Top Notch Tips About The Dupont Equation Partnership Financial Statements Example

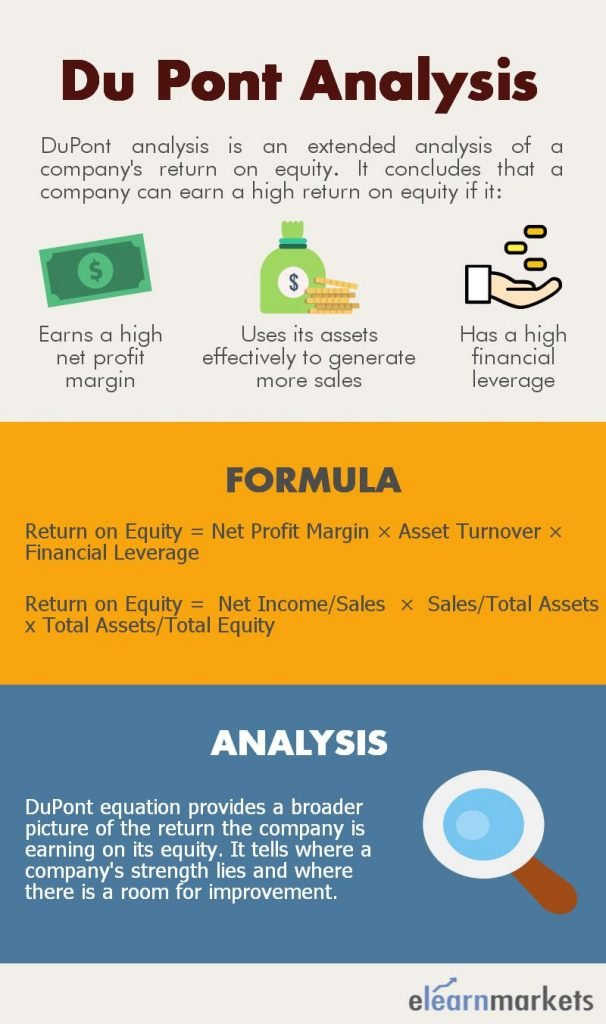

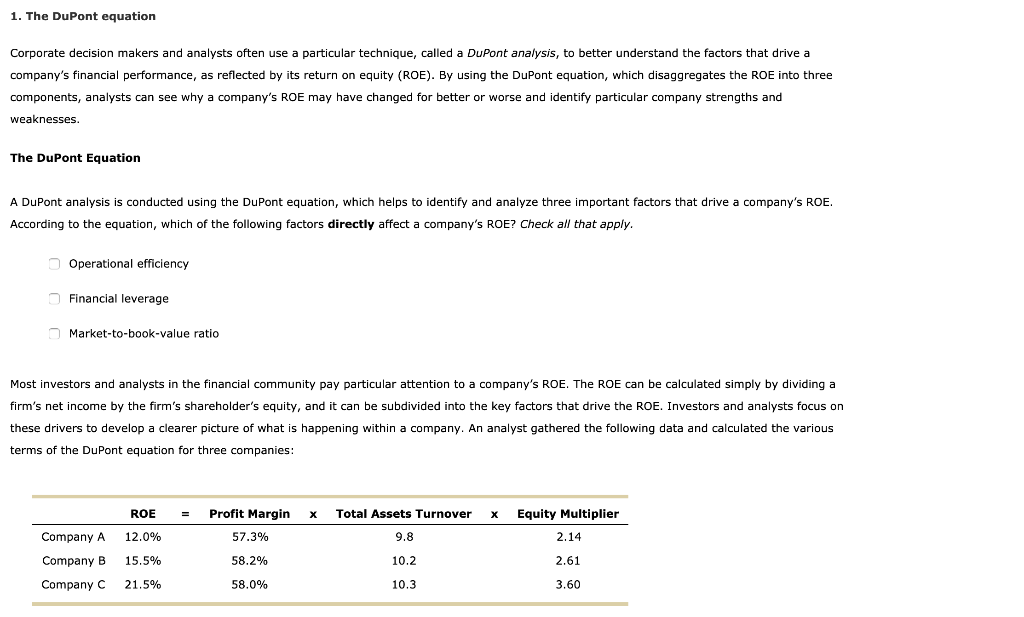

According to dupont’s analysis model, three metrics drive the roe:

