Fabulous Tips About Insurance Profit And Loss Statement Formula For Income In Excel

You can obtain current account balances from your.

Insurance profit and loss statement. The most reasonable approach to recording these proceeds is to. One in four people reported losing money to scams, with a median loss of $500 per person. It shows both turnover and profitability for the company over that length of time.

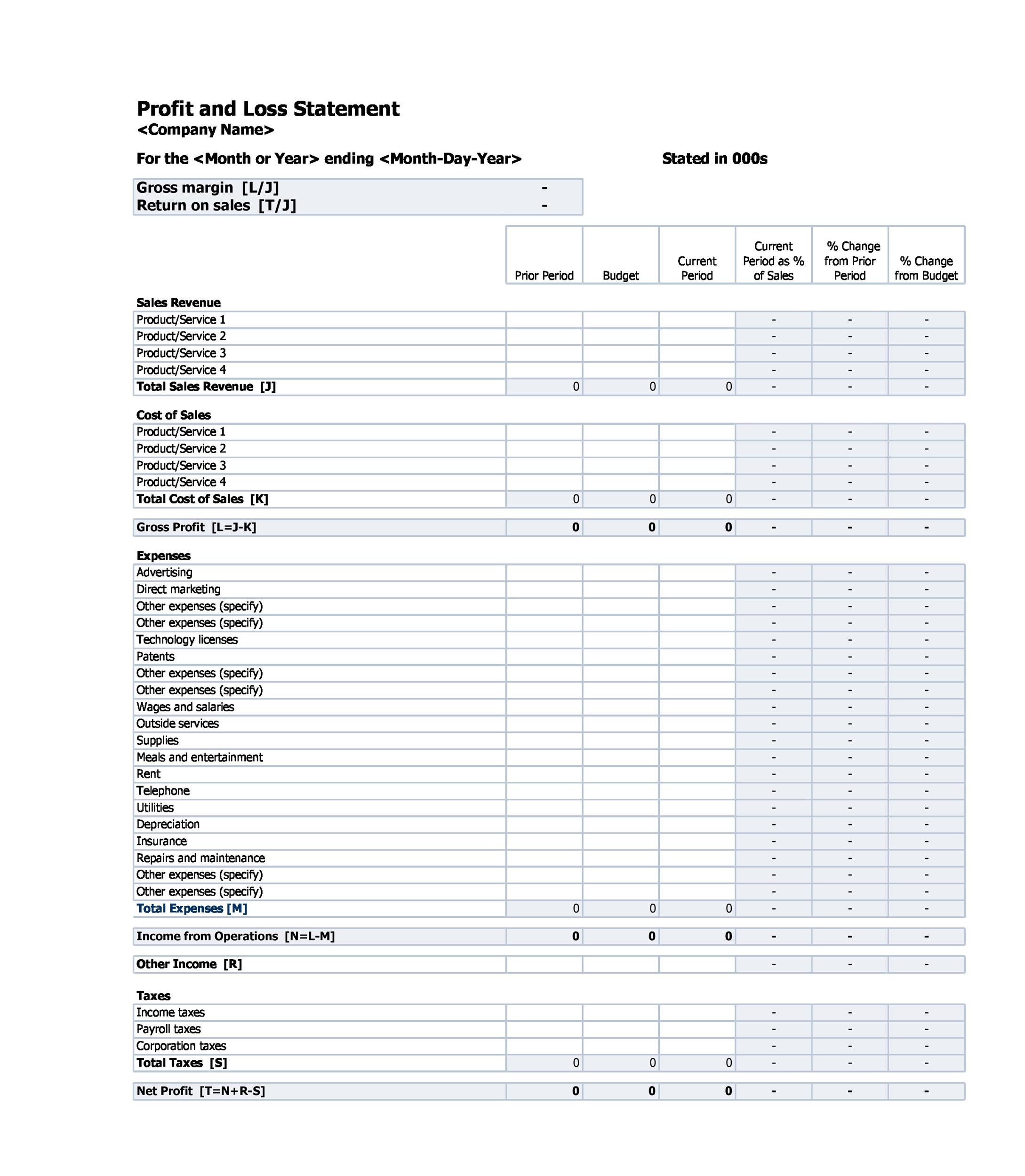

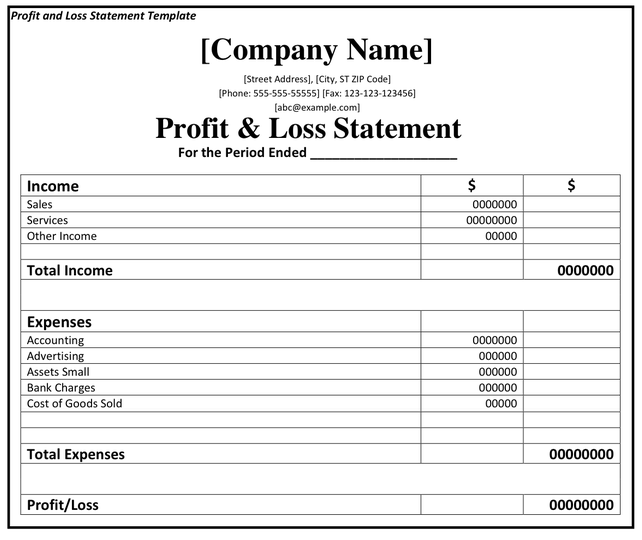

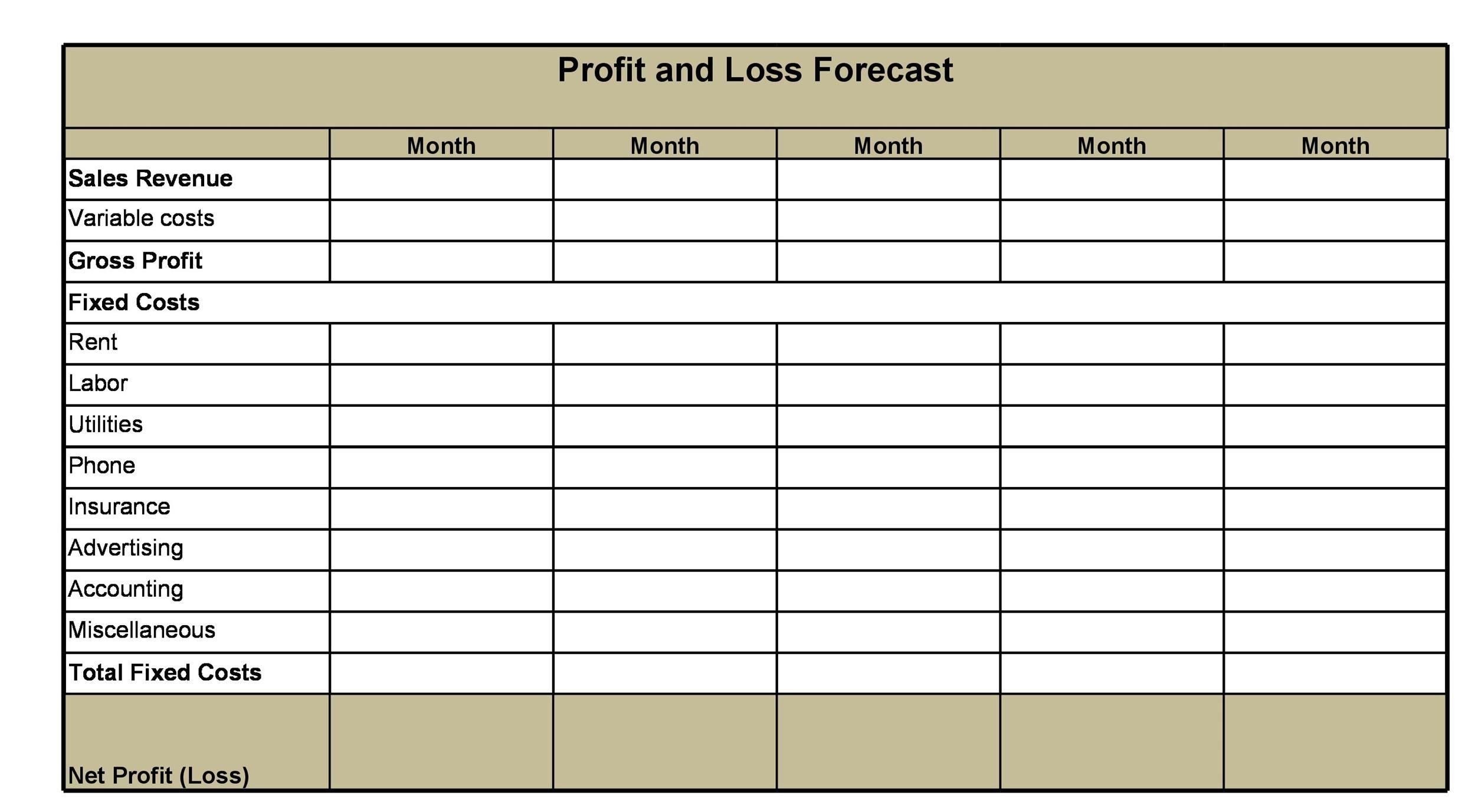

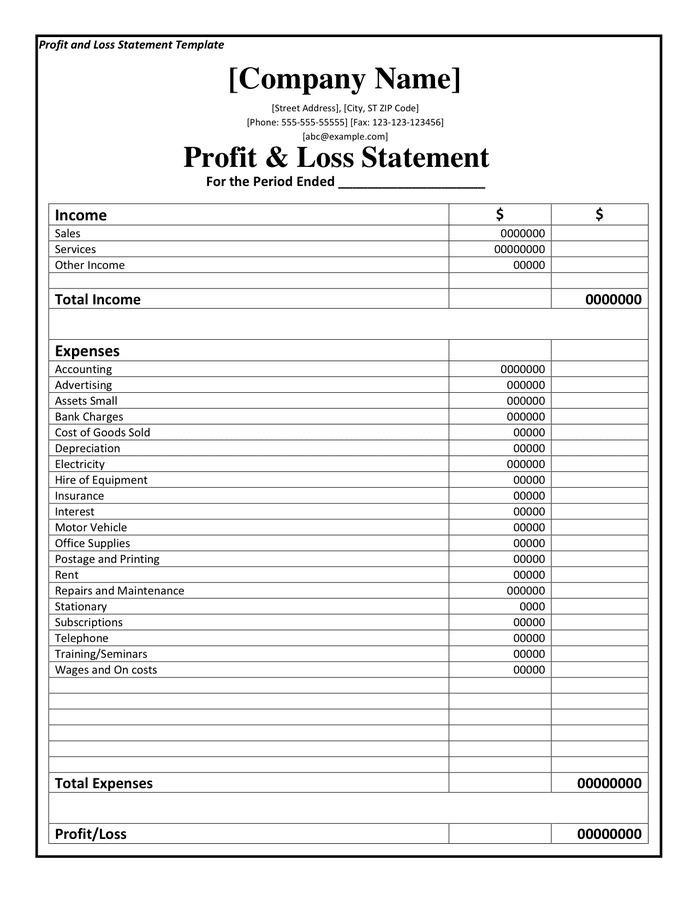

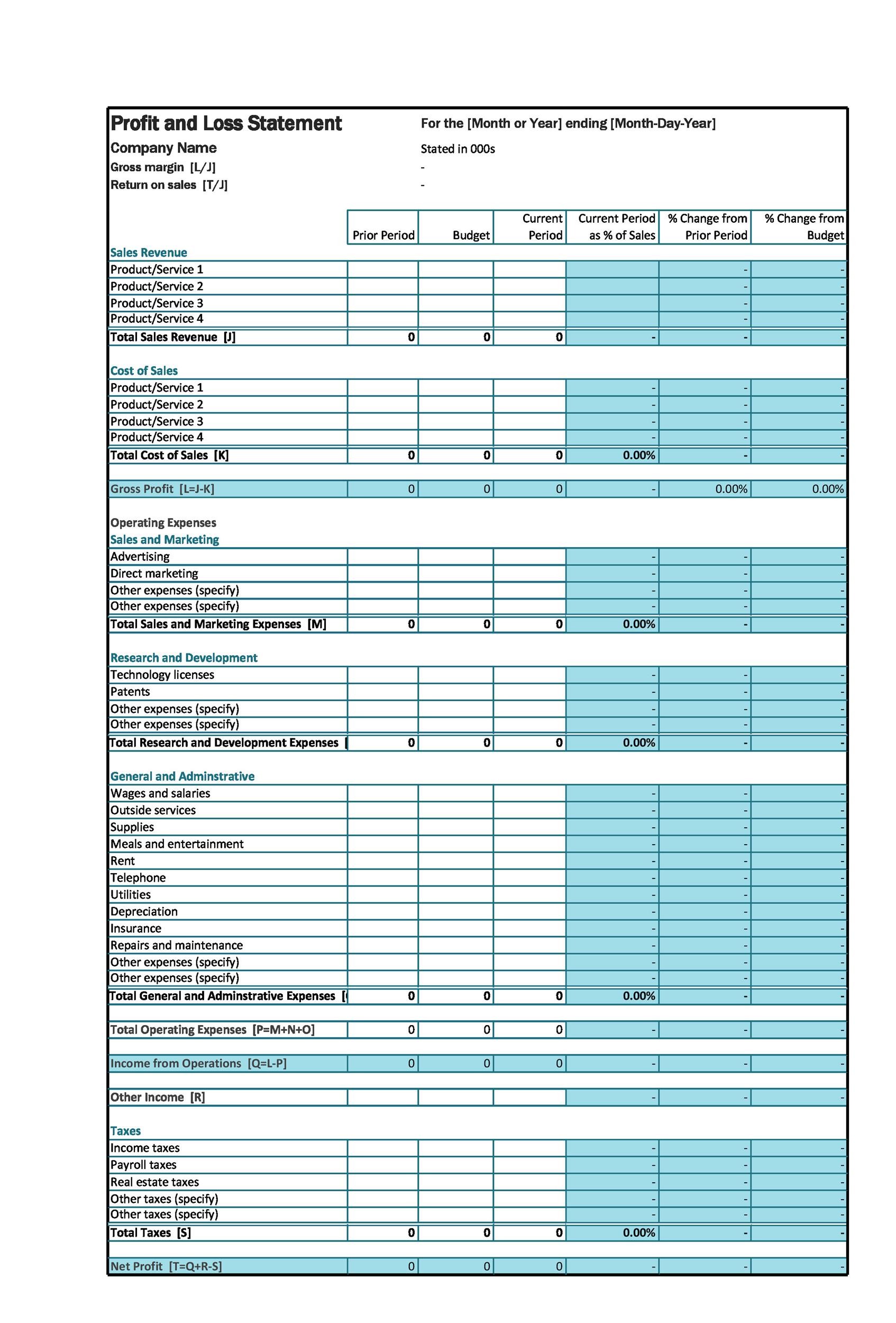

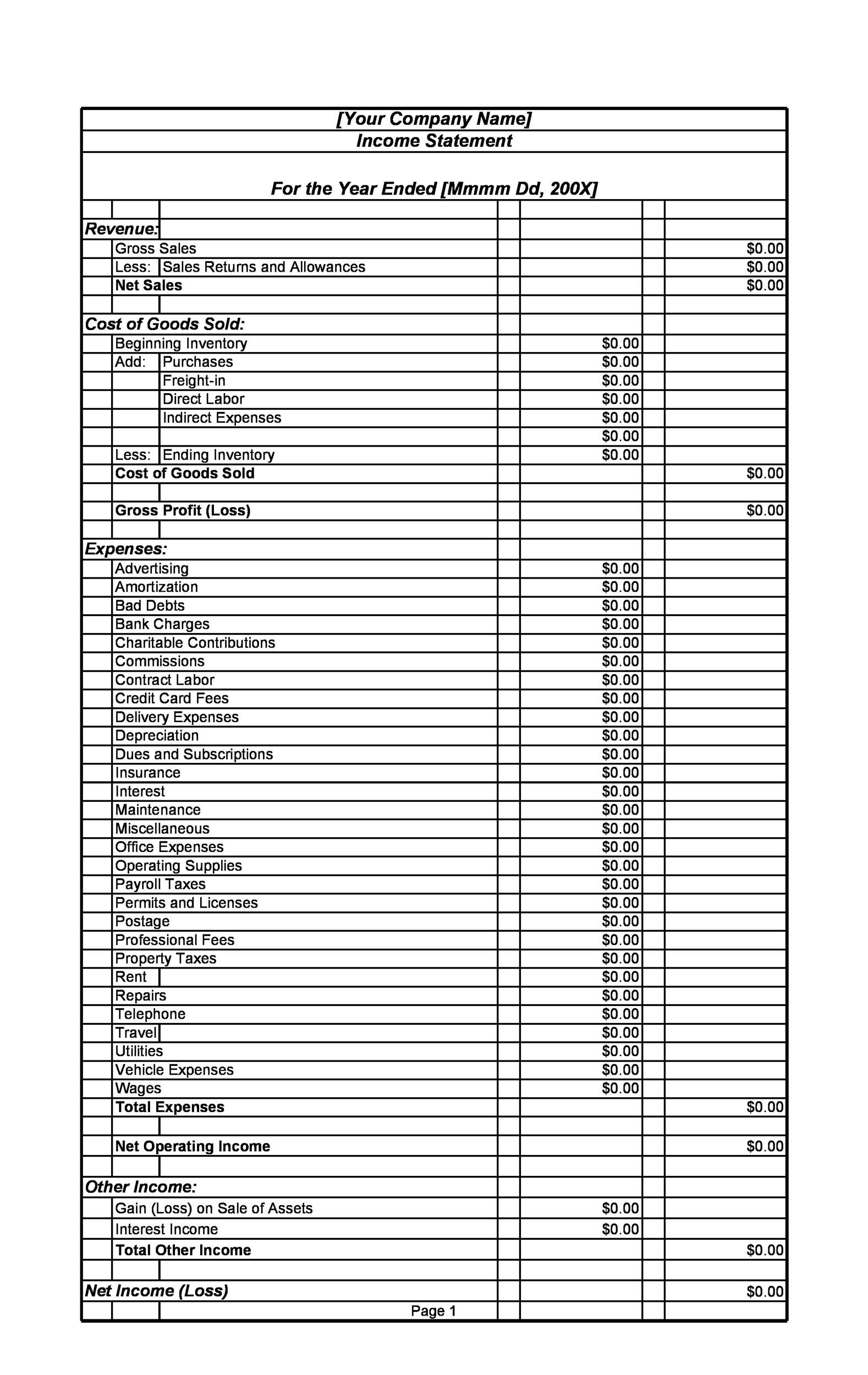

What is the profit and loss statement (p&l)? More advanced profit and loss statements also include operating profit and earnings before interest, taxes, depreciation, and amortization (ebitda). It summarizes revenues, costs, and expenses, allowing stakeholders to evaluate profitability.

What is a p&l statement? A profit and loss statement is part of a trifecta of financial statements that every public—but not private—company is required to issue on a quarterly and annual basis. Revenue, expenses, and net income.

