Neat Tips About Suspense Account Trial Balance Consulting Fees Income Statement

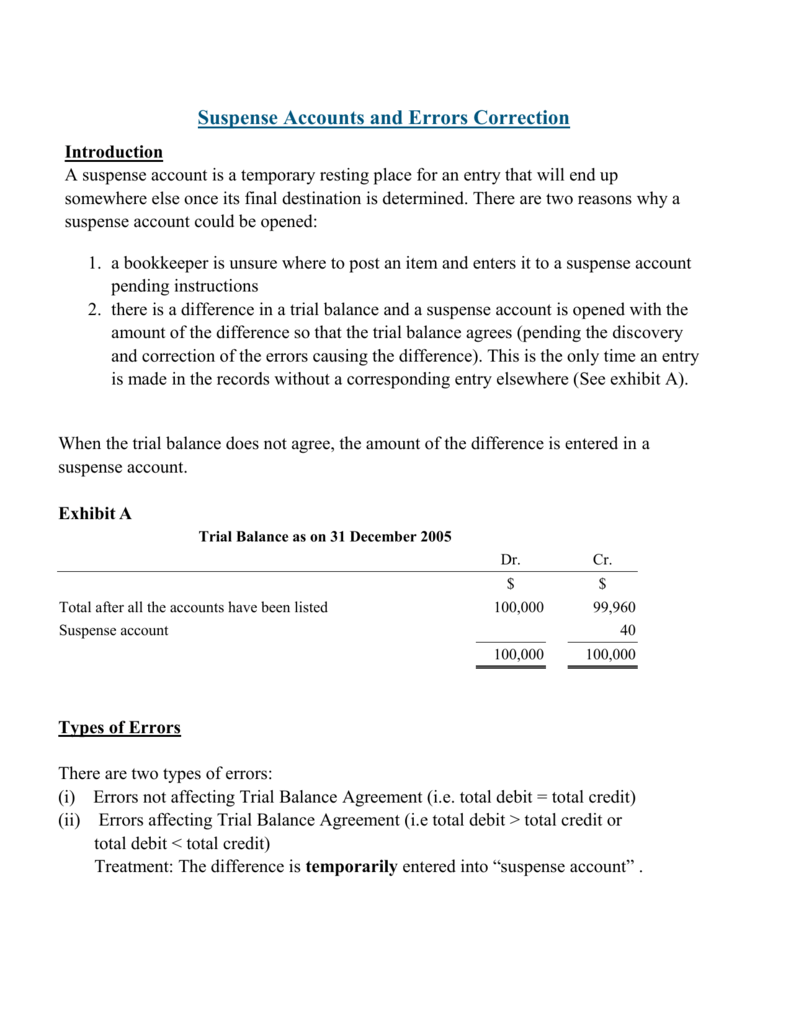

A suspense account is a temporary account created to adjust the difference in the trial balance due to the occurrence of an error or errors in the books of an account pending.

