Spectacular Tips About Accounting For Inventory And Cost Of Goods Sold Income Statement Def

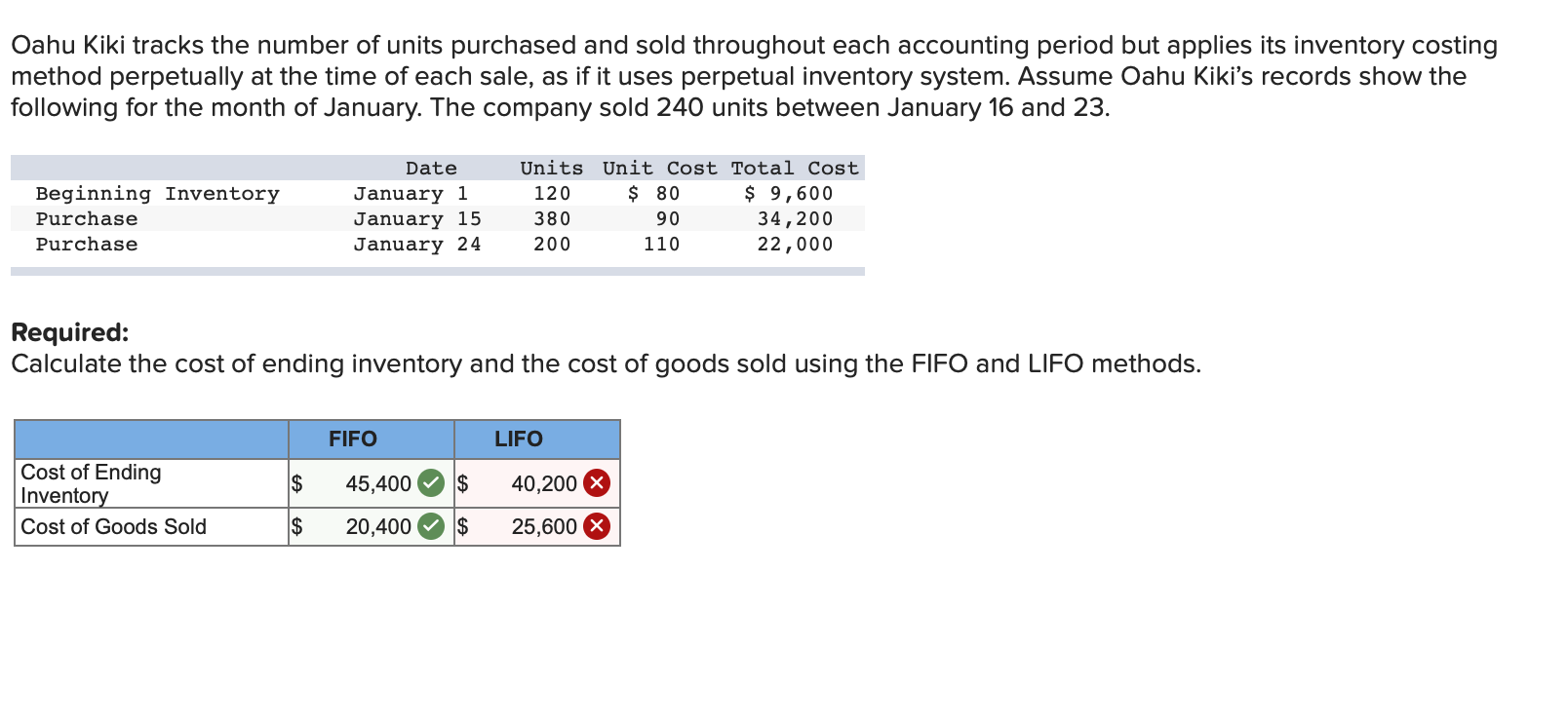

There are two ways to calculate cogs.

