaries for the year ended 31 march 2021. The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. So suppose the capital at the start of the year is 10, the profit is 100, and the drawings are 50.

So ias tells us that although we need to get to the. The balance sheet preparation of the profit and loss account and balance sheet the advantages of financial statements. The purpose of the statement of profit or loss and other comprehensive income (oci) is to show an entity’s financial performance in a way that is useful to a wide range of users so.

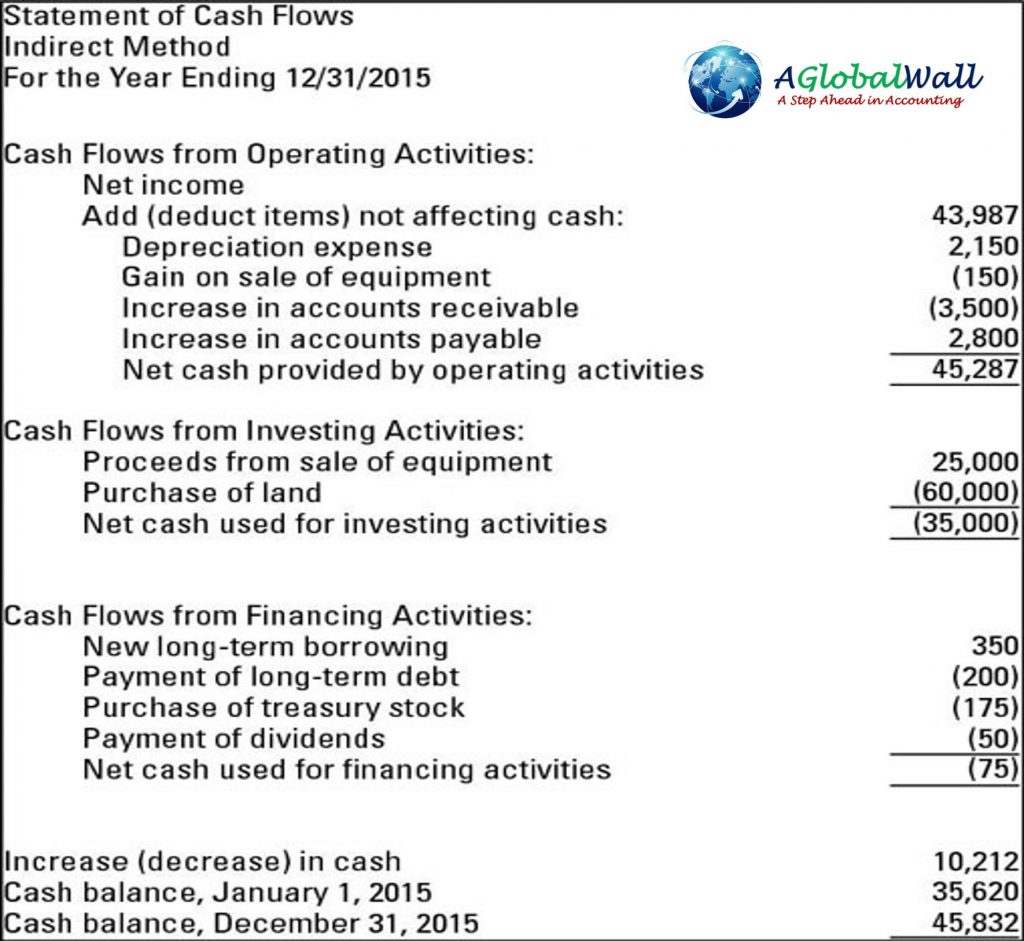

Statement of profit or loss and other comprehensive. It typically includes information on assets, liabilities, revenues, expenses, gains, and losses, and provides an overview of the financial health of the entity. The statement of cash flows contains three sections, namely cash flows from operating activities, investing activities and financing activities, each of which give us useful.

Statement of profit or loss. Find the cash and cash equivalent at the beginning and end of the reporting period step 3: Find the net profit from the income statement step 2:

7.1 the profit and loss account the profit and. Cash flows are usually calculated as a missing figure. For example, when the opening balance of an asset, liability or equity item is reconciled to its closing balance using information from the statement of profit or loss and/or additional notes, the balancing.