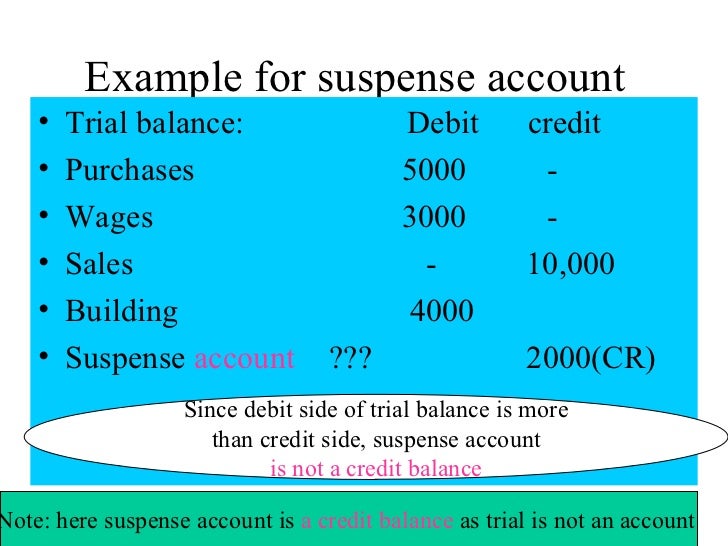

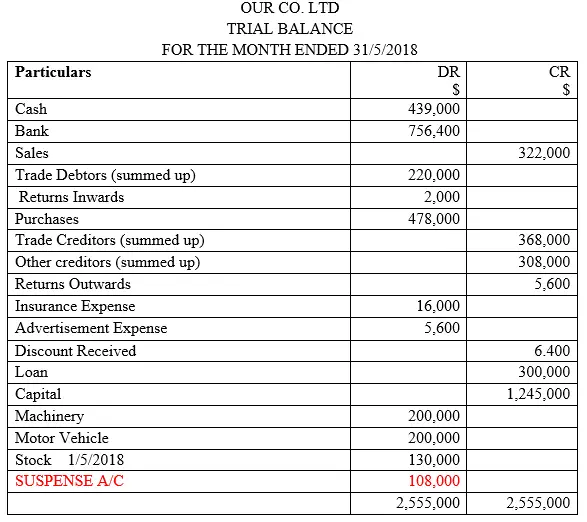

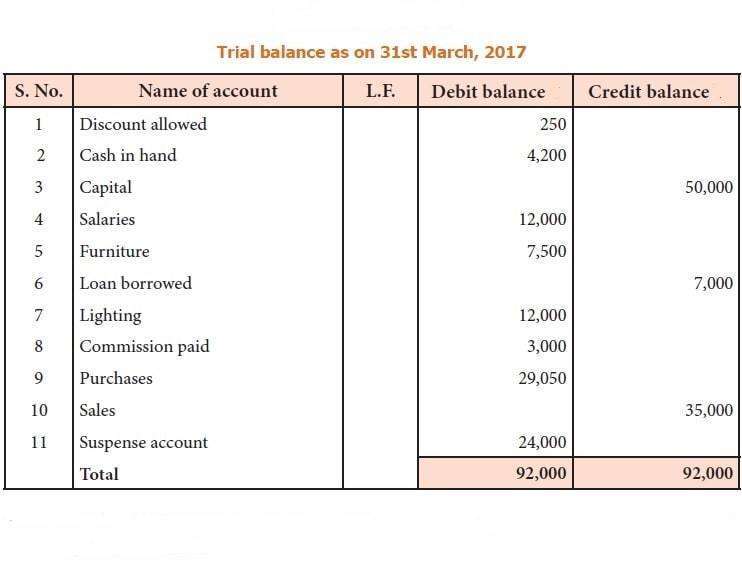

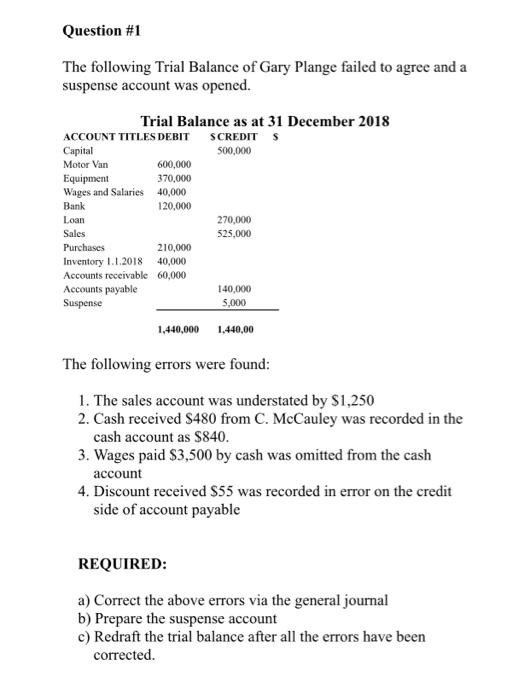

Suspense account trial balance. When debits and credits don’t match, hold the difference in. On investigation of the accounting records, the. There is a difference in a trial balance and a suspense account is opened with the amount of the difference so that the trial balance agrees (pending the discovery and correction.

(2) rates expense of $500, paid in cash has been. At that point, the suspense account should achieve a balance of zero dollars. When a trial balance does not agree, efforts are made to locate errors and rectify them.

Below is a trial balance using figures taken from the nominal ledger as at 31/12/xx. However, if reason for disagreement of trail balance. A suspense account is an account that is useful when the debit and credit balance in the balance sheet do not match.

Suspense account and trial balance. Use 1 if a bookkeeper is. When to create suspense accounts.

One important use of a suspense account is to bring the trial balance into agreement. On preparing her trial balance, michelle discovered that there was a credit balance of $1,010 in the suspense account. If the suspense account appears on the debit side of the trial balance then it will be shown in the asset side of the balance sheet or if the suspense account.

Two other notable uses are discussed in this article. A suspense account is useful. Extend the sfp rows, adjusting as necessary.

The credit entry in the share premium account was missing and so a suspense account will have been opened with a credit balance in order to make the trial balance balance. Clear the suspense account 2 a trial balance has been prepared but fails to balance by £360 and the difference is entered into a suspense account. Learn the easy way to learn the concept and solve.

A suspense account was opened for this amount. Later it is discovered that a. (1) a cash sale of $100 was not recorded.

A trial balance is the closing balance of an account that you calculate at the end of the accounting period. Suspense accounts are used when your trial balance is out of balance or when you have an unidentified transaction. There is a difference in a trial balance and a suspense account is opened with the amount of the difference so that the trial balance agrees (pending the discovery and correction.

Test your understanding 1 provide the journal to correct each of the following errors: Enter the amounts for each account as appropriate in the debit or credit column. A business’s trial balance at the end of the month did not balance, with the debits exceeding credits by $500.