Inspirating Info About Cash Flow Projection Chart Yearly Template Excel

Cash flow projections are often used to run potential outcomes in order to estimate the impact of a given decision, while forecasts are more literal.

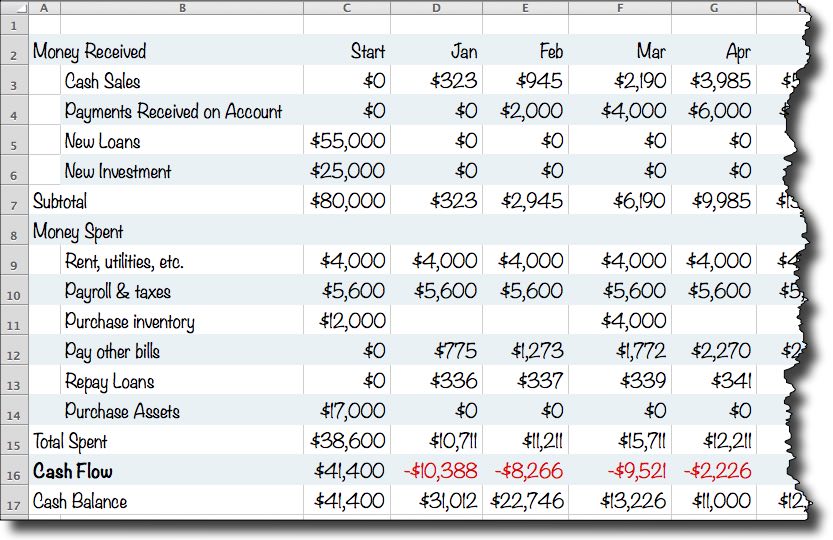

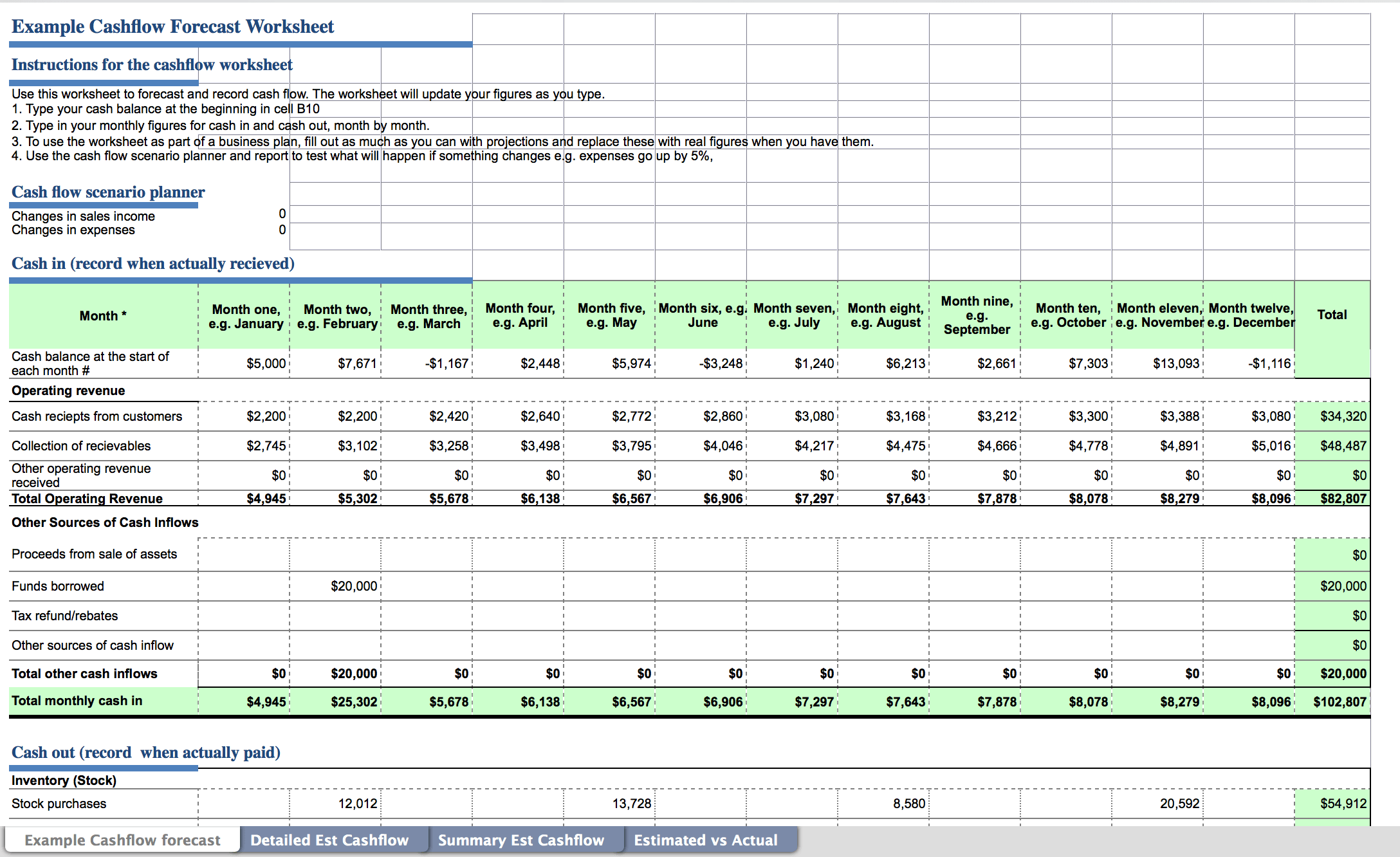

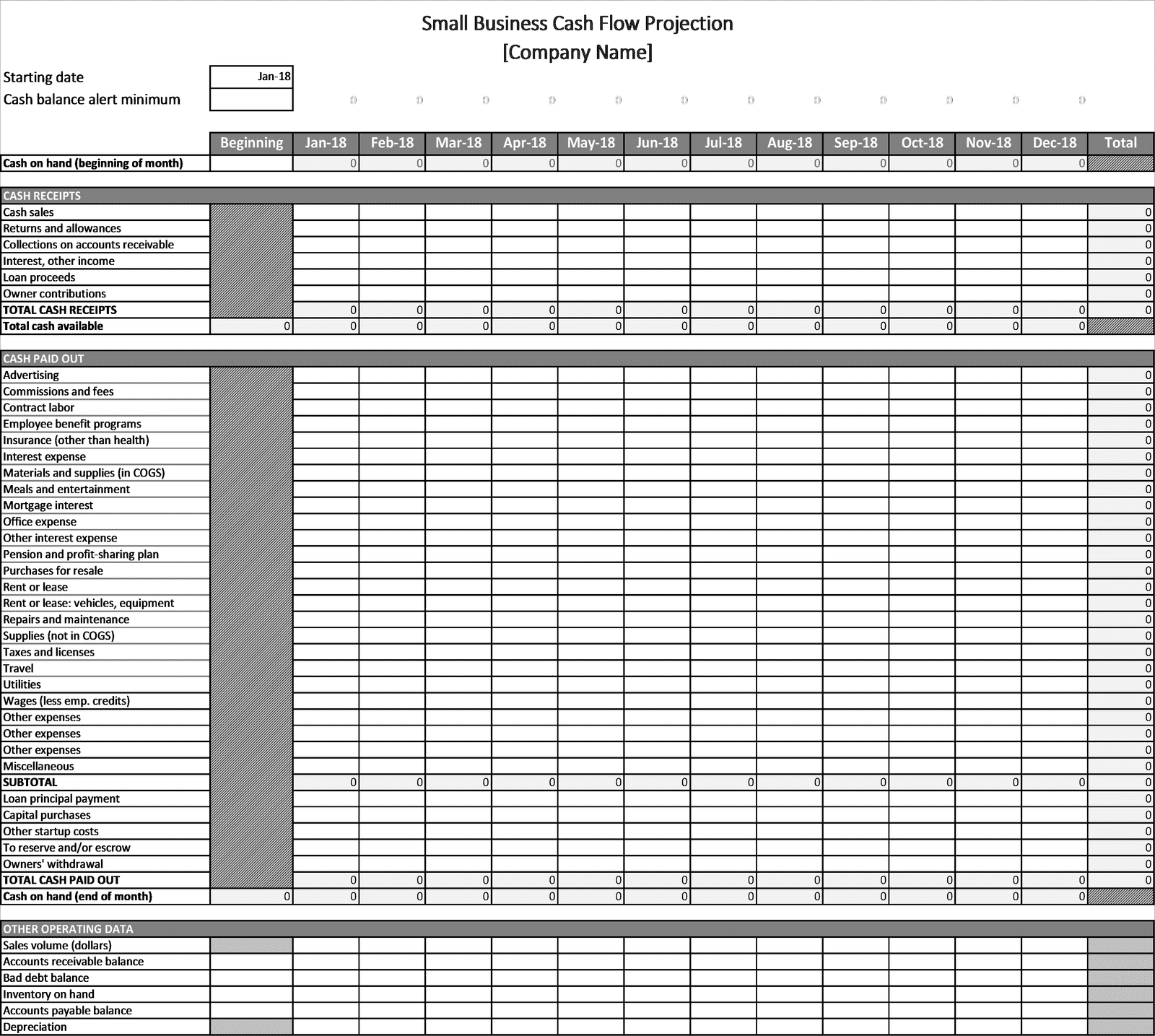

