Beautiful Info About Provision For Doubtful Debts Meaning Management And Auditor Responsibilities Internal Control

At the end of each financial year,.

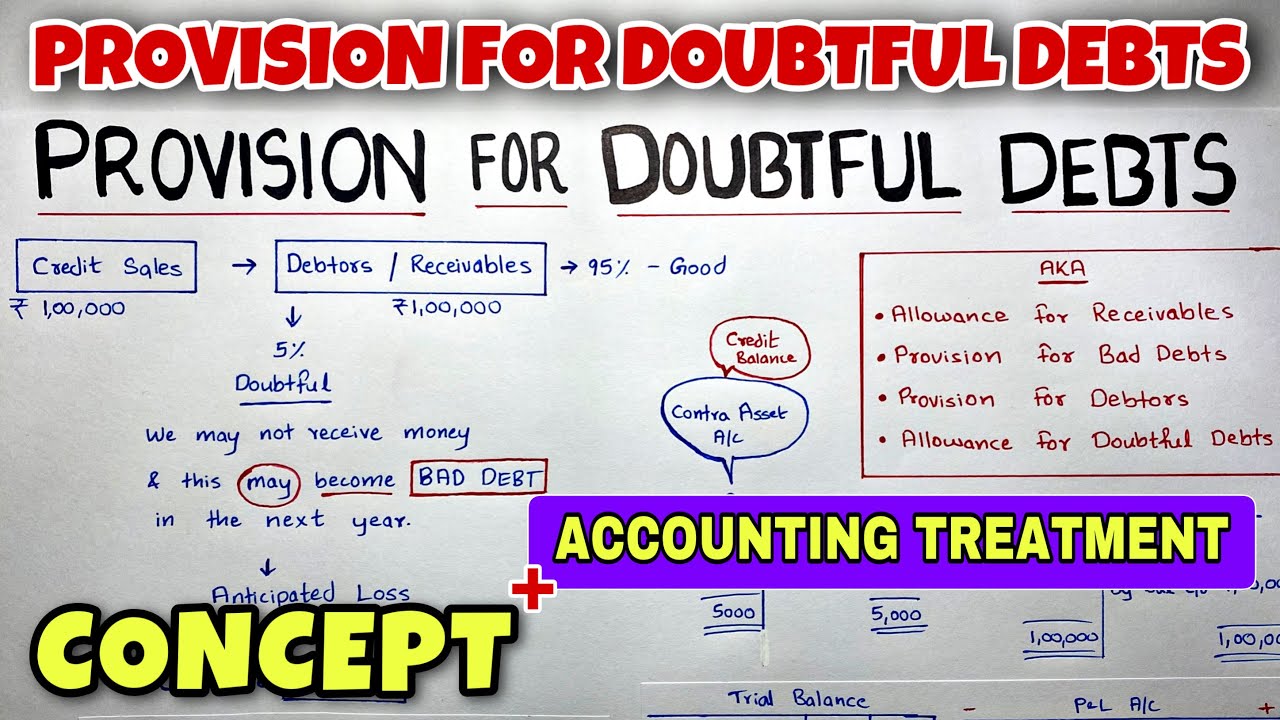

Provision for doubtful debts meaning. An allowance for doubtful accounts is a contra account that nets against the total receivables presented on the balance sheet to reflect only the amounts expected to. Bad debt is an amount of debt that a business fails to recover from its debtors. The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of.

An amount owed to an organization by a debtor that it might well not receive. Provision for doubtful debts acts as a liability for the business and is shown on the liability side of a balance sheet. A bad debt provision is also known as the allowance for doubtful accounts, the allowance for uncollectible accounts, or the allowance for bad debts.

An increase in provision for doubtful debts is an increase in expense. Recoverability of some receivables may be doubtful although not definitely irrecoverable. The provision for doubtful debts is an estimated amount of bad debts that are likely to arise from the accounts receivable that have been given but not yet collected from the.

If a creditor has a bad debt on the books, it becomes uncollectible. The allowance for doubtful debts is created by. Defining a provision for bad or doubtful debts?

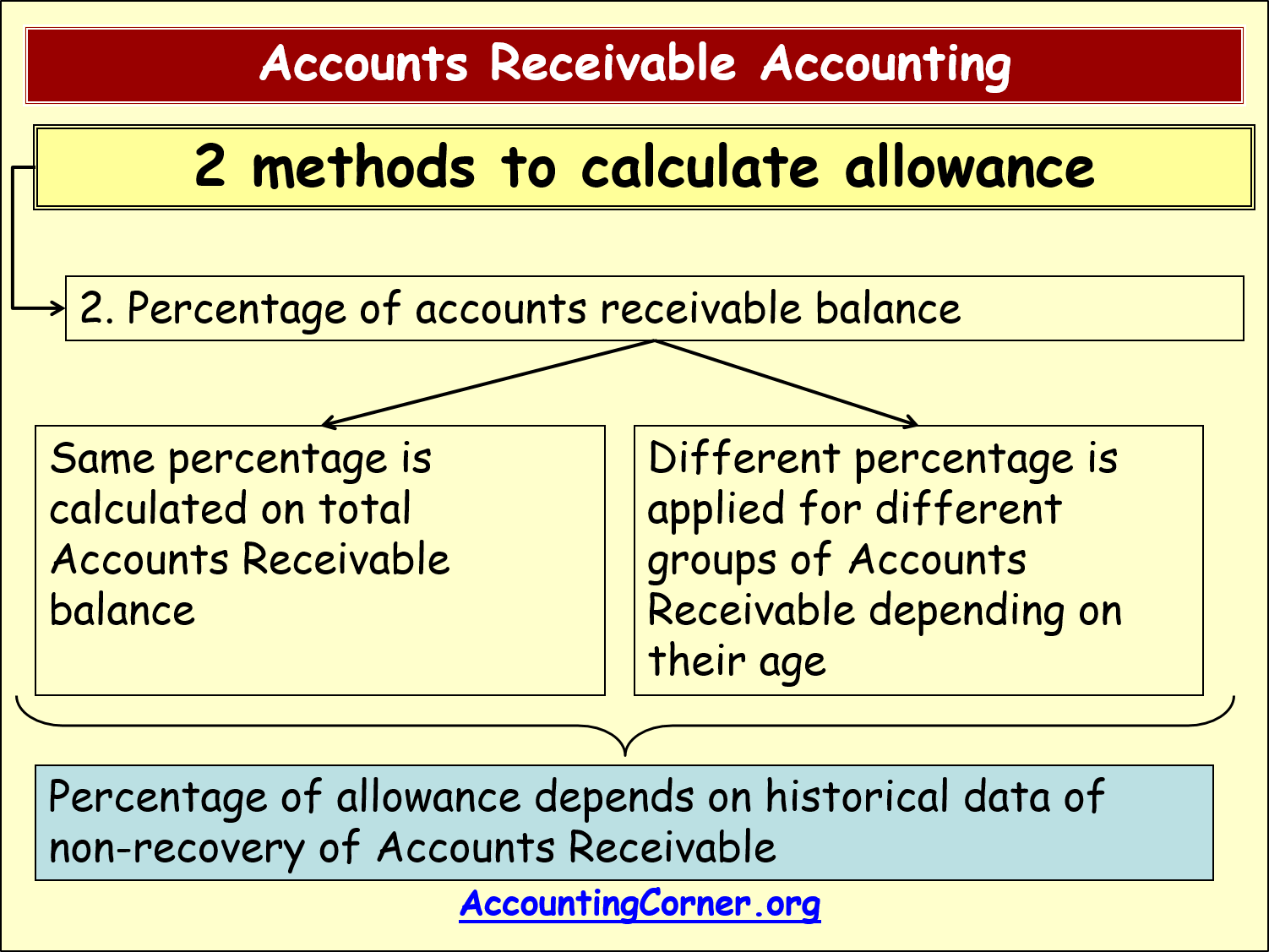

The provision for doubtful debts, often described as the provision for losses on accounts receivable or bad debt provision,. The provision for doubtful debts is shown in the financial statements immediately underneath the part of the budget for receivable accounts. Accounting for doubtful debts.

A provision for doubtful debts may be created, which may be based on specific debts. The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of. The provision for doubtful debt is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected.

When it is expected that the outstanding amount to the customers will not be recovered, it is advisable to recognize the anticipated loss. The definition for the provision for bad debts, or otherwise known as doubtful debts, is the estimated. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been.

Bad debt is an amount of money that a creditor must write off if a borrower defaults on the loans. It is charged against the current year’s profits. The provision for bad debts could refer to the balance sheet account also known as the allowance for bad debts, allowance for doubtful accounts, or allowance for.

Provisions for bad debts faqs what is bad debt? This estimate is called the bad debt provision or bad debt allowance and is recorded in a contra asset account to the balance sheet called the allowance for credit.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)