Recommendation Tips About Cash And Flow Whats Included In A Balance Sheet

Cash flow refers to the inflow and outflow of cash and cash equivalents.

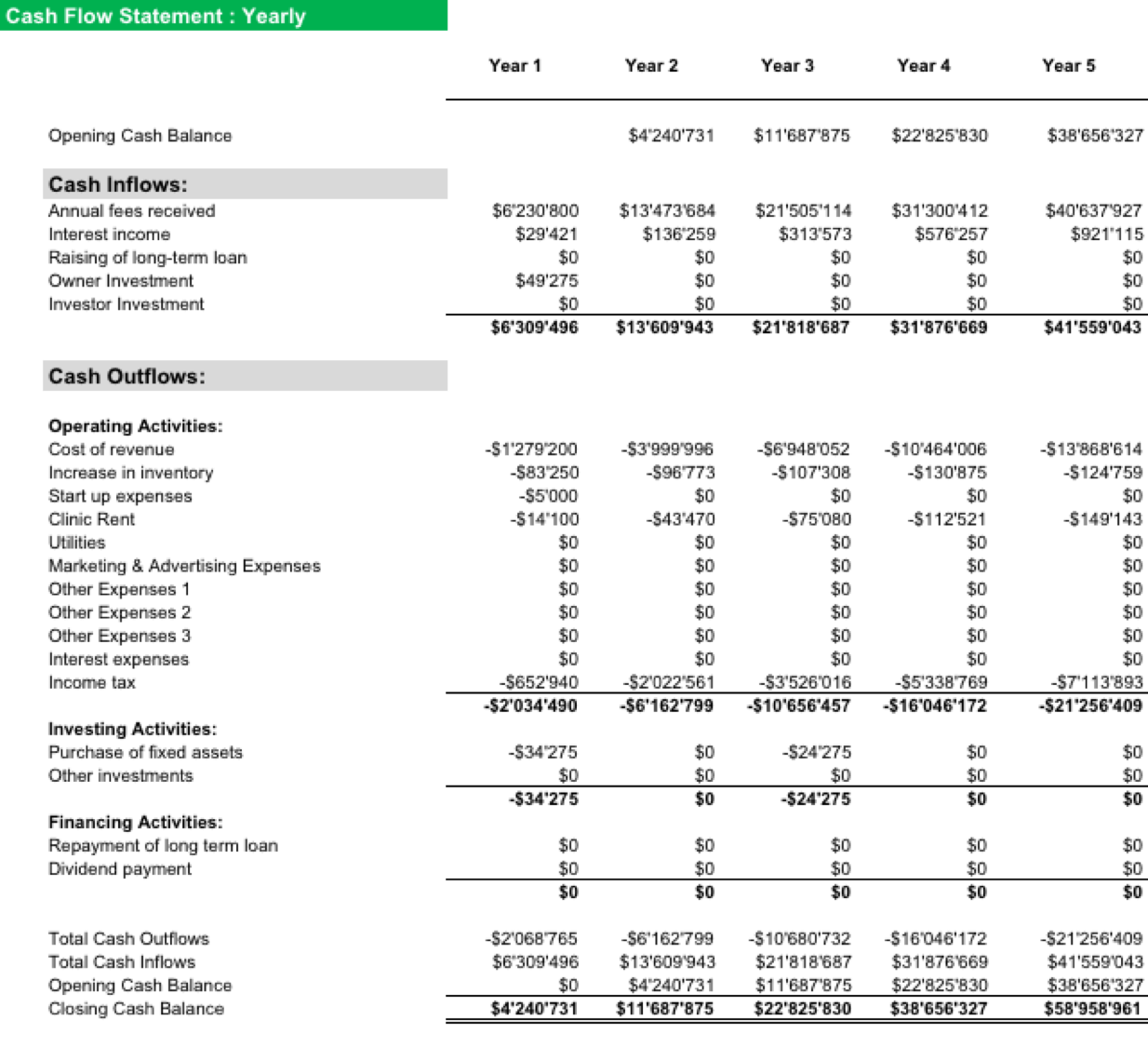

Cash and cash flow. The term cash flow is used to describe the amount of cash that is generated or spent within a certain time frame. It also set 2024 targets for the first time, aiming for underlying operating profit of between £1.7 and £2 billion and free cash flow of £1.7 billion to £1.9 billion, also exceeding estimates. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

