Spectacular Info About Cost Of Goods Sold Financial Statement Nike 2019 Statements

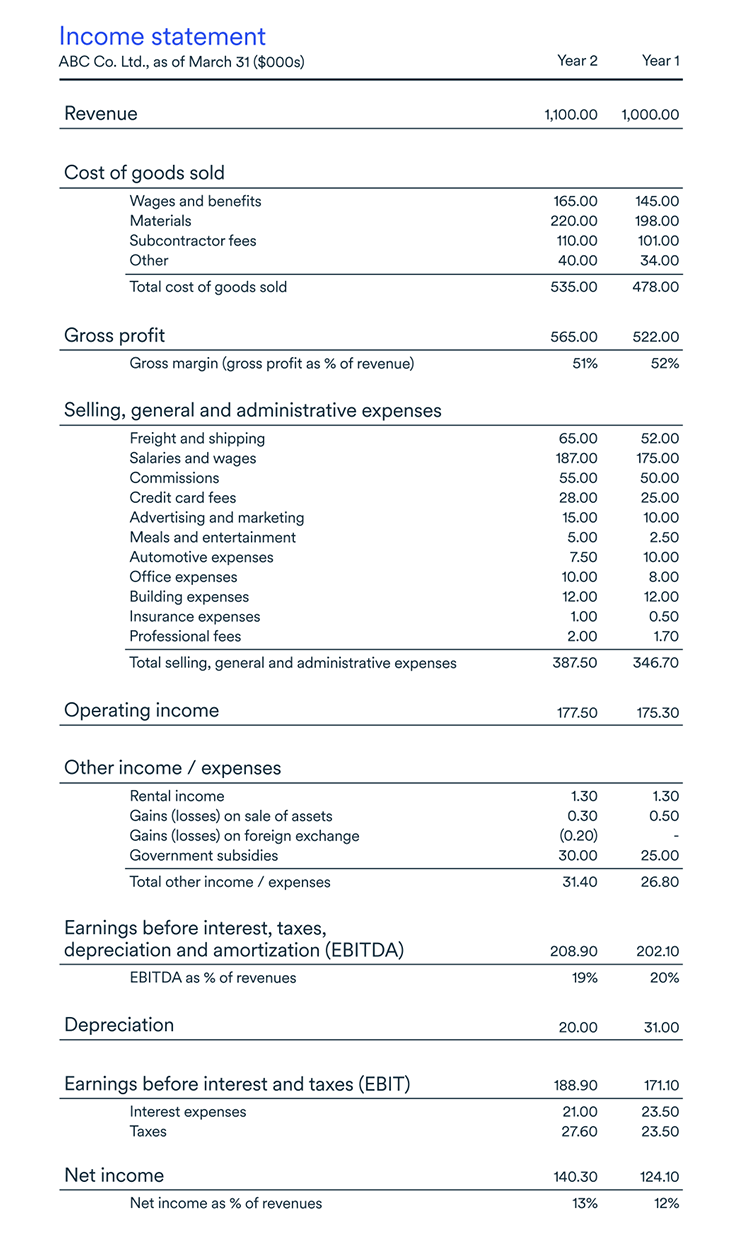

This financial data enables cfos to assess profitability, implement cost control measures, analyze gross profit margin, and develop accurate budget forecasts.

Cost of goods sold financial statement. This statement is not considered to be one of the main elements of the financial statements , and so is rarely found in practice. Ifrs and us gaap allow different policies for accounting for inventory and cost of goods sold. This number is vital for the company as it will help it make a better decision.

