Exemplary Tips About Cash Generated By Operations Hospital Financial Statements 2018

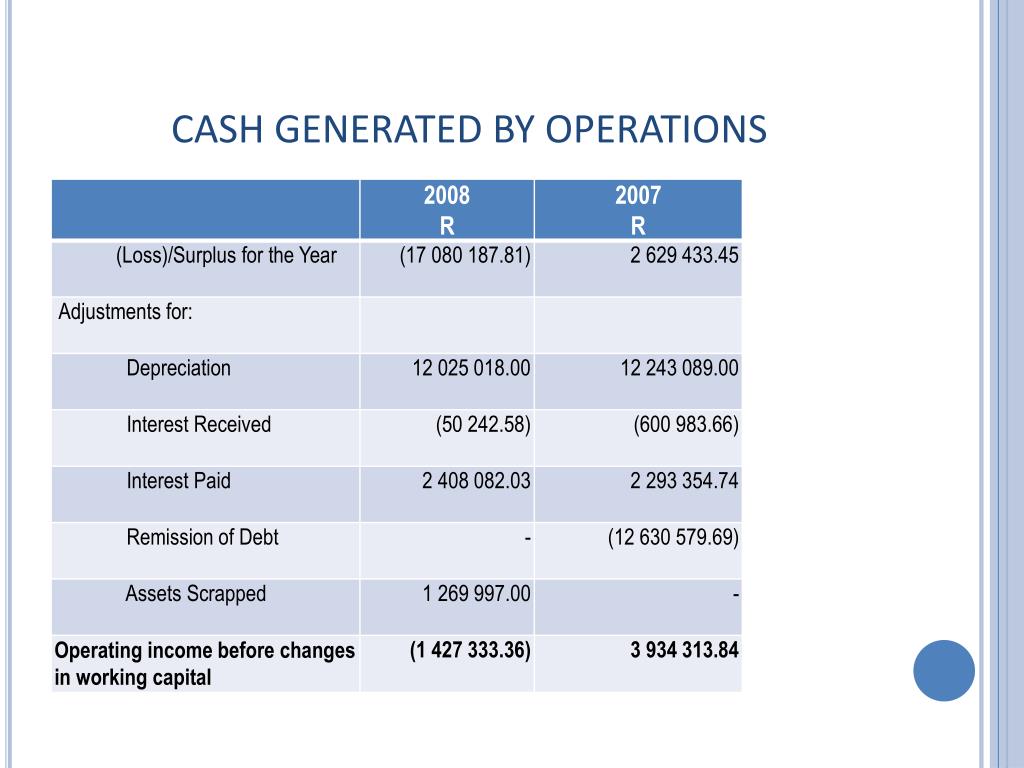

Cash generated from operations means the excess (or the deficiency in the case of a negative number) of operating cash receipts, including interest on investments, over operating cash expenditures, including debt service payments.

