Breathtaking Info About Income Tax In Cost Sheet Purchase Of Land Cash Flow Statement

Budget spreadsheets are a great way to keep track of your finances.

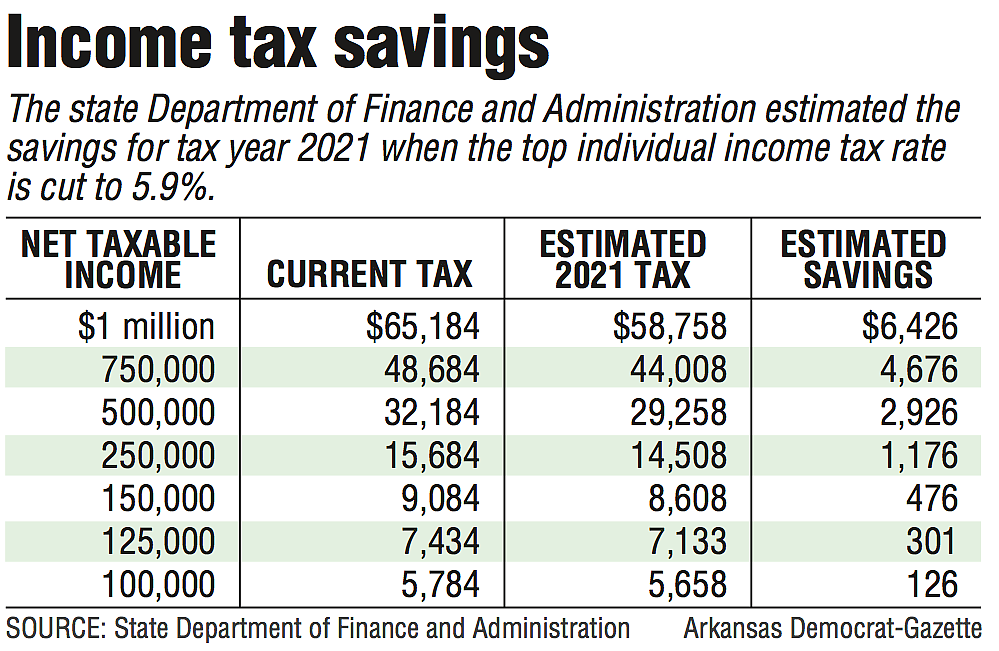

Income tax in cost sheet. Input the appropriate numbers in this formula: A cost sheet is a comprehensive financial document that serves as a roadmap for understanding the various cost components associated. For example, if your company had a total taxable income of $1.

Income tax expense is the amount of expense that a business recognizes in an accounting period for the government tax. Income tax expense on its income statement for the revenues and expenses appearing on the accounting period's income statement, and. And tax withholdings, and corporate income taxes accounted for about 91.4 percent of total tax and other revenues in fy 2023.

The budget planner enables you to input your monthly income and expenses. Here are the formulas on how to calculate personal (employee) income tax, pension, gross and net income in ethiopia. This may help offset some of the taxes social security beneficiaries could have to pay.

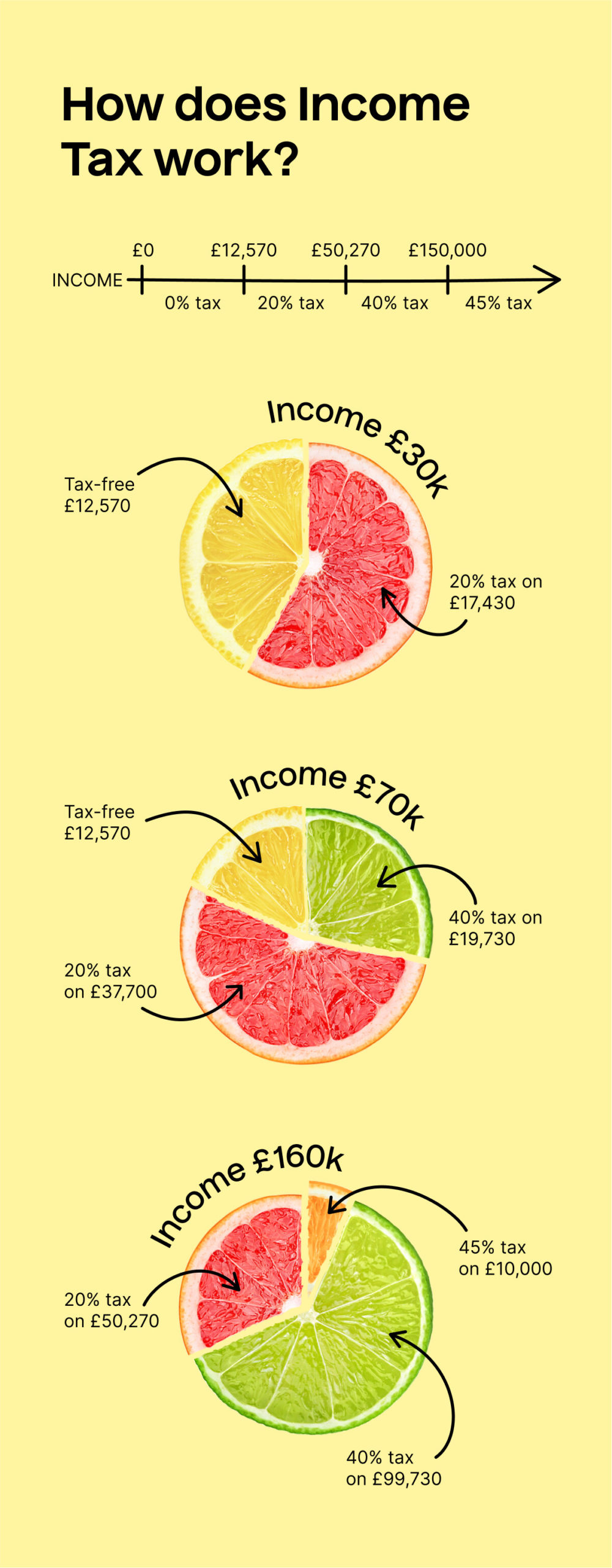

Other revenues include federal reserve earnings,. Taxable income x tax rate = income tax expense. · donation, · income tax, ·.