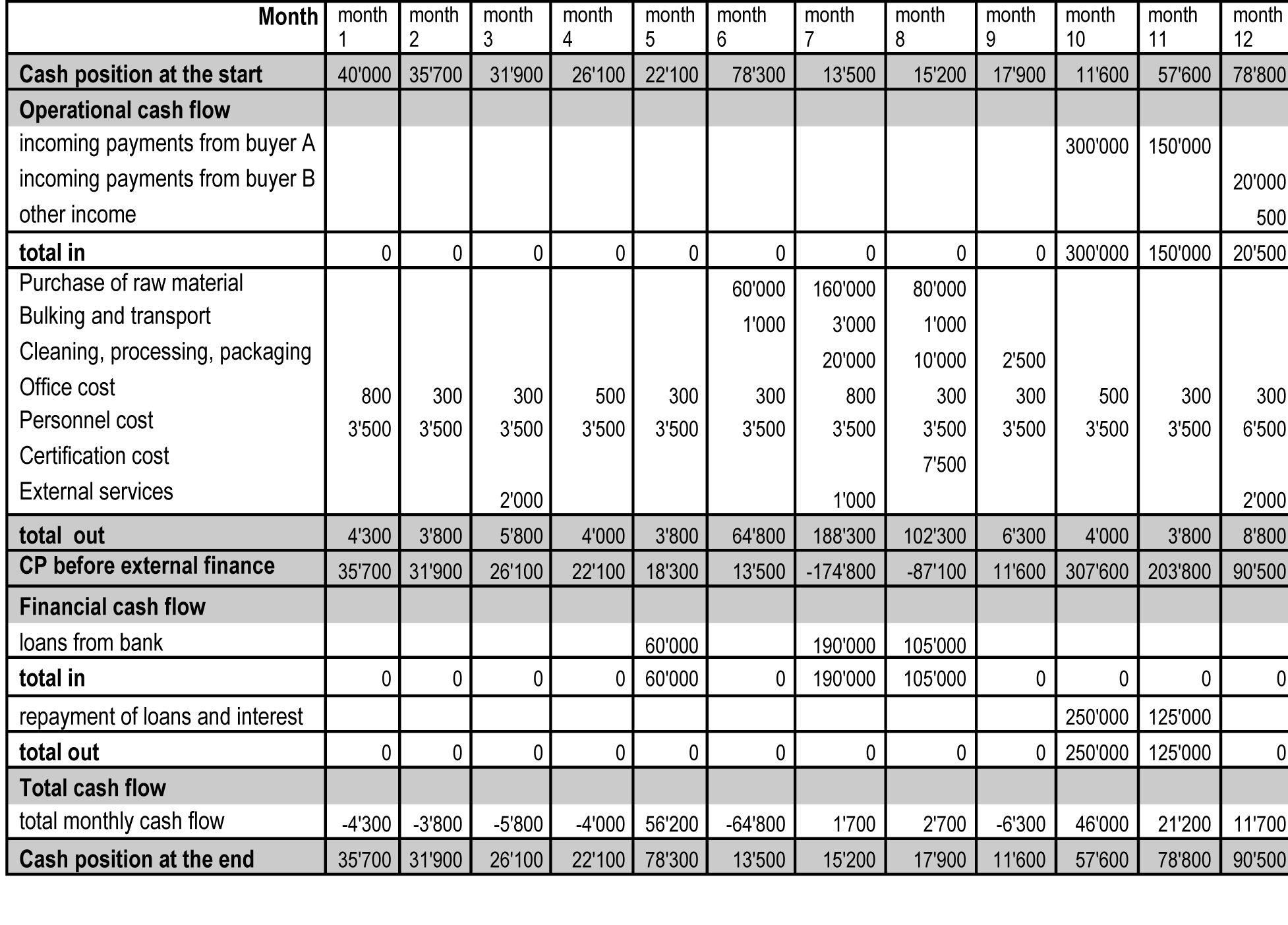

Cash flow refers to the net balance of cash moving into and out of a business at a specific point in time. Cash is constantly moving into and out of a business. The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

The purpose of a cash flow statement is to provide a detailed picture of what happened to a business’s cash during a specified period, known as the accounting period. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally. Trump’s cash, and will set his family business reeling.

The starting cash balance is necessary when leveraging the. Cash flow is a measure of a company’s net cash inflows and outflows. For positive cash flows, and to provide a return to investors, a.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). The cash flow statement is a standardized document that clarifies the state of a company's cash flow at a point in time. Measuring the amount of cash your business generates or spends is table stakes.

A company creates value for. A cash flow statement tells you how much cash is entering and leaving your business in a given period. Free cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric.

Cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. Cash flow is a measure of the money moving in and out of a business. The cfs highlights a company's cash management, including how well it generates.

It determines a business’s cash position and cash availability. Federal financial regulators are exploring allegations by two whistleblowers that cash app, the popular mobile payment platform, and entities providing transaction services to its users performed. Think of it as the vital fluid that keeps your business’s heart pumping, allowing you to cover expenses, pay employees, and invest in growth.

When you want to measure a business’s financial health, one of the first places to look is its cash flow. Engoron’s decision could drain all of former president donald j. Cash flow is the money that streams in and out of your small business—and it’s a key indicator of your company’s overall financial health.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources. C) to pik for a while. There were inflows of $16.1 billion to stocks, and $11.6 billion to bonds, compared to outflows of $18.4 billion from cash, the most in eight weeks, bofa said in its weekly roundup of fund flows.

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)