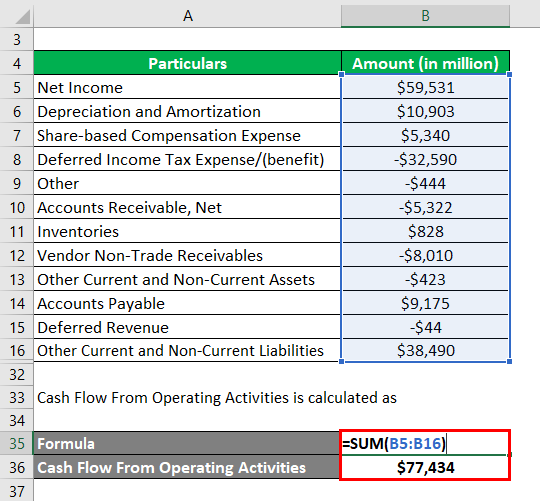

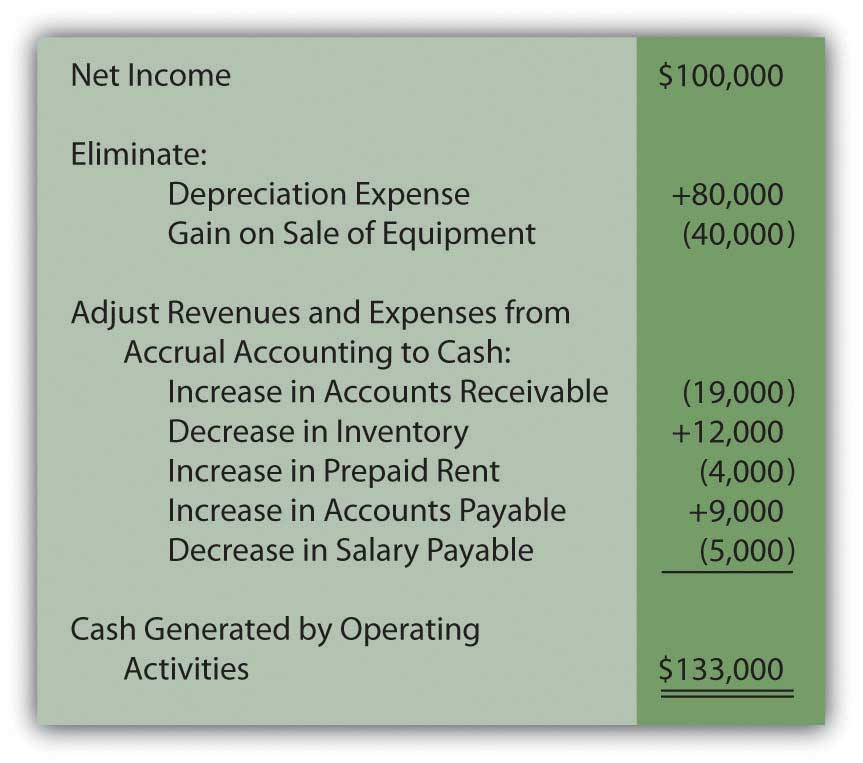

Cash generated by operations. Net cash provided by operating activities is a financial metric that measures the amount of cash generated or used by a company's normal business operations, such as sales and expenses. A san francisco startup using artificial intelligence to automate software development has quintupled its total funding with $117 million in. The cfs starts with the “cash flow from operating activities” section, which calculates a company’s operating cash flow (ocf) in a specified period.

