Looking Good Info About Advance Salary In Balance Sheet Information The Income Statement Helps Users To

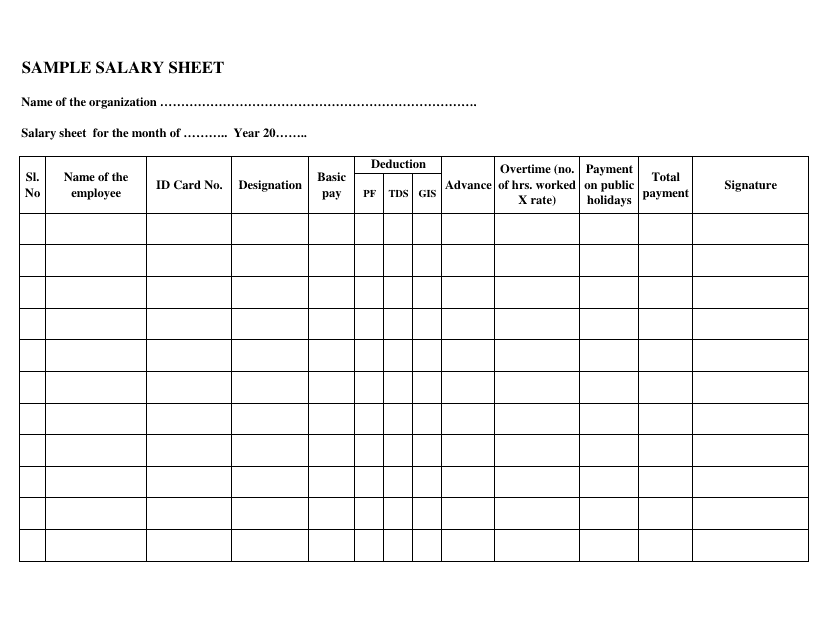

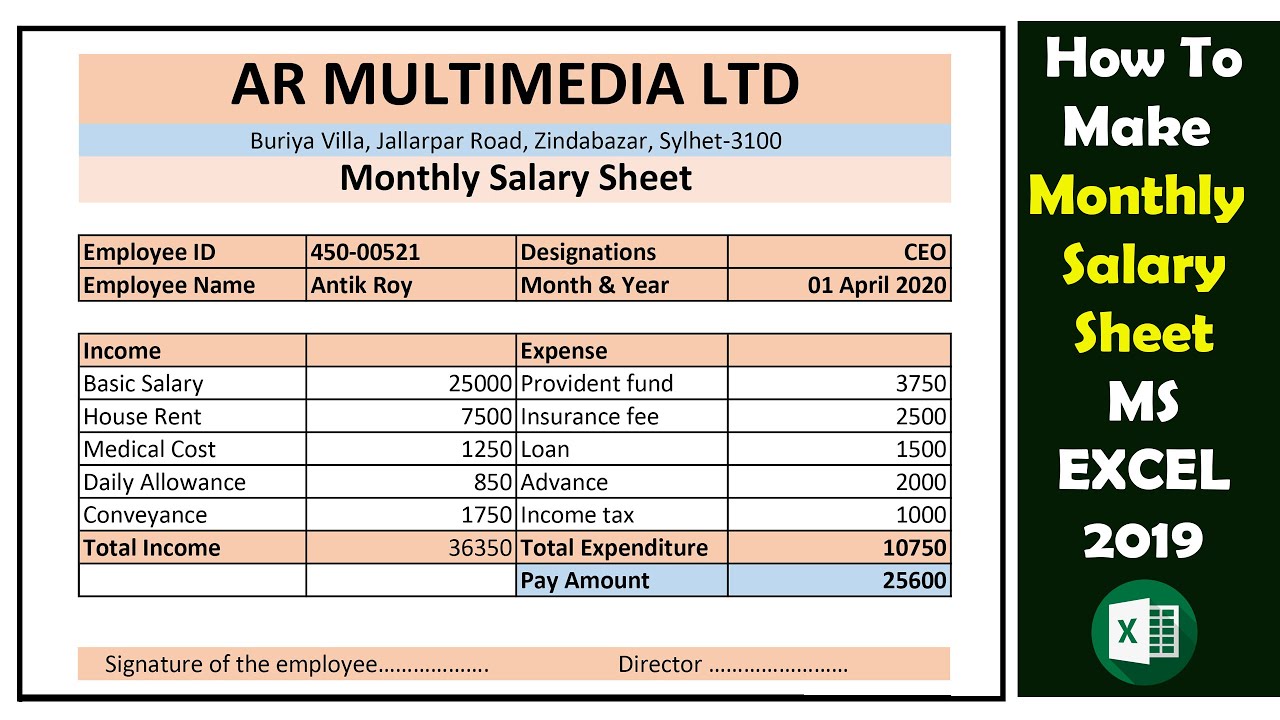

Salary paid in advance journal entry.