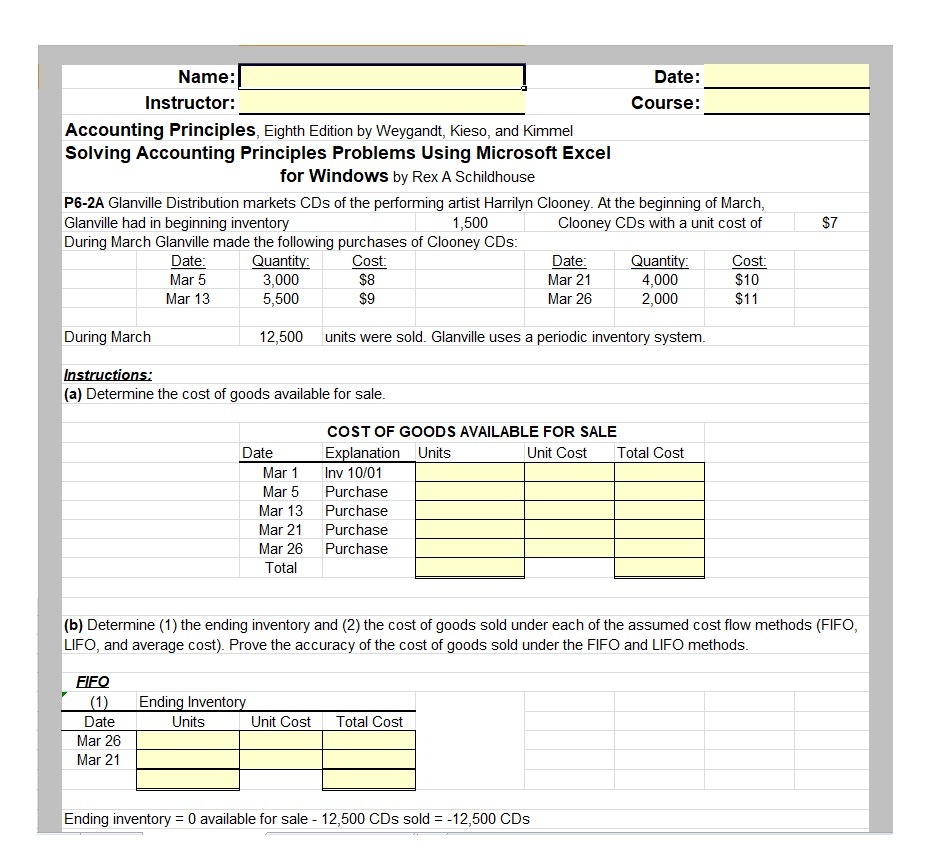

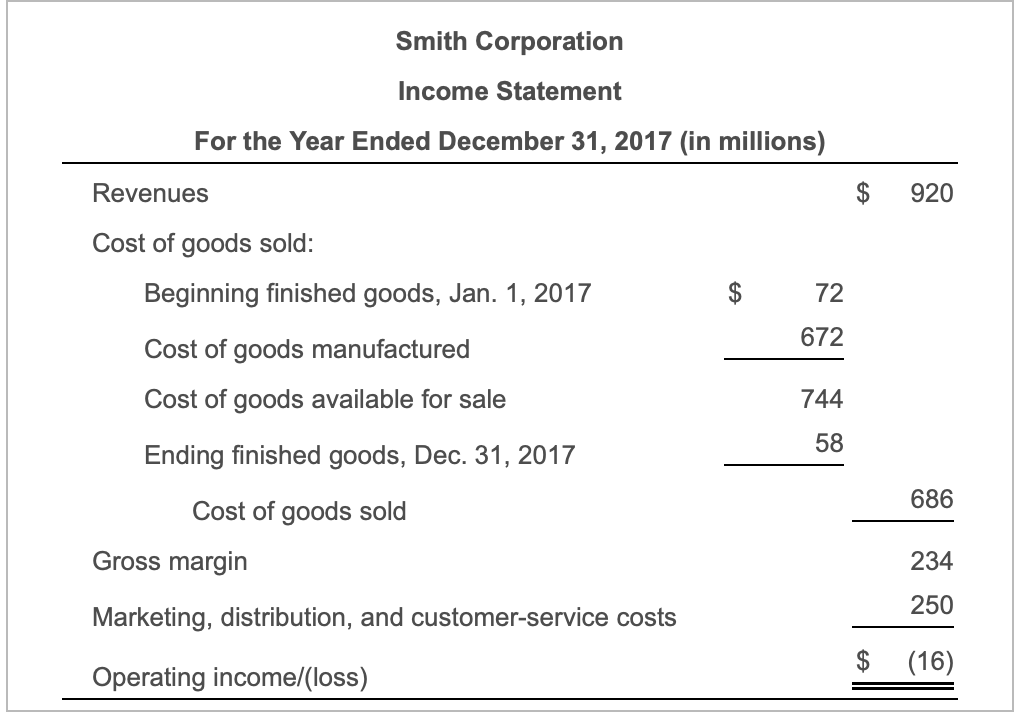

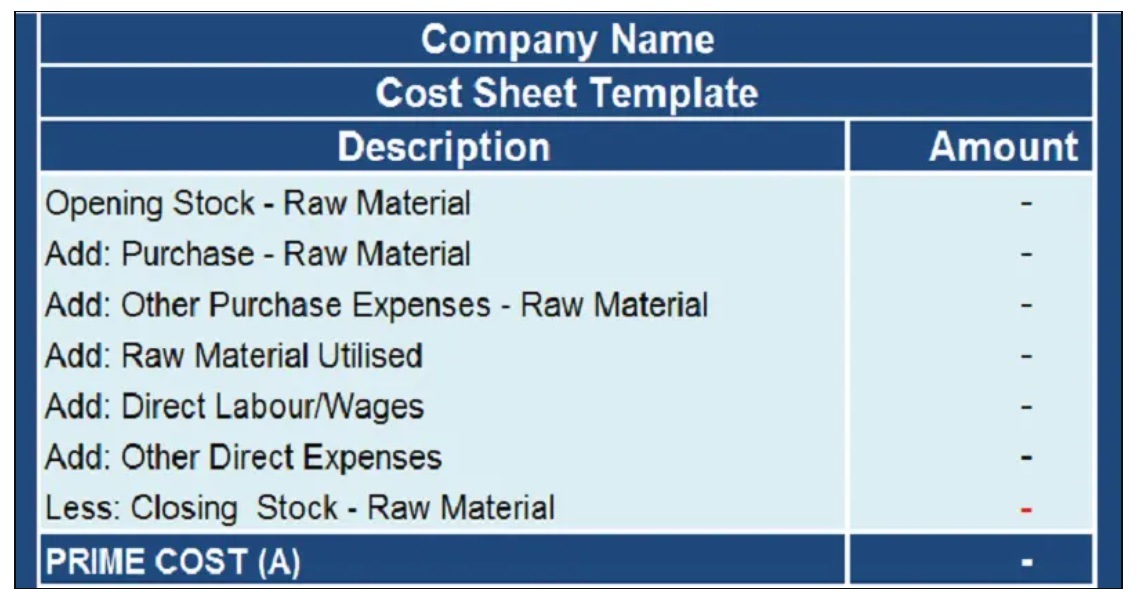

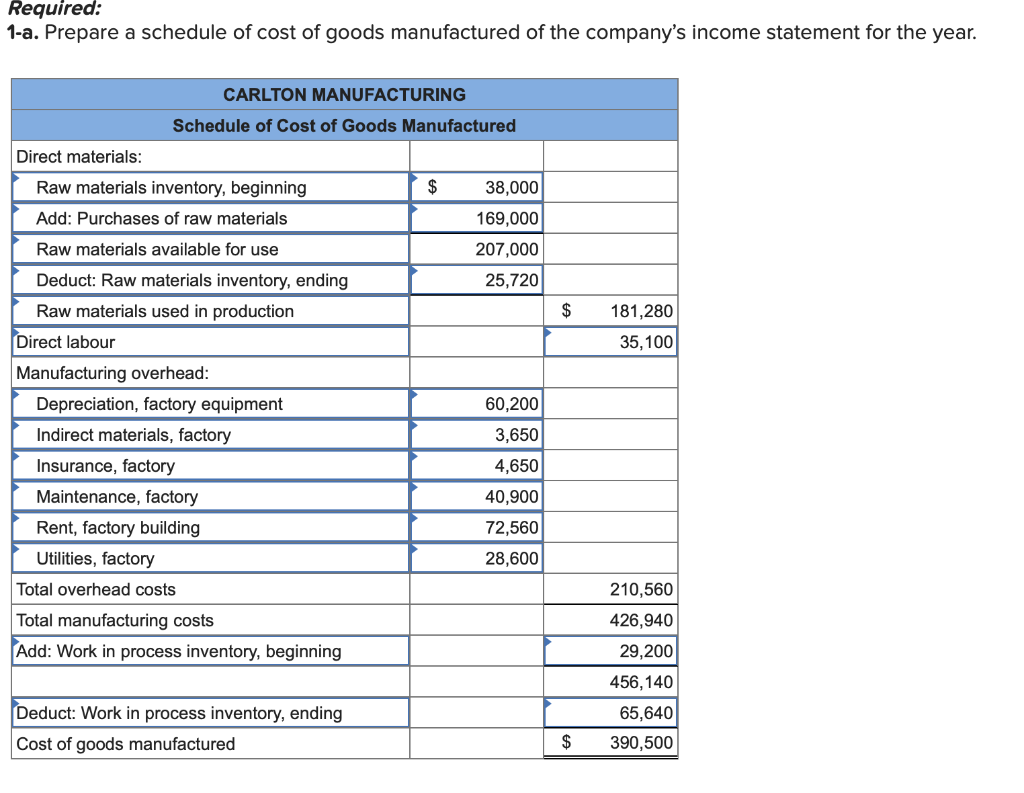

The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the ending inventory for the period. Cost of goods sold (cogs) is the cost of acquiring or manufacturing the products that a company sells during a period, so the only costs included in the measure are those that are directly. The cost of goods sold is considered an expense in accounting.

The cost of goods sold equation might seem a little strange at first, but it makes sense. The cost of goods sold (cogs) is an accounting term used to describe the direct expenses incurred by a company while attempting to generate revenue. The two most important numbers on this statement are the total manufacturing cost and the cost of goods manufactured.

Then, subtract the value of the inventory yet to be sold. Cogs reveals an organization’s total direct costs of producing or procuring goods and services they sell during a financial period. The cost of goods sold is the costs of goods or products sold during a specific period by the entity to its customers.

