Outstanding Tips About Dividends Paid Income Statement Types Of Trial Balance In Accounting

![[Solved] Following are the statement for 2018 and the](https://media.cheggcdn.com/media/52a/52a32e57-676c-4cc0-a6ae-1b7184310841/phpGnA5Ug.png)

Definition of dividend payments.

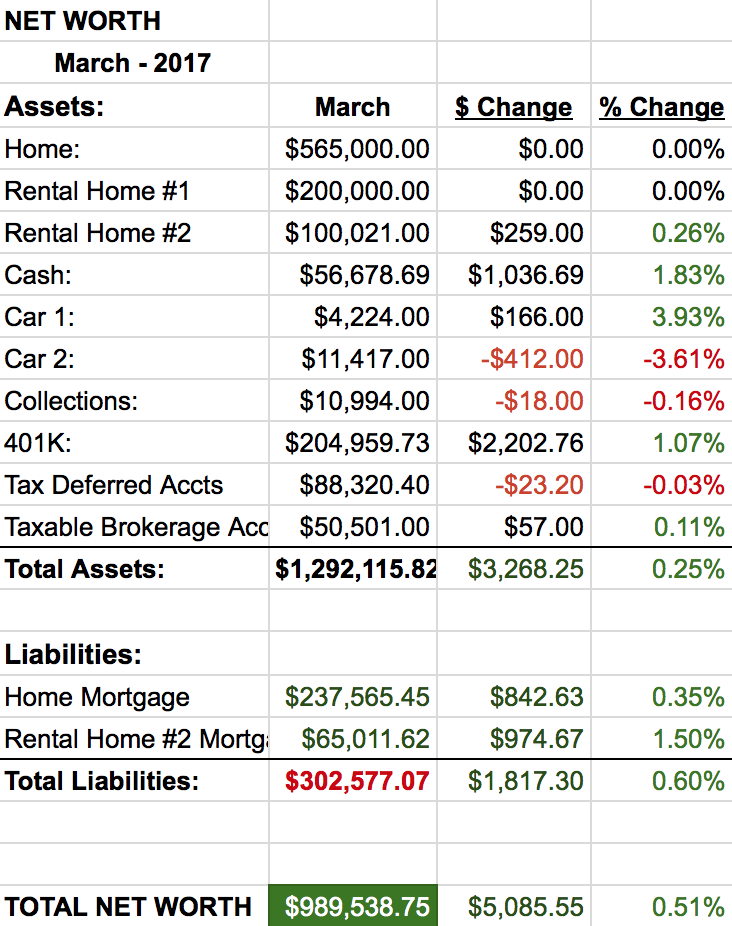

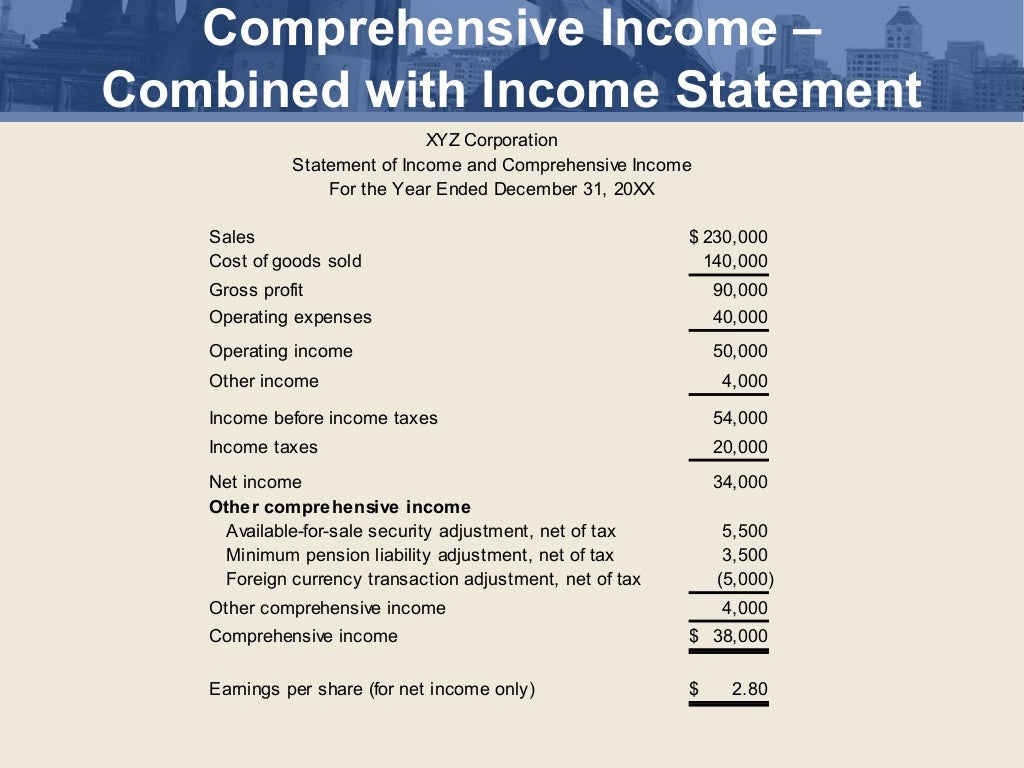

Dividends paid income statement. Before dividends are paid, there is no impact on the balance sheet. Dividends are payments made by companies to their shareholders out of their profits or reserves. The cash flow statement would show $9 million in.