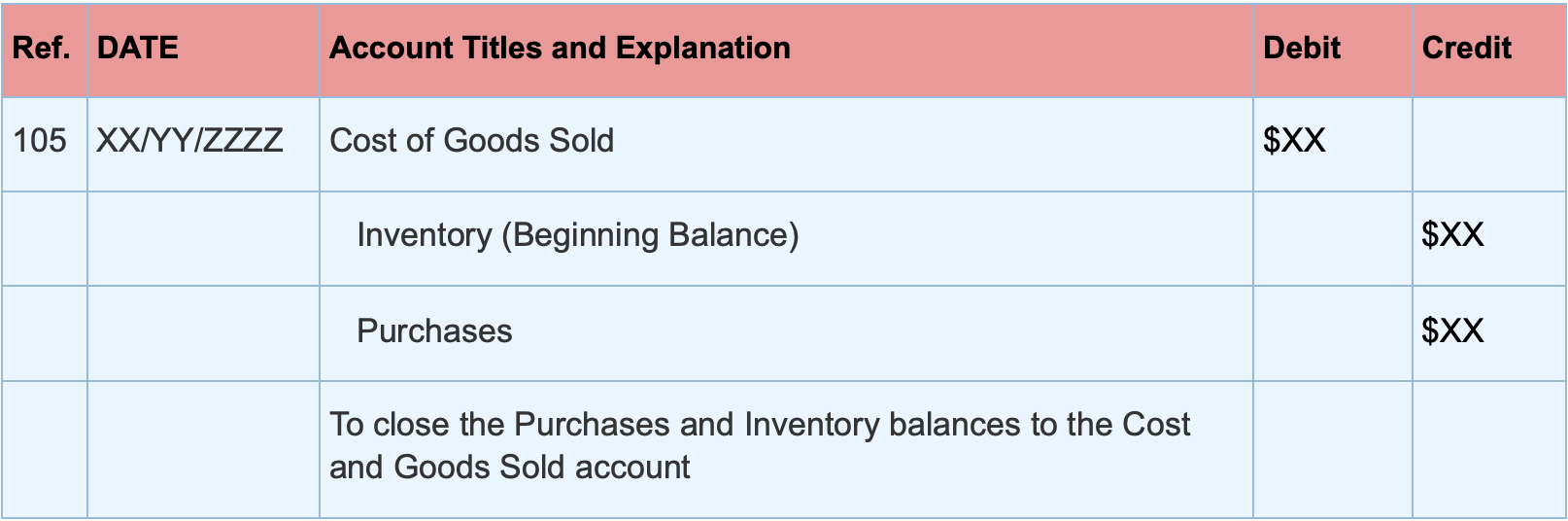

Accounting for inventory and cost of goods sold. Inventory asset has a counterpart: The answer is: Follow these steps to arrive at the cost of goods sold journal entry:

Once it is sold, that is what changes. The cost of goods sold is considered an expense in accounting. Accounting september 20, 2023 cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer.

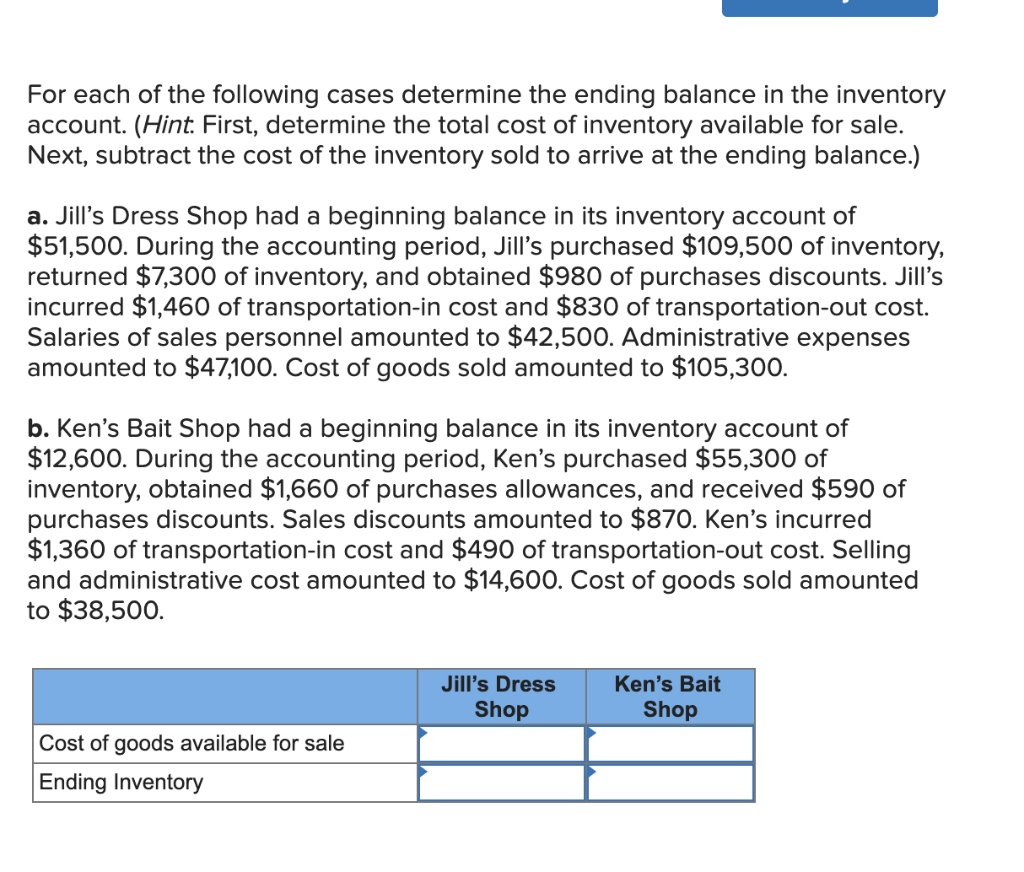

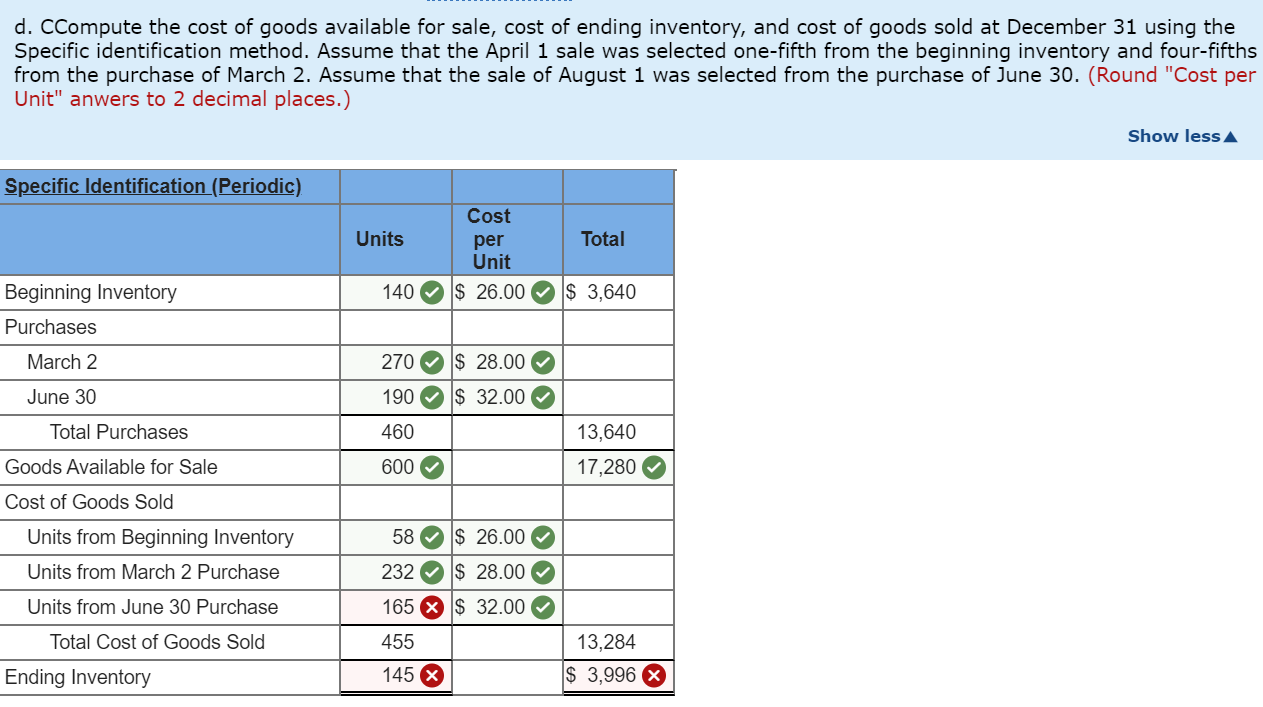

What is the cost of goods sold? Very briefly, there are four main valuation methods for inventory and cost of goods sold. The adjustment ensures that only the inventory costs that remain on hand are recorded, and the remainder of the goods available for sale are expensed on the income statement as cost of goods sold.

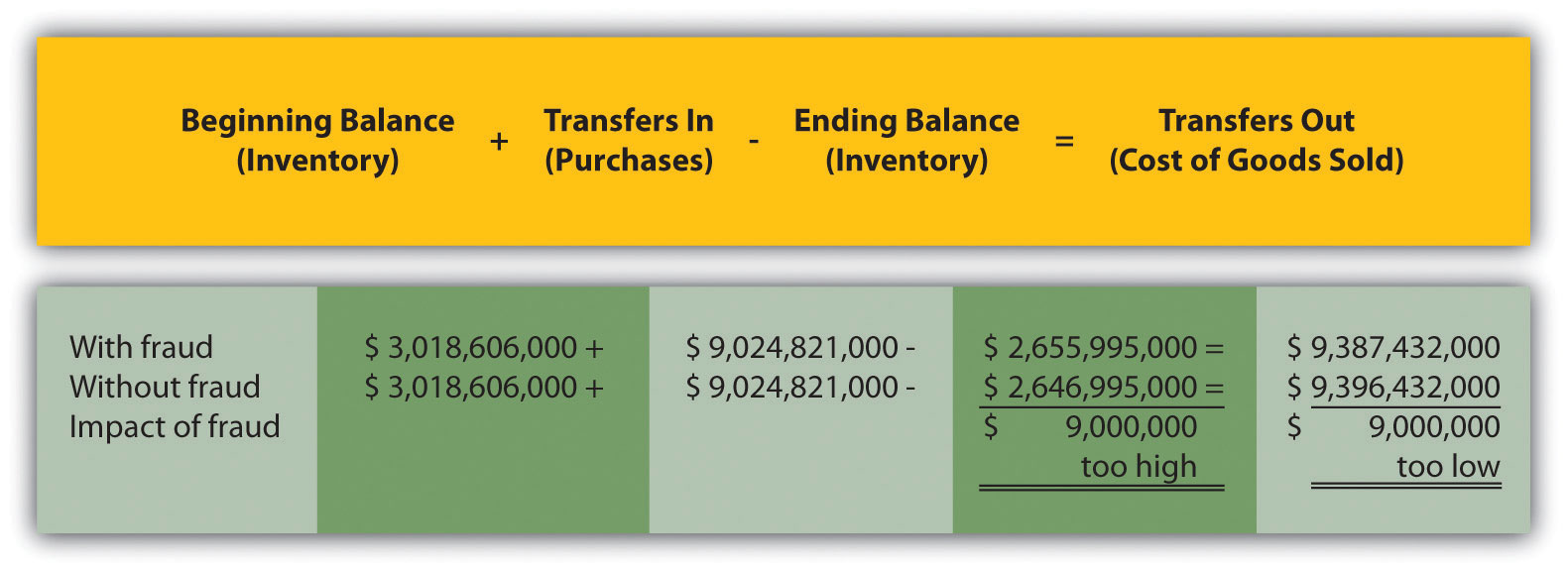

You are buying/creating an asset, so it should be shown on your balance sheet as such in an inventory asset account. Watch on what is included in cost of goods sold? Written as a formula, it is:

Cogs are listed on a financial report. Cogs = 780 x $8.65. How to calculate cost of goods sold.

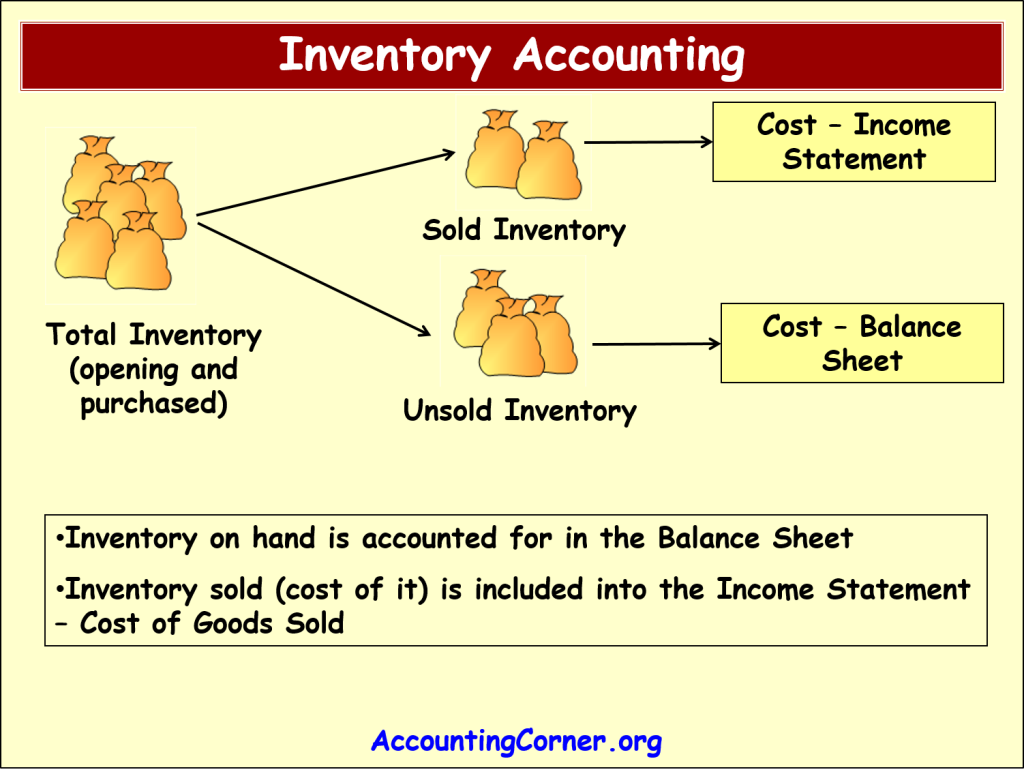

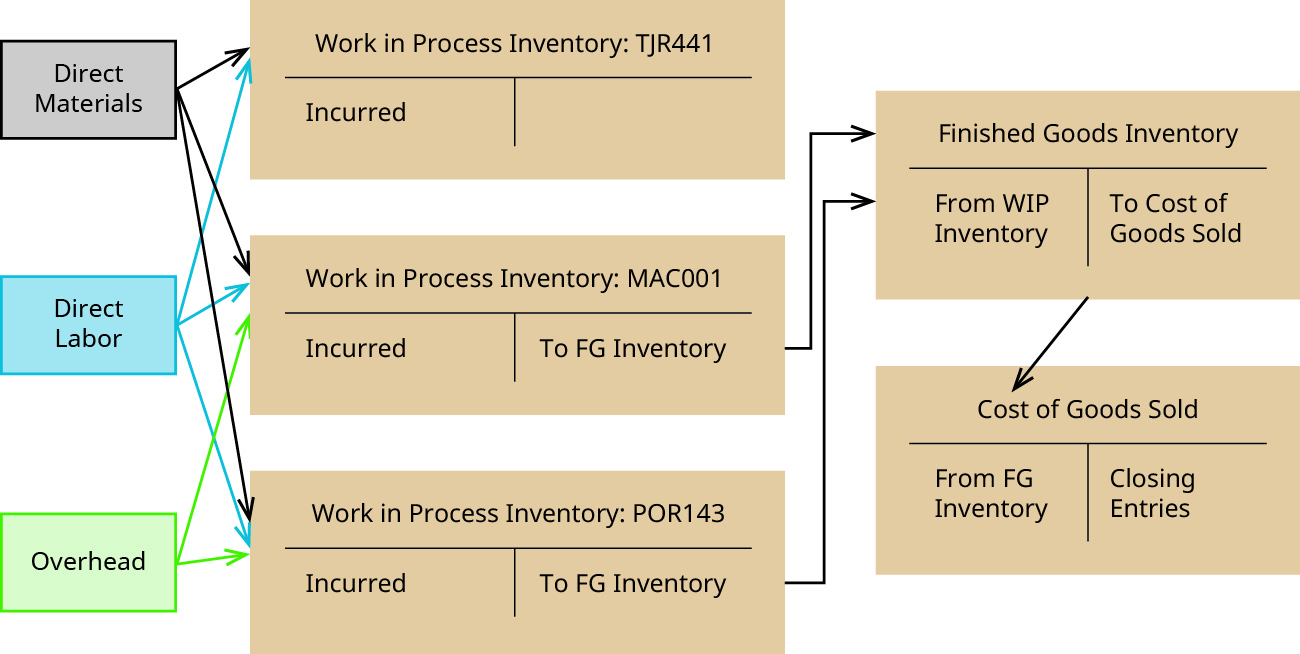

How the costs flow out of inventory will have an impact on the company's cost of goods sold. Cogs represents the inventory costs of goods sold to customers. When an inventory item is sold, the item's cost is removed from inventory and the cost is reported on the company's income statement as the cost of goods sold.

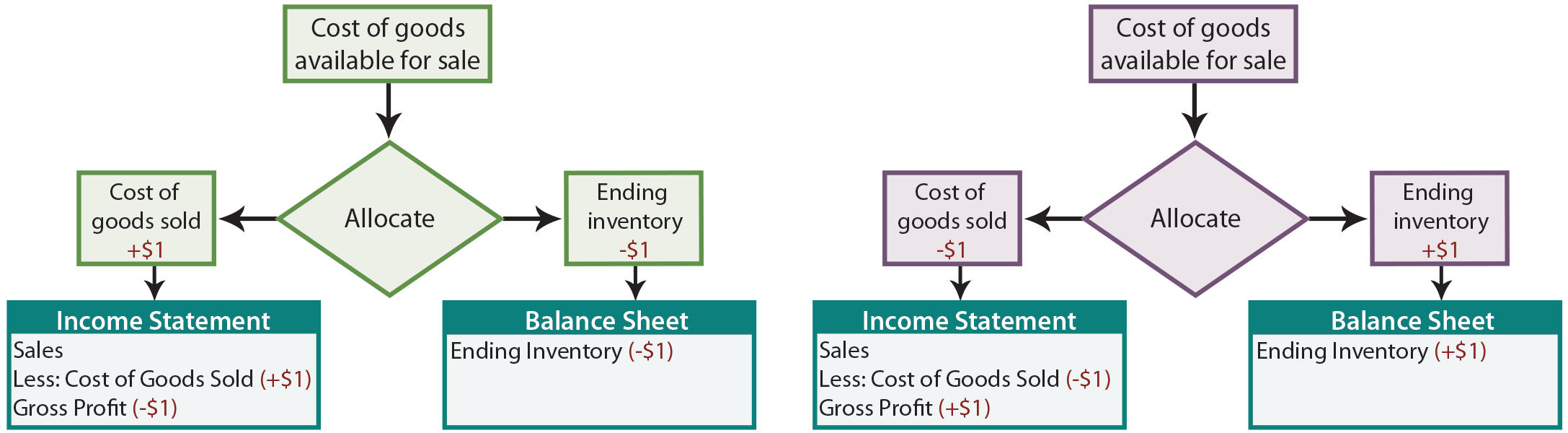

It involves a simple formula and can be. Cost of goods sold (cogs) is the inventory and production labor cost of what sold during a given period. In accounting, the difference in cost of goods sold (cogs) and inventory values are represented by where the accountant records them.

Then, subtract the value of the inventory yet to be sold. Specific identification inventory methods also commonly use a manual form of the perpetual system. The cost of goods sold will likely be the largest expense reported on the income statement.

Inventory is what you have, while cost of goods sold is the inventory that went out the door with a sale. Where the labor is attributable to an item in. Abc candles sold 780 candles in the second quarter.

Costs such as sales and marketing, salaries, and transportation are not included in cogs. Cost of goods sold is likely the largest expense reported on the income statement. Leftover) from the prior period purchases in current period → the cost of purchases made during the current period