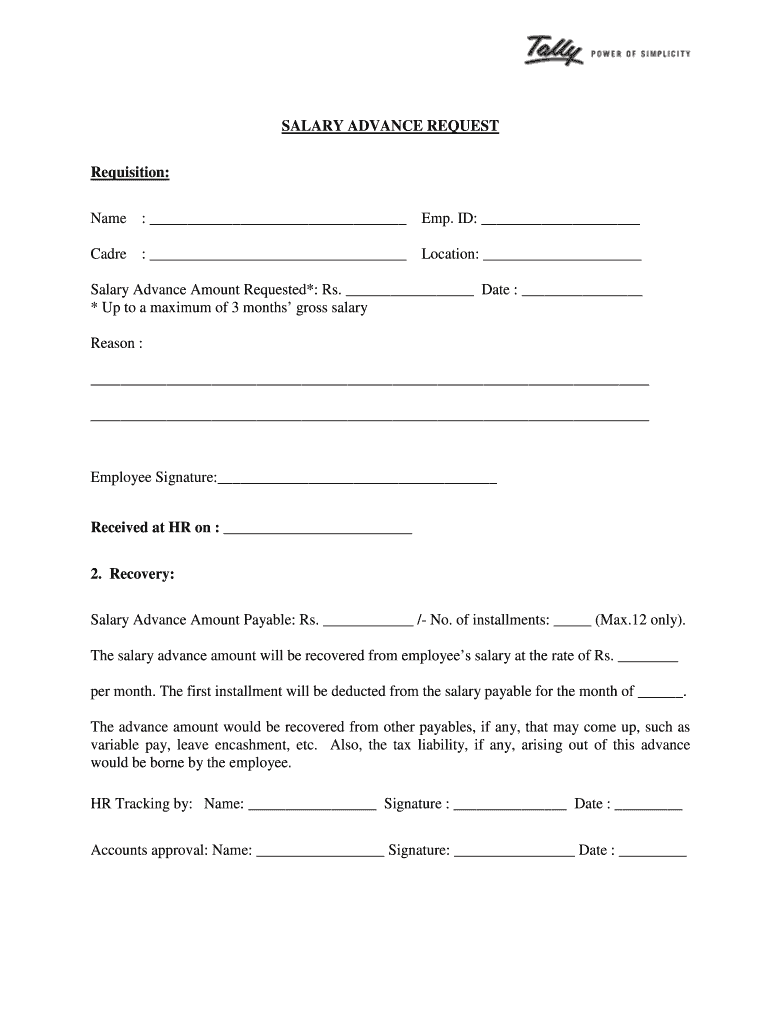

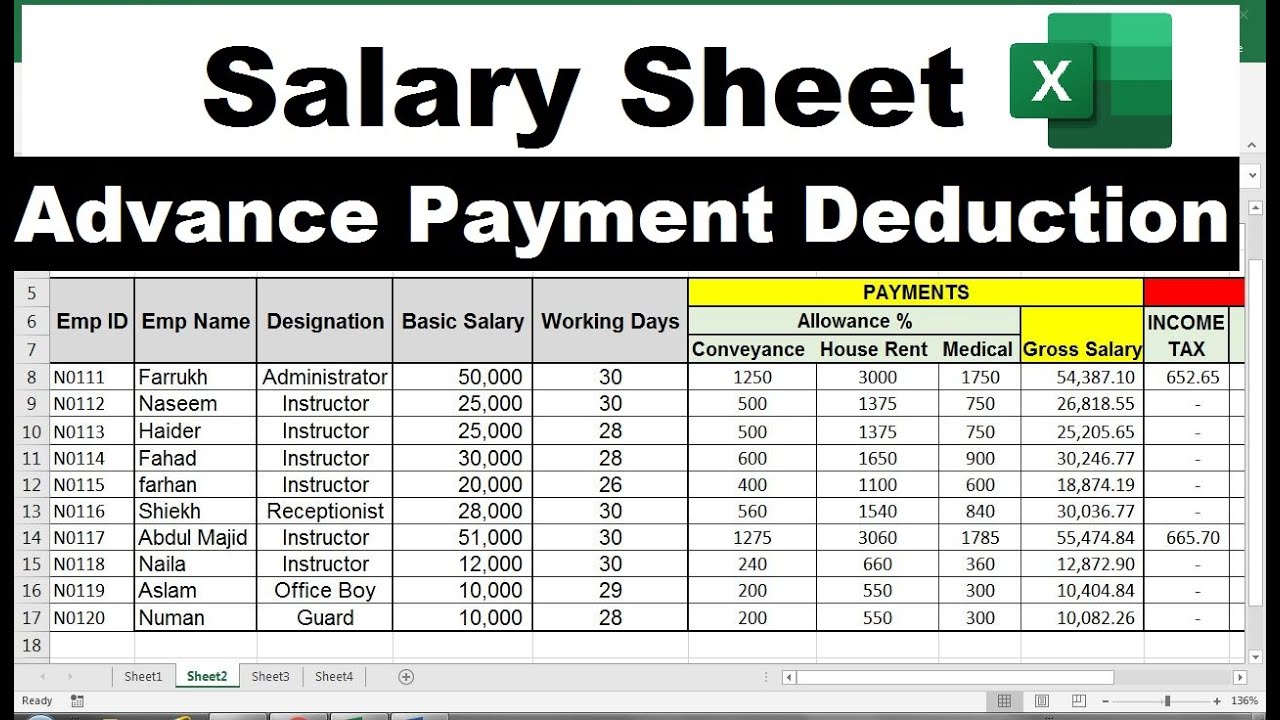

Advance salary in balance sheet. Published on 26 sep 2017. This journal entry does not affect the income statement. The company agrees to lend the employee $800 and to withhold $100 per week from the employee's weekly payroll checks until the $800 is repaid.

