Spectacular Tips About Asc 842 Balance Sheet Presentation Debit Of Profit And Loss Account In

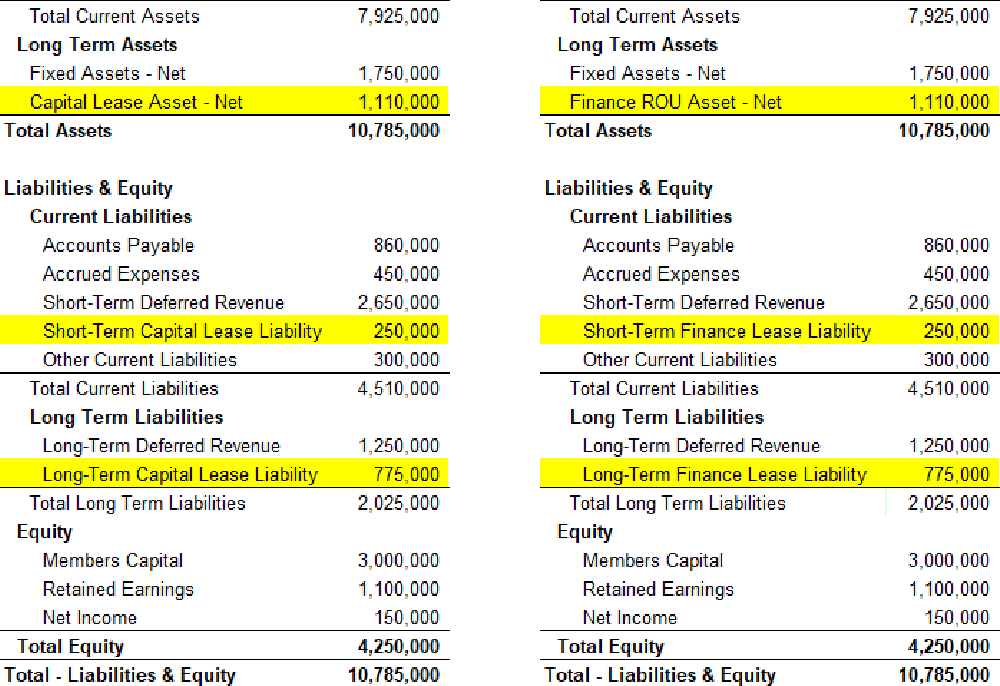

Accounting for leases under asc 842 updated september 2021 bdo knows presentation and disclosures overview during the project leading to the new lease.

