Divine Info About Financial Ratios For Insurance Companies Surplus In Balance Sheet

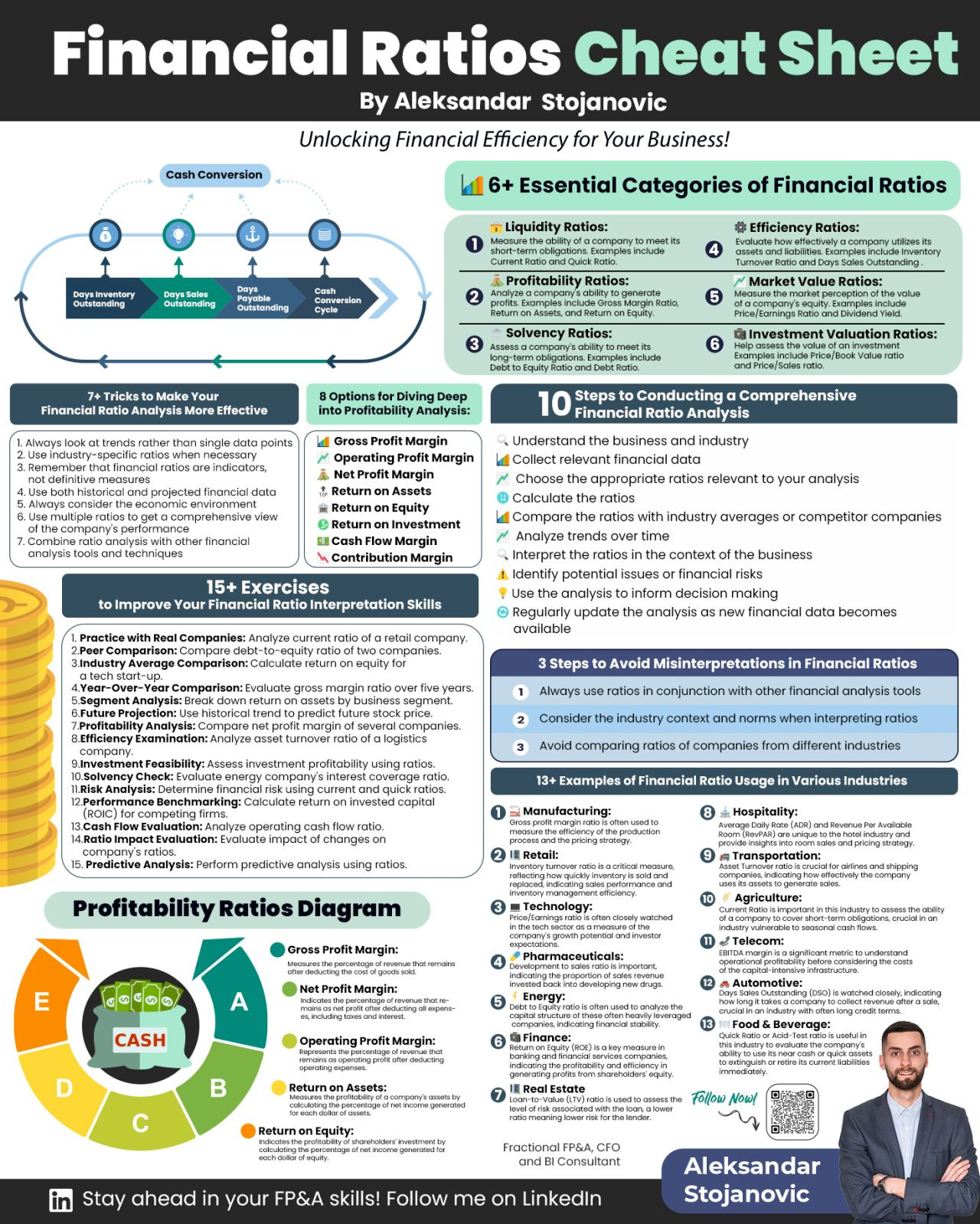

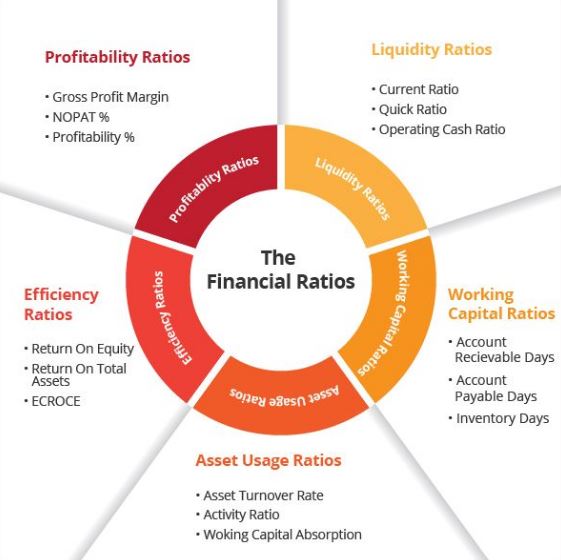

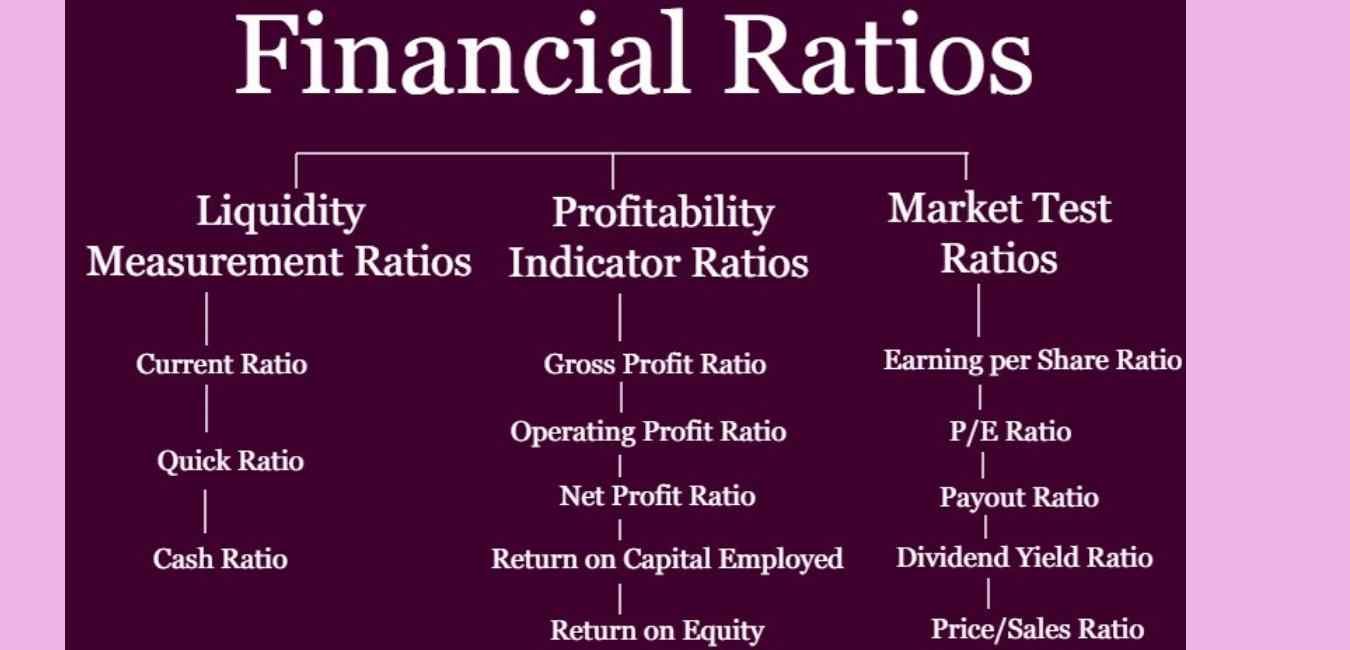

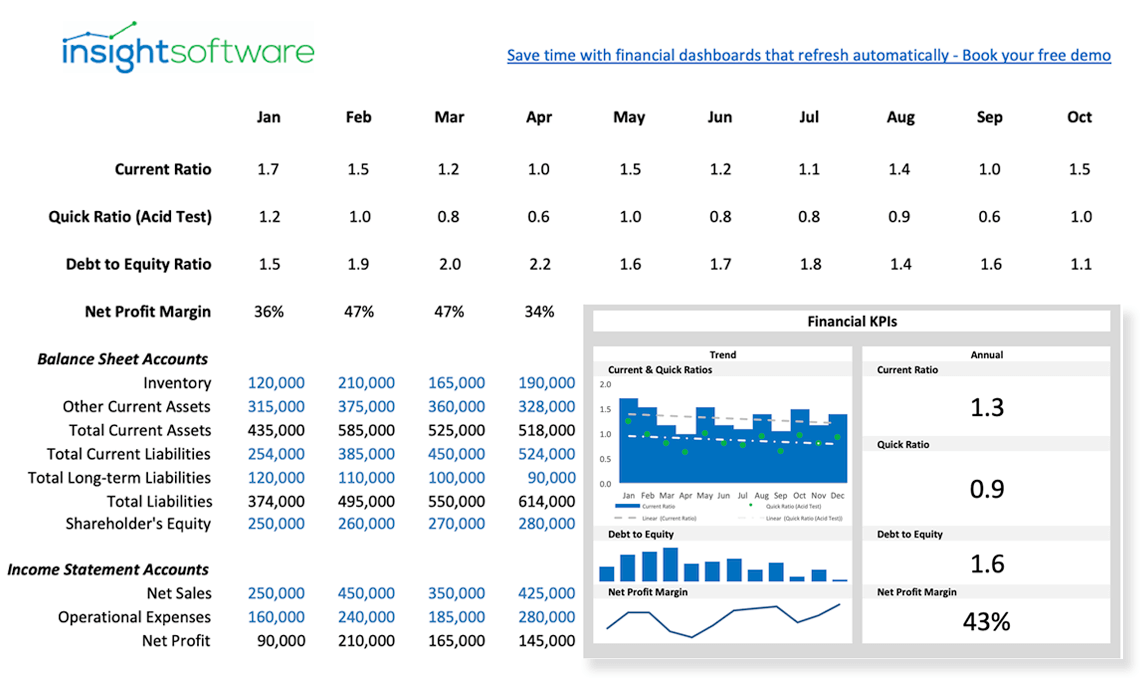

Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its financial statements such.

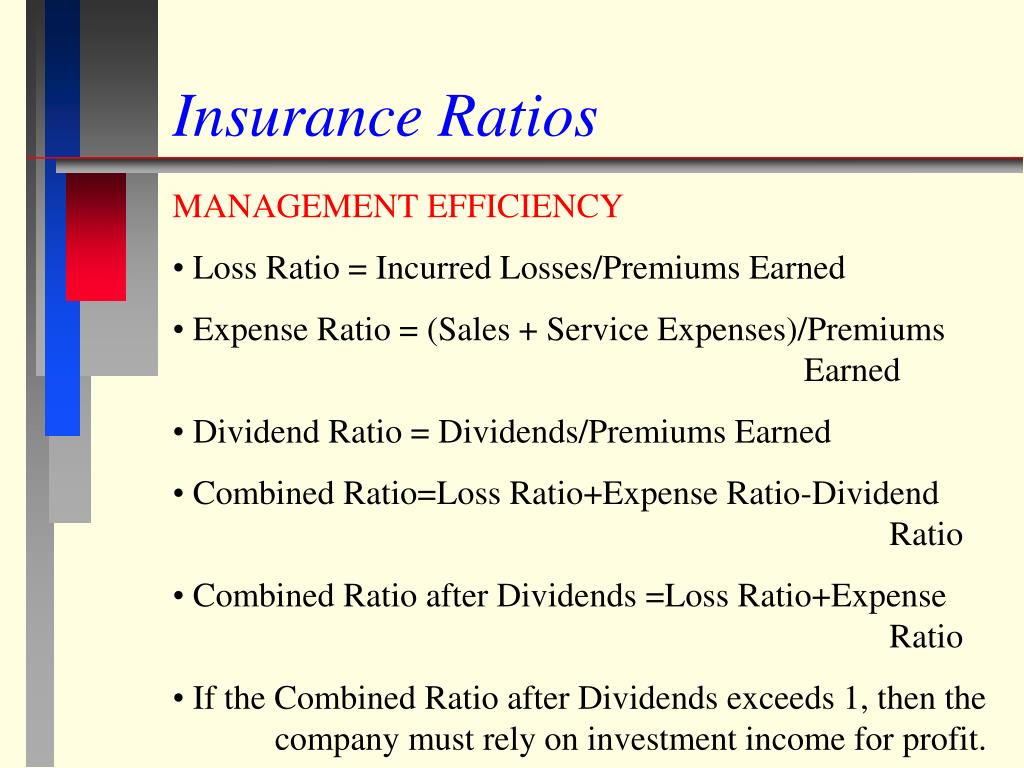

Financial ratios for insurance companies. Financial ratios, insurance companies, risk management, insurance, performance jel classification codes: Statutory accounting practices define the combined ratio as the. One of the most important profitability ratio used in an insurance industry is the combined ratio.

Crisil ratings assigns corporate credit ratings (ccr) to insurers to measure their financial strength, i.e. G17, g22, g32, g52, l25 Financial ratios are grouped into the following categories:

Combined ratio shows whether a company is profitable or not. Their ability to meet policyholder obligations. For a single insurance company, a combined ratio above 100% indicates an underwriting loss.

Loss ratio + expense ratio. Revenue per policyholder is a simple key performance indicator (kpi) that measures the amount of revenue generated by the. The balance sheet, income statement, and cash flow.

Revenue per policyholder what is this metric? Financial strength rating agencies for insurance companies include am best, standard & poor’s, fitch, moody’s, demotech, and kroll bond rating. Hover over the ratio value in the table to see the exact.

Expense ratio for an insurer is analyzed by class of business, along with the trend of the same. Uses and users of financial. Companies that submit financial statements to the sec.

Describe the key components of the naic's risk. Combined ratio is a measure of. Explain the methodologies used by rating agencies.