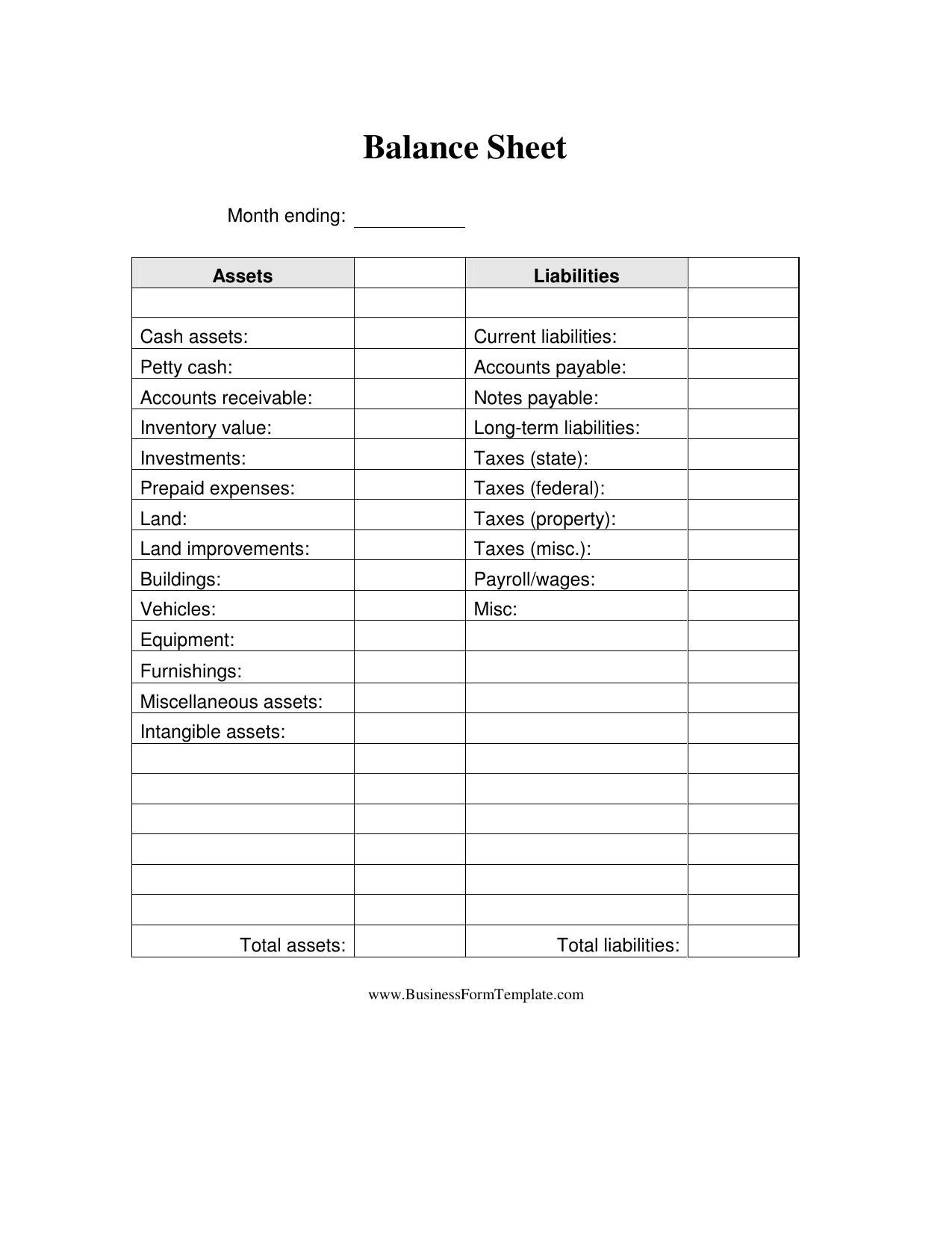

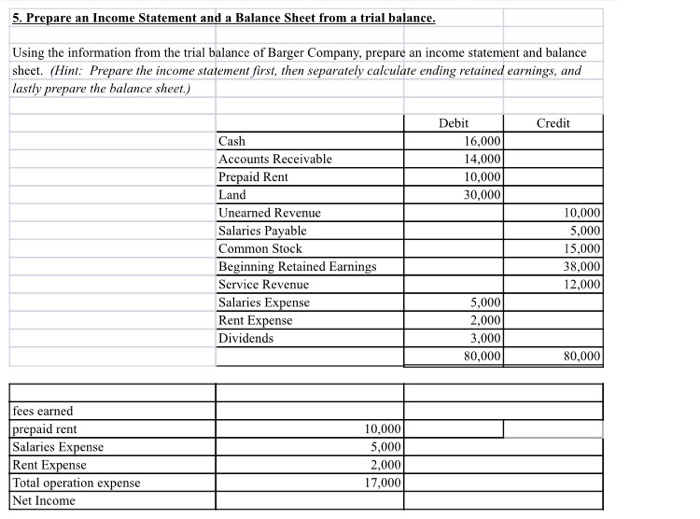

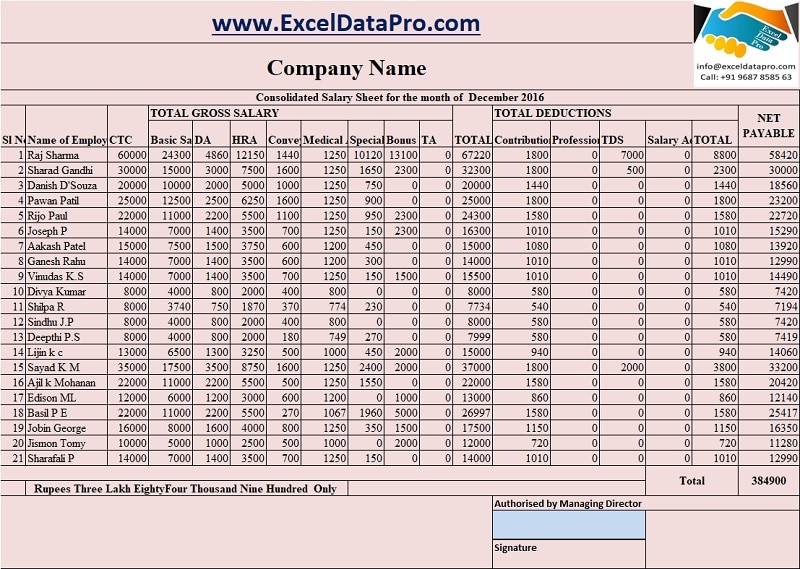

It is further shown under the head current asset in the balance sheet. The salary expense $ 11,000 will appear on the income statement and cash $ 11,000 will deduct from the cash account on balance sheet. Where does revenue received in advance go on a balance sheet?

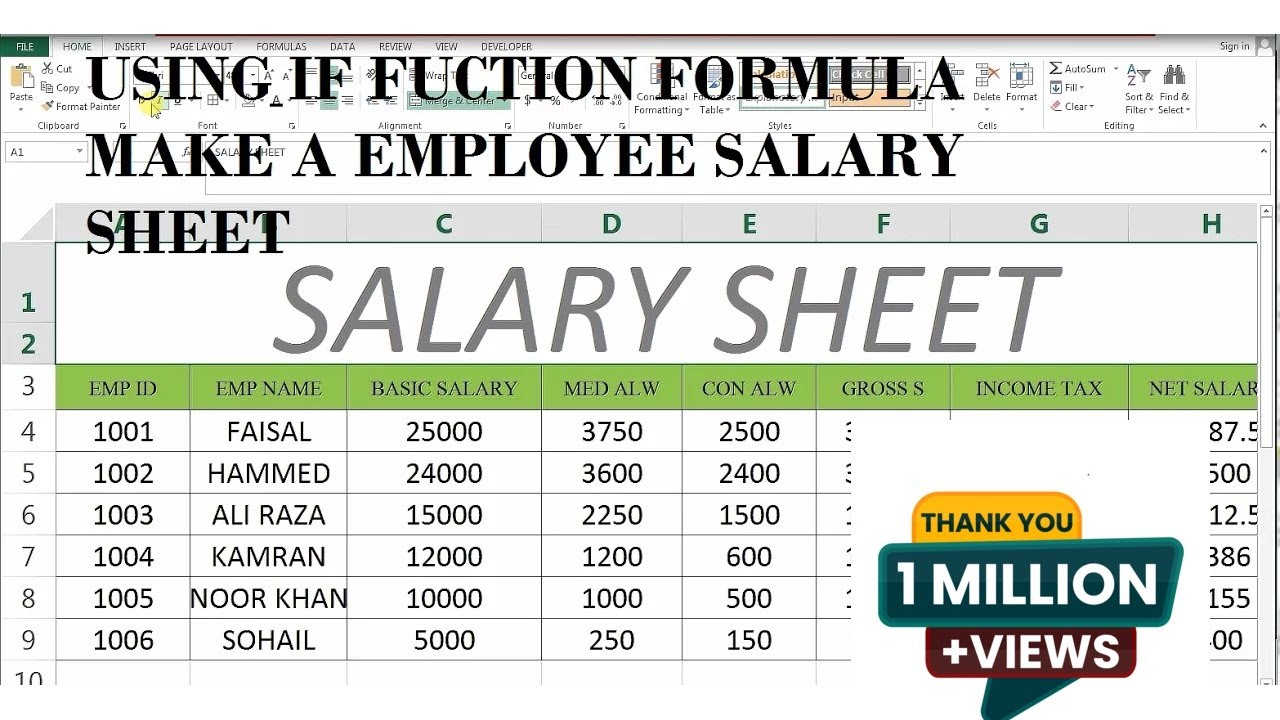

Journal entry (being salary paid in advance/ prepaid salary adjusted at the. The recording of accrued salaries journal entry is done in line with the accounting equation, which requires a liability to be stated under the liabilities section of the balance sheet. Journal entry for income received in advance also known as unearned income, it is income which is received in.