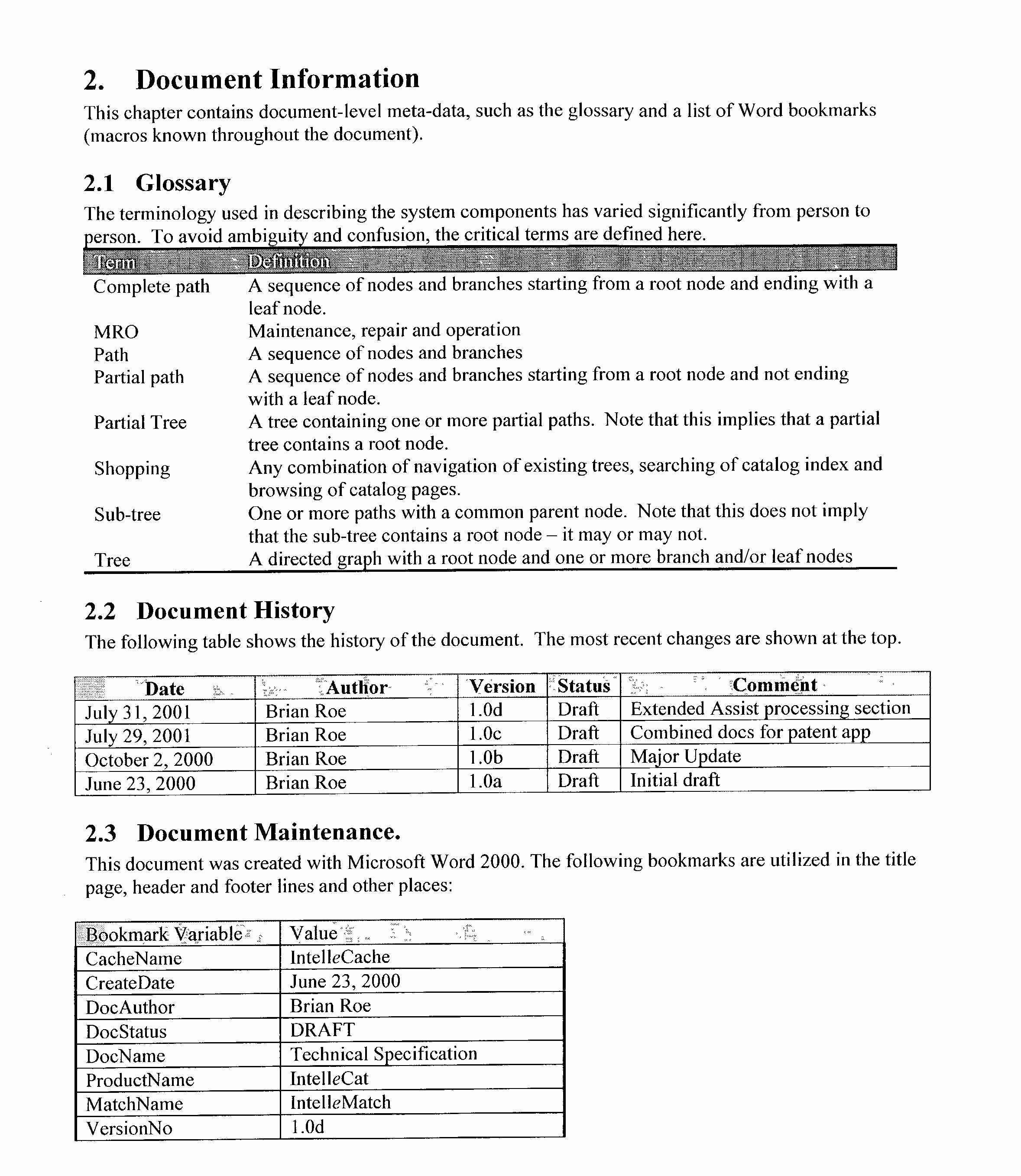

Ecl expected credit loss eir effective interest rate fcf fulfilment cash flows fvoci fair value through other comprehensive income fvtpl fair value through profit or loss gmm general measurement model ifrs international financial reporting standards lic liability for incurred claims lgd loss given default Prior to joining old republic in october, 2017 tammy worked as a commercial account manager at an insurance agency. The oil and gas company's earnings statement showed that adjusted net income totalled 513 million euros ($556 million) in.