Provide additional information on business activities. The balances on all the income. Cash flows are usually calculated as a missing figure.

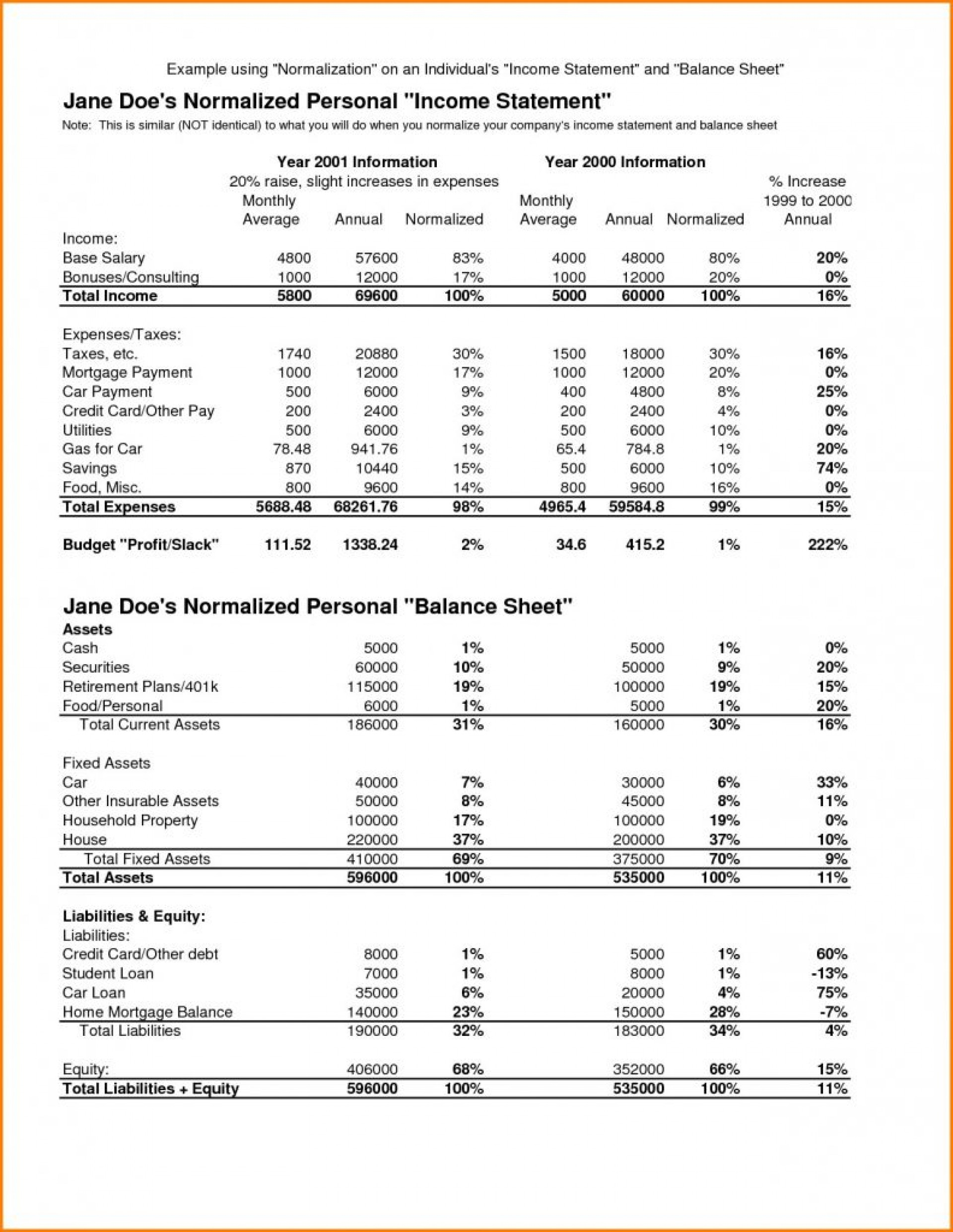

Common size profit and loss statements can help you compare trends and changes in your business. In particular, users will often attempt to assess the future net cash inflows of an entity. The first step in the process of preparing the financial statements is to open up another ledger account, called the statement of profit or loss.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.