Outstanding Info About Salaries And Wages Payable On Balance Sheet Cash Flow Statement Ppt

![[Solved] Help please?! On December 31, Year 1, Hilton Company](https://media.cheggcdn.com/media/383/38397cc7-2a3b-4852-97f7-10efad2bd4c8/php6ahqqW.png)

The salary payable is the current liability on the balance sheet.

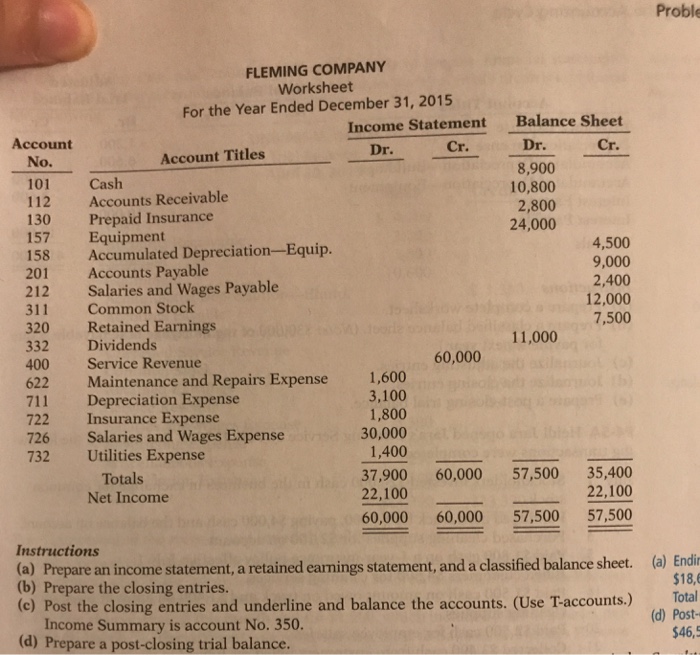

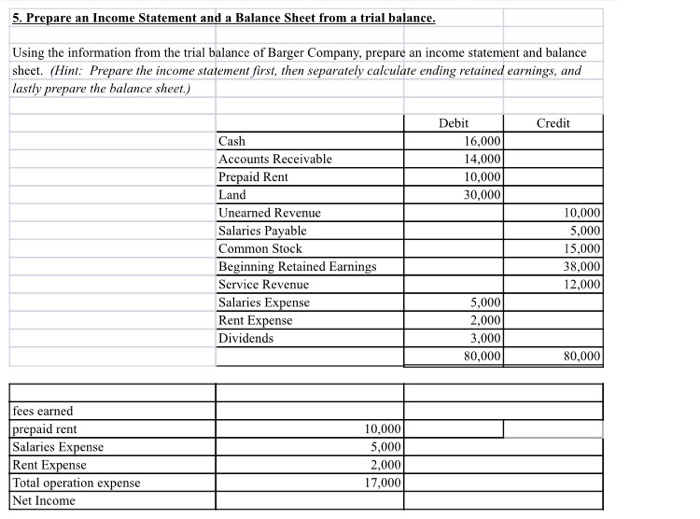

Salaries and wages payable on balance sheet. It is a current liability. Thus, unpaid salaries are included in the calculation of the company's working. Wages payable, works in progress, and capitalized expenses.