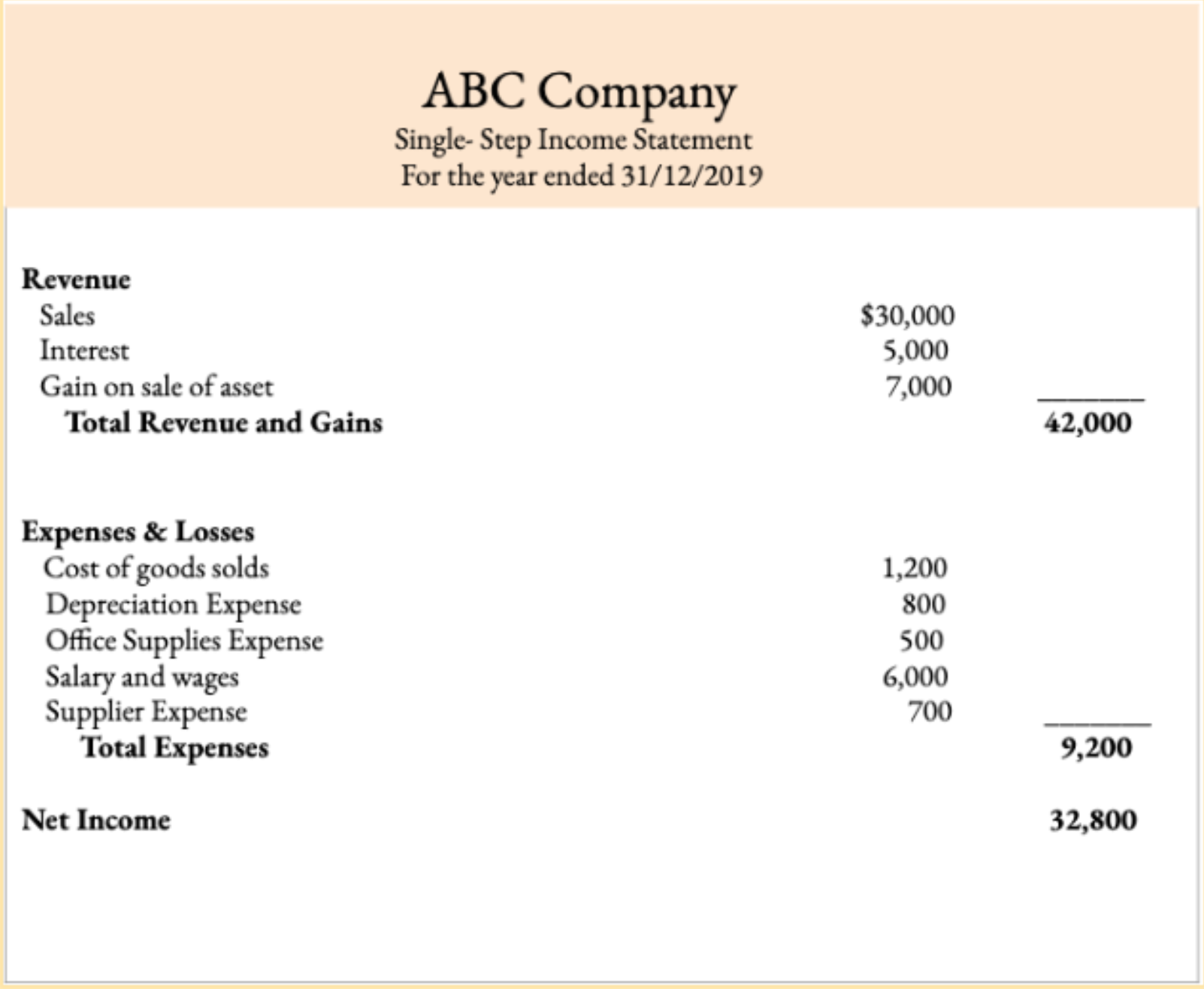

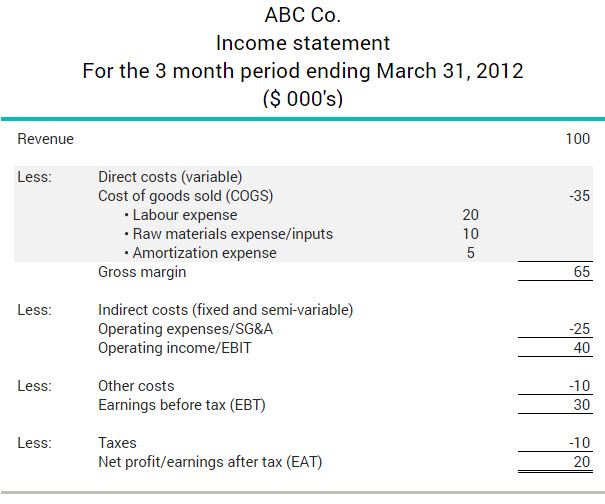

Cogs is an accounting term with a specific definition under u.s. On the income statement , the cost of goods sold (cogs) line item is the first expense following revenue (i.e. However, it excludes all the indirect expenses incurred by the company.

Sales revenue minus cost of goods sold is a business’s gross profit. Generally accepted accounting principles (gaap) that requires product companies to apply inventory costing principles. It does not include costs associated with marketing, sales or.

Cost of goods sold is the direct cost incurred in the production of any goods or services. What is cost of goods sold (cogs)? Hub accounting september 20, 2023 cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer.

Remember, we want to calculate the cost of the merchandise that was sold during the year, so we. The cost of goods sold (cogs) is the sum of all direct costs associated with making a product. Cost of goods sold in the financial statements.

The formula is cost of goods sold divided by revenue. Cost of goods sold is an important figure for investors to consider because it has a direct impact on profits. It appears on an income statement and typically includes money mainly spent on raw materials and labour.

Financial and income statements usually list cogs according to the. Cogs is considered a business expense and impacts your profit — the higher your cogs, the lower your profit margin. Cost of goods sold refers to the direct costs involved in producing a company's goods.

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)