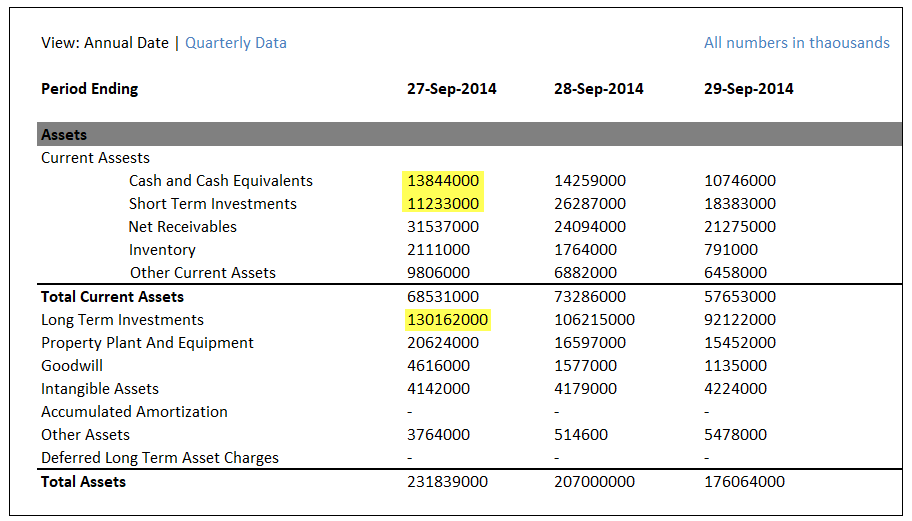

Outstanding Info About Cash And Equivalents In Flow Statement Formula For Balance Sheet Excel Apple Inc