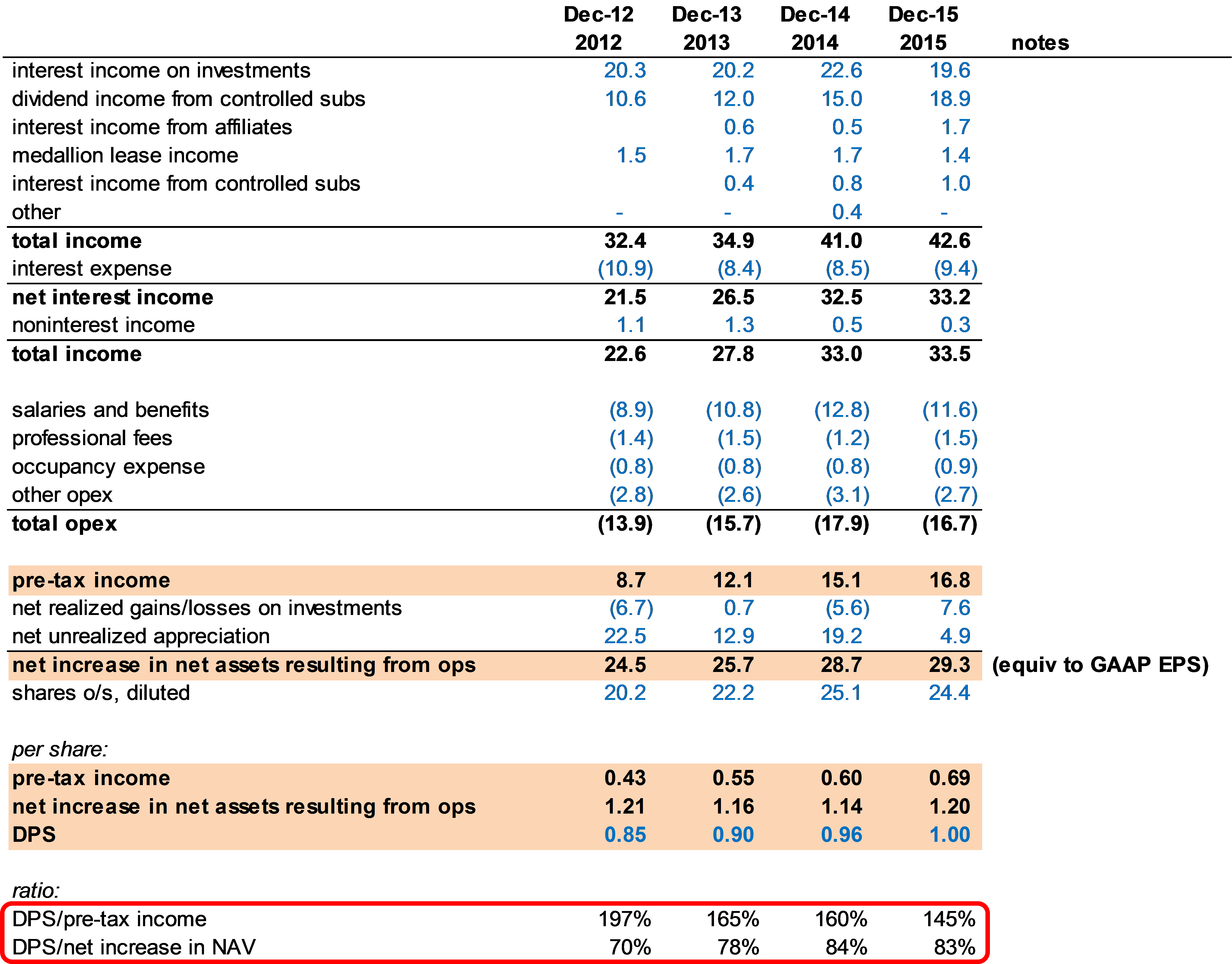

In this example, $169.10 may be exempt from state tax. A cash dividend primarily impacts the cash and shareholder equity accounts. The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income.

Take the retained earnings at the beginning of the year and. The total cash dividend to be paid is based on the number of shares outstanding is: You will need to file a return for the 2024 tax year:

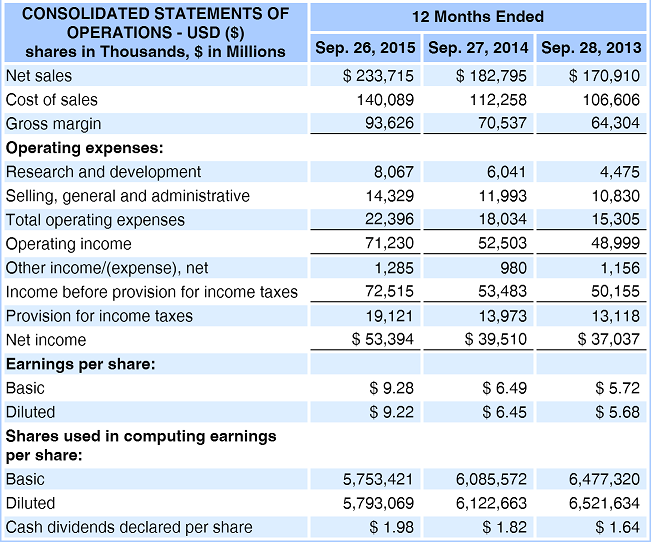

The journal entry to record the declaration of the cash dividends involves a decrease (debit) to retained earnings (a shareholders’ equity account) and an. In terms of dividends, the company has paid out a $1.19 per share quarterly dividend in the last four quarters. Calculate dividends example calculation conclusion additional resources introduction welcome to the world of dividends!

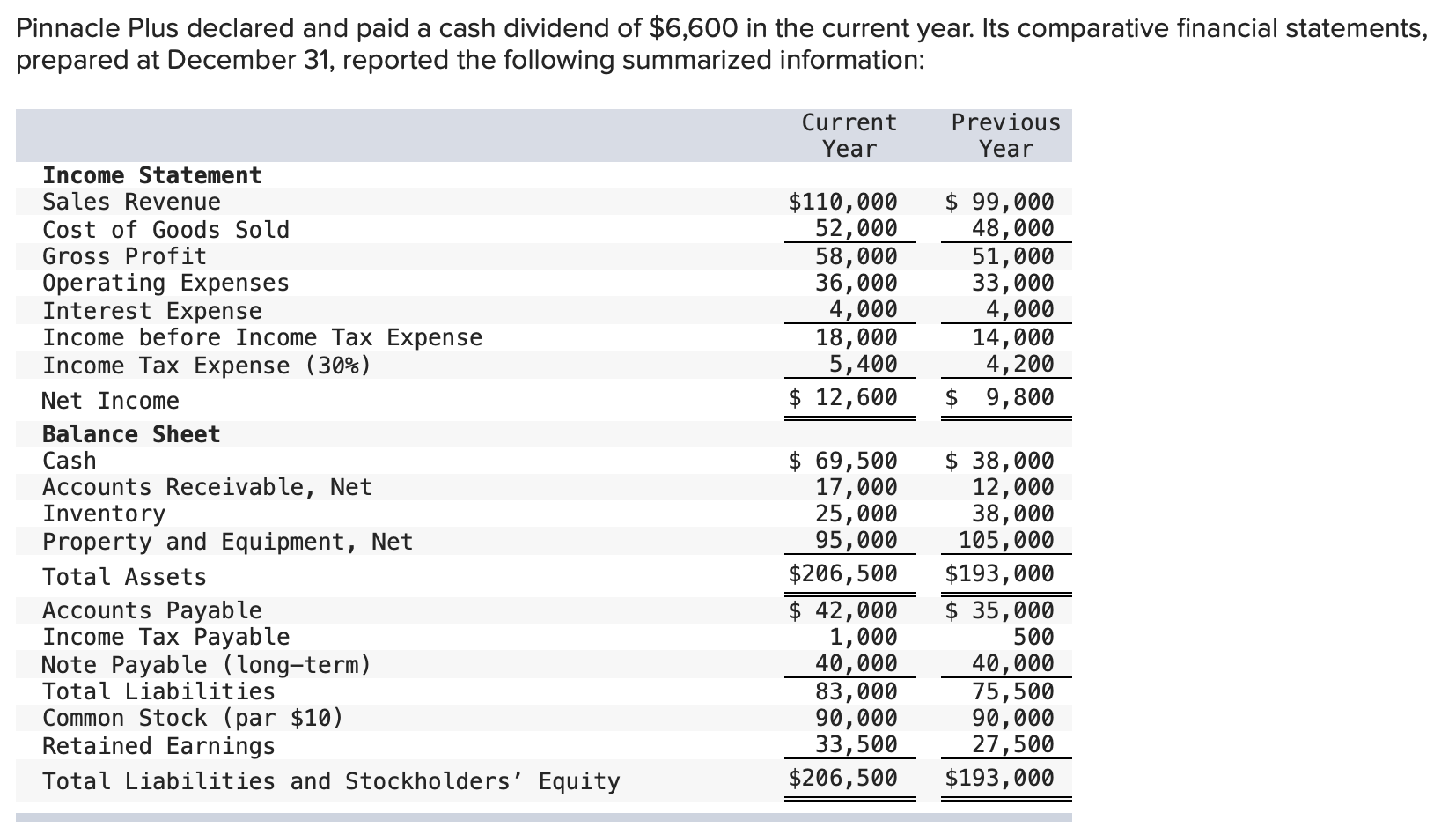

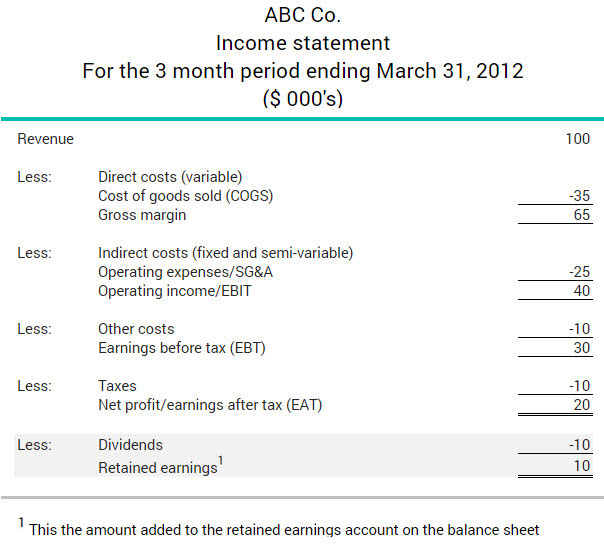

Percentage of eligible income from u.s. $10,000,000 / 7,000,000 = $1.4286 net income per share. The dividends declared and paid by a corporation in the most recent year will be reported on these financial statements for the recent year:

Identify the net income step 3: Cash dividends declared are generally reported as a deduction from retained earnings. The deduction allows eligible taxpayers to deduct up to 20 percent of their qbi, plus 20.

As a result, both cash and retained earnings are reduced by $250,000 leaving $750,000 remaining in. Cash dividends have no effect on a company's overall income statement. The total value of the dividend is $0.50 x 500,000, or $250,000, to be paid to shareholders.

Obtain the income statement step 2: Examples of how cash dividends affect the financial statements when a corporation's board of directors declares a cash dividend on its stock, the following will occur: Enter realty income (o 0.27%), a real estate investment trust (reit).

The net income of this company is $10,000,000. For investors, dividends serve as a reward, a share in the profits earned by the company. The income statement would show $10 million, and the balance sheet would show $1 million.

As a reit, realty income is required to pay out at least. Dividing the net income by the outstanding shares will give you the net income per share. The company historically paid out 45% of its earnings as dividends.