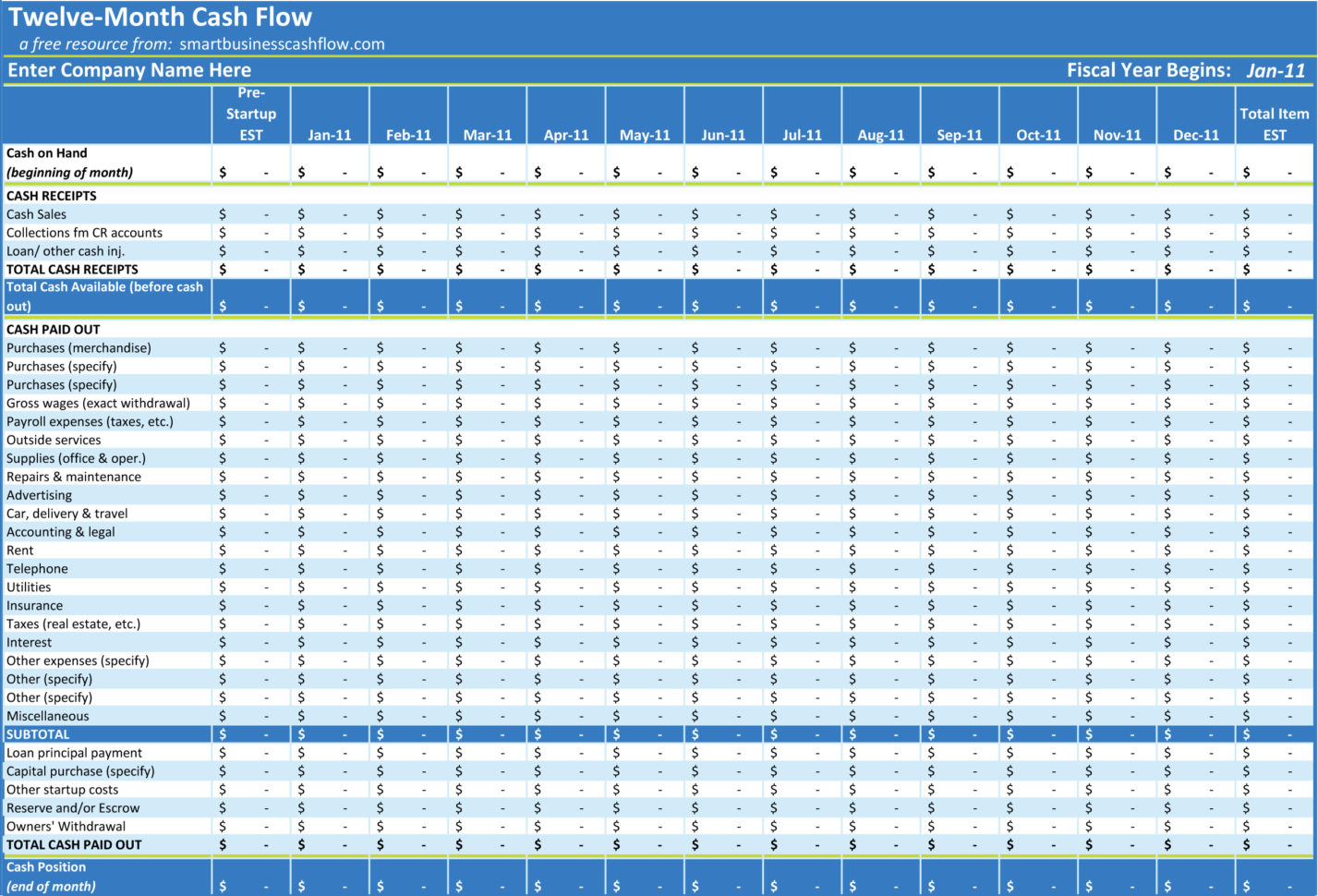

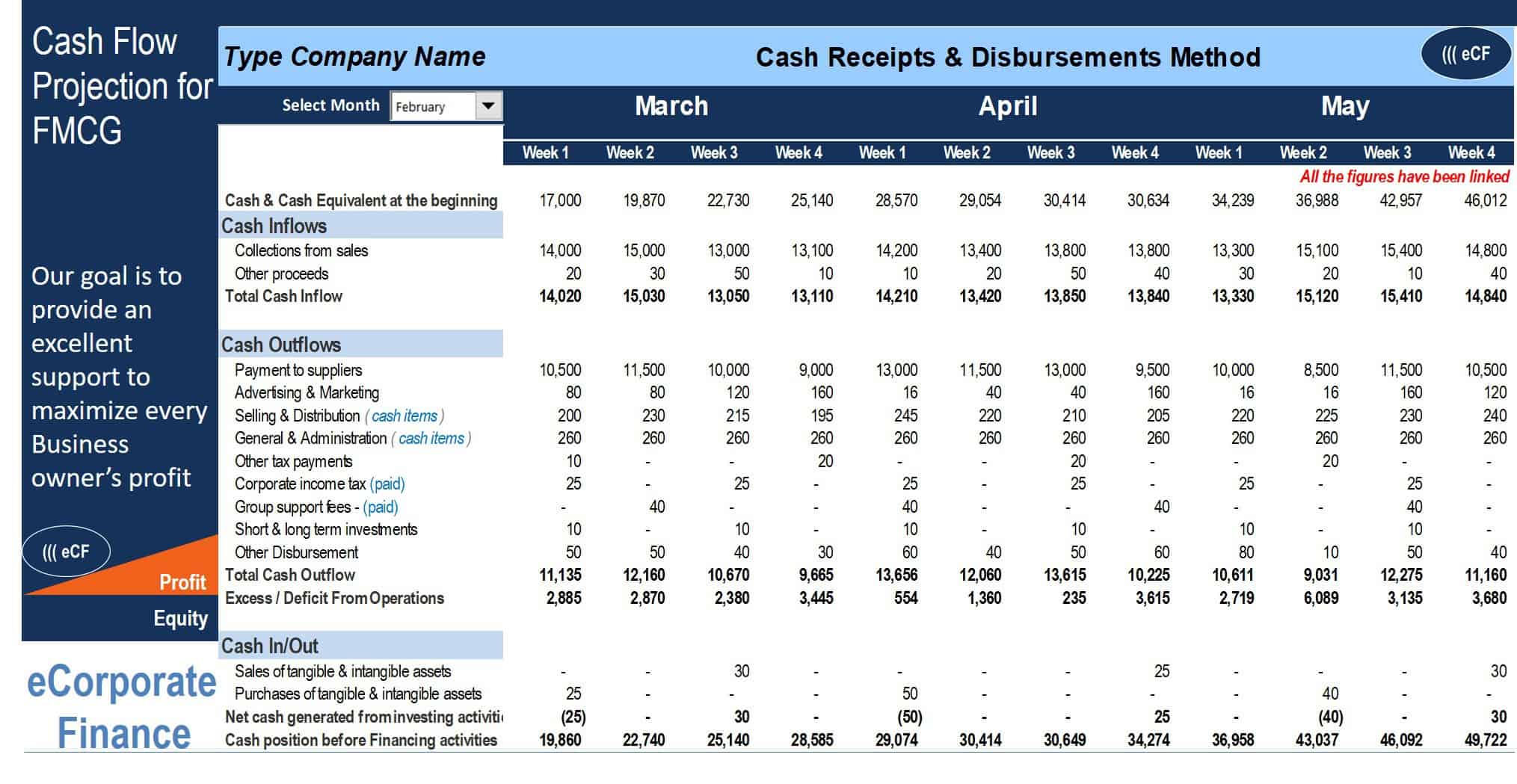

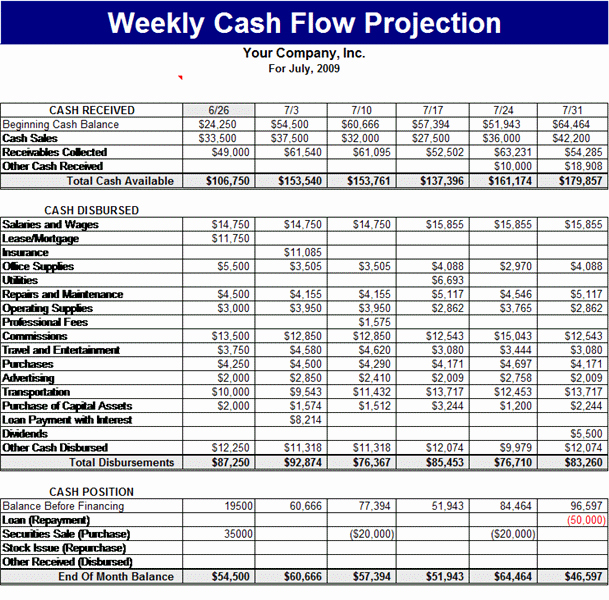

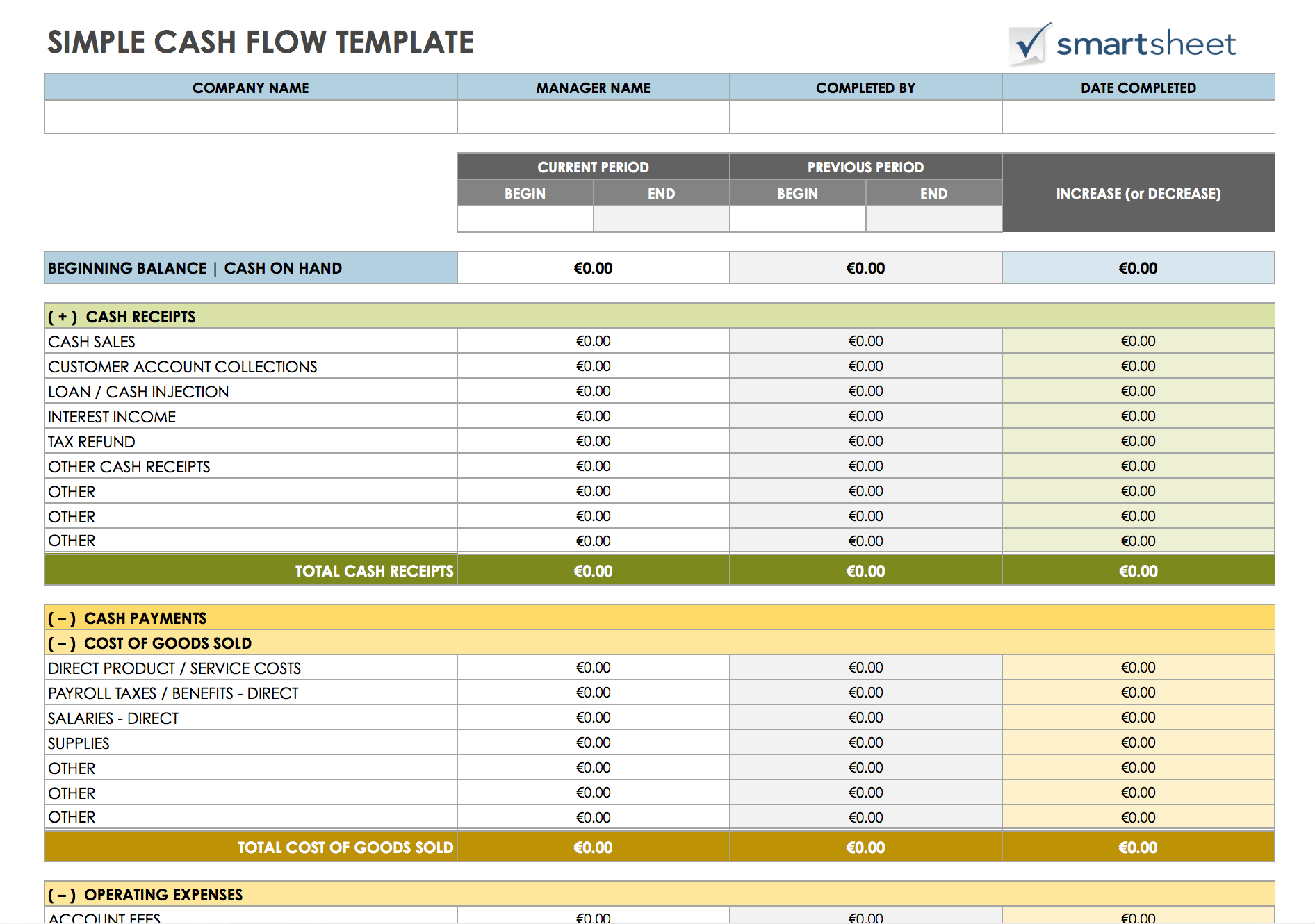