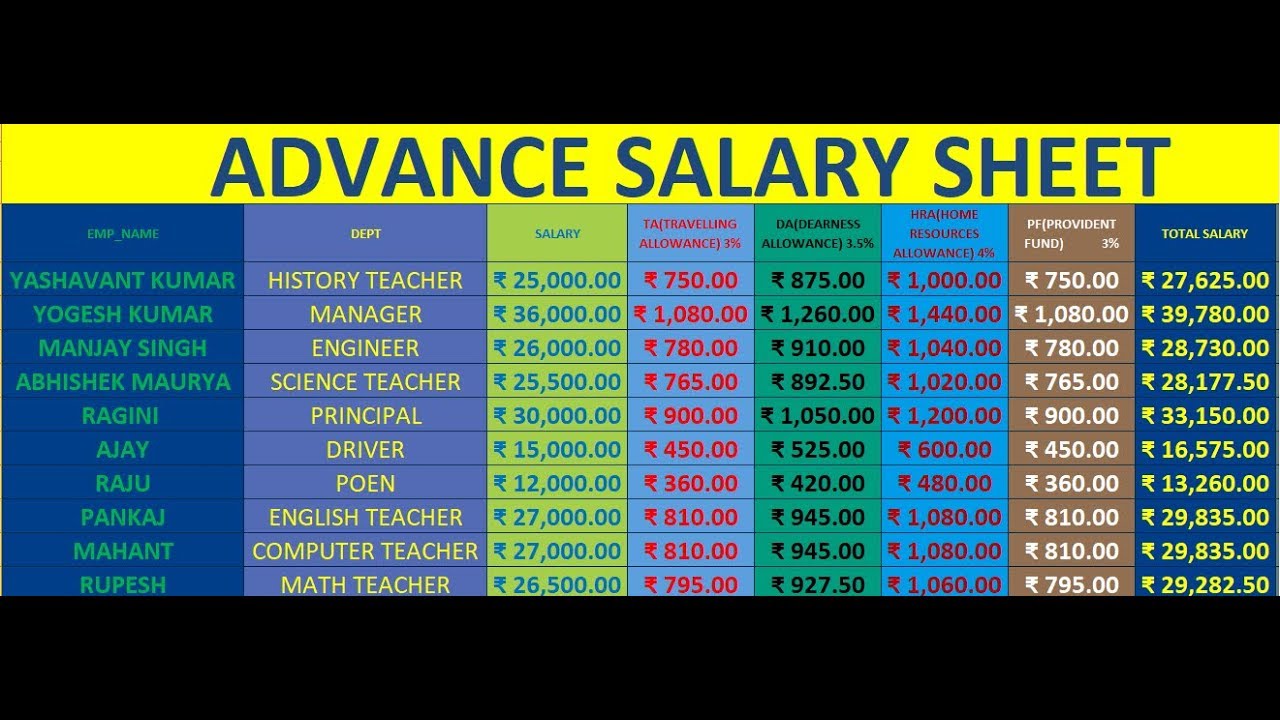

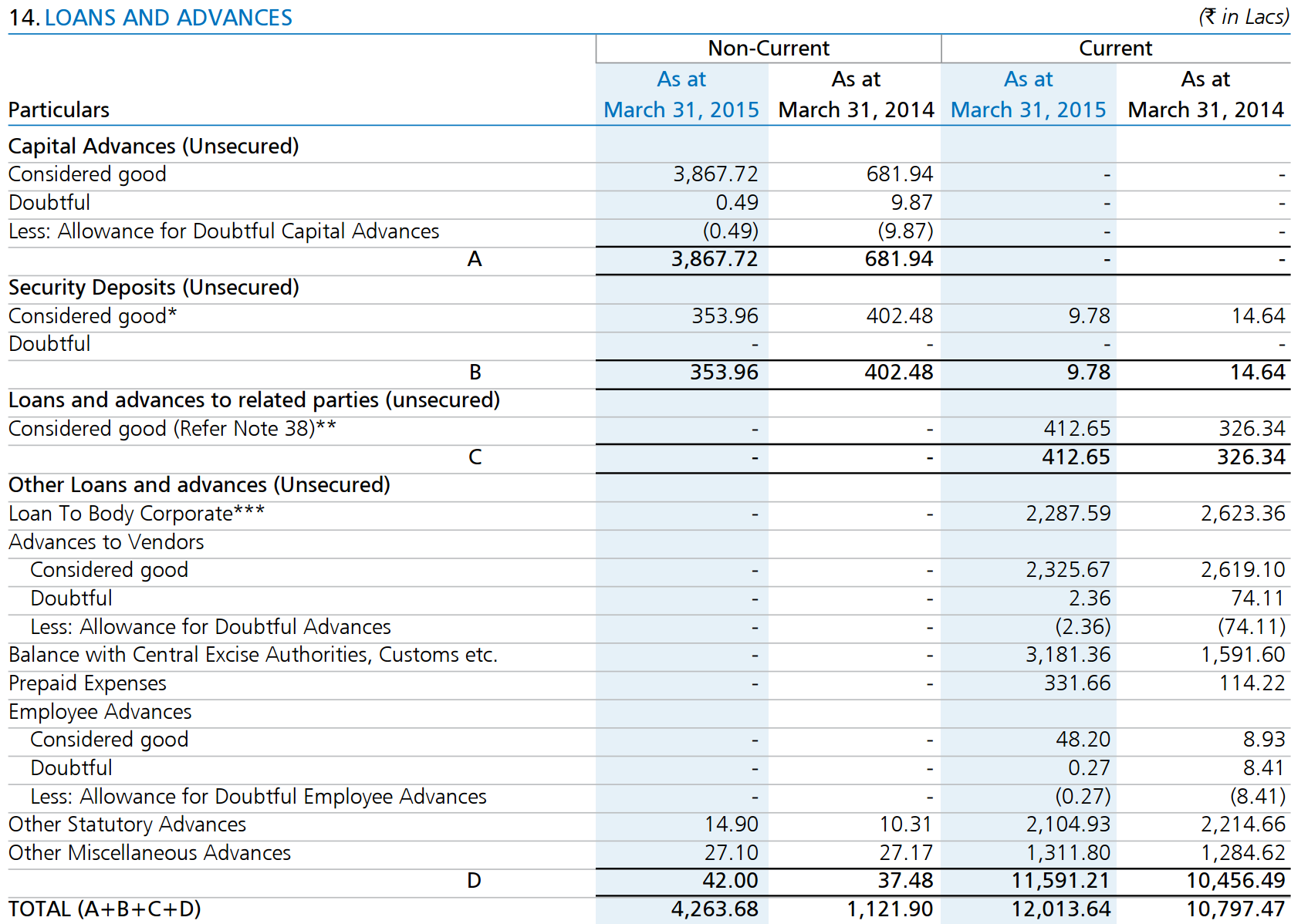

Loans and advances are general descriptions of debt obligations companies owe and must show on their balance sheet as part of total. Advance payments are recorded as assets on a company's balance sheet. So, unpaid salary to be shown as liability under ‘expenses payable’ or ‘salary payable’ in the balance sheet on.

As such, it is recorded as a current asset in the company's balance sheet. Salary payable can be attributed to the type of payroll journal entry that shall be used to record in the books of account the compensation which shall be paid to the employees. The company will debit the.

Hence, advances to employees and officers can be found in the current assets section on the balance sheet. Advances to employees can be listed on the balance sheet as. As per the matching concept, salary is due but not yet paid.

In the normal course of business, some of the expenses may be paid in advance. Advance payments affect the balance sheet balance sheeta balance. In the case of advance salary, the employee has not provided services for the entire month.

Before you start the process of requesting a salary advance, take some time to carefully think about your situation in its entirety. As these assets are used, they are expended and recorded on the income statement for the. Definition of revenue received in advance under the accrual basis of accounting, revenues received in.

Salaries payable is a liability account and will increase total liabilities and equity by $1,500 on the balance sheet. The company can make the journal entry for advance salary by debiting the advance salary account and crediting the cash account. What is the journal entry for income received in advance?

Advance to employees is usually in the form of salary paid in advance. However, the organization may not receive the benefits from these expenses by the end of the. It is presented as a current asset in the balance sheet, as it is an advance payment made by the firm.