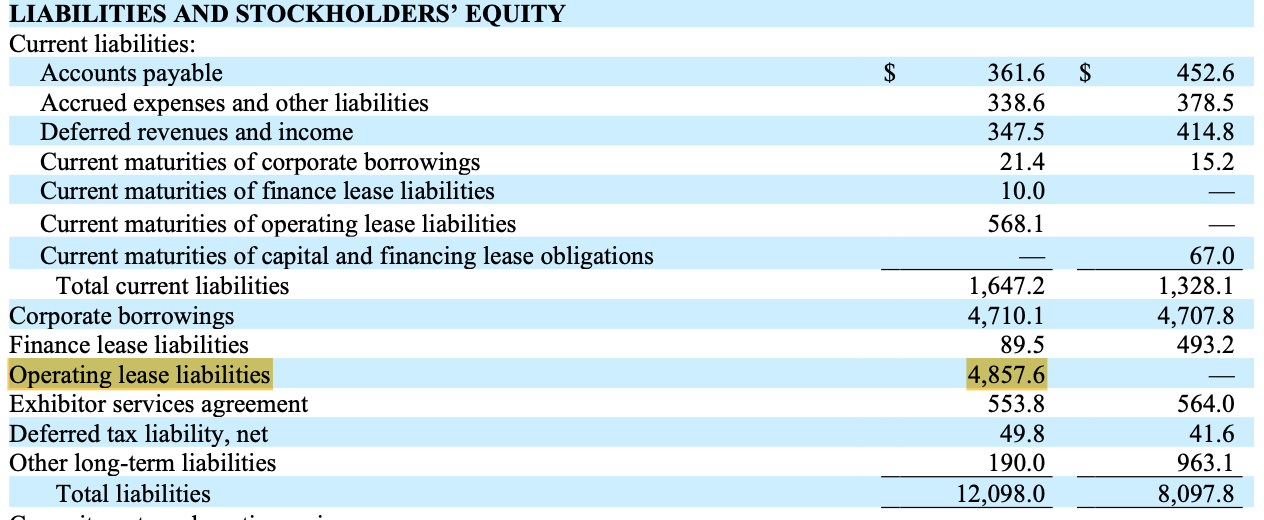

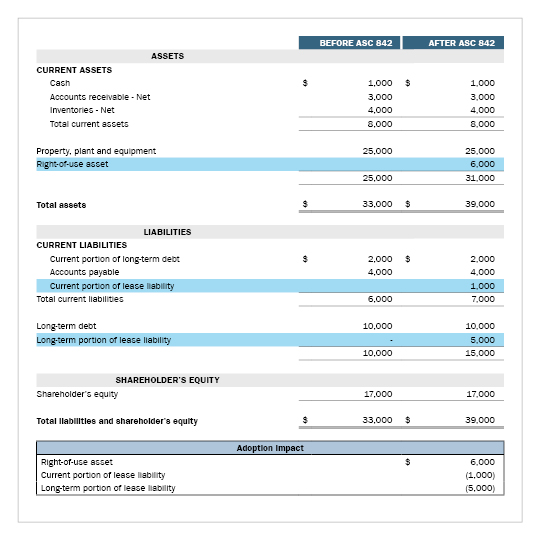

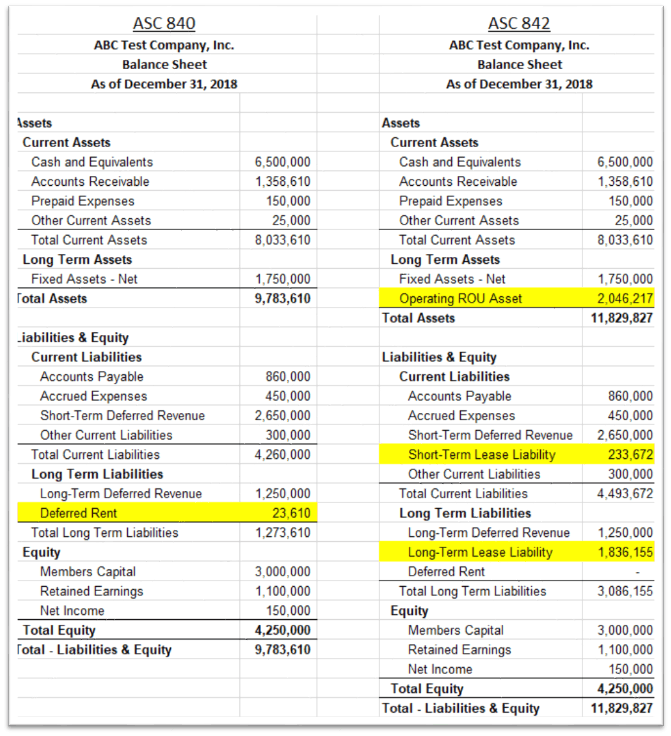

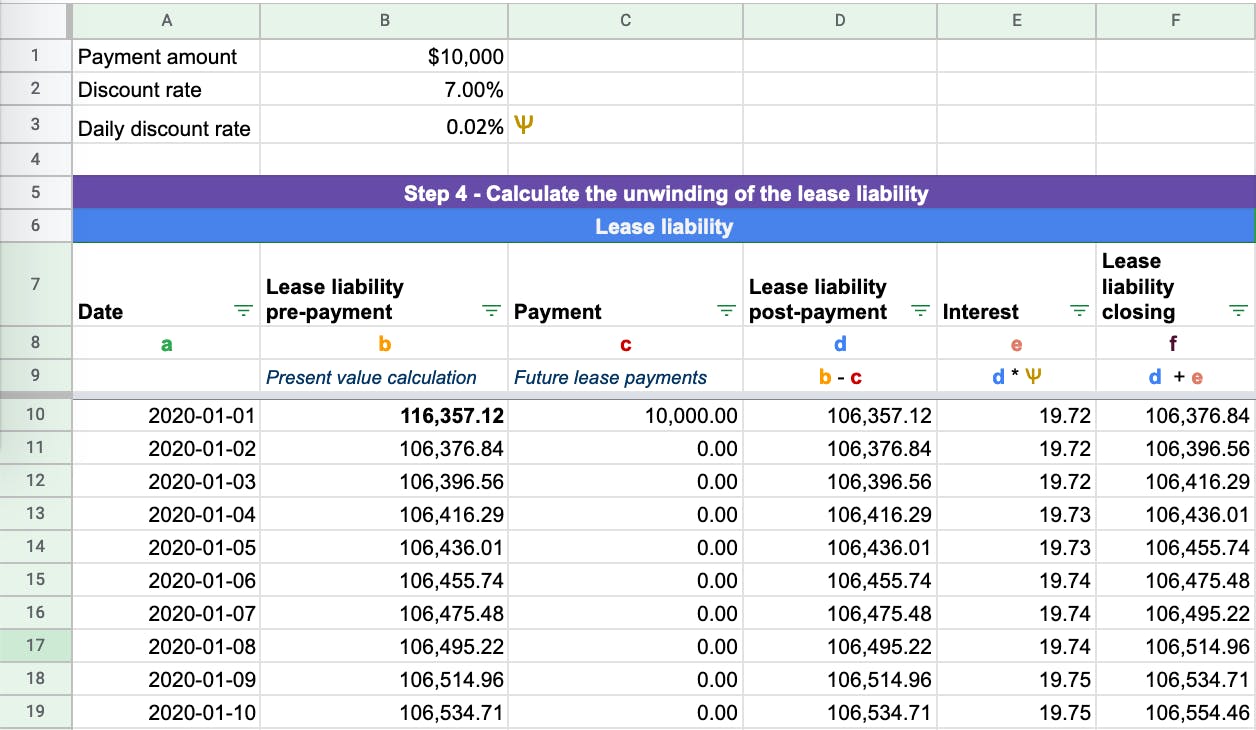

Asc 842 balance sheet presentation. Most nonpublic companies will be required to adopt asc 842 (or the “new standard”) in 2022. According to the new standard, the objective of the disclosure requirements of asc 842 is to “enable users of financial statements to assess the amount, timing, and uncertainty of. The entity’s presentation of leases on its balance sheet, income statement and cash flows statement and the disclosures required of lessees and lessors under.

