The Secret Of Info About Bonds Payable Cash Flow Statement Liquidity Position Formula

Bonds payable represent a contractual obligation between a bond issuer and a bond purchaser.

Bonds payable cash flow statement. Bonds are an agreement in which the issuer obtains financing in. Determine net cash flows from operating activities using the indirect method, operating net cash. However, when companies acquire finance through bonds or repay them,.

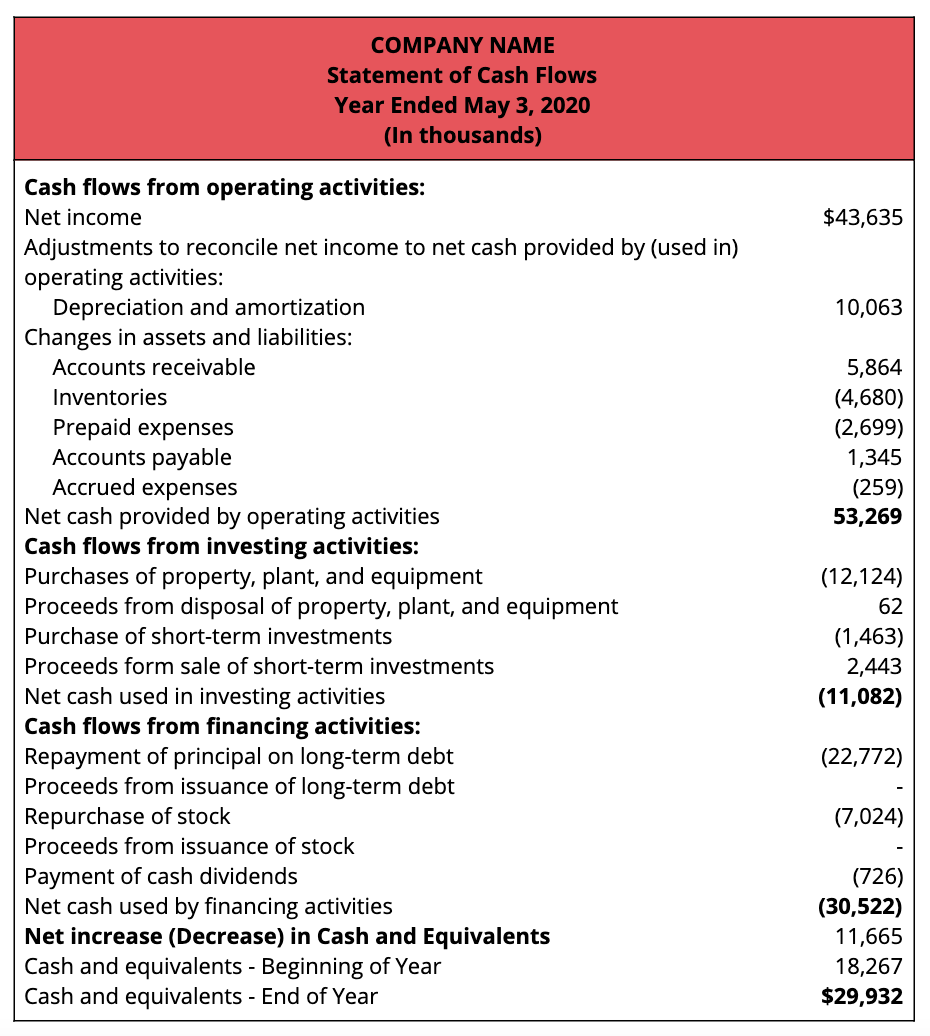

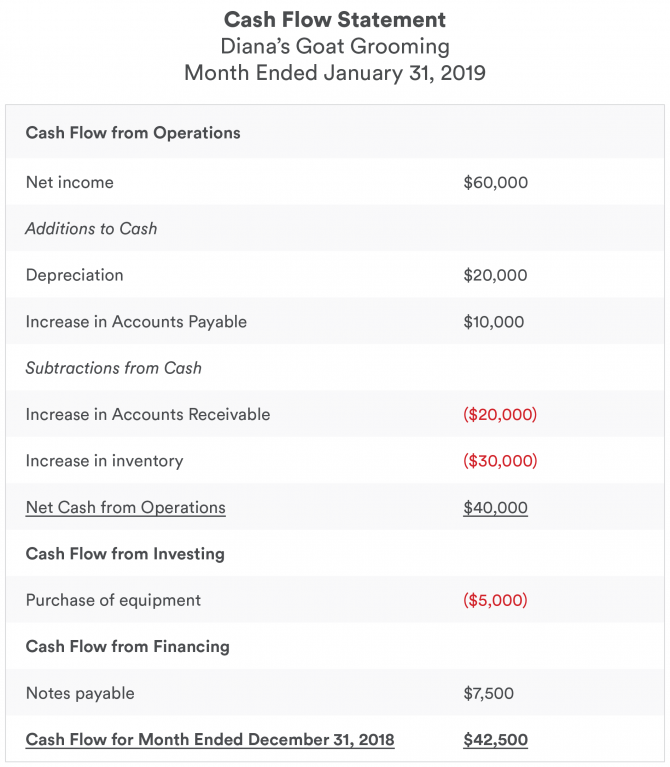

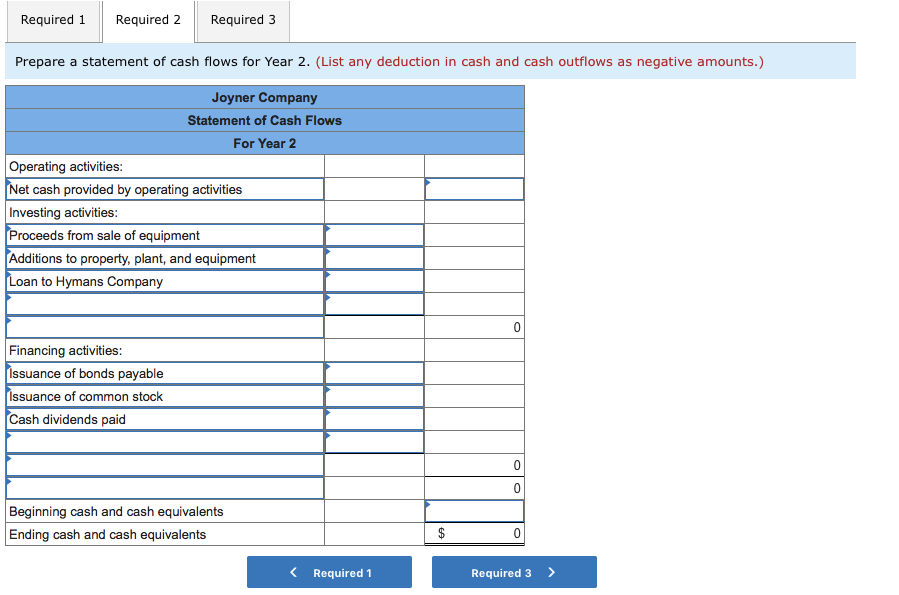

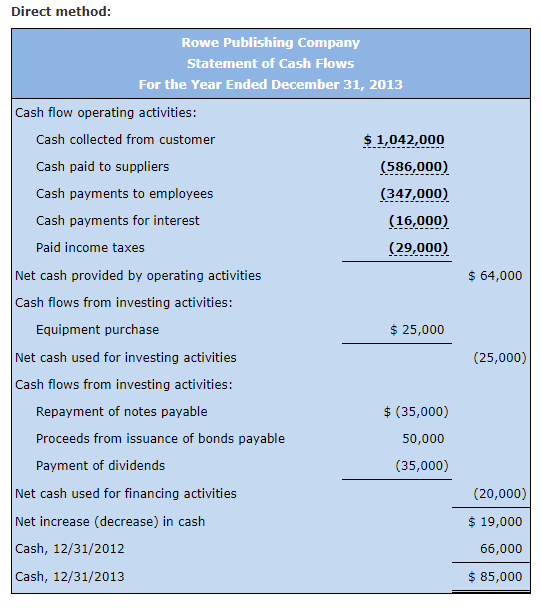

Ced = cash in flows from issuing equity or debt cd = cash paid as dividends rp = repurchase of debt and equity. A cash flow statement tells you how much cash is entering and leaving your business in a given period. To provide clear information about what areas of the business generated and used cash, the statement of cash flows is broken down into three key categories:

The cash flow statement reports the cash generated. Accountants report distinct elements of notes payable on different portions of a cash flow statement. The statement of cash flows is prepared by following these steps:

The statement of cash flows presents sources and uses of cash in three distinct categories: Bonds payable on cash flow statement. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