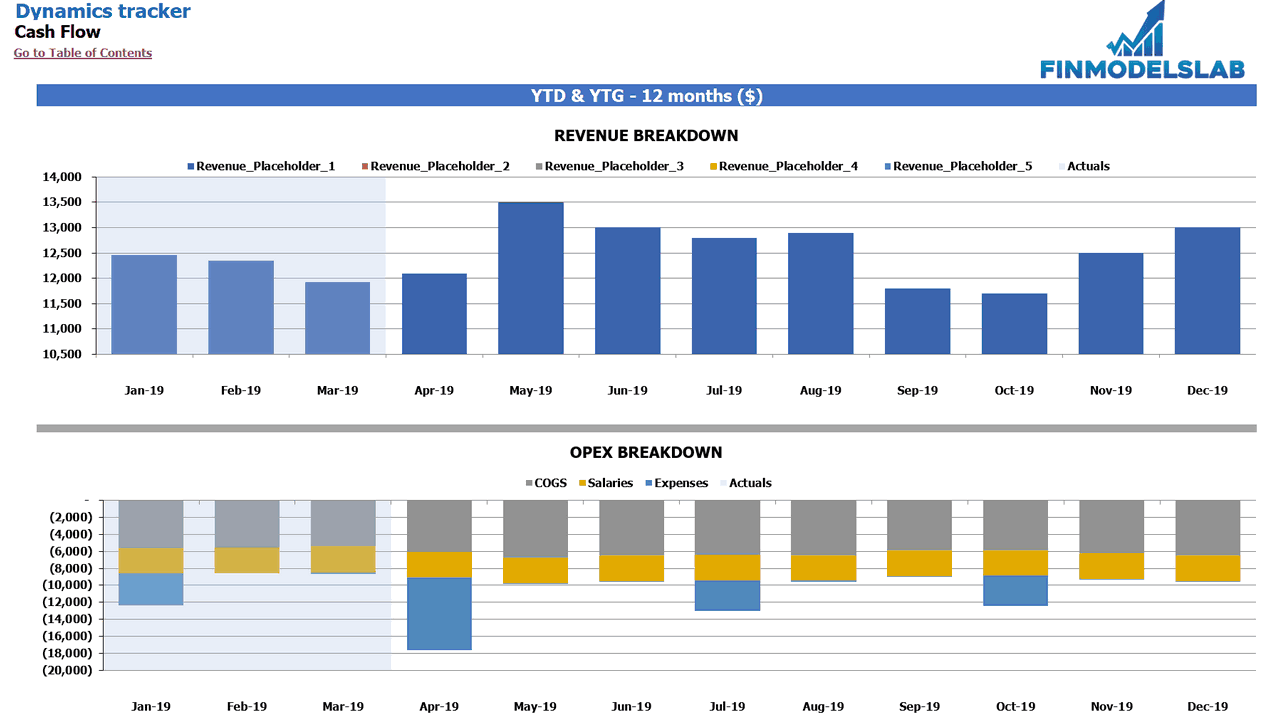

Cash flow projection chart. To create a cash flow projection, you’ll need to determine the time frame, calculate all revenue and costs, and create a simple chart to fill in all financial data for corresponding months or weeks. Four steps to a simple cash flow forecast one option is to use free financial forecasting software online, which can help you plan ahead for the next week, 30 days, or six weeks. This is your cash flow forecast and can be as simple or as complex as you want it to be.