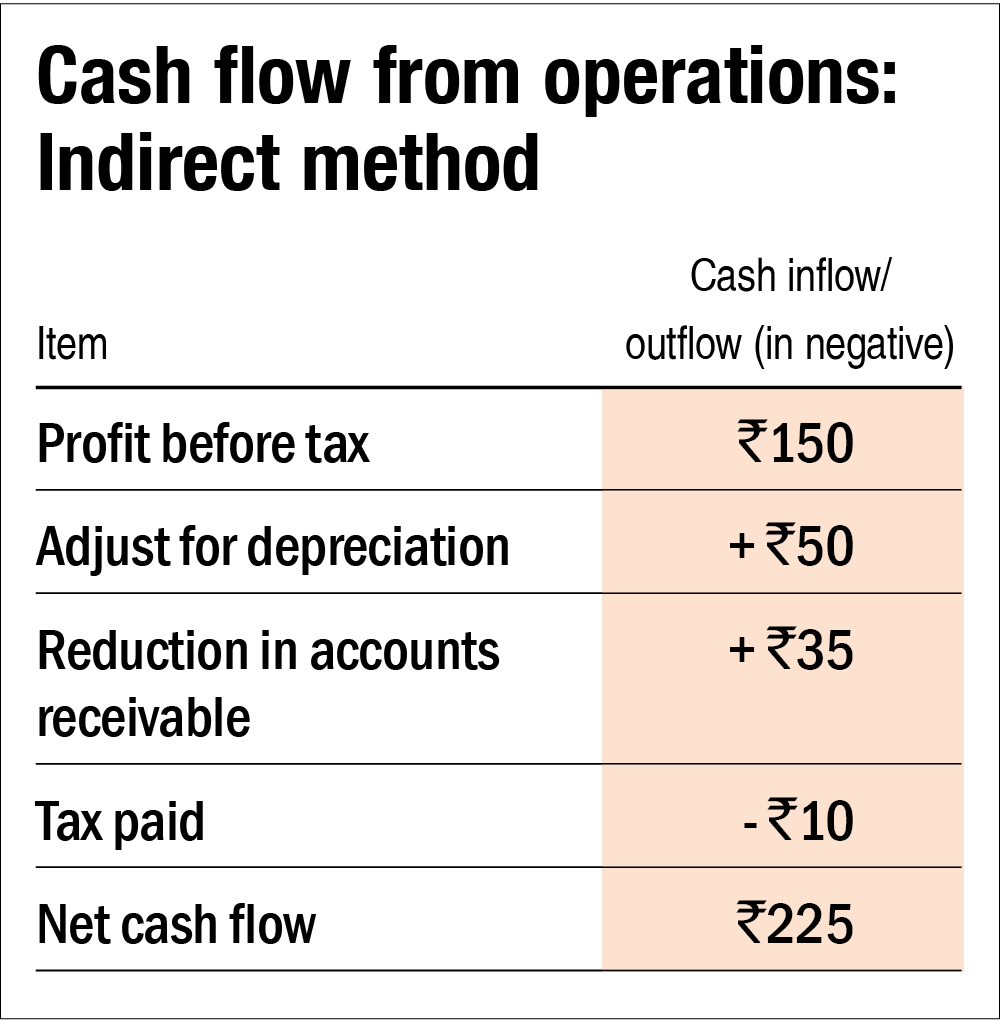

February 20, 2024, 12:22pm pst updated 16 hours ago. It includes cash flows from receivables, payables, inventory, and depreciation. Now you can calculate the cash flow from operations ratio:

Sample 1 based on 2. First, a company's profit for the year is $1,500,000 after considering the following items. Operating cash flow (ocf) is a measure of the amount of cash generated by a company's normal business operations.

Net income, adjustments to net income, and changes to. Operating cash flow (ocf), sometimes called cash flow from operations, is a measure of the amount of cash generated by a business’s normal business operations. Operating cash flow is the cash generated by a company's normal business operations.

This means that the company earns £3 from its operations for every £1 of liabilities. The cash flow from operations is the first section of the cash flow statement and includes money that goes into and out of a company. We generated record cash flows for the year, while making meaningful strategic investments in our operations, sales and marketing capabilities, and our industry leading product innovations.

Operating activities include cash received from sales, cash expenses paid for direct costs as well as payment is done for funding working capital. Generated $112 million of operating cash flow in the fourth. Firms have increased their hoards of cash, reaching $6.9 trillion, an amount larger than the gdp of all but two.

London stock exchange | london stock exchange. It represents if the company has a positive or negative cash flow from business operations. Cash flow from operations ratio = cash flow from operations / change in accounts payable = £60,000 / £20,000 = 3.