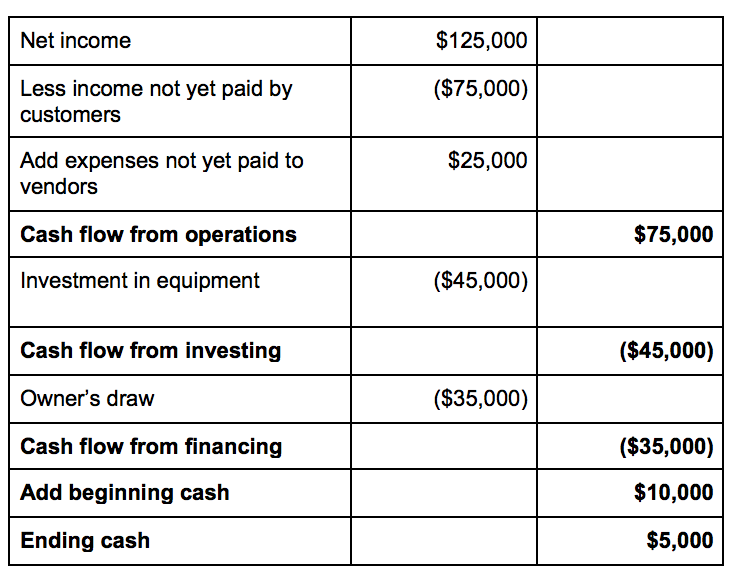

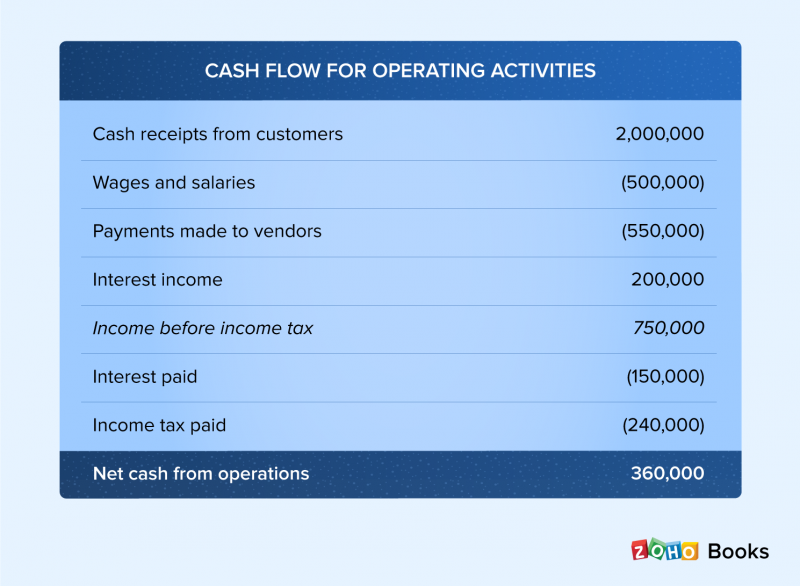

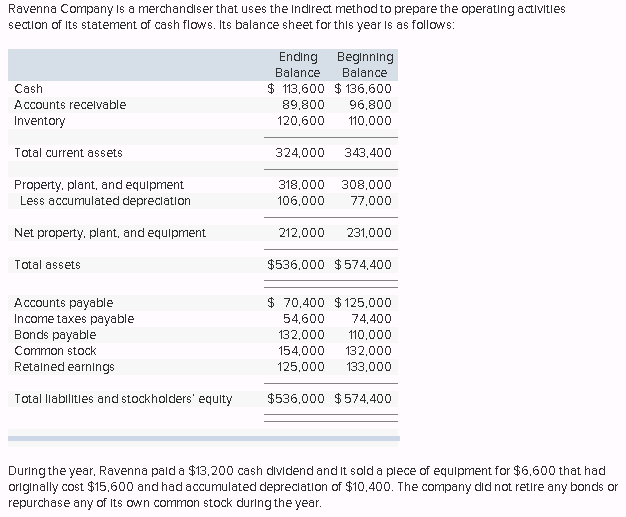

On the other hand, the cash flow statement shows the activities that occurred during the period that contributed to any changes in account balances.