This will provide clarity and transparency regarding the underlying assumptions and enable. Cash flow projection. A cash flow projection statement is a financial record that both records a company's current cash flow and estimates cash flow in the future.

This template can be used for tracking or projecting cash flows of a business or individual over 12 months. Choose from 15 free excel templates for cash flow management, including monthly and daily cash flow statements, cash projection templates, and more. How to create cash flow projection.

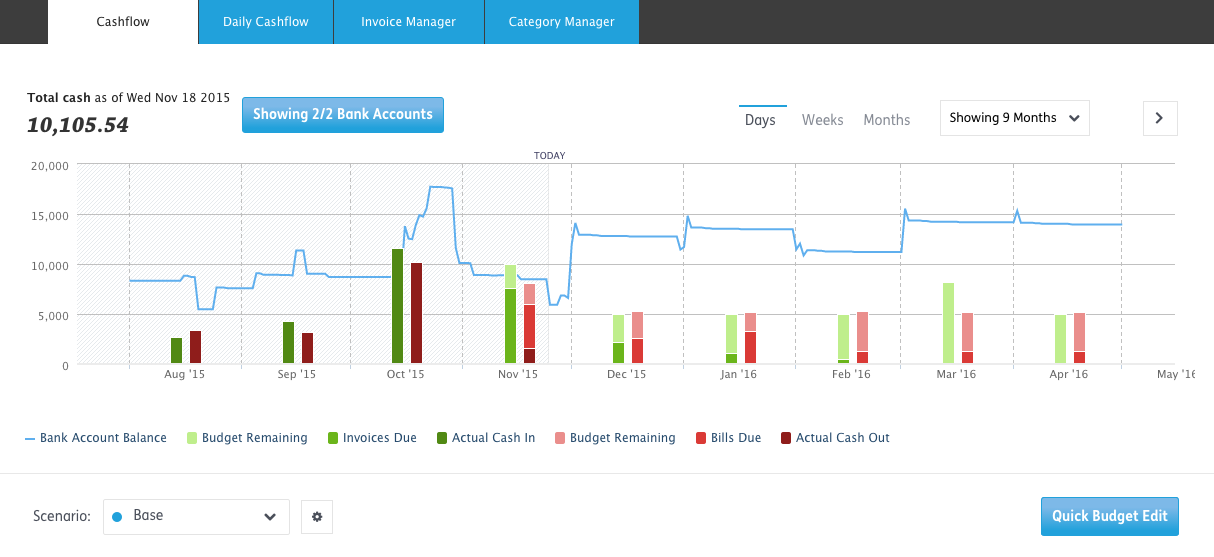

This is the “opening balance” for the period of your cash flow projection. Cash flow projections predict the amount of money entering and leaving your small business. Each month, your cashflow forecast chart will give you a prediction of your bank balance month by month into the future.

Document the assumptions made and parameters used for estimating and projecting the cash flow. This step is nice and easy. Upload cash flow projection chart.

Now you know the target value of each week. And then evaluate how much cash one is. What is a cash flow forecast?

Here are all the categories you’ll need for your cash flow projection: A project cash flow forecast includes cost estimates for a project, as well as a schedule of when you will incur those costs. Head into your banking app or financial planning platform, and grab your total cash balance across all bank accounts or other cash accounts.

Get started control all the assumptions you can experiment with different models for inflation, investment growth rates, dividend yield, when you retire, life expectancy, stock/bond allocation, tax configuration, and more. Here are all the elements you’ll require to create a cash flow projection: In a cash flow forecast, “cash” refers to funds that are easily available and spendable — this includes money in checking and.

How do i read the cashflow forecast chart? If you want to reach your revenue goal, then you will have to produce/invoice/collect (on average), $19,230 per week for 52 weeks. Accordingly, cash flow projections for a given period are often based on cash.

And cash flow is the net amount of cash and “cash equivalents” that transfers in and out of your business. This forecast also displays the project’s revenue and a schedule of. Or you can follow the four steps below to build your own cash flow forecast.