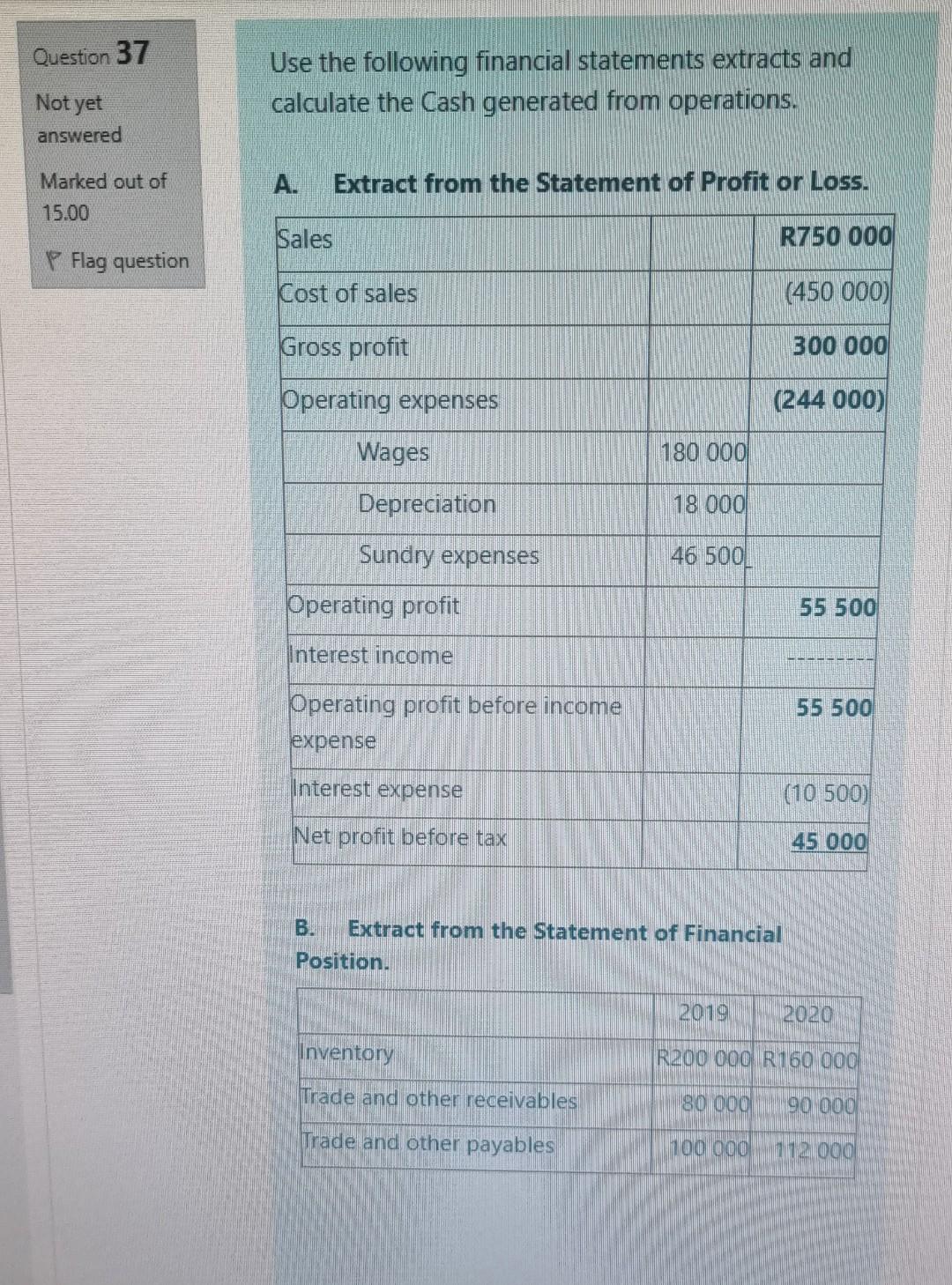

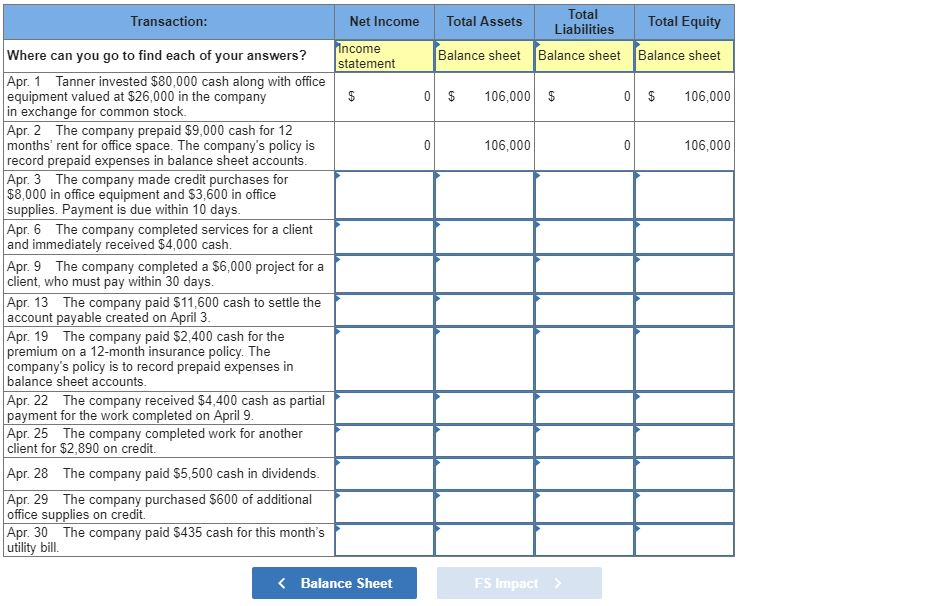

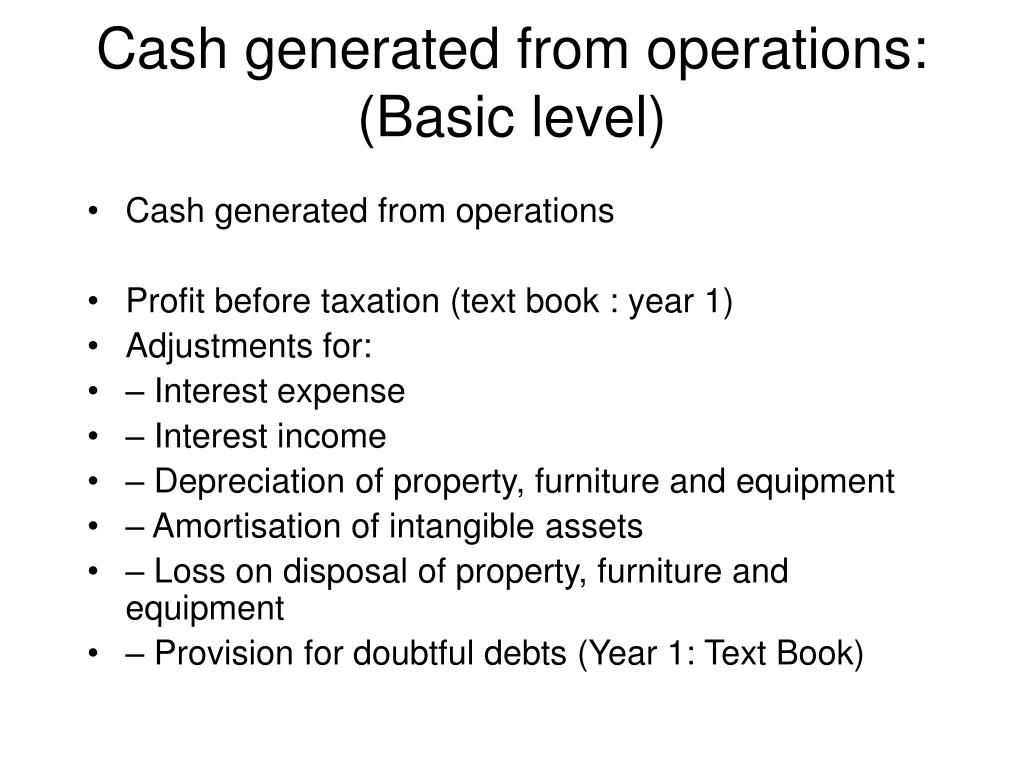

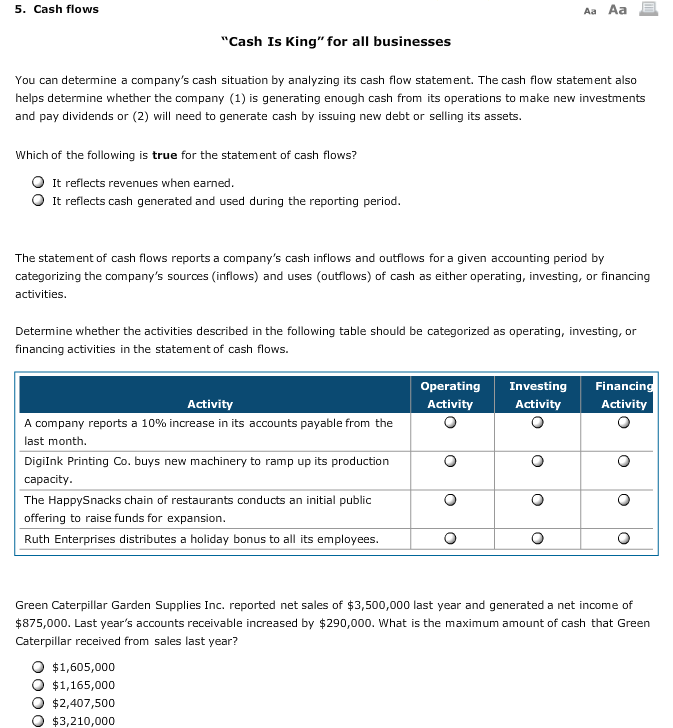

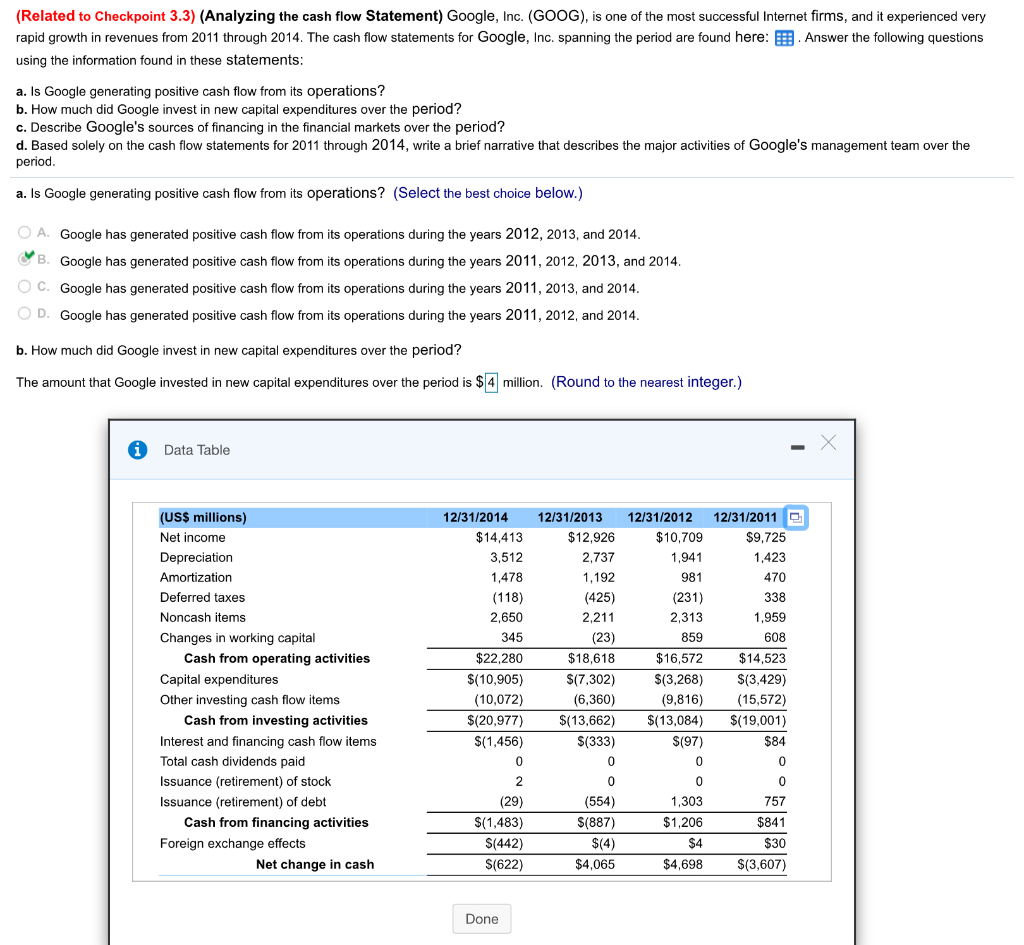

Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. Calculate cash flows from operating activities using the indirect method calculate cash flows from operating activities using the direct method calculate the cash flows from investing activities calculate the cash flows from financing activities prepare extracts from statement of cash flows from given information. Operating cash flow measures cash generated by a company's business operations.

What is cash flow from operations? The ocf calculation will always include the following three components: Operating cash flow indicates whether a company can generate sufficient.

Operating cash flow (ocf) is the cash generated by a business through regular operational activities, such as service provision, marketing, recruiting, and payroll, within a specific time. Fcf is the cash from normal business operations after subtracting any money spent on capital expenditures (capex). Ocf is the net amount of cash generated from operating activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)