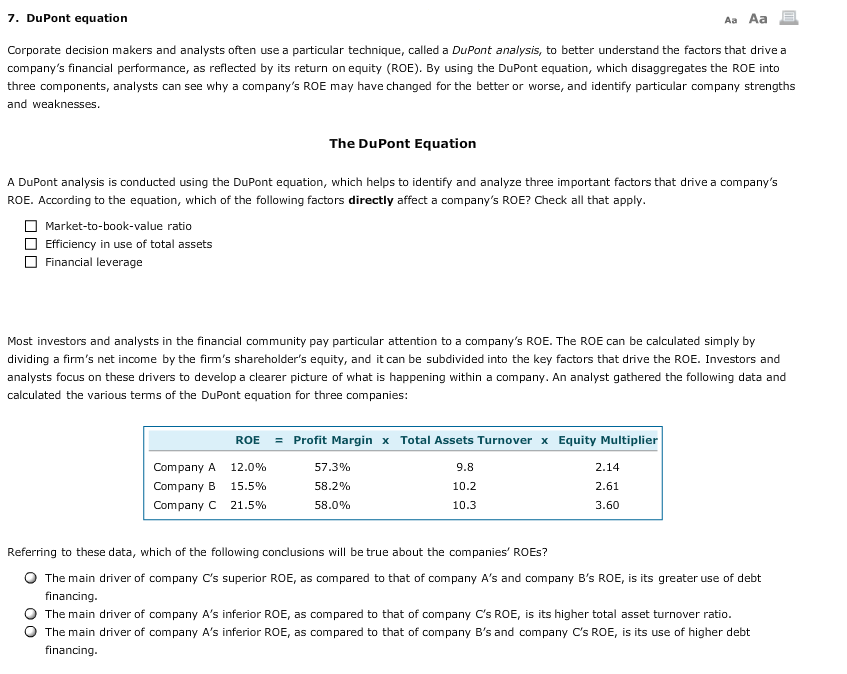

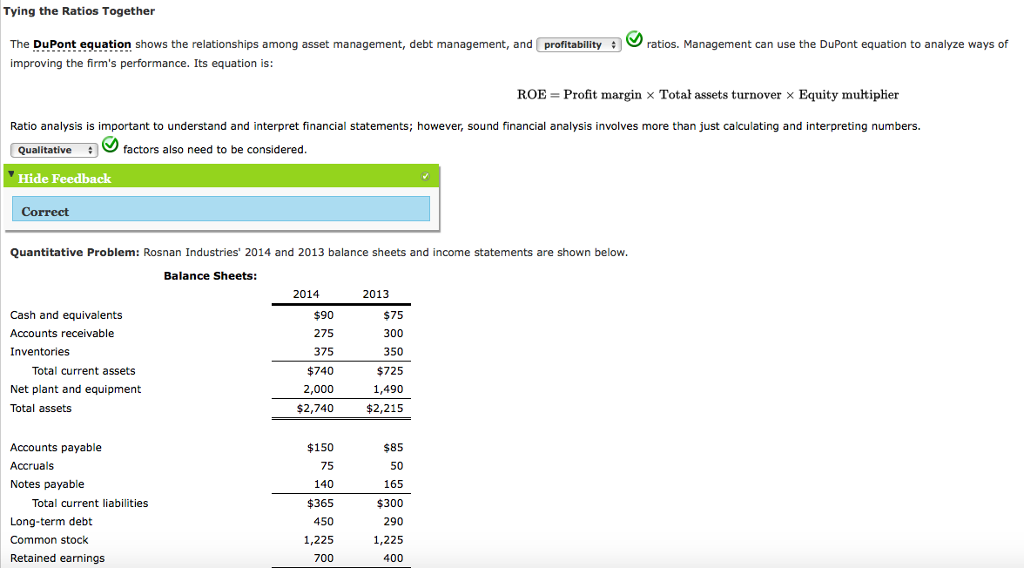

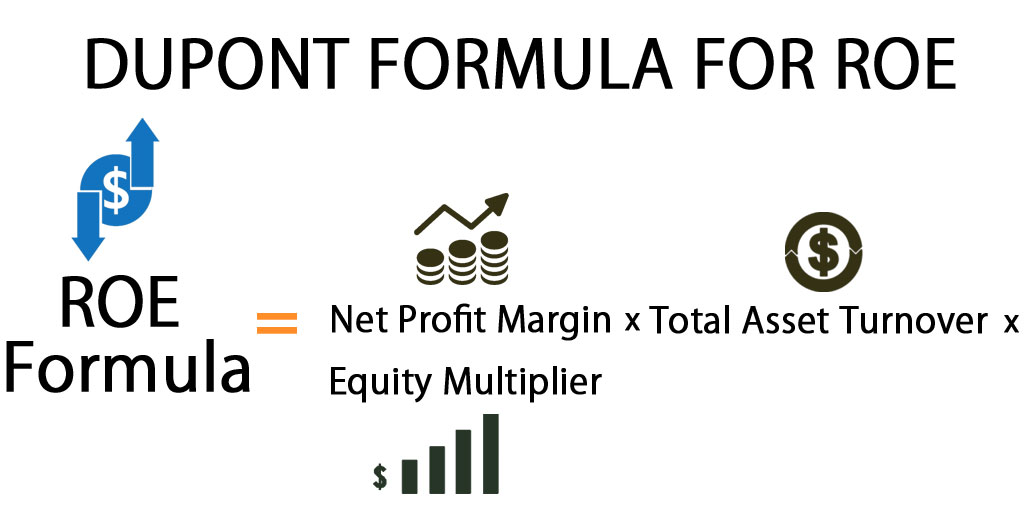

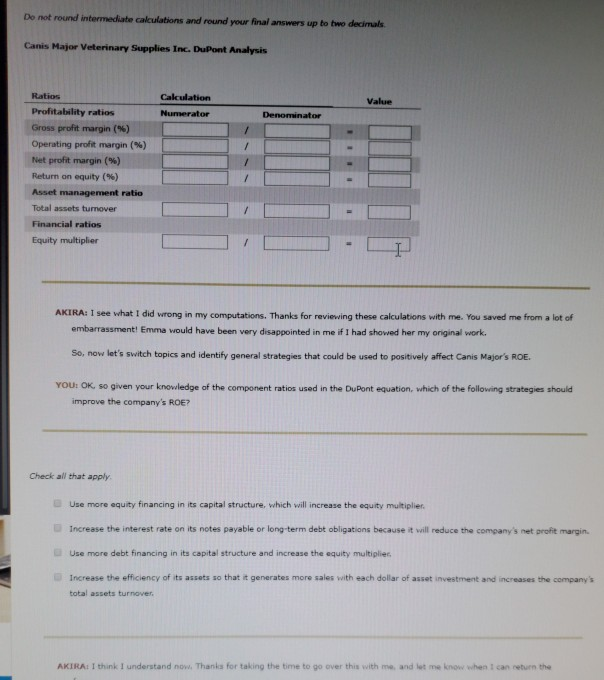

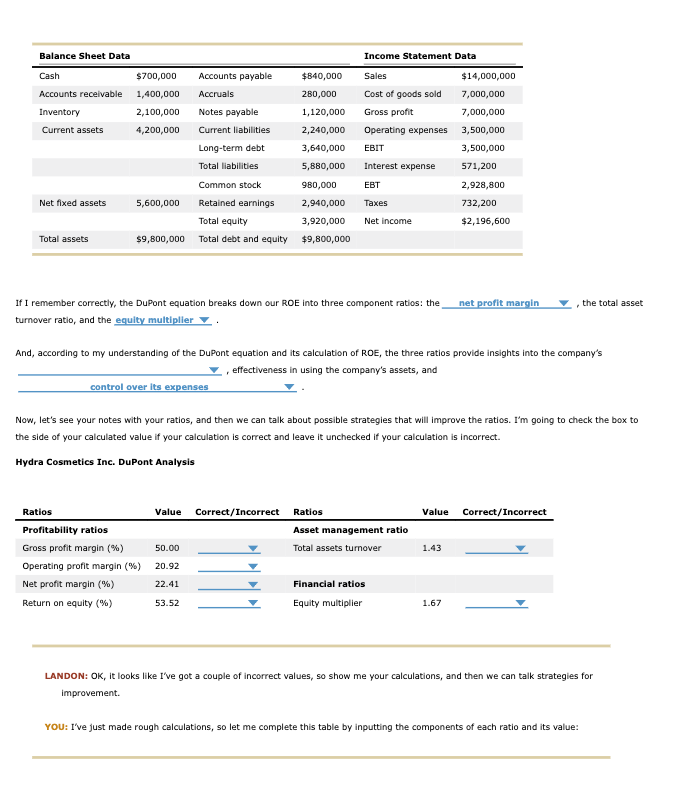

The dupont equation. It evaluates the contribution of different factors, such as