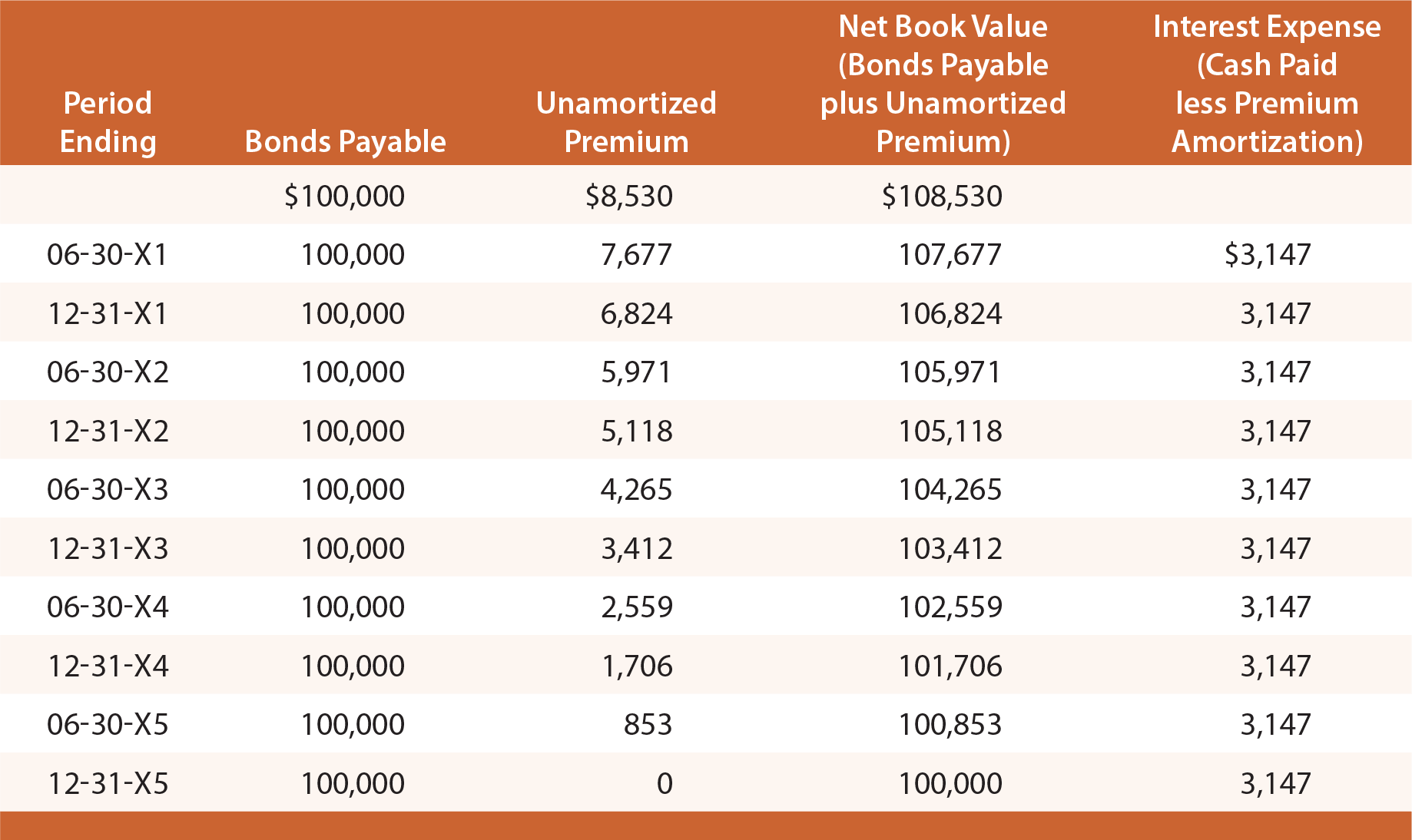

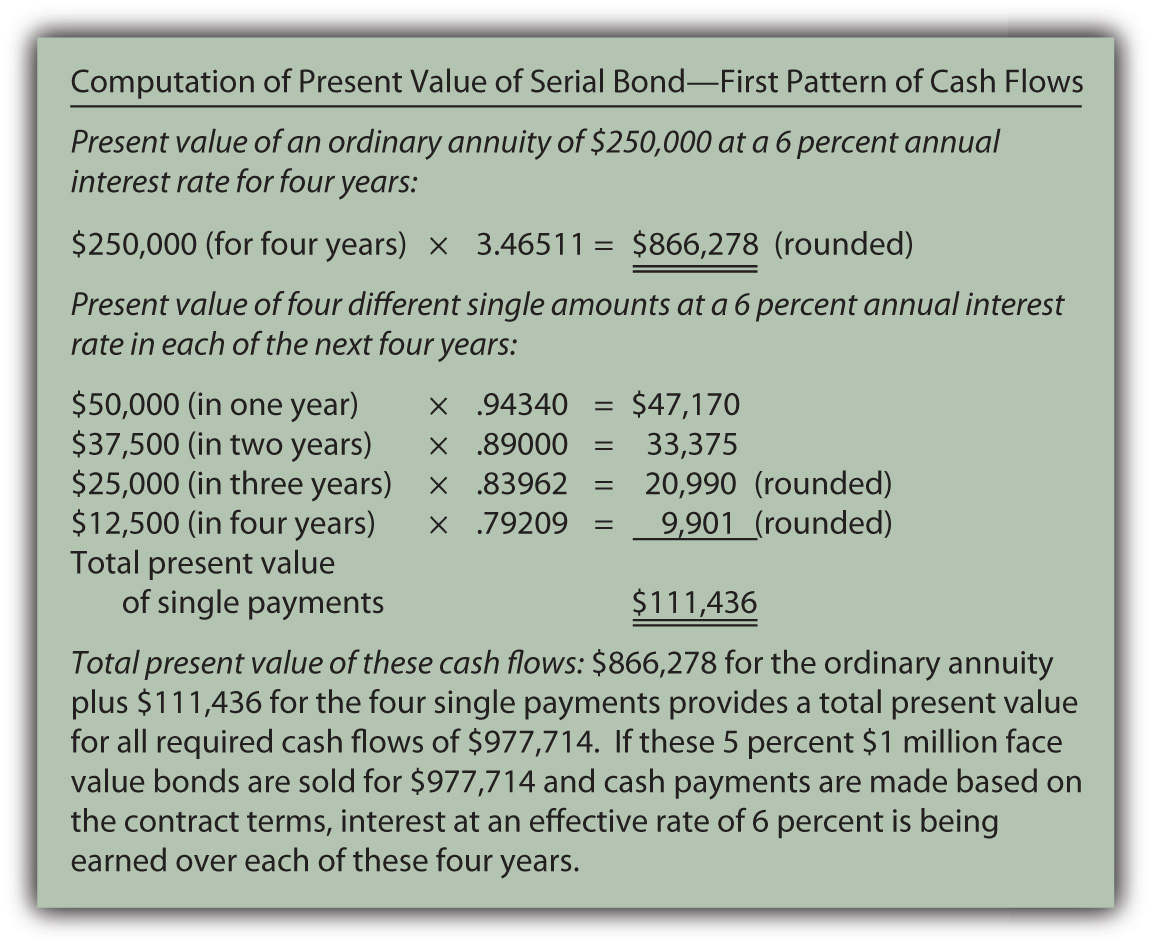

The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during. Accounting principles ii bonds payable bonds payable one source of financing available to corporations is long‐term bonds. Bonds payable are recorded when a company issues bonds to generate cash.

Bonds represent an obligation to repay a principal. During the final year, this balance gets transferred to current liabilities. Principal repayment or redemption of notes or bonds payable, or.

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. The cash flows from financing activities section reports the cash flows associated with the issuance and repurchase of a corporation's bonds and capital stock, the payment of. Although various aspects of a bond transaction directly reduce your cash flow, using bonds for debt financing or for investment can also positively affect your business.

How to report preferred stock on a cash flow statement ; As a bond issuer, the company is a borrower. The cfs highlights a company's cash.

How to adjust entries on a trial balance for note payable ; Bonds payable are the financial instrument that company uses to issue to get cash from investors. Asc 230 allows a reporting entity to prepare and present its statement of cash flows using either the direct or indirect method (see fsp 6.4.2), though asc.

Part 1 introduction to bonds payable, bond interest and principal payments part 2 accrued interest, bonds issued at par with no accrued interest part 3 bonds issued at. However, it does not impact the company’s cash flow statement. Along with balance sheets and income statements, it’s one.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)