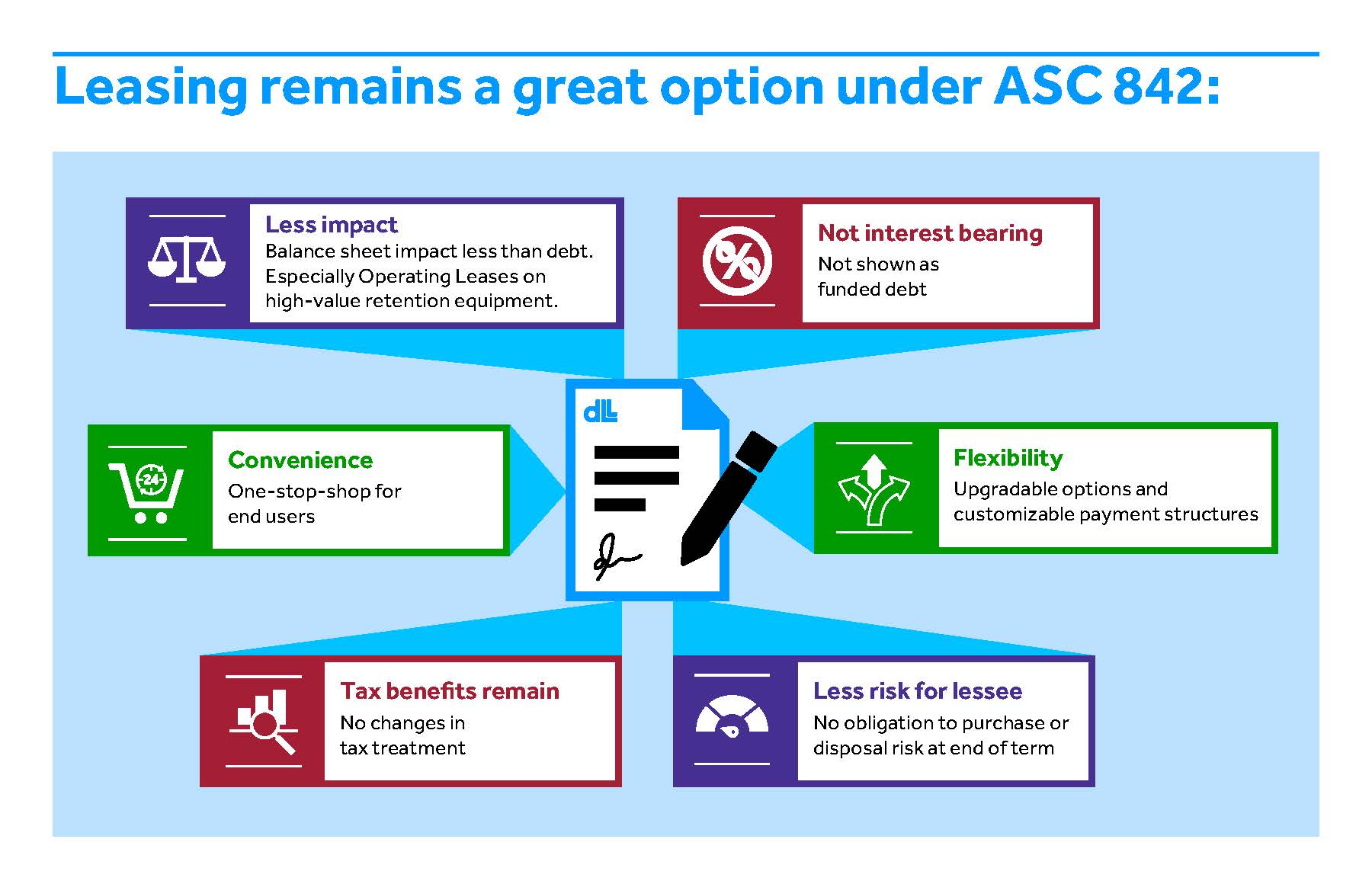

For a comprehensive discussion of the lease accounting guidance in asc. As discussed above, asc 842 requires all leases, including operating leases, be recorded on the balance sheet. Richard stuart, partner, national professional standards group, rsm us llp.

A guide to lessee accounting under asc 842 prepared by: Key balance sheet measures and ratios may change, it.

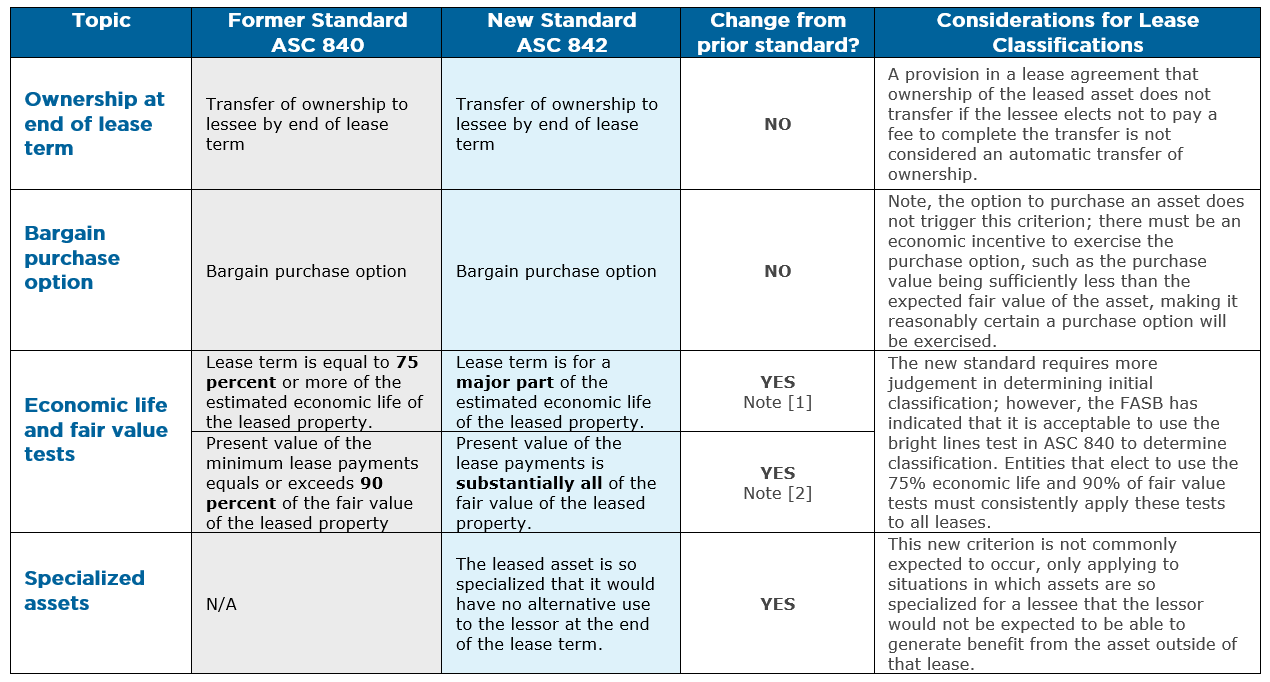

842 may follow the same transition requirements used to apply topic 842 or may. Asc 842 balance sheet changes: The definition of a lease in asc 842 is “a contract, or part of a contract, that conveys the right to control the use of identified property, plant, or equipment (an.

Under asc 842, all leases 12 months and longer must be identified on the balance sheet. Private company asc 842 adoption: A quick reference by marc betesh september 8, 2021 lease accounting are you beginning to plan for your transition to.

Learn how to comply with the new leasing standard asc 842 for lessees and lessors, which requires separate presentation of rou assets and lease liabilities on the. Asc 842 offers practical expedients that can be elected by certain entities or in certain arrangements. Furthermore, both the lessor and lessee are required to identify these.

In this report, we will cover the guidance in fasb asc 842 related to presentation in the balance sheet, income statement, and statement of cash flows. This new requirement affects both assets. The guidance in asc 842 should generally be applied as follows: