Smart Tips About Cash Payments For Operating Expenses Brand P&l

Liberto’s income statement reported net income of $100,000.

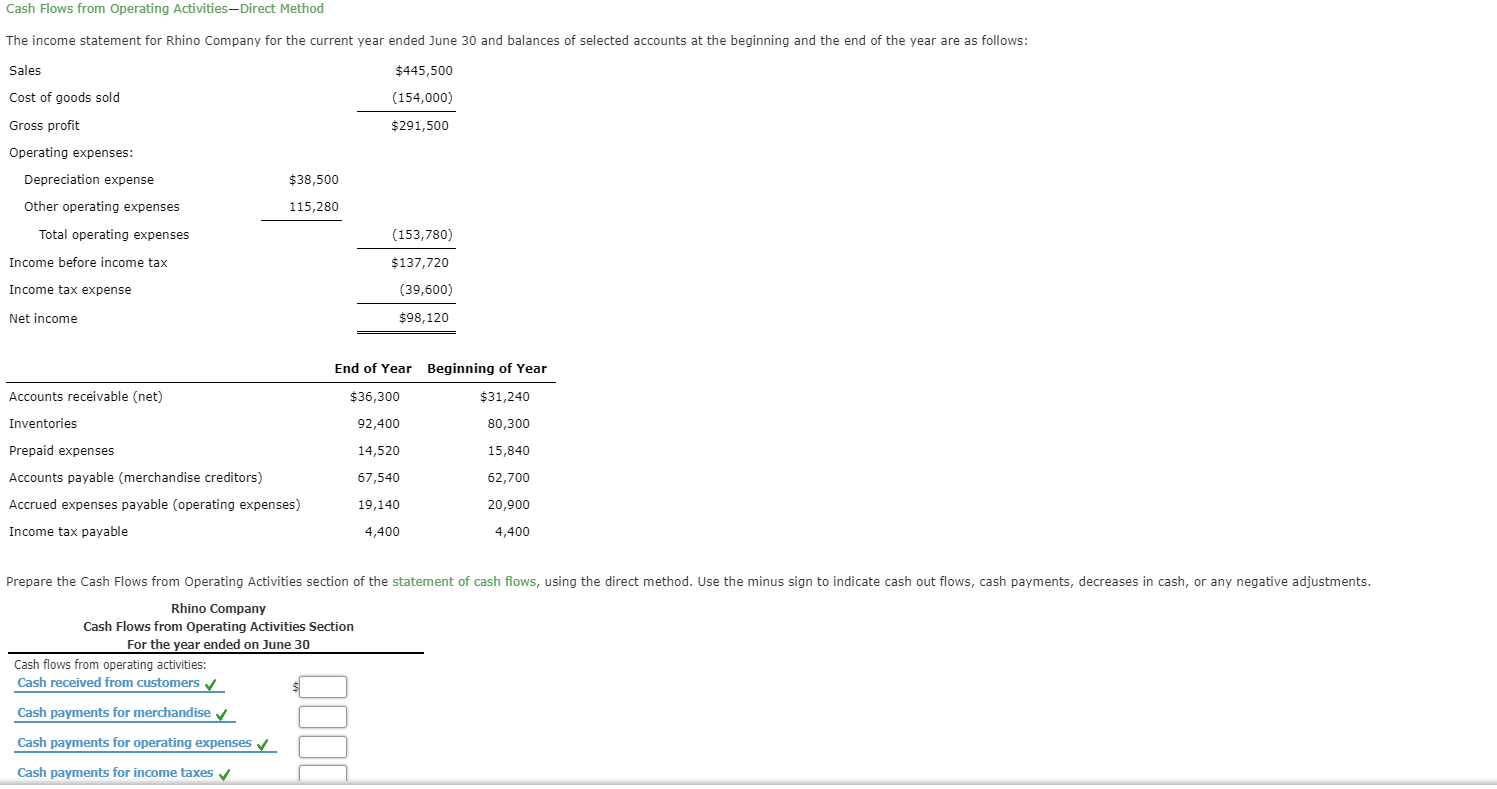

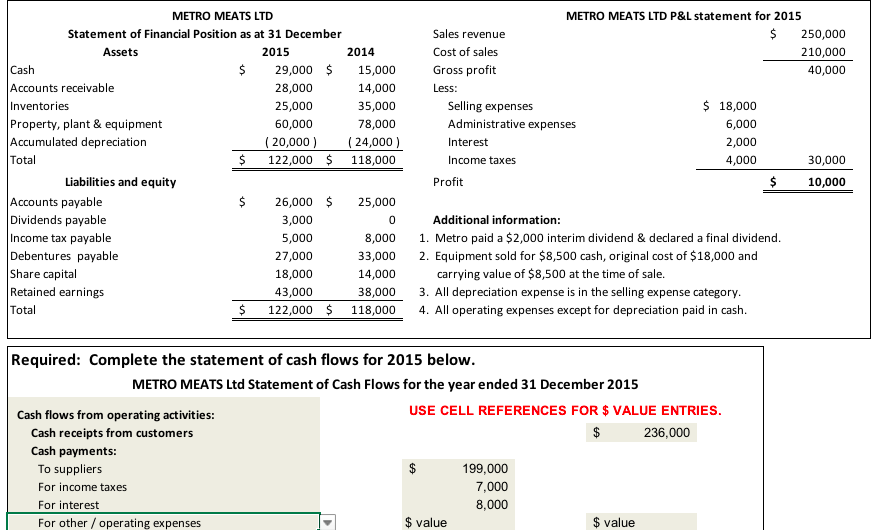

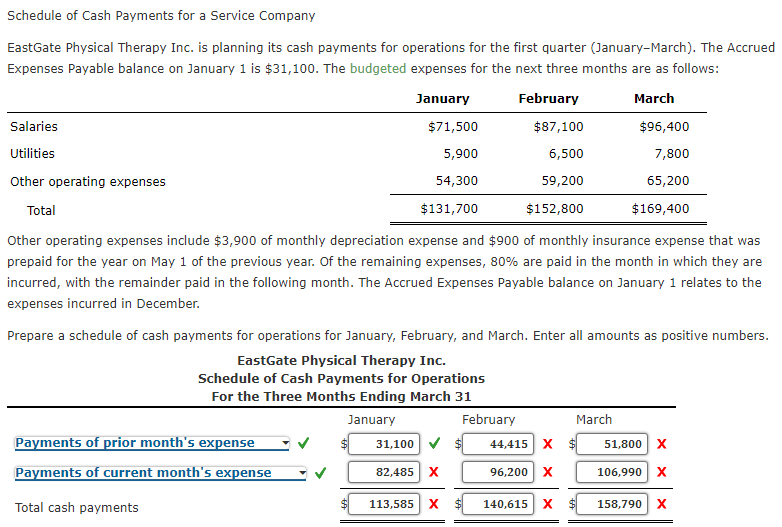

Cash payments for operating expenses. Purchasing inventory, making payroll, and collecting customer payments are posted here. Compensation expense from stock options. Operating cash flow (ocf) is a measure of the amount of cash generated by a company's normal business operations.

Conduct credit checks on customers seeking credit to minimize. Formula to calculate and interpret it

Improving cash flow is a top priority for small business owners. + expired rent, expired insurance etc. First, the amount of total operating expenses in the income statement of $42,600 is reduced by $14,400 depreciation expense because depreciation is a non‐cash expense.

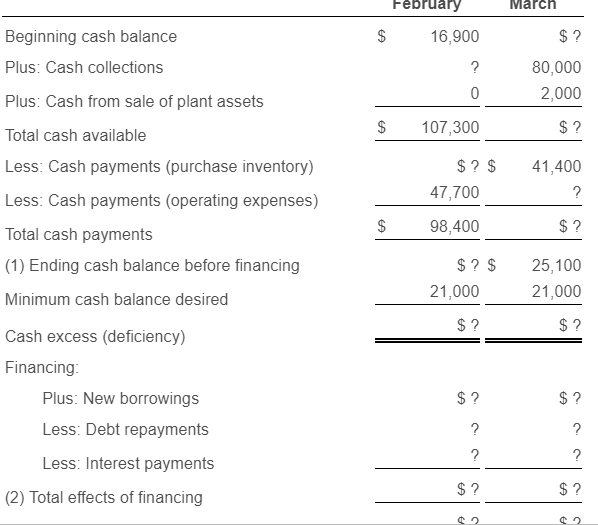

Judge fines donald trump more than $350 million, bars him from running businesses in n.y. The following example shows the format of schedule of expected cash payments to suppliers. These producers may need large cash down payments to reach profitability with new or refinanced debt.

Often abbreviated as opex, operating expenses include rent, equipment, inventory costs, marketing, payroll, insurance, step costs, and funds allocated for research and development. A cash payment is a transaction in which a business settles the cost of an expense immediately in cash. Format and example.

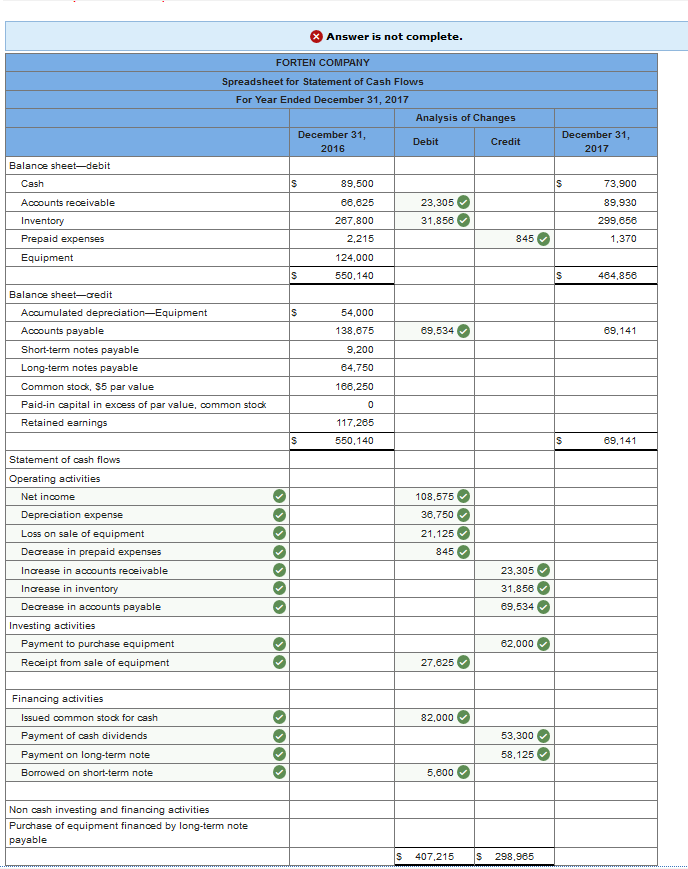

The interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility remain unchanged at 4.50%, 4.75% and 4.00% respectively. The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. Here is the indirect formula in detail:

Add back noncash expenses, such as depreciation, amortization, and depletion. This includes wages and other operating costs. The cash flow statement can be.

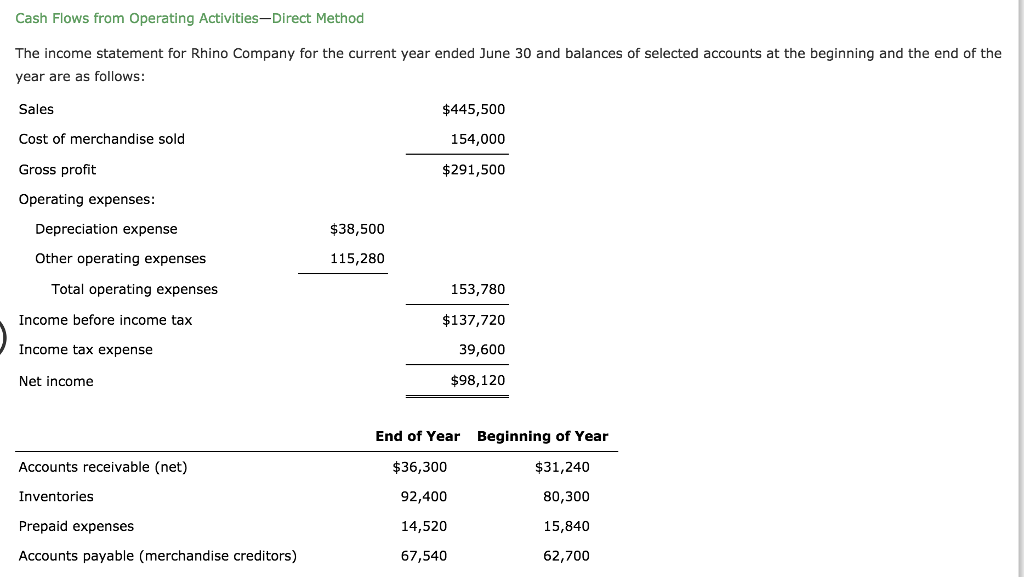

In the income statement, operating expenses are presented separately from the cost of goods sold. The 1 adjustment to operating expenses at home store, inc., results in cash payments for operating expenses of $118,000 (= $120,000 selling and administrative expenses − $2,000 decrease in prepaid expenses). Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period.

You can calculate cash flow from operating activities using the indirect method. Cash payments for operating expenses. Suppose a business has a monthly premises rent of 1,000 and pays the amount in cash to the landlord.

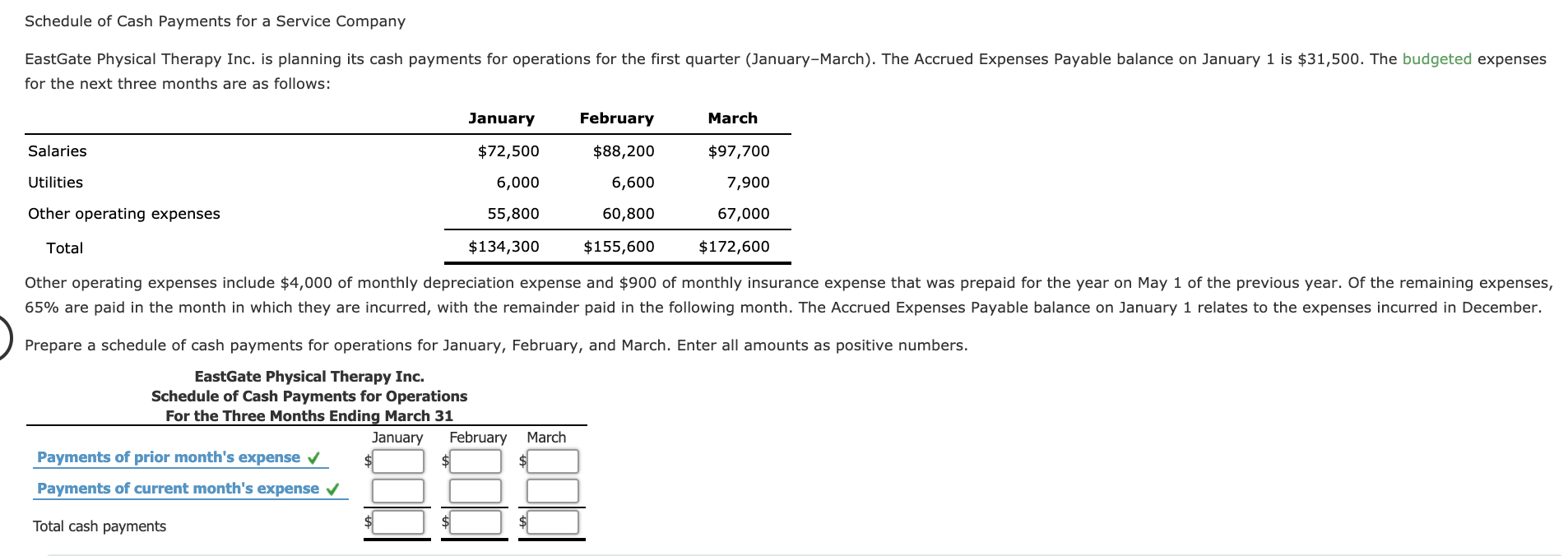

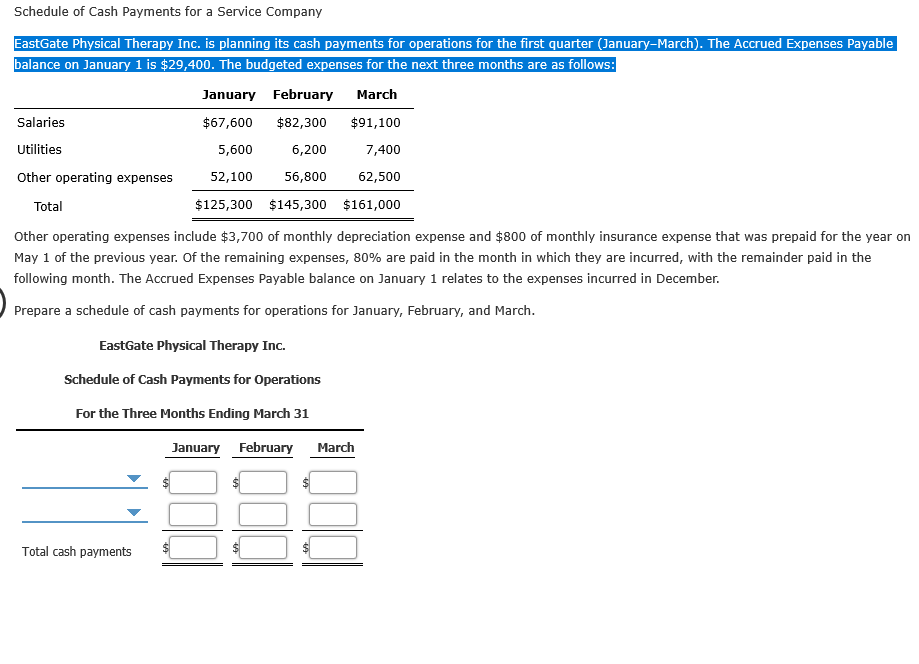

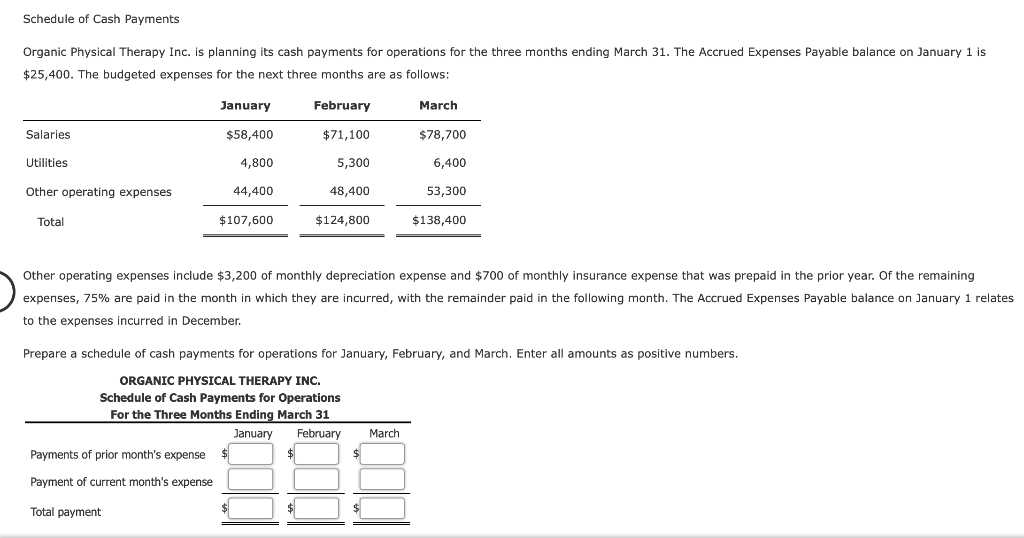

To calculate the cash payments for operating expenses, two steps are required. More free cash flow (fcf): Items that typically do so include: