Stunning Tips About Financing Cash Flow Examples Monthly Profit And Loss

The cash generated by the company itself without any investment of another party.

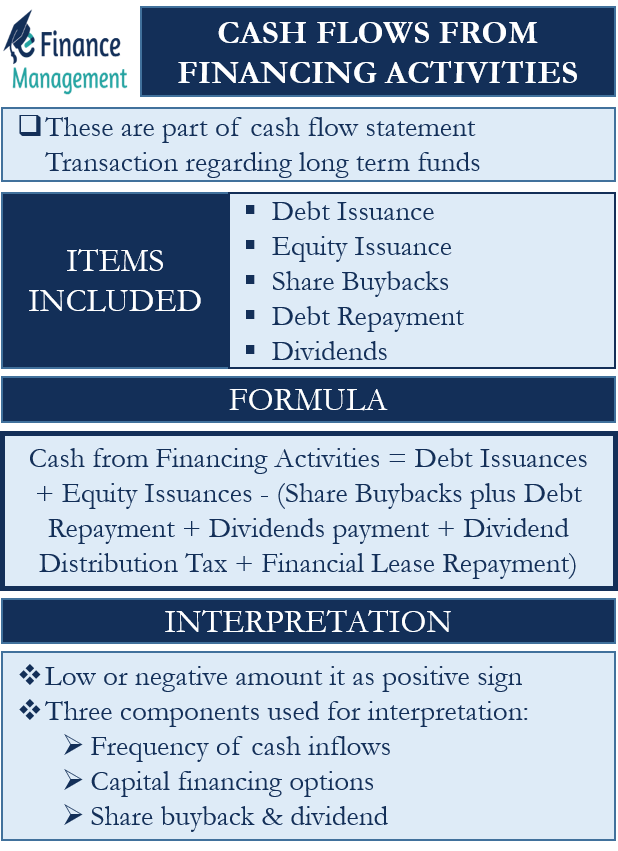

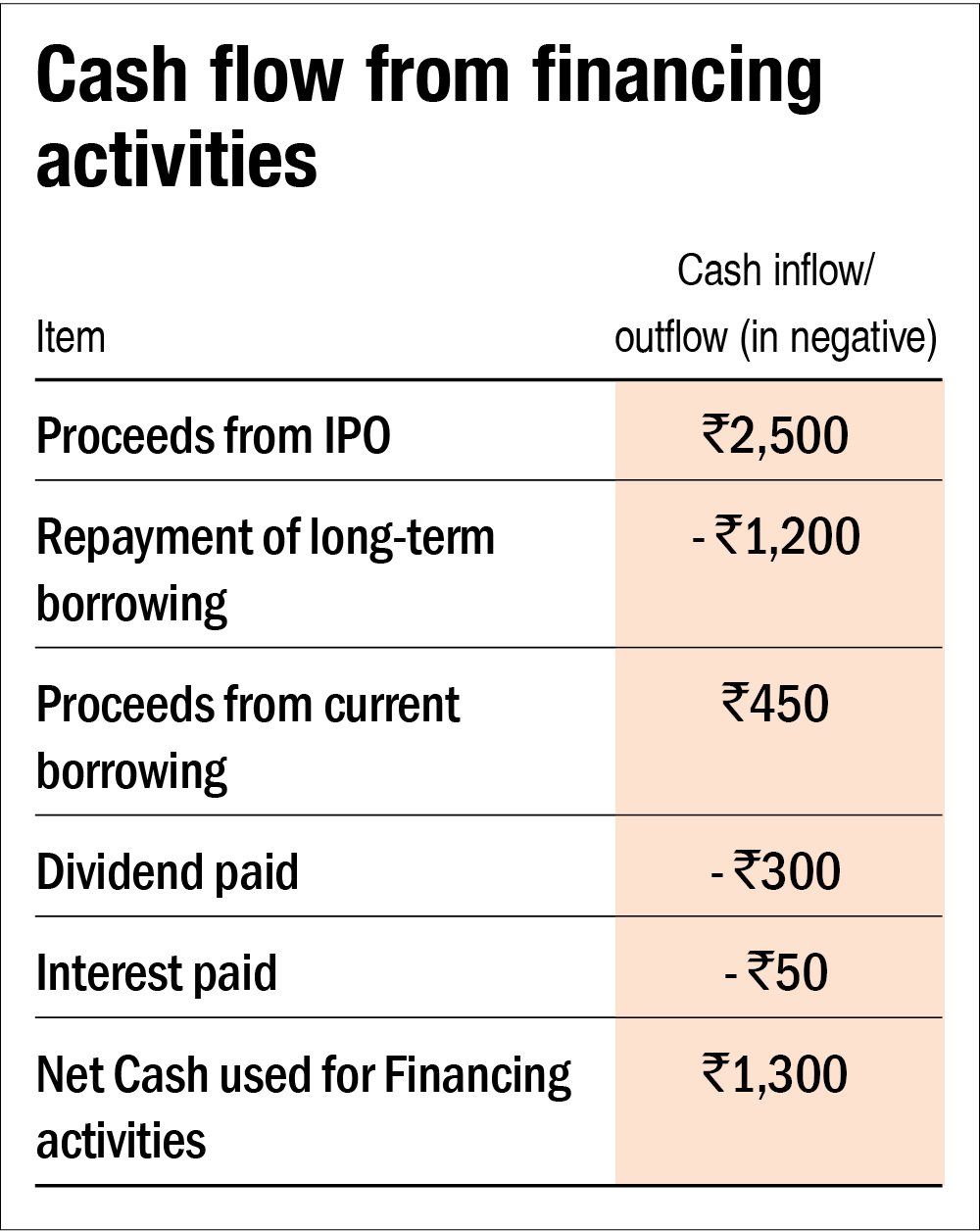

Financing cash flow examples. Cash flow financing is a form of business financing. Following are the common items that come under cash flows from financing activities:

There are a couple ways you can prioritize which balances to target first, and both have advantages for improving your cash flow. Get the financing your business needs financing cash flow formula Receiving cash from issuing stock or spending cash to repurchase shares receiving cash from issuing.

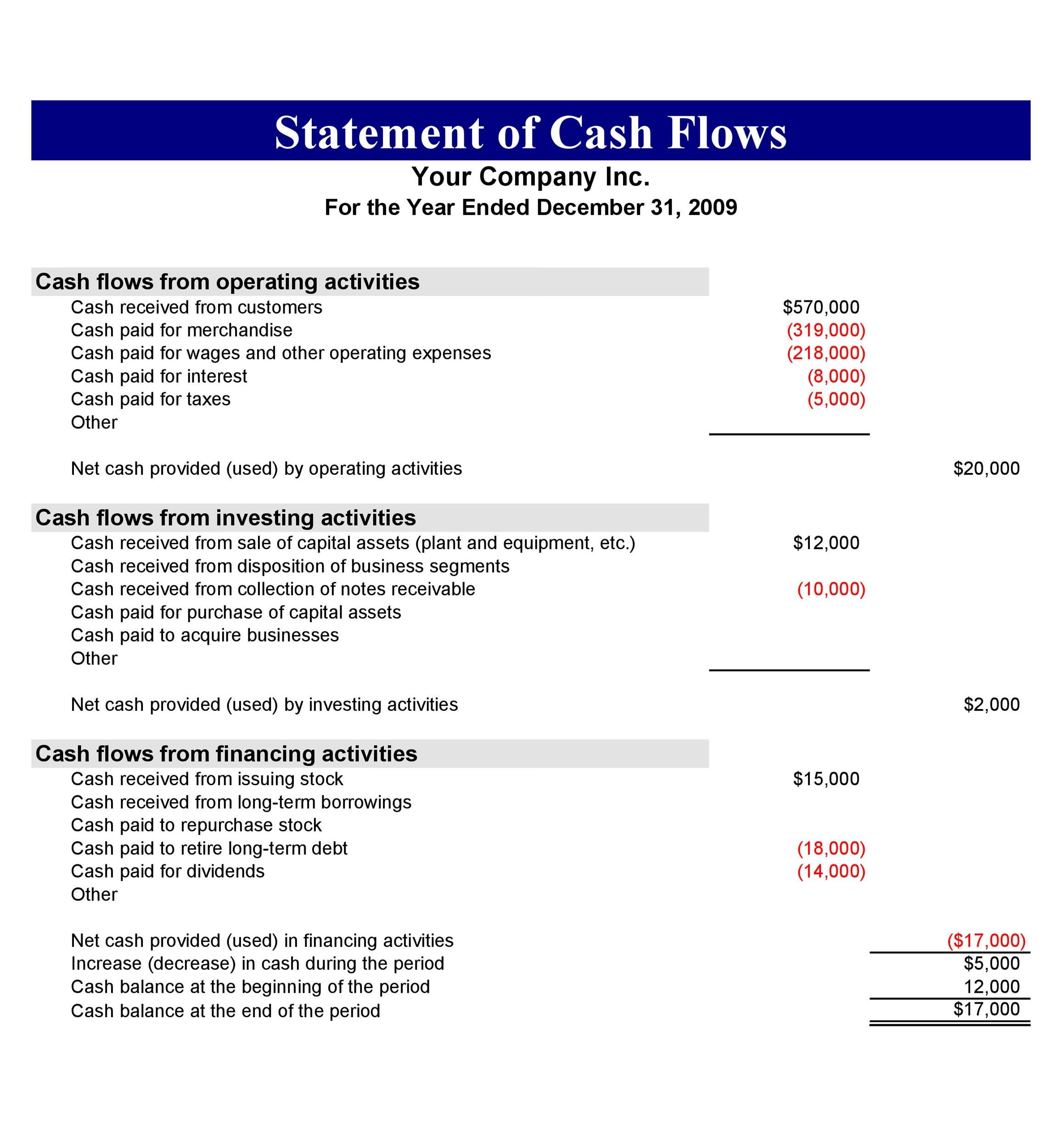

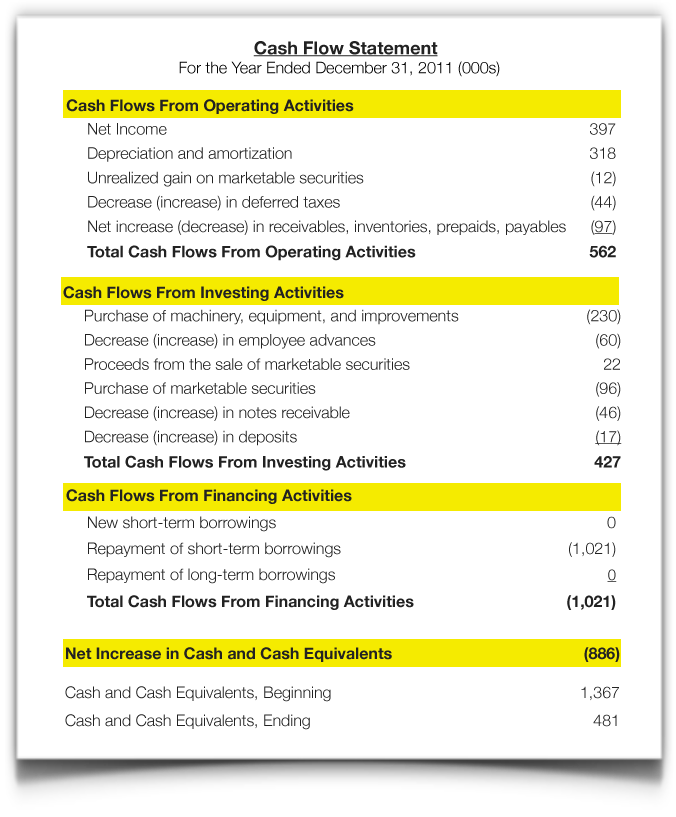

Unless you went to business school—or at least took an accounting or finance course—you’ve probably never given much thought to financial statements such as balance sheets, income statements, or statements of cash flow, right?but now you’ve got some money to invest, you’re looking at a few companies and trying to figure out whether. The formula for calculating the cash from financing section is as follows: Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and financing activities.

Cash flows from financing activities includes. Cash proceeds from issuing shares. It's an important measure of an organisation's financial health because it shows how much cash the organisation has for important transactions, such as debt repayments, dividends and new investments.

Examples of common cash flow items stemming from a firm’s financing activities are: In the bottom area of the statement, you will see the cash inflow and outflow related to financing. Cash from operating activities:

The separate disclosure of cash flows arising from financing activities is important because it is useful in predicting claims on future cash flows by providers of capital to the enterprise. The bbc reported a net cash flow of £170m for its annual report and accounts for 2020/2021. Free cash flow to the firm (fcff):

Adam hayes updated july 31, 2023 reviewed by amy drury fact checked by melody kazel what is cash flow? Free cash flow to equity Financing cash flow examples include receiving cash from notes, bonds, capital stock, dividends, retained earnings withdrawals, loans, and business income or equity.

The key to making great decisions is found in managing your future budgets and forecasting future cash flow. Cash flow is the net cash and cash equivalents transferred in and out of a company. Cash flow from financing activities is considered one of the most important sections of the statement of cash flows.

Some entrepreneurs finance their businesses entirely with cash, equity, or debt and equity. Examples of financing activities sources of cash provided by financing activities include: Under these terms, a loan made to a company is backed by a company's.

Cash flow from financing activities is the third section of an organization’s cash flow statement, outlining the inflows and outflows of cash used to fund the business for a given period. 'free cash flow, or fcf, is the cash flow available after the company meets all the necessary capital expenditures. If you're carrying balances that charge you monthly interest, paying them off is an opportunity for better to reduce your expenses long term.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)