profitability, leverage, and efficiency, to a. Roe = profit margin ×total asset turnover ×equity multiplier roe = profit margin × total asset turnover × equity multiplier. Profit margin, asset turnover, and leverage.

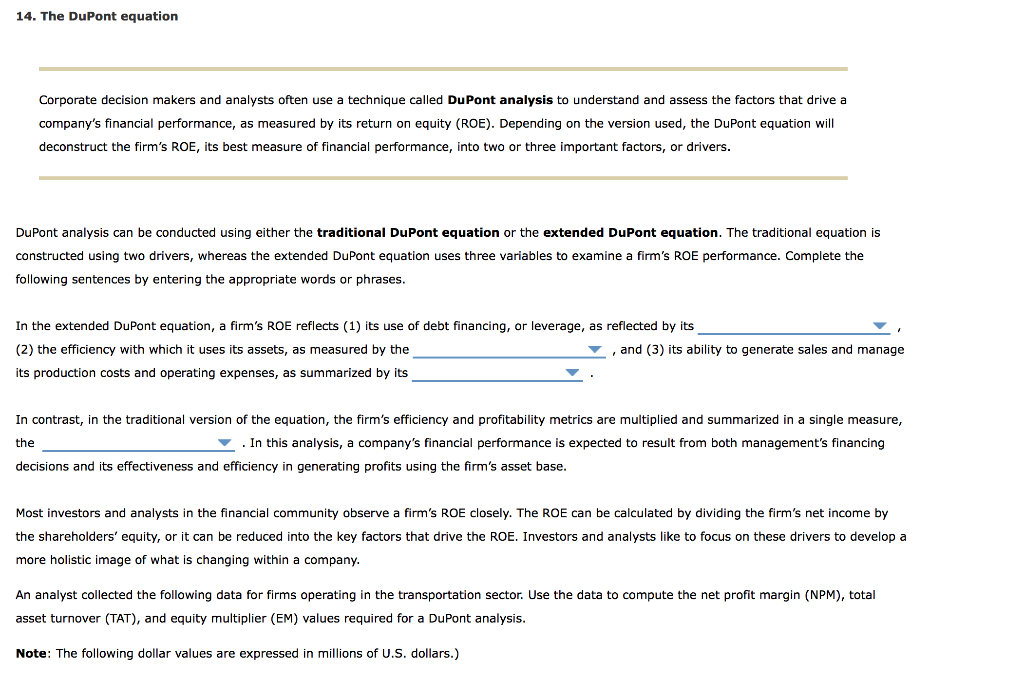

The larger these components, the more productive the business is. It is a top down approach to analyze existing operations. Dupont analysis (also known as the dupont identity, dupont equation, dupont framework, dupont model, dupont method or dupont system) is a tool used in financial analysis, where return on equity (roe) is separated into its component parts.