It shows the amount that an organization expects to pay in income taxes within 12. For the 2024 tax year, the standard tax deduction for single filers has been. Nerdwallet’s budget planner.

Income taxes payable (a current liability. Expenses = $6,000 + $2,000 + $10,000 + $1,000 + $1,000 = $20,000. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable.

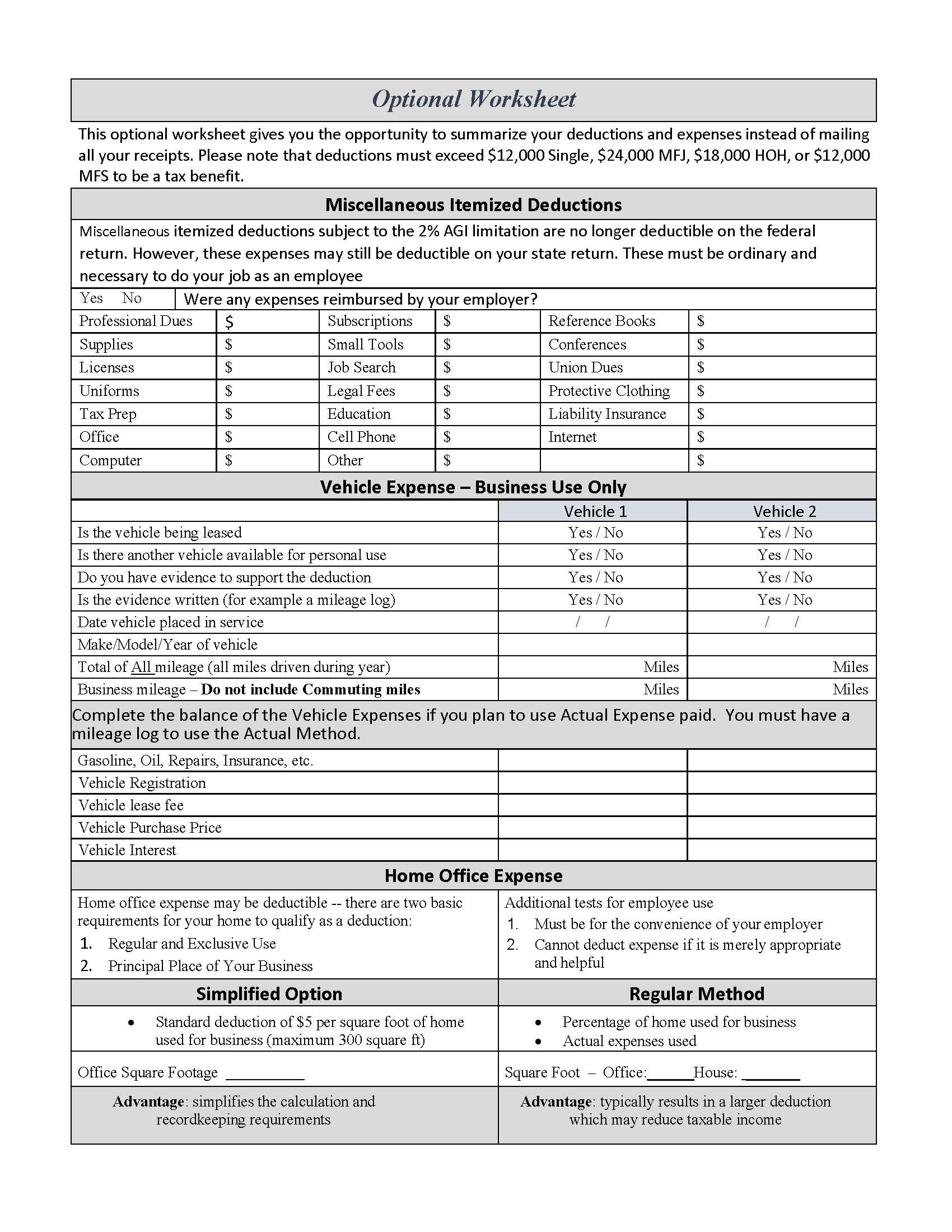

Income tax payable is a liability reported for financial accounting purposes. What is a cost sheet? Some items, such as income tax and legal expenses, are commonly excluded because they are not related to production costs.

What is a cost sheet? Now, wyatt can calculate his net income by taking his gross income, and subtracting expenses: It helps in fixing the selling price/quotation.

It also helps in formulating production policy. A cost sheet is a statement that shows the various components of total cost for a product and shows previous data for comparison. You can add up all of your income and expenses in one place and be well prepared to drop your final.

2023 — following feedback from taxpayers, tax professionals, and payment processors and to reduce taxpayer confusion, the internal. The new tax slab would be default tax slab. Salary income tax = (gross salary * tax.