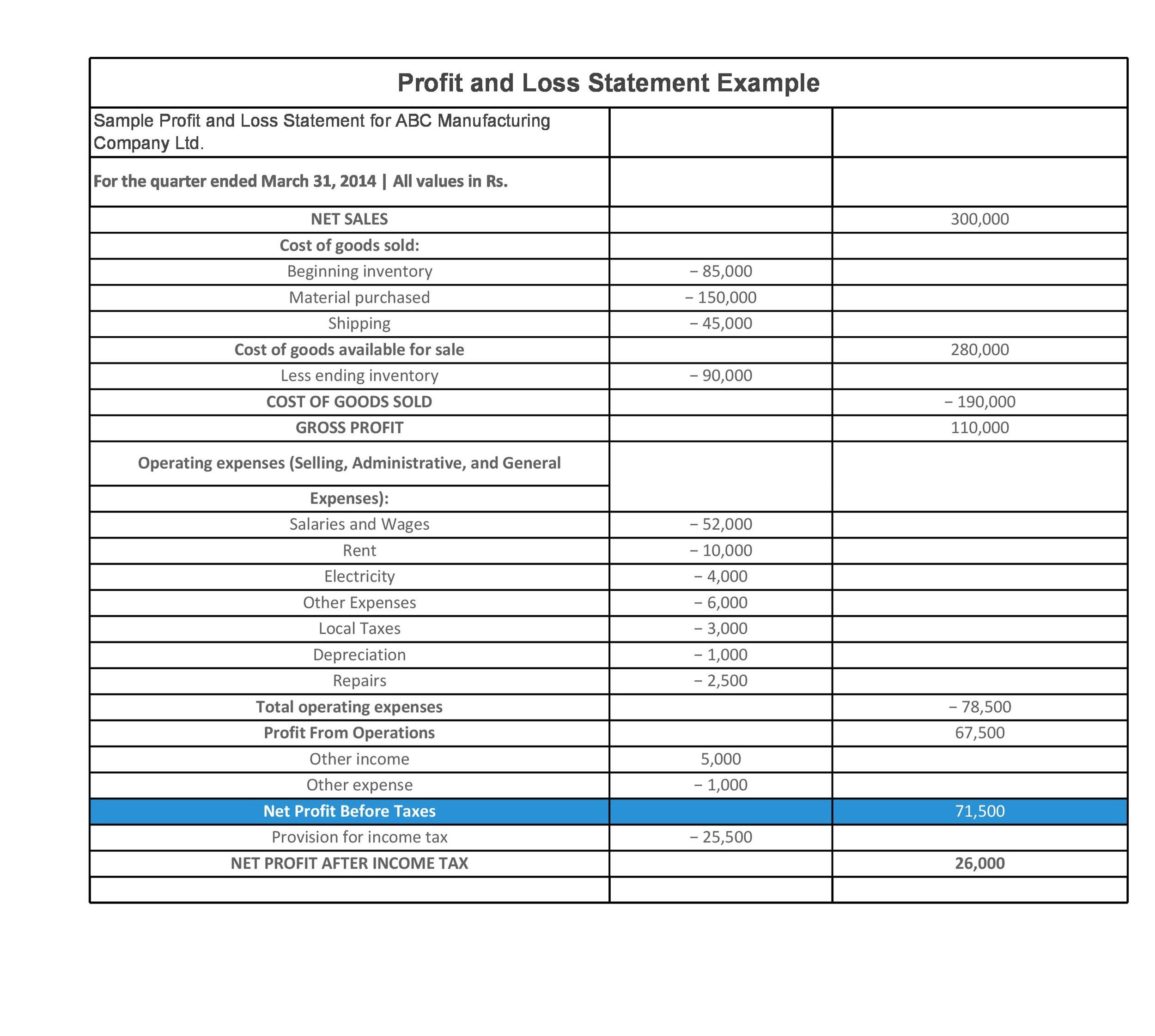

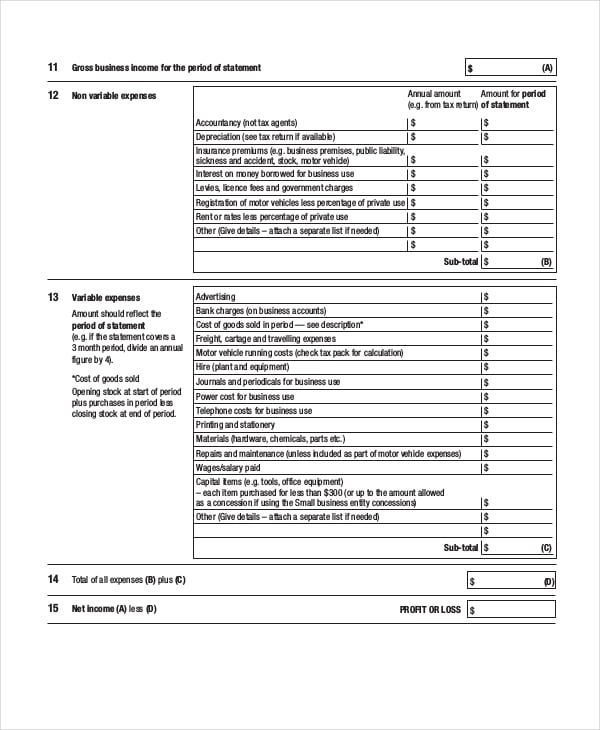

This is different to the current ifrs 4 income statement, where there is no such split. December 04, 2023 when a business suffers a loss that is covered by an insurance policy, it recognizes a gain in the amount of the insurance proceeds received. The single step profit and loss statement formula is:

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. Also known as a profit and loss statement, the income statement provides the end user with an overview of the company’s results over a specific period of time. An income statement, also known interchangeably as a profit and loss account, provides a summary of a company’s revenues, expenses, and profits over a specific period.