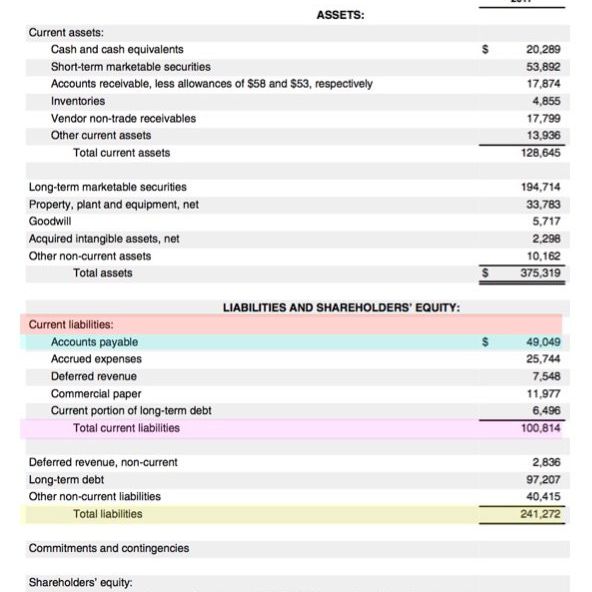

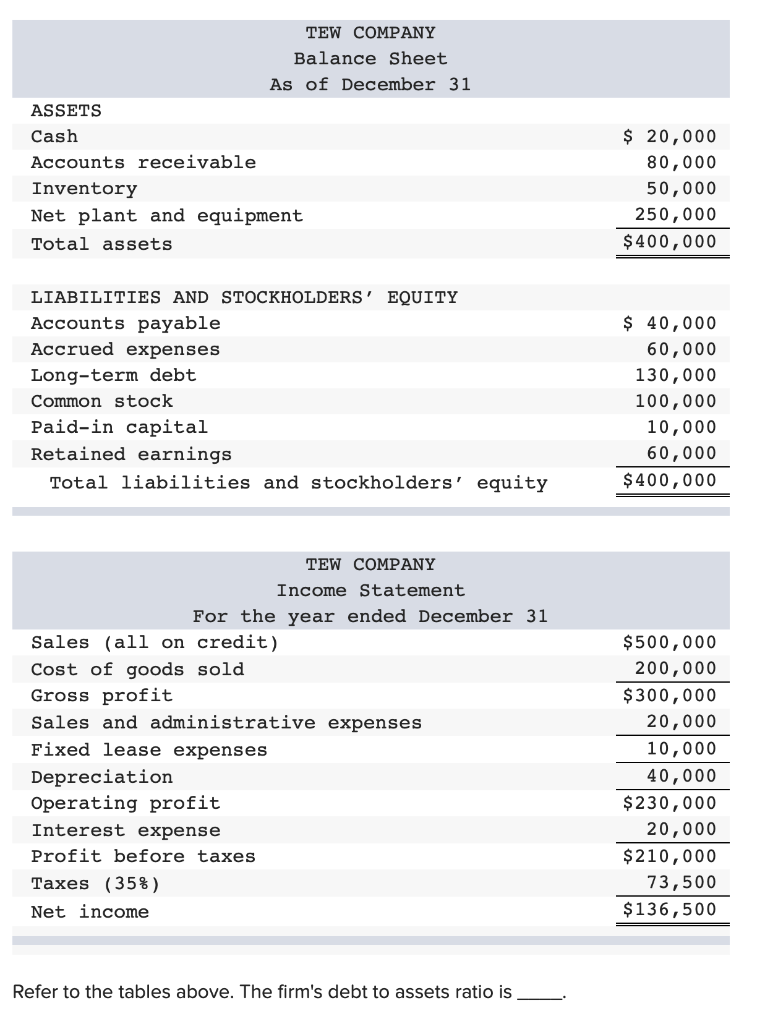

Balance sheet january 1, 2015 assets equities cash $52,146 accounts payable $229,614 accounts receivable 11,793 wages. Accounts payables are the amounts owed to suppliers, employees, shareholders, vendors, or customers. Accounting managers and professionals often record both salaries payable and accrued salaries on the balance sheet account under current liabilities.

Identify which financial statement each account will go on: What are accounts payable on a balance sheet? The term ‘payroll’ is often used in businesses for recording the net.

The balance sheet of abdan & co will show a balance of $37,000 in their salaries and wages payable account under the head of current liabilities. What is a balance sheet? Salary payable vs salary expense.

Employee fica tax payable, wages payable, federal and state income tax payables, and employee health insurance payable are all common payroll liability. Definition of wages payable wages payable refers to the wages that a company's employees have earned, but have not yet been paid. Theoretically, the salary payable account balance increases with credit and decreases with a debit.

Under the accrual method of. Accrued payrolls are an important item in the balance sheet and accounting books of a business entity. A company accrues unpaid salaries on its balance sheet as part of accounts payable;

Salaries and wages payable is a balance sheet account that increases the total liabilities of a business. This financial statement is used. Wages payable, or “accrued wages”, represent the unmet payment obligations owed to employees remaining at the end of a reporting period.

Most students learn that labor and wages are a cost item on the profit and loss statement (p&l). However, labor expenses appear on the balance sheet as well, and in three notable ways: Wages payable refers to the liability incurred by an organization for wages earned by but not yet paid to employees.

A balance sheet provides a snapshot of a company’s financial performance at a given point in time. A sample formula for salary payable is as follows. As mentioned, these will include employee salaries, wages, taxes, overtime, bonuses, and other related amounts.

The following balance sheet is for x company: When the company makes a payment to the employee, the accountant needs to reverse the salary payable from.

![[Solved] The following balance sheet and st SolutionInn](https://s3.amazonaws.com/si.question.images/images/question_images/1543/4/8/9/7785bffc8f24e92a1543472299196.jpg)