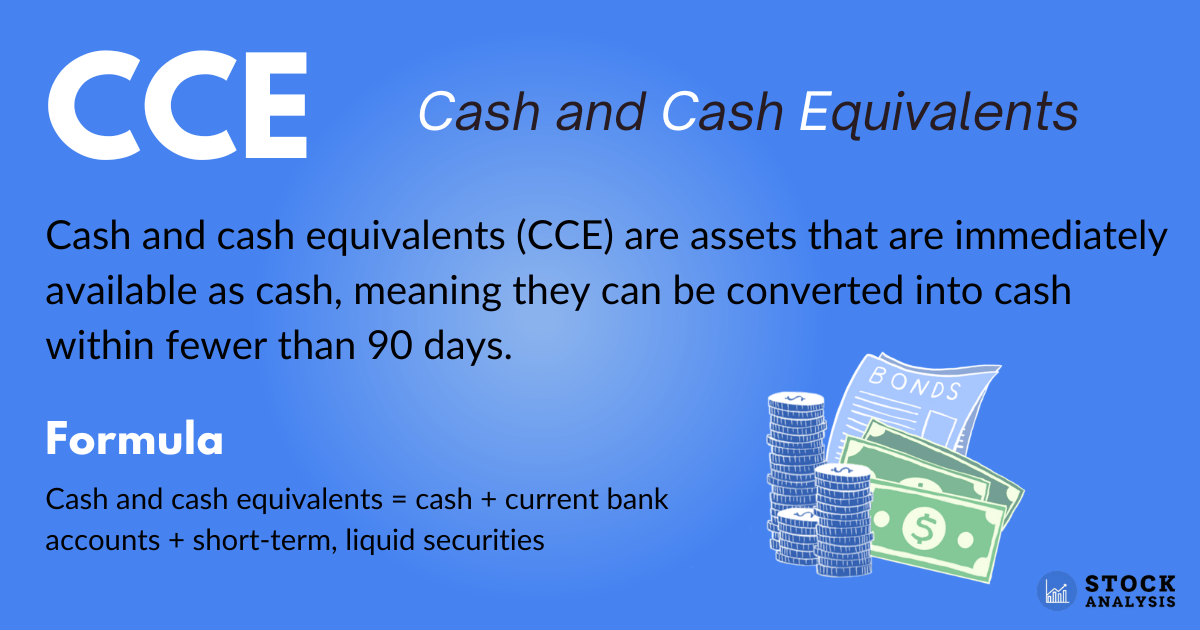

Cash and cash equivalents in cash flow statement formula for balance sheet in excel. Assets = liabilities + equity). In theory, cash flow isn’t too complicated—it’s a reflection of how money moves into and out of your business. To calculate the total value of cash and cash equivalents, a company can add together all cash accounts and any highly.

This has been a guide to what is cash and cash equivalents. We can see that the cash movement between the balance sheets is the ending cash balance (75) less the beginning cash balance (30) which, comparing this to the cash flow statement above, is the same as the cash flow (45), so the link between the cash flow and balance sheet is: To find the amount of closing cash and cash equivalents , type the formula below in cell e30 :