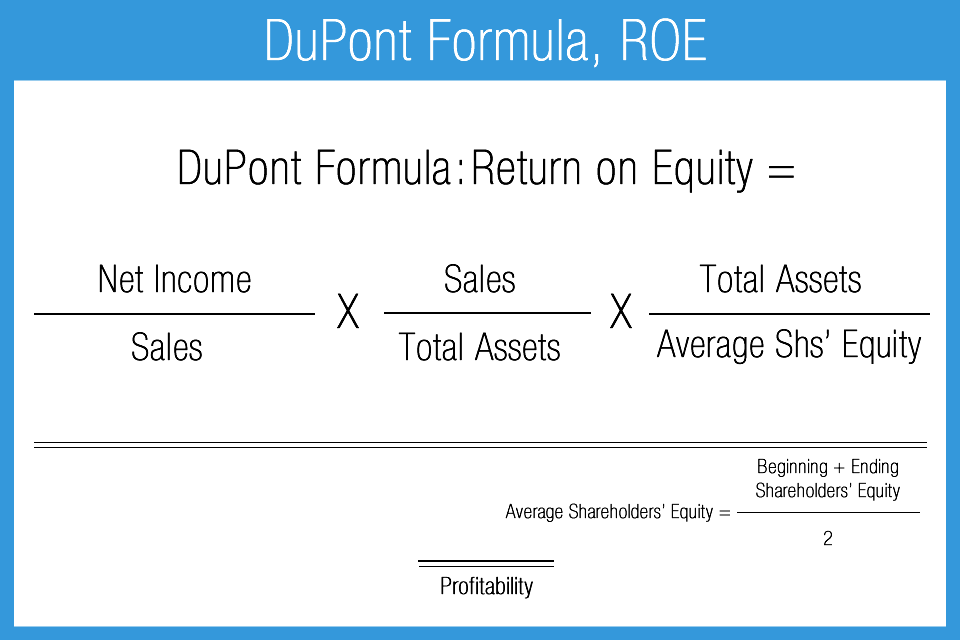

As you can see, the dupont equation is simply a multiplication of three different ratios. Profit margin x asset turnover x equity multiplier = dupont equation (or return on equity) if you break down the components in the dupont method into their respective ratios, the. Dupont analysis = net profit margin × at × em where:

The dupont equation is an expression which breaks return on equity down into three parts: This represents the company's ability to turn revenues into profits. Using the dupont method, return on equity looks like this:

Dupont’s arrival could propel them to a first title since 2005. Components of dupont analysis the dupont analysis is composed of three ratios: This is known as the dupont method.

It allows you to decompose a company's return on equity (roe) into several powerful financial ratios to help you understand the company's underlying strengths. The dupont equation. The first two components assess the operations of the business.

This video covers dupont analysis and the dupont method.📈 nee. The formula can be expressed as follows: The dupont equation can be written as follows:

In the dupont equation, roe is equal to profit margin multiplied by asset turnover multiplied by financial leverage. Let’s take a closer look at each of these ratios and see how they contribute to roe. Asset turnover = revenue ÷ average total assets;

Cars wait in traffic near formula one las vegas grand prix grandstands on south koval lane monday, oct. The dupont formula is based on accounting figures and connects the lines in the financial statement to obtain basic kpis like gross margin, ebit and profit margin as well as mixed ratios like asset turnover and return on capital combining the p&l and balance sheet figures. 2 the dupont method can be expressed using this formula:

In the dupont equation, roe is equal to profit margin multiplied by asset turnover multiplied by financial leverage. The dupont analysis also called the dupont model is a financial ratio based on the return on equity ratio that is used to analyze a company’s ability to increase its return on equity. Dupont's analysis formula, also known as the dupont framework or dupont equation, is a useful investing technique to analyze a company's competitiveness.