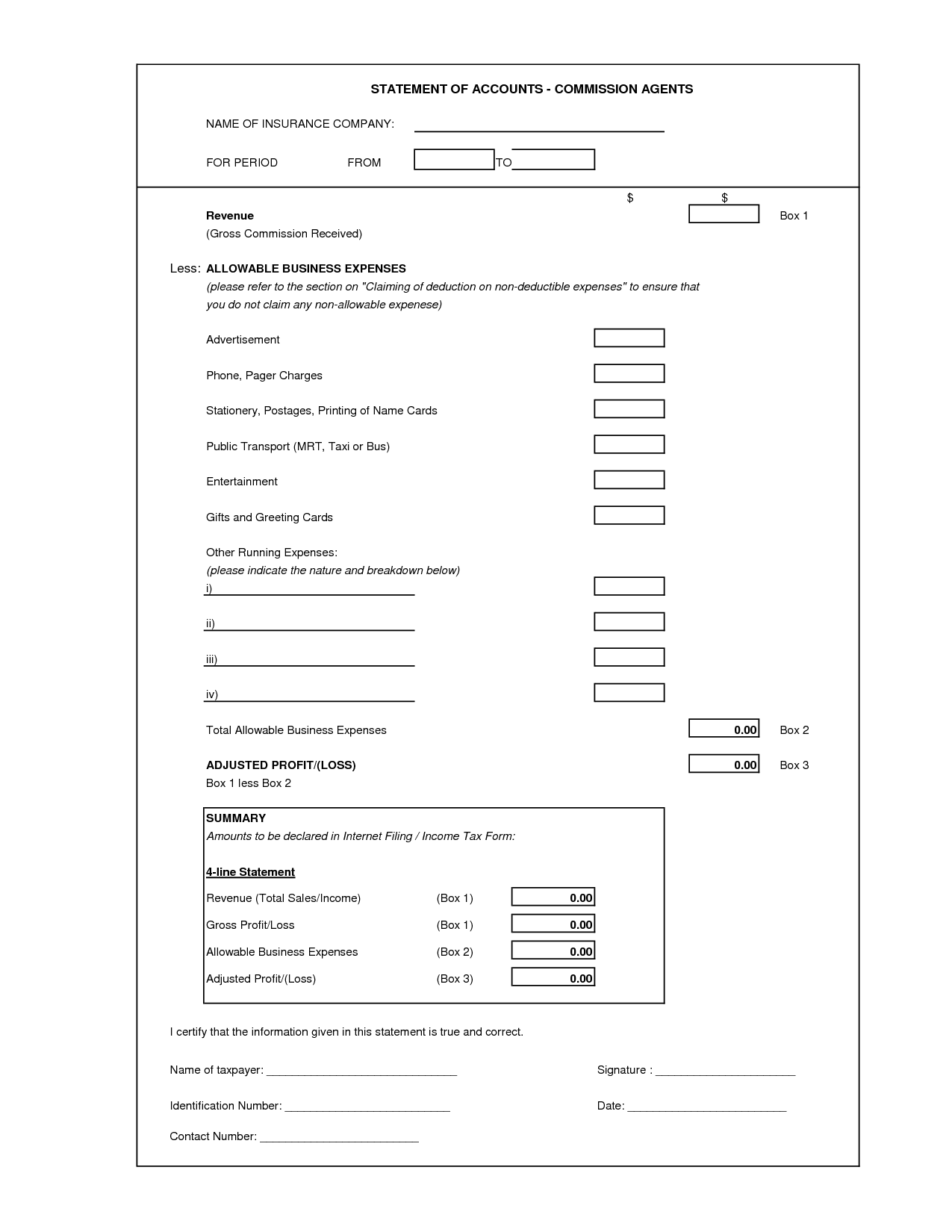

Create the report either annually, quarterly, monthly or even weekly. A profit and loss statement (p&l), also known as an income statement or statement of earnings, is a crucial financial document that provides insights into a company’s financial performance. A profit & loss statement (p&l) statement is a tally of all that you earn, & all that you lose or spend.

A sample profit and loss statement demonstrates a company’s ability to make money, drive sales, and. Difference of total of (profit/ (loss) after tax and balance at the beginning of the year) and (interim dividend paid during the year, proposed final dividend, dividend distribution on tax, transfer to reserves/other accounts) The final figure will show the financial performance and show if the business has made a profit or loss.

Balance sheet, cash flow statement, and the p&l report. A p&l statement compares company revenue against expenses to determine the net income of the business. Consider the image below, which shows best buy's income statement for the.

A profit and loss statement, also commonly called an income statement, is a financial statement that provides a summary or detailed view of the agency’s revenue and expenses for a defined period of time. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. It shows all the company’s income and expenses incurred over a given period.

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2020/06/Quarterly-Profit-Loss-Statement-Template-TemplateLab-790x1102.jpg)