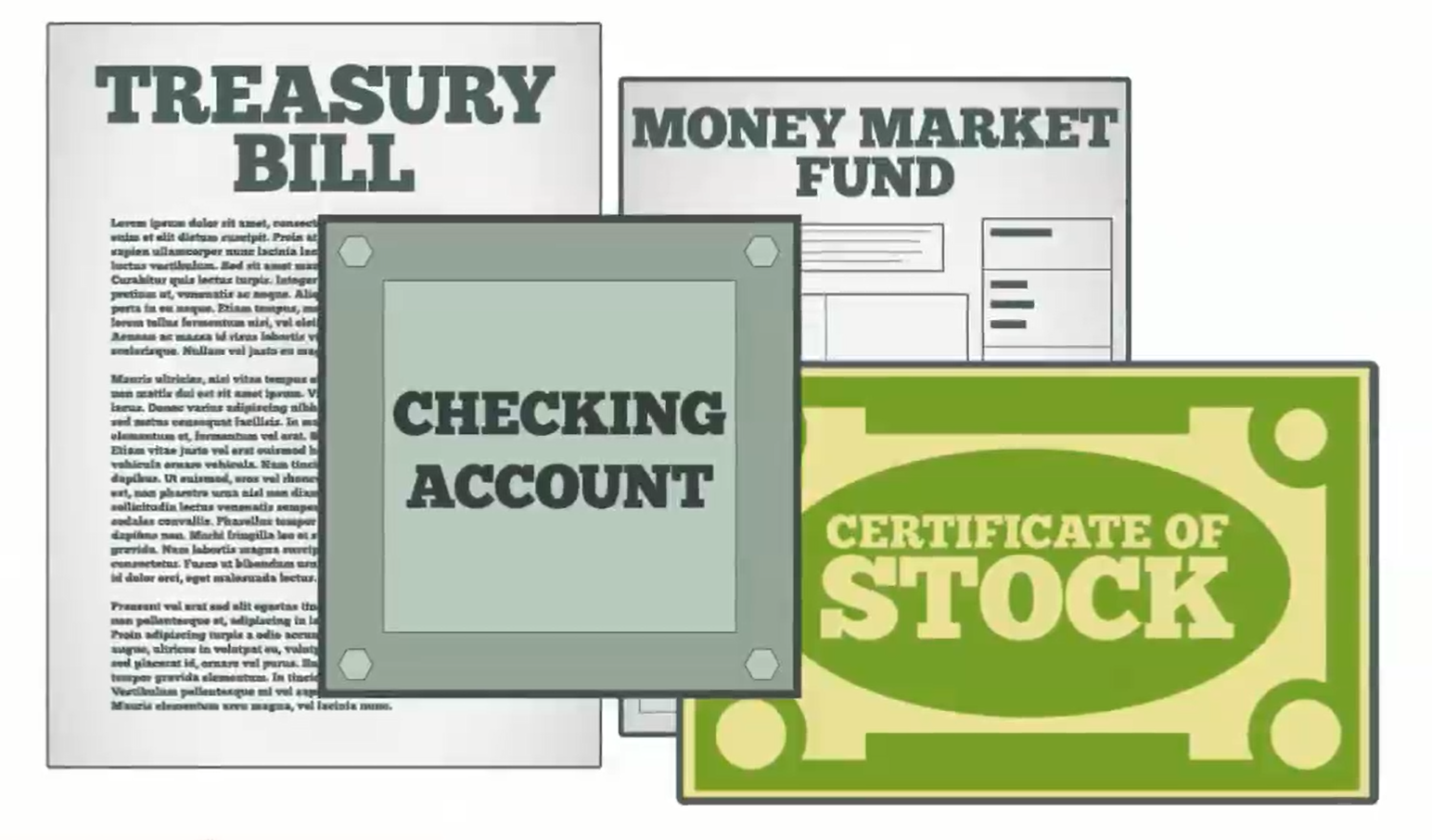

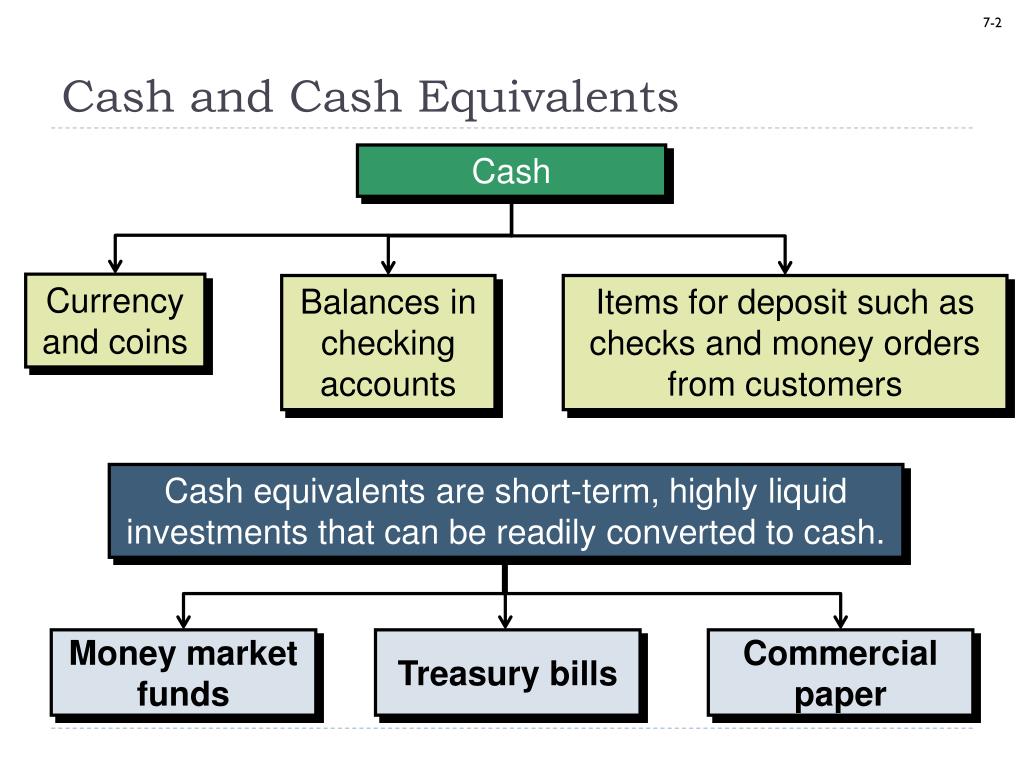

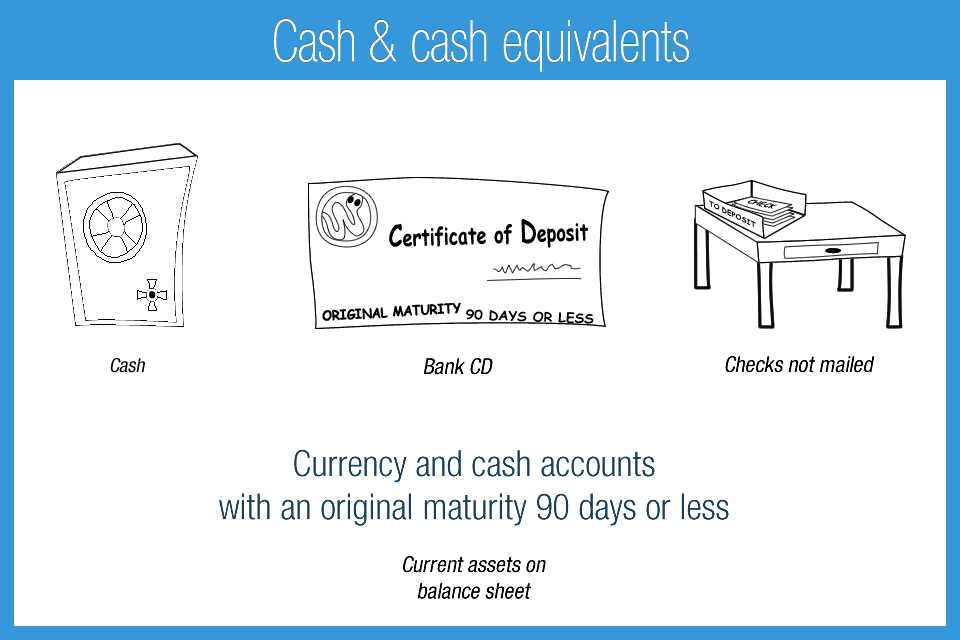

The value of opening cash and cash equivalents is extracted from the balance sheet. What is a cash flow statement? They mainly include a couple of support, which have relative ease with converting them into cash.

The whole sum of cash and cash equivalents is computed by aggregating all cash accounts and any highly liquid investments that can be easily turned into cash that qualify as a cash equivalent. A balance sheet shows what a company owns in the form of assets, what it owes in the form of liabilities, and the amount of money invested by shareholders listed under shareholders' equity. Cash ratio = cash and cash equivalents ÷ current liabilities current ratio = current assets ÷ current liabilities quick ratio = (cash & equivalents + a/r) ÷ current liabilities how cash and cash equivalents impact net working capital (nwc)?

The beginning and ending balance of cash, cash equivalents, restricted cash, and restricted cash equivalents and any other segregated cash and cash equivalents shown on the statement of cash flows should agree to the total of similarly titled line items on the balance sheet. Takeaway cash and cash equivalents (cce) are assets that are immediately available as cash, meaning they can be converted into cash within fewer than 90 days. You can learn more about finance through:

The cash flow statement shows how a company's cash and cash equivalents have changed over a specific period of time. $30m + $18m = $48m. A cash flow statement is a financial document that shows the movement of cash and cash equivalents in your business.

Cash and cash equivalents are calculated by adding up these assets, like so: The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid). Cash and cash equivalents are balance sheet details that summarize the worth of a company's assets that are cash or may be converted into cash instantly.

You could see where all the money in your business came from and where you spend it. Cash flow = balance sheet cash balance movement. Definition of cash and cash equivalents.

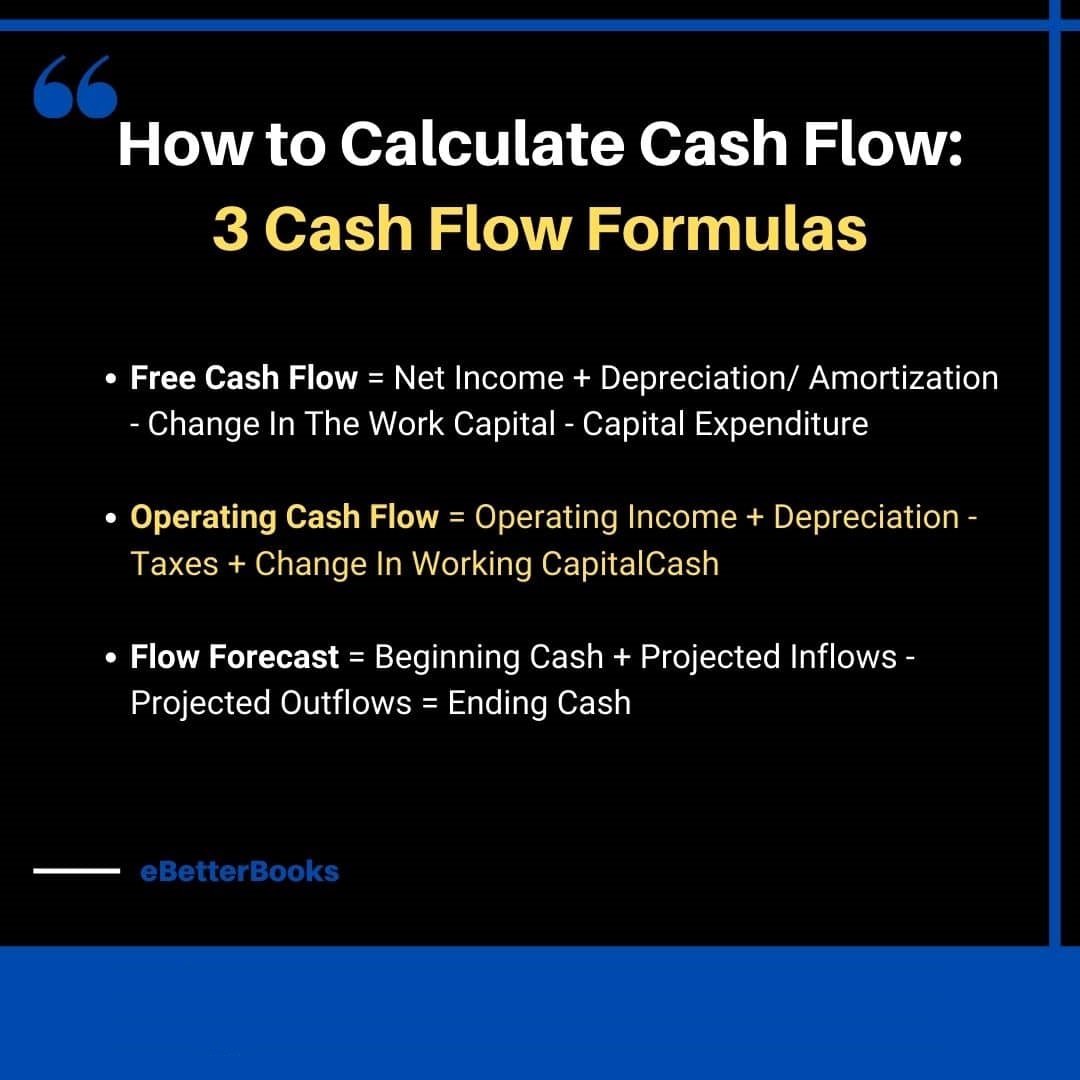

Unfortunately, for small business owners, understanding and using cash flow formulas doesn’t always come naturally. In the cash flow statement, cash and cash equivalent show the balance of two different dates or times. On a company's balance sheet, cash and cash equivalents are recorded as current assets.

Marketable securities and money market holdings are equivalent to cash because they are highly liquid and do not have material deviations in value. Cash flow statement sections below is a breakdown of each section in a statement of cash flows. Net working capital is equal to current assets, less current liabilities.